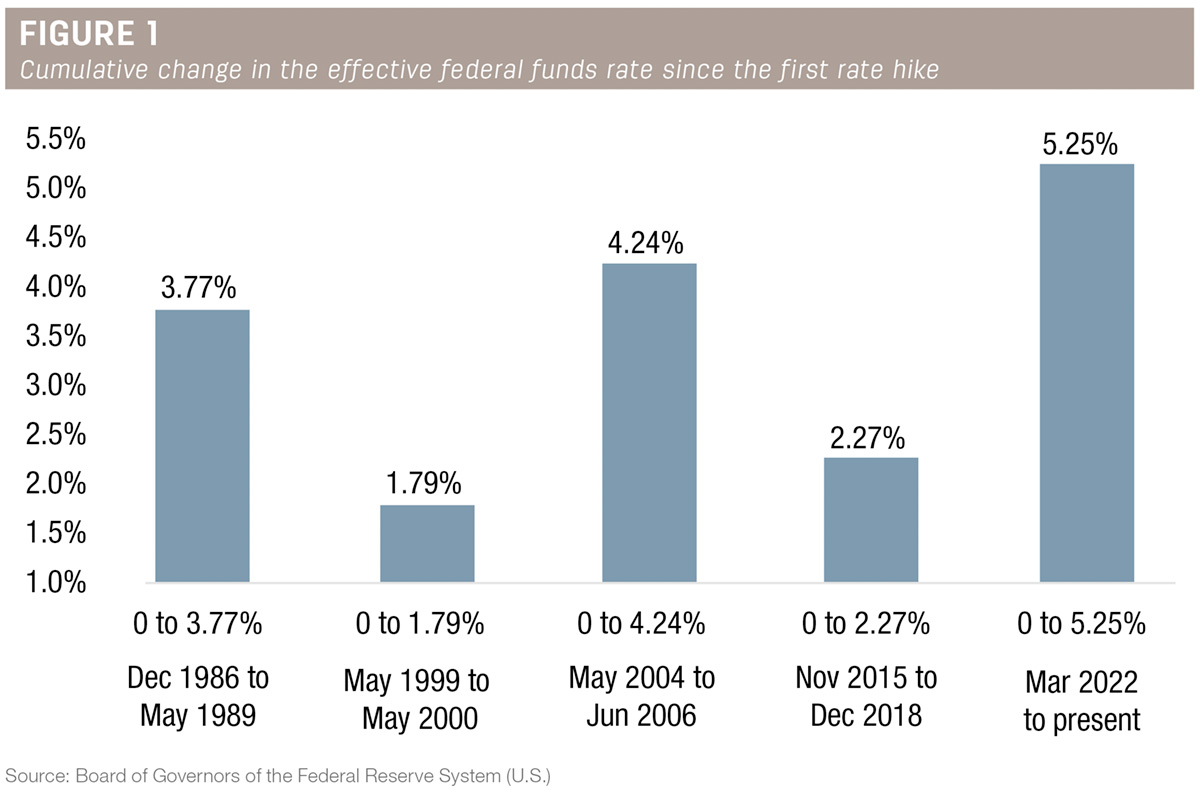

The current interest rate hiking cycle began in March 2022 with an initial 0.25% hike in the federal funds rate.

The Federal Reserve has increased interest rates by an additional 5% during the intervening months. The interest rates on most operating lines of credit and other variable-rate loans change in a similar fashion as the federal funds rate.

Recent comments from the Fed chair, Jerome Powell, and the Federal Open Market Committee (FOMC) statement suggest an intent to hold the federal funds rate at its current level for several more months before beginning to cut rates in 2024.

However, they have been careful to leave the door open for additional rate increases if inflation doesn’t continue to trend down toward their 2% target or if the labor market tightens.

As illustrated in Figure 1, this has resulted in the most aggressive rate hiking cycle of the past 40 years, both in measures of time and scale.

