A USDA survey showed the percentage of dairy farmers with health care coverage was far less than other agricultural groups. Progressive Dairyman looks at some options to raise those numbers.

As political debate over the Affordable Care Act (ACA, or Obamacare) continues, a group of rural sociologists have identified the 2018 Farm Bill as one means to address the coverage of health care cost needs of farmers.

The newly released report “Health Insurance and National Farm Policy,” was compiled by members of the Health Insurance Rural Economic Development and Agriculture (HIREDnAg) project. It is summarized in the Agricultural & Applied Economics Association’s CHOICES publication.

The report says recent farm bills and other federal policies have not adequately considered how health insurance influences farming and rural economic development.

According to the report’s authors, health insurance is a cross-sector risk for agriculture, interconnected with farm risk management, productivity, health, retirement, the need for off-farm income for farmers of all ages and land access for young and beginning farmers. A survey of farmers found 74 percent said they believed the USDA should represent their unique needs in national health insurance policy discussions.

Federal farm bills and other policies frequently support new and beginning farmers through strategic investments in production, marketing, access to capital and land, and succession planning. However, those policies do not address health insurance.

Farmer health insurance surveys

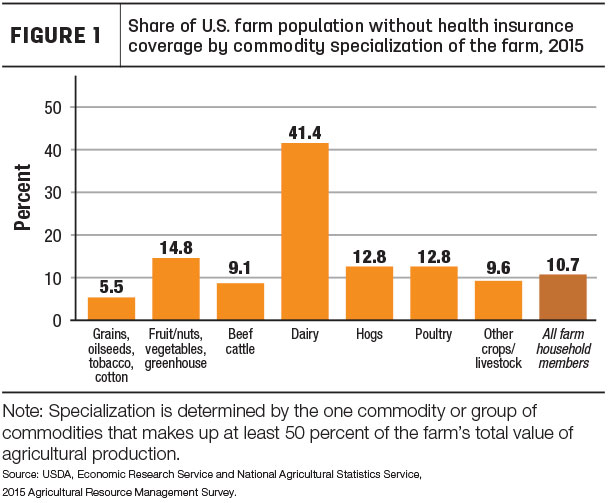

In 2011 and 2015, the USDA included questions about health insurance on the Agriculture Resource Management Survey (ARMS), tracking the overall numbers of farmers insured and their source of coverage. Findings from the USDA’s 2015 ARMS found farmers were just slightly more likely to be uninsured than the general population (10.7 percent versus 9.1 percent). The HIREDnAg survey found that in 2016, 8 percent of those farmers sampled had no health insurance, citing unaffordable premiums, the high cost of deductibles and out-of-pocket costs.

Additionally, the HIREDnAg project found the way farm families are insured is complex, varying by age and life stage, health, values and the structure of the farming enterprise. Based on their survey, farmers’ sources of health care coverage included:

• Off-farm employer – 23.4 percent

• Spouse or partner off-farm employer – 26.9 percent

• Direct purchase of private policy – 29 percent

• Public health insurance plan (Medicaid, Medicare or Children’s Health Insurance Program) – 38.5 percent

• Through an organization (Farm Bureau or Farmers Union) – 3.7 percent

• Through their parents’ plan – 3.6 percent

• Health care sharing or faith-based plans – 1.1 percent

Nearly one-third of farmers reported two or more health insurance plans within the same family.

About one out of five farmers (19 percent of farmers) shared that marketplace health insurance options available after 2010 through ACA allowed them to sign up for health insurance for the first time.

Dairy farm disparity

While about 90 percent of the general farm population had health insurance coverage, the rate was much lower for dairy farmers. Due to the nature of their business (more likely full-time farmers with less opportunity for off-farm employment), the USDA ARMS survey revealed 41.4 percent of dairy farmers were without health insurance coverage (see Figure 1). While more than 50 percent of all farmers had access to health care coverage through off-farm employment (either themselves or a spouse), that rate was just 36 percent among dairy farmers.

Read: Farm Household Wellbeing: Health Insurance Coverage

Seeking further analysis, members of the HIREDnAg project examined health insurance access and use in the farm population, and looked at connections between health insurance and risk management, farm viability and impacts of attracting the next generation of farmers.

In-depth case studies were conducted in 10 states (California, Kentucky, Massachusetts, Michigan, Mississippi, Nebraska, Pennsylvania, Utah, Vermont and Washington), interviewing about 10 families in each state in 2015-16. Additionally, random surveys of producer households were conducted in 2017, yielding 1,062 responses.

Family and farm risks

Led by Shoshanah Inwood, assistant professor in Ohio State University’s School of Environment and Natural Resources, the research found that 65 percent of commercial farmers identified the cost of health insurance as the most serious threat to their farm, more significant than the cost of land, inputs, market conditions or development pressure.

In early 2017, more than 3,500 respondents to a Young Farmer Coalition survey cited health insurance as one of the top four issues affecting the trajectory and success of young and beginning farmers.

Farming is an inherently risky and dangerous occupation, and 74 percent of farmers surveyed said they viewed health insurance as part of their risk management strategy.

The health and well-being of all farm family members directly impact the farm enterprise. The farm enterprise and farm family are often treated as separate, but the two are intertwined. Two out of five farmers (40 percent) reported that they or a family member had health problems affecting their ability to farm. In addition, 50 percent reported they would have no one to run the farm in the case of a major illness or injury.

The finances of farm operations and farm families are often commingled, and health care costs can influence the trajectory of the farming enterprise. Greater than two-thirds (64 percent) of farmers reported that they were not confident they could pay the costs of a major illness or injury such as a heart attack, cancer or loss of limb without going into debt.

Moreover, 53 percent reported they were concerned they would have to sell all or a portion of their farm land or assets – often for nonfarm development – to address health-related costs such as long-term care, nursing home care or in-home health assistance.

While health care costs impact management decisions for farmers at the end of their careers, it also influences younger, beginning farm families. Examples cited included the need to take additional off-farm jobs for health care coverage, at the expense of time, energy and resources to build and manage the farm business, and the loss of time spent with their spouse and children, adding to family stress.

USDA: Beyond commodity insurance?

According to the report’s authors, the 2018 Farm Bill presents a new opportunity to integrate health, access to health care, health care costs and health insurance into the Risk Management Agency (RMA) and Rural Development (RD) initiatives to promote a vibrant and resilient farm sector. Policies and programs designed to build a young, vibrant farm population should be explored and should show health insurance factors into young and beginning farmer’s business plans and family needs.

Separately, Inwood has identified the need for extension to develop educational resources and programming to connect the agriculture and health insurance sectors.

Other challenges

Additional health care challenges faced by farmers include consolidation and closure of rural hospitals.

In early February, U.S. Reps. Doug LaMalfa (R-California) and Cheri Bustos (D-Illinois) introduced a bipartisan bill that would designate a rural health liaison within the USDA.

USDA already offers grants to help smaller hospitals address health disparities. This bill directs USDA to make sure this funding is used efficiently by designating one point of contact to coordinate efforts between different agencies and serve as a liaison for rural communities.

The Rural Health Liaison would promote the awareness and availability of health care resources, including telemedicine and health education, and provide guidance and technical assistance to USDA field offices and staff on how to best serve their communities. The liaison would also coordinate with other government agencies on rural health issues.

Next week: ‘Association’ policies might offer dairy health insurance opportunity ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke