One purpose of a milk pricing system is to give dairy farmers the economic signal to produce the milk components of greatest value. For many years, our U.S. milk pricing system placed the greatest economic value on the skim portion of milk and the components in the skim, especially protein.

The butterfat portion of milk was the minority value. In markets with multiple component pricing, the signal to dairy farmers was to produce more protein. Dairy farmers in these markets did respond, which is evident by average milk protein content increasing from about 3.02 percent in 2000 to 3.12 percent in 2016.

The pricing signal has now changed. Protein is no longer the most valuable milk component; butterfat is now milk’s most valuable component. Skim and the components in the skim, protein and other solids, are now the minority value.

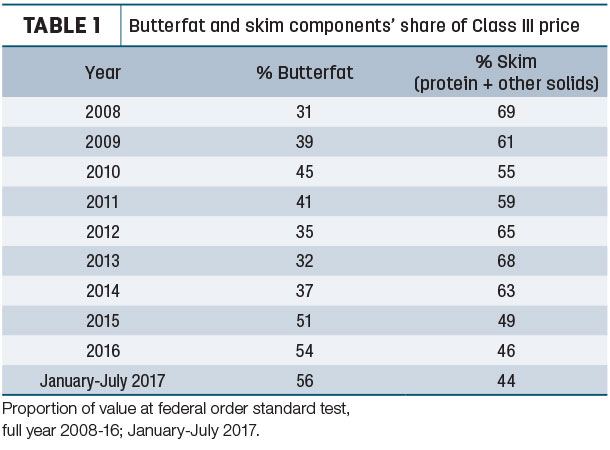

As shown in Table 1, butterfat only accounted for 32 percent of the Class III price four years ago. But two years later, in 2015, the shift in milk’s value began. Since 2015, butterfat has contributed to one-half or more of the Class III price.

Butterfat versus protein

In January 2000, multiple component pricing became the milk pricing system for about 90 percent of federal order milk production. One of the advantages of multiple component pricing is: It provides clear pricing signals to dairy farmers in regards to the economic value of milk components.

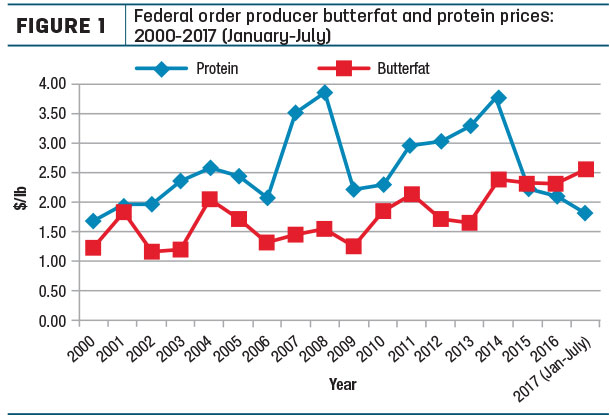

From 2000 to 2014, the average annual producer protein price was higher than butterfat every year. In 2013, protein was almost double the price of butterfat, $3.30 per pound to $1.66 per pound. In 2015, the shift started – the butterfat price became higher than protein (Figure 1).

So far this year, the shift from protein to butterfat has accelerated. For the first seven months of 2017, the producer butterfat price has exceeded protein every month. In July, butterfat was almost two-and-a-half times greater than protein, $2.95 per pound to $1.22 per pound. The milk pricing system is signaling dairy farmers: Produce butterfat.

Not only is milkfat demand growing in the U.S., but it is increasing on the world market as well, as seen by the world butter price. For the first half of 2017, Oceania butter averaged $2.27 per pound compared to $1.27 per pound during the first half of 2016.

Without looking at the numbers, the increased value of butterfat relative to skim is occurring in the marketing of milk. During the first half of this year, finding markets for all milk production was a challenge. In areas with this marketing challenge, excess milk was separated into cream and skim.

Markets were available for the separated cream, and it was sold. Unfortunately, the skim (protein and other solids) was dumped due to no markets. This is reminiscent of market conditions in many parts of the U.S. prior to World War II. Milk was separated on the farm. The cream was sold because it was in demand. But the skim remained on the farm and was fed to hogs. History has a way of repeating itself.