Many of the economic impacts from this rate cycle haven’t occurred yet due to the lag effect of rate increases. A large body of research suggests it may take 18 months or longer for the full impact of tighter monetary policy (higher interest rates) to be realized in the broader economy. As a result, the economic effects of this rate cycle won’t be fully realized until 2024.

Inverted yield curve

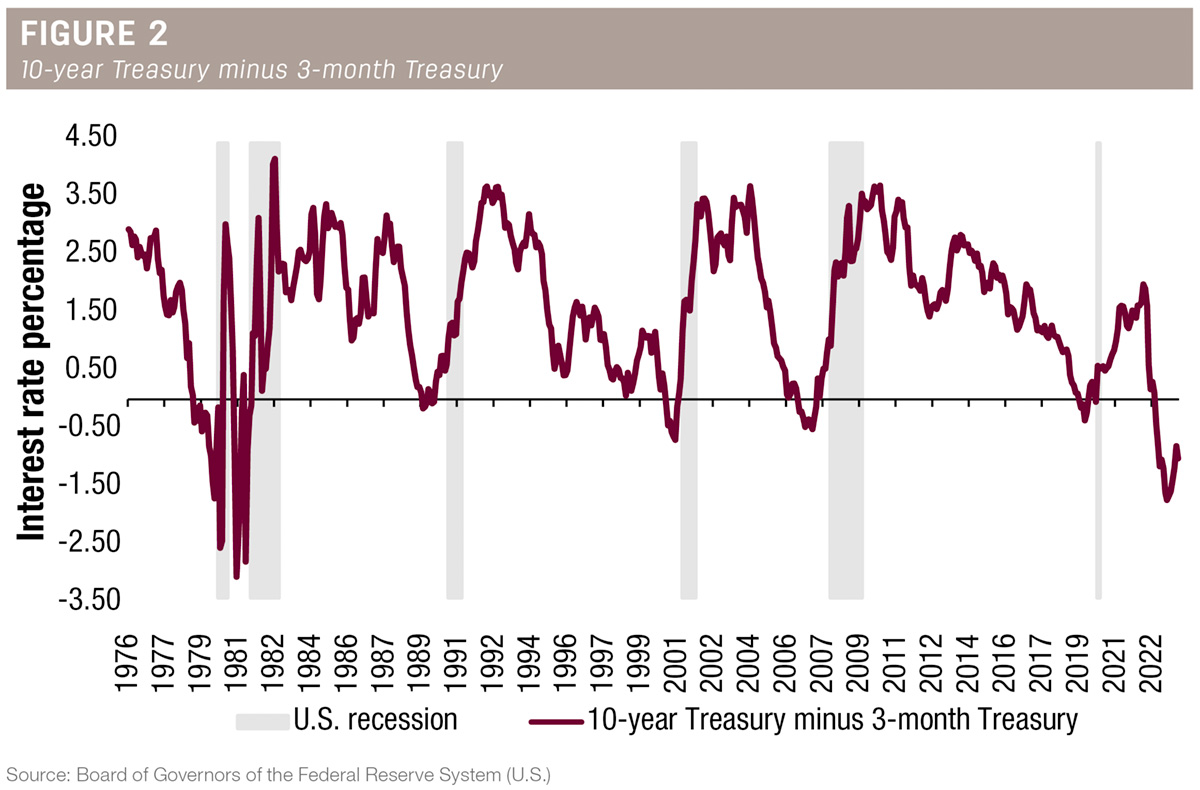

An inverted yield curve occurs when short-term interest rates are higher than long-term interest rates. This is often measured by the 10-year U.S. Treasury rate minus the three-month Treasury Bill rate. Since 1976, a yield curve inversion for this measure has only existed 10% of the time (Figure 2).

The yield curve is currently inverted. Historically, this has been an indicator of pending economic weakness. The last nine recessions in the U.S. were preceded by a yield curve inversion with only one false positive, which occurred during the 1960s and was followed by an economic slowdown, but not an official recession.

