When it comes to the state of the U.S. dairy category, there’s what you may hear and then there’s reality.

I will choose reality, and the proof points to myth-bust the “dairy is dying” narrative that is usually rooted in groups that oppose animal agriculture or produce non-dairy alternatives.

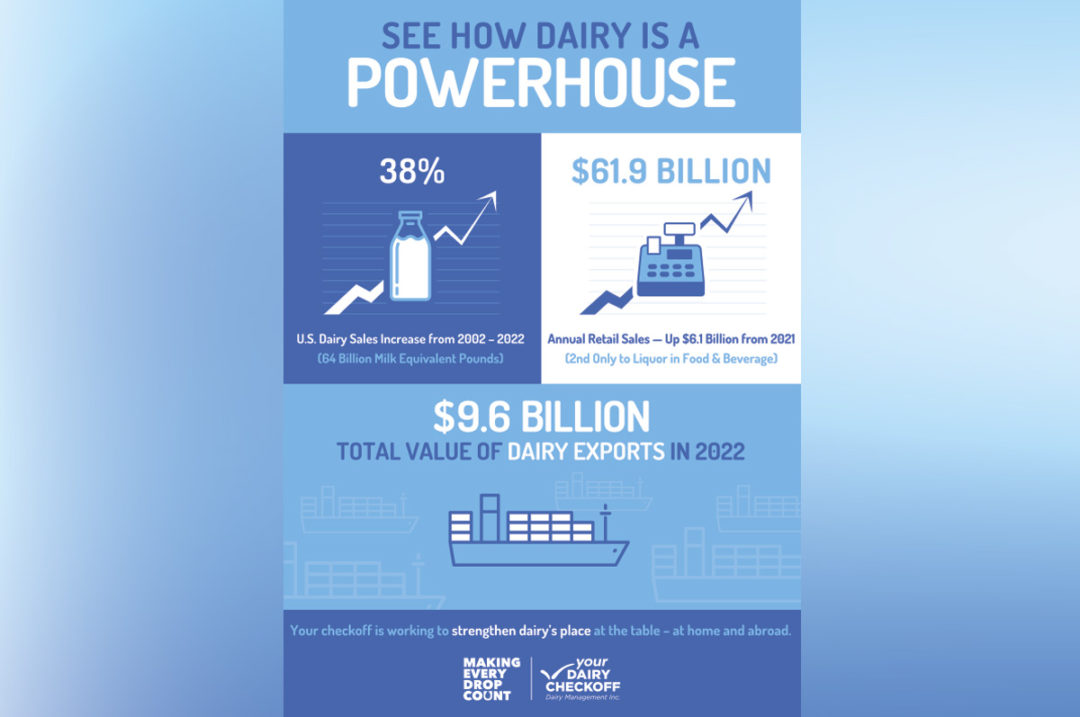

The reality? Dairy is a powerhouse category that is growing domestically and globally. We have been a powerhouse for a long time and are poised to maintain our strong position when observing the exciting innovation and changing mindsets across the industry to meet consumer demand, not just here but around the world.

Here are indicators to back this up:

- From 2002 to 2022, total U.S. dairy sales grew 38% and 64 billion milk equivalent pounds (total solids basis). This growth is split nearly evenly between domestic dairy sales (up 19%, 30-billion-pound-plus increase) and exports (up 495%, 33.6-billion-pound increase).

- Despite the challenges of COVID-19 and the most recent challenge of inflation, dairy has continued to deliver sales growth of 2.6 billion pounds the last five years.

- Sales of real dairy products at retail last year totaled $61.9 billion, up $6.1 billion from 2022. This growth is bigger than snacks, liquor, carbonated soft drinks, meat, candy, and sport and energy drinks. Real dairy is bigger than every food and beverage category except liquor.

- According to Circana data, U.S. dairy sales for the 52-week period ending Feb. 26 show:

- 97% of households bought cheese, representing 42 pounds per buyer and $25.8 billion in sales.

- 92% of households bought milk (28 gallons per buyer and $16.5 billion in sales)

- 80% of households bought yogurt (34 pints per buyer and $8.6 billion in sales)

- The checkoff-founded U.S. Dairy Export Council helps open international markets for U.S. dairy. In 2022, we hit record export sales value of $9.6 billion, representing 25% growth and 18% of U.S. milk production. This translates to one of every seven milk tankers heading to an international market.

While dairy is performing very well here and around the world, the dairy checkoff and broader industry must continue adapting to and understanding a changing consumer base that has new expectations for their food choices. That is why your checkoff staff studies consumers and their purchase habits to help U.S. dairy not only stay on top of our game, but continue the positive trajectories outlined above.

Changing world

Today’s world is very different from generations ago as the U.S. population growth is slowing. In the latest decade (2010-20), the U.S. experienced the smallest population growth since the Great Depression at 7.4%, and projected annual growth is 0.5% to the year 2030.

The birthrate has fallen 20% since the 2007 recession. This has resulted in the average household size dropping from 3.14 in 1970 to 2.5 in 2022. Also, 70% of U.S. households do not have children.

Our world is more diverse, too. About 41% of the U.S. population identifies as people of color, including more than half of children under 18. People of color represent at least 20% of the population in 39 states, and the white non-Hispanic population will drop to under 50% for Americans under 40 by 2035.

These factors, combined with a fast-paced, e-connected society, all contribute to a reduction in the traditional meal occasions for breakfast and dinner where milk has been a generations-long staple, while unlocking new opportunities and uses for dairy.

Embrace disruption

So, knowing these demographics, where can dairy make more inroads?

It starts with adopting what I call a “challenger mindset,” which means attacking new categories with dairy. Examples include cooking oils with liquid clarified butter or the snack aisle with dehydrated cheese or yogurt.

We must challenge how we define our competitive frame. We are not milk; we are a beverage. What’s growing in beverages and how do we win? We are not cheese; we are a snack. How do we bring in fruits, pretzels and nuts to cheeses to compete with top snacking products? Let’s focus on the occasion and offering delightful dairy innovation.

We also must embrace disruption through powerful marketing. We have strong nutrition science in the top health and wellness areas consumers are looking for, from bone health to sports performance to emerging areas such as inflammation and digestive health. We will need to collaborate across our relationships with influencers and health care professionals and use our consumer marketing platforms.

The dairy checkoff’s role is to spark innovation, and we meet regularly with co-op, processor and manufacturer leaders to share insights. We do the same with our food service partners to identify more ways to drive dairy sales. There have been some great breakthrough moments, such as the creation of the shelf-stable dairy creamer that Taco Bell uses in its popular line of frozen whips and beverages.

We also have become engaged in the infamous chicken sandwich wars. While many consumers are enjoying the innovative options that quick-serve chains are offering, we saw cheese is often an overlooked ingredient. Of the approximately 3 billion chicken sandwiches sold every year by the leading chains, about 2.3 billion go out the door without a slice of cheese.

Pizza is another untapped growth area, but not in the U.S. The checkoff is working globally with Domino’s and Pizza Hut to increase pizza consumption frequency. Consider that here, pizza has a 14% share of quick-serve restaurant sales. However, in Asia, it’s only 1% because pizza is consumed only a handful of times a year, mostly on special occasions.

I am confident the checkoff can continue its mission of building sales and trust in U.S. dairy, and we know there is much opportunity ahead of us.

It is great we are working from a place of strength as a longtime powerhouse category.

To learn more about your national dairy checkoff, visit the checkoff website or to reach us directly, send an email.

This article was written by Paul Ziemnisky. He is the group executive vice president, head of wellness, insights and innovation for Dairy Management Inc.