The USDA’s semiannual estimate of cattle inventories indicates there were more dairy cows but fewer replacement heifers to start the new year. Per 100 cows currently in the U.S. dairy herd, the ratio of dairy replacement heifers expected to calve in 2023 has hit a two-decade low.

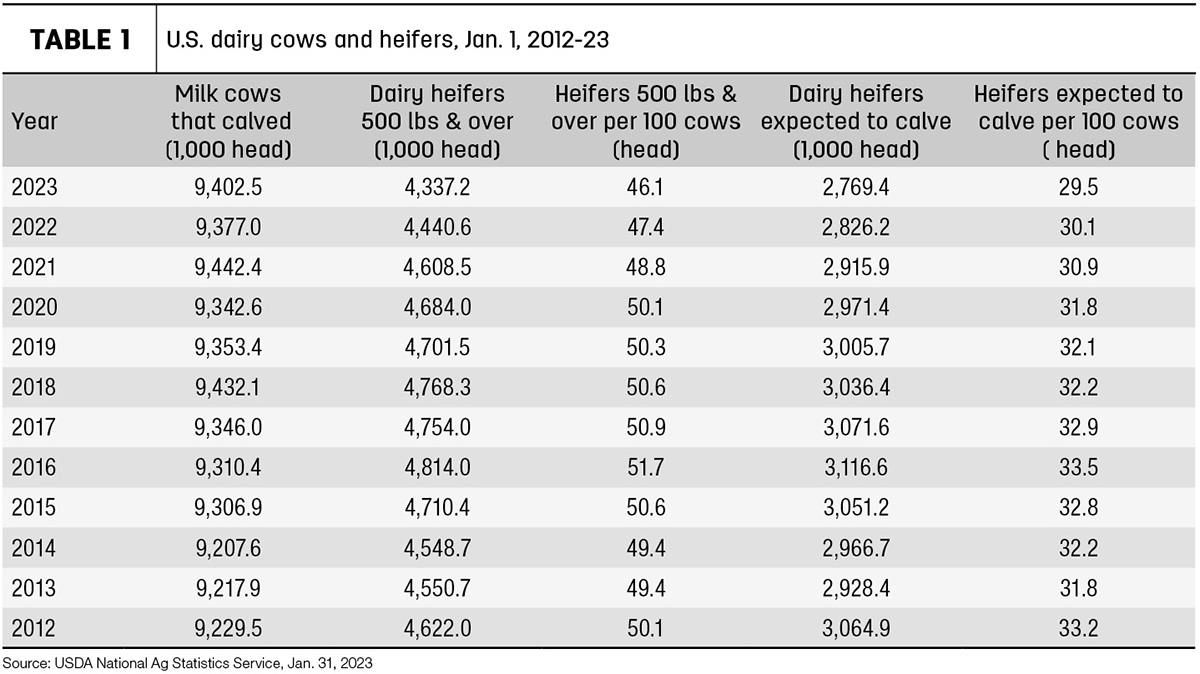

As of Jan. 1, 2023, U.S. dairy herds contained about 9.402 million dairy cows that calved in 2022, up about 25,500 from a year earlier (Table 1).

Fourteen states had more cows to start 2023 compared to a year earlier, led by Texas (+25,000), South Dakota (+17,000), Iowa (+15,000) and New York (+10,000). In contrast, 23 states started the year with fewer cows, led by New Mexico and Florida (each -13,000).

Looking at potential replacements, there were about 4.337 million dairy heifers weighing 500 pounds or more, down 103,400 from a year earlier and the lowest number to start a year since 2007. That averages out to be about 46.1 heifers per 100 cows, the smallest ratio since 2005.

Of the dairy replacement heifers, 2.769 million head are expected to calve in 2023, down about 56,800 from 2022. As of Jan. 1, 2023, there were 29.5 replacements expected to calve for every 100 cows currently in the herd, the smallest percentage since 2001.

The inventories are based on data compiled by the USDA from about 35,400 dairy and beef operations during the first half of January.

(Detailed statistical analysis of state and national dairy herds and milk production will be featured in the April 1, 2023, issue of Progressive Dairy.)

Have replacement cow prices plateaued?

A weakening outlook for milk prices and tightening margins offset a lower inventory of replacement heifers, keeping the lid on U.S. average prices for dairy replacements to start the new year, according to latest quarterly estimates from the USDA. Meanwhile, average cull cow prices ended the year slightly lower but were still the highest since 2015.