The current consensus has shifted away from most market participants believing a recession is imminent to many believing the U.S. economy will slow but avoid recession. Recessions are infrequent and difficult to forecast; very few economists have a positive track record making these calls. Many economists expected a recession to occur in 2023, but economic growth accelerated. The effects of pandemic-era stimulus, supportive industrial policies, retiring Baby Boomers and high deficit spending further complicate the economic outlook.

Yield curve inversions are resolved when the Fed begins cutting the federal funds rate, often as the economy begins to slow or shows signs of weakness.

Long-term interest rates

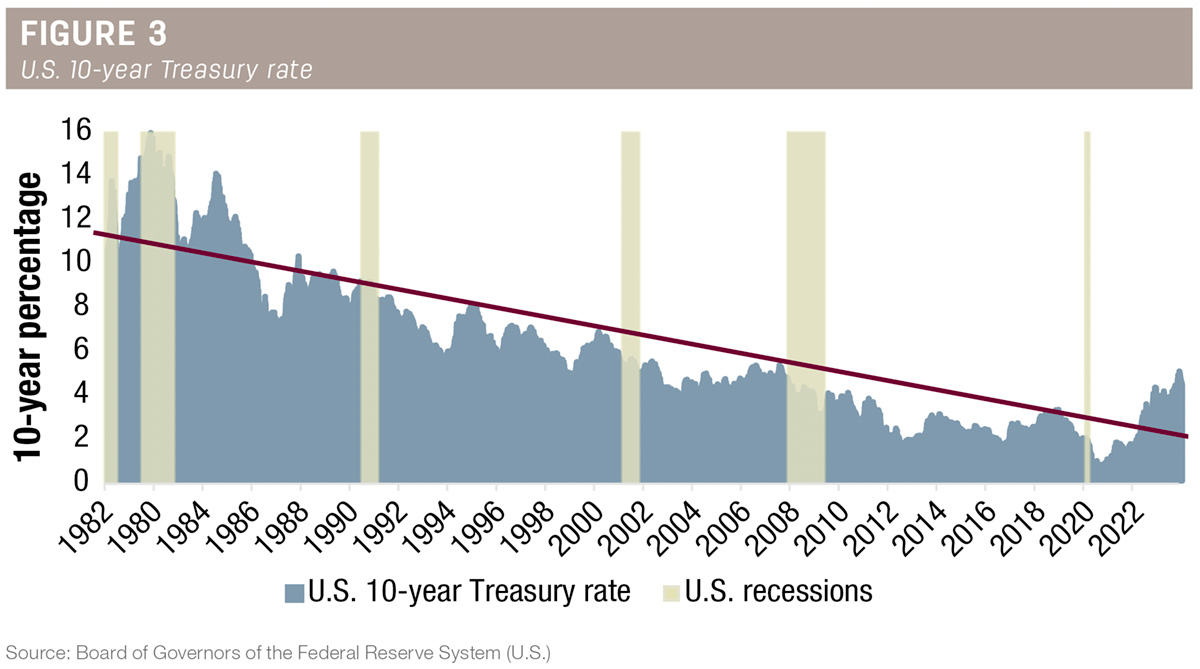

The U.S. 10-year Treasury is a bellwether for long-term interest rates and has followed the same general path higher as the Fed increased the federal funds rate. After reaching a closing high of 4.98% in October 2023, the 10-year Treasury has traded lower.

Many analysts believe the interest rate surge in 2022 and 2023 broke the 40-year downtrend in long-term rates, as illustrated in Figure 3.

These analysts expect a higher 10-year Treasury rate following this cycle and a return to “normal” long-term interest rates. The average interest rate for the U.S. 10-year Treasury yield over the past 200 years has been approximately 4.5%.

The 10-year Treasury is highly correlated with the federal funds rate and often follows the trend set by the Fed with short-term interest rates. The 10-year Treasury and related long-term rates are likely to decrease modestly as the Fed begins to reduce the federal funds rate.

