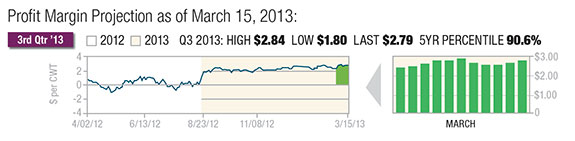

The profit margin landscape continues to look favorable for dairy producers as we head into the second half of the year. While down around $1 per hundredweight (cwt) from their highs back in April, forward margin projections remain very strong from a historical perspective, existing at or above the 80th percentile of the previous 10 years through the first quarter of 2014.

Opportunities remain abundant to protect this historical profitability in each of these forward time periods, and many dairies we work with have been active securing this profitability with various forms of contracting over the last

several weeks.

Concerns appear to be subsiding over a late corn planting campaign, as early crop conditions are generally good, and this has kept new-crop price strength in check.

Forward milk values have also held up quite well despite a sharp drop in summer future contracts during the month of May.

The figures reflect both the current outlook for dairy margins through the second quarter of 2014 as well as comparison figures to these same forward profit margin projections back in March.

Coming off a historic drought this past season, there has been heightened sensitivity this spring over Midwest field conditions as farmers prepared to plant this year’s corn crop.

The U.S. Drought Monitor continued to show a large area of the western Midwest in the heart of the Corn Belt under severe to exceptional drought conditions as recently as early to mid-March, although record rainfall during the month of April in some areas went a long way to restore soil moisture in the region.

This was unfortunately a mixed blessing given that while it recharged soil moisture, it also prevented farmers from planting their fields.

As of May 12, only 28 percent of the corn crop had been seeded according to USDA’s weekly crop progress report, the slowest pace on record since NASS began reporting weekly progress back in 1980.

Fortunately, there was a big push the following week once conditions finally moderated to allow widespread activity, and planting progress reached 71 percent complete for the week ending May 19. Further rainfall continued to slow down progress during the last half of May, and many fields remained unplanted heading into June.

This presented some producers with a quandary on whether or not to elect preventative planting in their insurance policies, or switch the intended acreage to another crop.

As of this writing, market expectations generally reflect a one million to three million acre reduction in final corn plantings relative to the March prospective plantings estimate of 97.3 million acres.

Despite the planting delays and expectations for reduced acreage in the final report, the corn crop is still off to a good start, and the outlook is favorable for trendline or better yields to be achieved should normal weather conditions prevail though the summer.

USDA reported 63 percent of the crop in good to excellent condition as of June 2 compared to 66 percent on average and 72 percent last season.

While initial crop condition ratings do not have a very strong correlation to final yields, the generally favorable conditions have raised hopes that a good crop can definitely be achieved should the weather cooperate.

Also favorable is the fact that there currently is no indication of any potential adverse weather in NOAA long-range forecast models.

Meanwhile, from a demand perspective, the outlook is likewise positive. USDA is forecasting a big increase in world production outside the U.S. – particularly in the EU and FSU.

Aggressive offers from South America combined with increased supplies out of Europe will likely limit U.S. export prospects in the new-crop season, although shipments are expected to rebound from the very slow pace this year.

In the domestic market, while ethanol margins have rebounded and production has increased recently, we are still facing the “blend wall” with analysts suggesting it will be difficult to increase the ethanol corn grind beyond five billion bushels without raising the 10 percent limit of ethanol inclusion in reformulated gasoline blends.

On top of this, poor pasture conditions will slow the pace of beef cattle expansion while hog producers remain cautious about herd

expansion until a recovery in feed supplies can be confirmed later in the year.

Given the lack of feed availability recently, livestock integrators have also had to become more creative in managing their feed rations, and many operations have learned how to limit corn use as a result.

Milk prices appear to be stabilizing after a recent selloff during May, and deferred contracts are holding up quite well to maintain profit margins further out in time.

April dairy product exports were quite strong, with nonfat dairy and skim milk powder exports setting a new record of 121.7 million pounds, which shattered the previous high of 109 million posted in Oct. 2010.

Double-digit increases were noted throughout Southeast Asia to the Philippines, Thailand, Vietnam and Malaysia, seeming to confirm that the recent drought in Oceania has definitely benefited U.S. dairy exports.

Through April, total year-to-date NDM-SMP sales are up 3 percent versus 2012, while butter and milkfat exports are up 4 percent and cheese exports up 7 percent.

In addition to lower production from Oceania, the EU is also struggling with milk production. European milk production has trailed the previous year since June of 2012 due to poor quality and limited access to feed and forages as well as higher prices for feed concentrates.

Erhard Richarts, Chairman of the Food Industry Institute in Kiel, Germany, is expecting EU 2013 milk production to decline 0.5 percent from last year to 308.6 billion pounds.

In addition, he is forecasting limited EU dairy product exports in the second half of the year due to a combination of seasonally lower milk production and increased seasonal demand for cheese and other fresh products.

This may help continue the positive U.S. export trend, as the EU is the largest global exporter of SMP. Lower EU butter stocks should also help the U.S. garner additional export opportunities in that market.

Returning to the perspective of projected forward profit margins, much of the favorable outlook continues to be predicated upon expectations for declining feed costs and milk prices maintaining current levels through year-end.

While on a surface level nothing is fundamentally flawed with these expectations or the reasoning behind them, the lesson of the last few years is that much can change regarding forward expectations and eventual reality in a deferred time period.

I

n particular, much of what has allowed margins to be preserved following the decline in milk prices recently has been a similar drop in projected feed costs.

Although a drought is not likely this summer for the main Corn Belt states, there is a long growing season ahead with a lot of uncertainty surrounding acreage and production.

Milk prices similarly face an uncertain landscape and any number of things may cause prices to weaken over the medium to longer term.

With forward margins still existing at attractive historical levels, it would seem prudent to have a plan in place to protect them from deteriorating. There are a variety of ways this can be accomplished, including many flexible strategies that would allow for stronger profit margins to be realized over time.

Another lesson that is good to keep in mind is the best opportunities to capture a strong profit margin often occur well ahead of the actual marketing period. Hopefully, your dairy is well positioned to capture the opportunities currently available. PD

Whalen is a senior risk manager and director of education for Commodity & Ingredient Hedging based in Chicago, Illinois. For more information, he can be reached by email .

Chip Whalen

Senior Risk Manager and Director of Education

CIH – Commodity & Ingredient Hedging LLC