More demand for butterfat

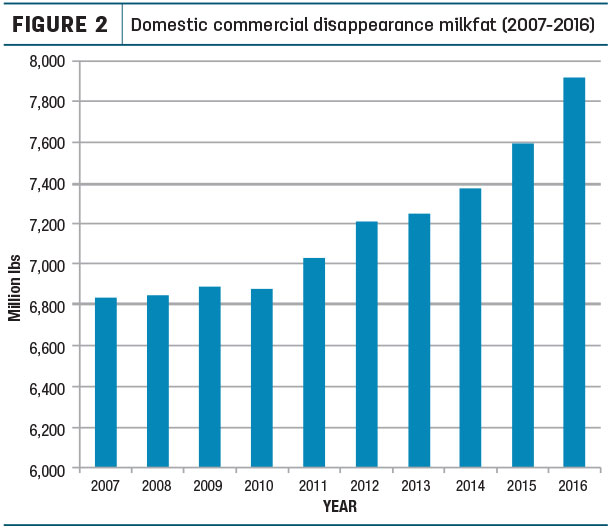

Higher butterfat prices are the result of increased demand for milkfat. As seen in Figure 2, domestic disappearance for milkfat increased over 1 billion pounds in the 10-year period from 2007 to 2016.

A closer look at Figure 2 shows over one-half of the billion-pound increase occurred recently from 2014 to 2016. Already during the first five months of 2017, compared to the same period in 2016, domestic disappearance of milkfat is up over 1.5 percent.

One obvious place the additional butterfat usage is going is into butter. Domestic butter consumption increased at an annual rate of about 3 percent over the past 10 years. Households, restaurants and food manufacturers are turning away from margarine and vegetable substitutes, and using butter.

Another product increasing in consumption is whole milk (3.25 percent butterfat). While consumption of all fluid milk is declining, consumption of whole is increasing. From 2014 to 2016 consumption of whole milk increased over 1.2 billion pounds.

Through May of this year, whole milk sales are 2.1 percent higher than a year ago. Increased consumption of whole milk means less butterfat available for the butter churn, thus supporting a higher butter price which, in turn, increases the producer butterfat price.

Not to be overlooked, we must remember cheese utilizes a significant portion of the nation’s butterfat. Most cheeses are required to contain a minimum of 45 to 50 percent milkfat on a dry matter basis. Similar to butter, cheese consumption continues to grow about 3 percent a year, thus utilizing more butterfat.

Plus, due to low protein prices relative to butterfat, more cheesemakers are standardizing cheese milk by adding protein versus removing butterfat. This decreases the supply of butterfat available for other uses and again supports higher butterfat prices.

No doubt consumers are paying attention to the scientific studies, books and popular press articles that began appearing in 2014 which explained that saturated fat, the kind found in dairy products, does not increase the risk of heart disease. Plus, these sources also point out butter and cheese should be part of a healthy diet.

Protein prices are dragging down farmgate prices

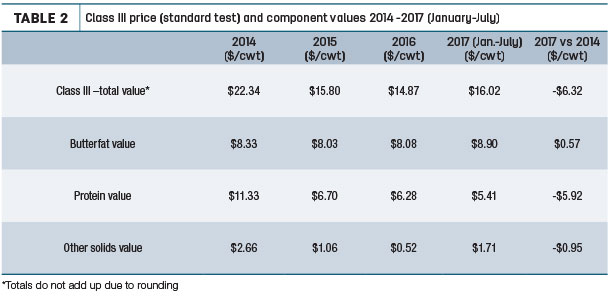

Since record farm milk prices in 2014, prices have declined significantly. The Class III price so far in 2017 is $6.32 per hundredweight lower than 2014. Breaking the Class III price down into its component values shows the entire decline is due to lower protein and other-solids prices.

The butterfat value within the Class III price is actually higher today than in 2014 (Table 2). Without the strong butterfat price, farm milk prices would be even lower. Increased demand for milkfat, and the resulting higher butterfat price, is driving milk prices.

No one can predict with 100 percent accuracy future milk prices. However, all current indications point to the demand for milkfat remaining strong, which means butterfat prices remaining high, relative to previous years. For the foreseeable future, butterfat will continue to drive farmgate milk prices. ![]()

Calvin Covington is a retired dairy cooperative CEO and now does some farming, consulting, writing and public speaking.

-

Calvin Covington

- Retired Dairy Co-op Executive

- Email Calvin Covington