Real interest rates

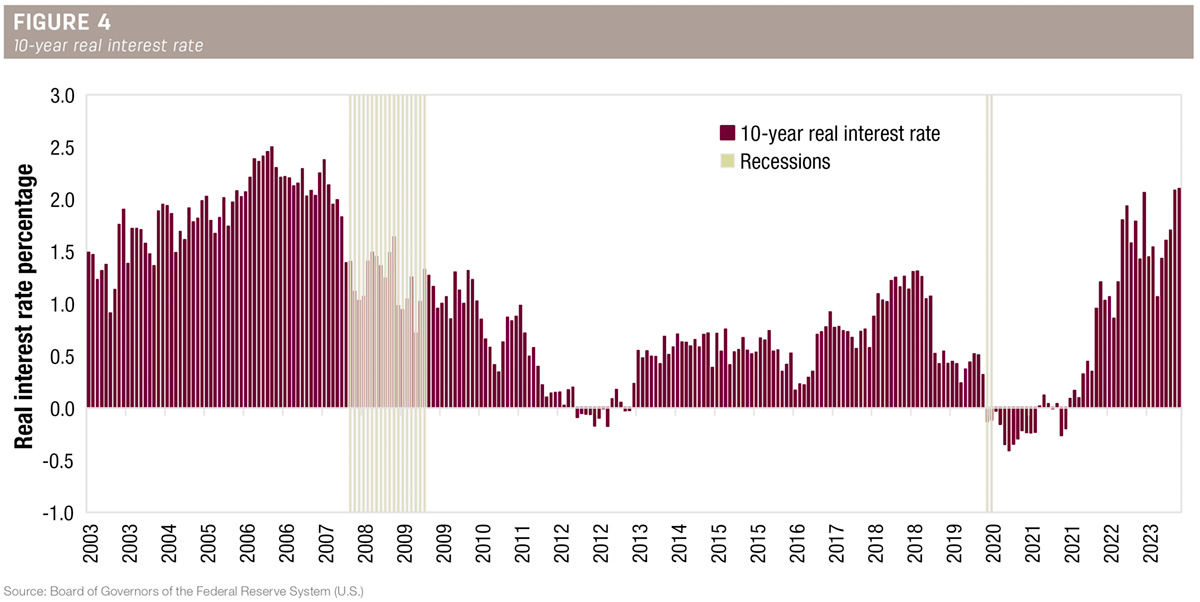

The 10-year real interest rate is a measure of the U.S. 10-year Treasury rate less the rate of inflation. Effectively, it is the spread or margin over the rate of inflation that investors charge to hold U.S. debt. This spread has increased significantly over the past two years and is near highs last seen in 2007, with the recent three-month average at 1.95%. This is more than 2.3% higher than the lows reached in 2020, when the real rate traded below the rate of inflation and was negative (Figure 4).

The increase in spread between the U.S. 10-year Treasury rate and the rate of inflation is attributable to several key factors. These include large fiscal deficits in the U.S., political uncertainty related to the debt ceiling and threats of government shutdowns, and the Fed's efforts to shrink its balance sheet, otherwise referred to as quantitative tightening.

This increase in spread is likely to remain a supportive factor for treasury yields, pushing up long-term rates, until the Federal Reserve changes course on monetary policy. Additionally, long-term interest rates may follow the general path of the federal funds rate but are unlikely to decrease at the same pace as short-term rates.

