Today, I went around to all the pickups with a plastic bag and gathered all the receipts out of the glove boxes – so we are officially getting started on our taxes. And I know we are not the only ranch family that does this.

All joking aside, working on your operation’s finances is not necessarily fun or even simple. As producers move into the new year, it is a great time to refocus on their financial goals.

While our priorities typically fall on creating effective enterprise budgets, it is just as important to have a functional household budget. For ranching families, it is common for their household expenditures to be included in their operating budget and loan. With that, household budgets need to be managed differently for ranch families than for families who don’t utilize operating loans. Here are some helpful tips to manage your household budget.

1. Create a household budget

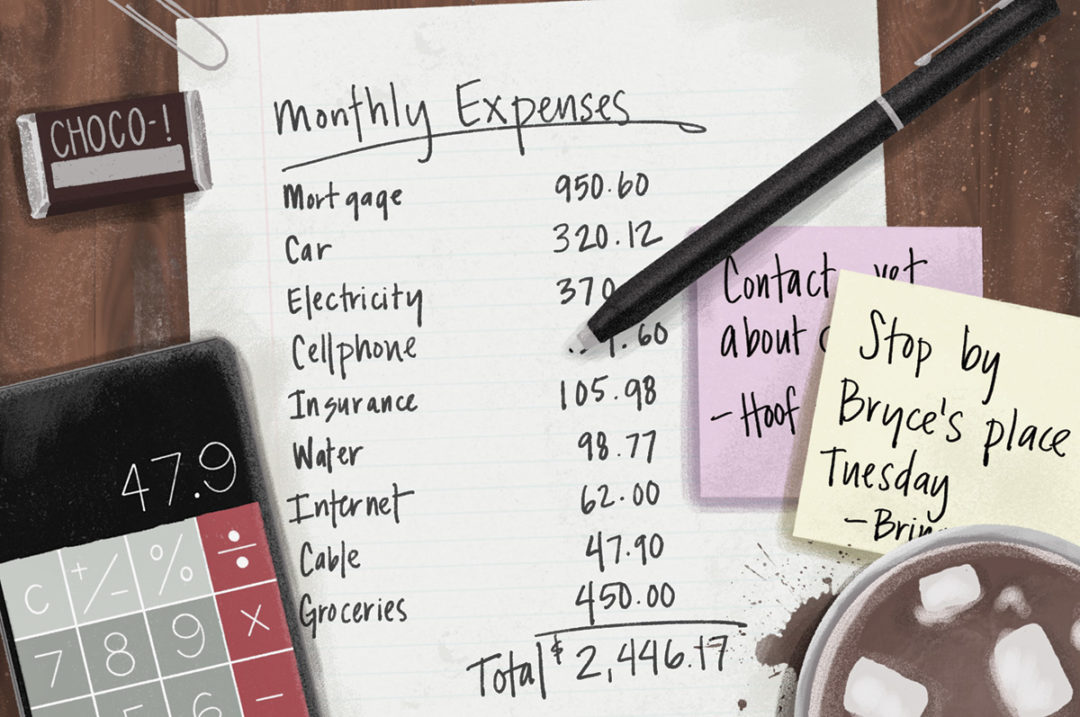

While this seems elementary, many households do not have a monthly household budget. It is standard for cattlemen to put together a budget for something like their replacement heifer program, but when it comes to the household, most are lacking. Take the time to work through all monthly expenses that are associated with the operation of the household. It works well to take a three-month average. Don’t forget to add in those things that come due once or twice a year such as auto insurance. Once you create your budget, revisit it regularly to ensure it is accurate. Things change, like the cost of groceries.

2. Keep personal and business accounts separate

Having two separate accounts will make your life simpler and your budget much easier to manage. This will allow you to keep track of exactly what is being spent on household expenses, making it much cleaner and easier to track. The perks of having two separate accounts are twofold: First, you will be able to manage your household expense and adjust your budget as needed – and second, the ability of tracking the cash flow from your ranch more efficiently. Not to mention, your year-end accounting and taxes will be streamlined. Trust me, your accountant will thank you.

3. Make a single monthly transfer from operating loan to personal account

This one is huge, and having a separate account for your household expenses will make it possible. It is easy to transfer money over as you need it, but that is a bad habit to get in. Ideally, you will refer to your monthly budget and transfer the needed monthly total at the beginning of the month. For example, if you have $2,000 budgeted for your household, you will transfer $2,000 in one lump sum into your personal account from your operating loan. This creates simplicity and efficiency.

4. Find a record-keeping system that works best for you

For some of us, that includes keeping receipts from every transaction in the console of our car or a grocery bag. For others, that may include a very detailed spreadsheet or QuickBooks. No matter the system you use, ensure it works for you and your family. If it fits your personality style, you are more likely to use it. Tracking and categorizing your expenses will allow you to create a more effective monthly budget for operating loan requests in the future years. This will also help you determine where you can save and what areas you need to adjust moving forward.

Running your household like a business – just like you do your operation – can create extra cash flow, simplicity, insight and efficiency in your total operation. I’ve often heard it said: The quickest way to give yourself a raise is to track where you are spending your money.

To learn more, watch a recent webinar by Kalyn Waters and Stefanie Gilbert, a mortgage officer and financial counselor, here.