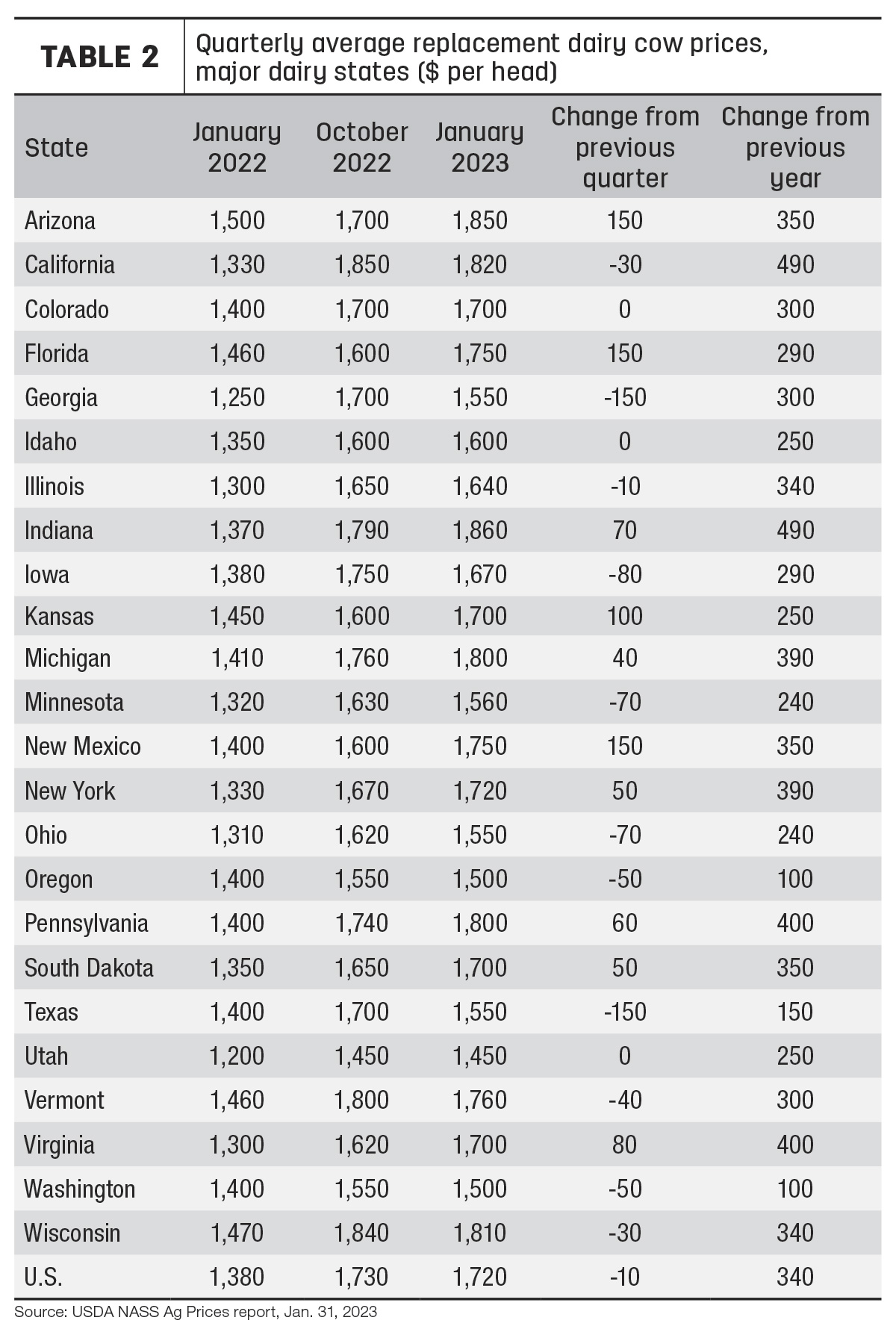

U.S. replacement dairy cow prices averaged $1,720 per head in January 2023, down $10 (1%) from October 2022 but $350 (25%) more than January 2022. It marked the third straight quarter the U.S. average price was above $1,700 per head, but still 35% less that the last peak of $2,120 per head in October 2014.

The USDA estimates are based on quarterly surveys (January, April, July and October) of dairy farmers in 24 major dairy states, as well as an annual survey (February) in all states. The prices reflect those paid or received for cows that have had at least one calf and are sold for replacement purposes, not as cull cows. The report does not summarize auction market prices.

Despite the small decline in the overall average compared to the previous quarter, prices for replacement cow prices were up in 10 of 24 major dairy states (Table 2). Largest quarterly increases were In Arizona, Florida, New Mexico and Kansas.

Compared to a year earlier, January 2023 replacement cow prices were up $400 or more per head in four states, led by a $490 increase in California and Indiana.

Progressive Dairy’s Cattle Market Watch tracks dairy heifer prices from about 20 auction markets throughout the U.S., with price summaries updated about every two weeks. The listings cover top and medium springers, shortbred and open heifers, and heifer calves.

Market cow prices dip

With a month lag in reporting data, U.S. average prices received for cull cows (beef and dairy, combined) in December averaged $76.90 per hundredweight (cwt), down $1.50 from November and the lowest monthly average since January. At $84.21 per cwt, annual average cull cow prices were the highest since 2015.