Fed fund futures

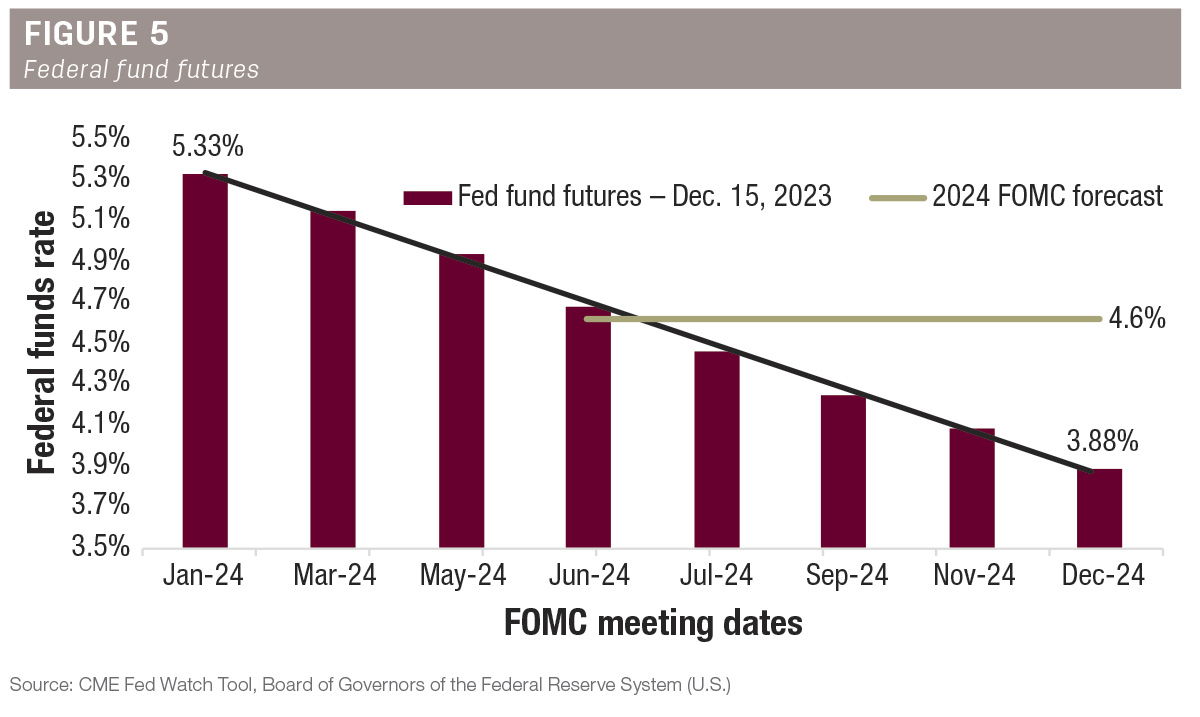

The fed fund futures represent the market's view of the future path of the federal funds rate (Figure 5).

The futures suggest the Fed will begin cutting interest rates in 2024, with the first rate cut occurring at the March or May FOMC meeting. The futures also suggest rate cuts of 1.45% by the end of 2024. However, the Fed’s FOMC projections from December 2023 are more conservative and only call for 0.75% in total rate cuts during 2024.

Over the past few months, markets have reacted to dovish inflation data and pause-suggestive language from central bankers with an additional 0.7% in total cuts getting priced in before the end of 2024. The path of the actual federal funds rate could vary significantly from what is currently forecast by the fed fund futures.

Key takeaways

- The fed funds rate has likely peaked, but the full economic impact of higher interest rates won’t be fully realized for at least 18 months.

- The yield curve inversion won’t be resolved until the Fed begins cutting the fed funds rate; this typically occurs as the economy begins to slow or shows signs of weakness.

- Long-term interest rates are highly correlated with the federal funds rate and will likely decrease modestly as the Fed cuts the federal funds rate.

- Real interest rates (rates after adjusting for inflation) have increased and will keep longer-term rates from reverting to levels seen during the 2010s.

- Fed fund futures suggest the Fed will cut the fed funds rate by 1.45% over the course of 2024, though reality often differs from the futures market.

References omitted but are available upon request by sending an email to the editor.

.jpg?height=auto&t=1713304395&width=285)

.jpg?height=auto&t=1713198780&width=285)