Production in second-quarter 2019 was raised based on greater expected fed cattle slaughter (i.e., steers and heifers) that was partially offset by lower expected carcass weights. Fourth-quarter 2019 production was lowered on anticipated reduced fed cattle slaughter due to fewer expected placements in second-quarter 2019. The forecast for 2020 beef production was lowered marginally from the previous month’s forecast to 27.4 billion pounds, also based on anticipation of fewer fed cattle slaughtered.

Feed prices to slow feedlot placements in second-half 2019

According to the May Cattle on Feed report, the May 1 cattle-on-feed number increased more than 2% from the previous year to 11.8 million head, the largest number of cattle on feed for the month of May since reporting began in 1996. Nearly 7% more fed cattle were marketed in April than at the same time last year. When adjusted for the additional weekday of slaughter available compared to April 2018, marketings were only about 2% higher in April 2019.

Also based on the report, the number of net placements (total placements minus disappearance) of cattle in feedlots was 1.8 million head, which was about 9% above the previous year’s level. The report showed placements of feeder cattle 800 pounds or heavier in April 2019 as a percentage of total net placements was close to year-earlier levels, which is expected at a time when cattle held on winter pasture in the first quarter would likely be coming off pasture and placed in feedlots. Based on the weekly USDA Agricultural Marketing Service National Feeder & Stocker Cattle Summary reports for the month of May, there were about 25% fewer sales receipts compared to the same time last year.

Anticipated placements of steers and heifers in feedlots in late 2019 were reduced. Softening fed cattle prices in 2019 and the prospect of higher feed input costs could delay steers and heifers from entering feedlots. This could incentivize keeping lightweight cattle on pasture longer to add weight, which may lead to a more gradual pace of heavier cattle placed on feed so feedlots will spend less time feeding them to the appropriate finishing weights. The slower pace of placement will likely be reflected in fewer fed cattle to be marketed for slaughter in early 2020.

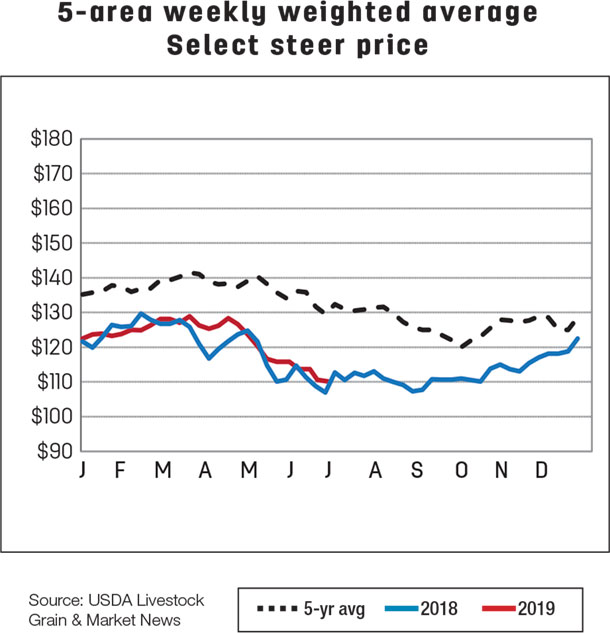

Cattle prices decline on higher input prices

Since the spring peak, weekly average fed steer prices in the 5-area marketing region have fallen to $113.76 per hundredweight (cwt) for the week ending June 9, 2019, about an 11% decrease. Based on recent price data and expectations of higher steer and heifer marketings, the price forecast for second-quarter 2019 was lowered $3 to $118 per cwt. Historically, prices drop about 15% from the seasonal peak, which would suggest prices will continue to decline into the fall. With expectations of seasonally declining beef prices, the third-quarter 2019 price forecast was lowered $3 to $110 per cwt. As a result, the 2019 annual price is forecast at $117 per cwt, $1.50 lower than the previous month and just below 2018 price levels. The forecast for the 2020 annual price was lowered by $2 to $119 per cwt.

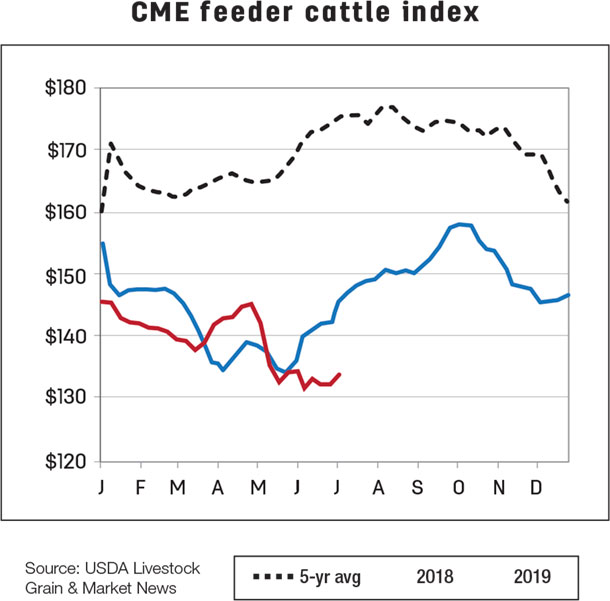

Lower fed cattle prices have turned feedlot margins negative, and higher forecast feed input prices could make feedlots less willing to bid up prices for feeder cattle for the rest of 2019. Based on recent price data, the second-quarter 2019 feeder steer price was lowered by $3 to $142 per cwt. Faced with continued poor operating margins, the 2019 third- and fourth-quarter price forecasts were each lowered $5 from the prior month to $145 and $142 per cwt, respectively. As a result, June’s annual price forecast for 2019 was $4 lower at $142 per cwt. The 2020 annual price forecast was reduced $5 from the previous month’s forecast to $145 per cwt as higher forecast feed costs and a lower forecast for fed cattle prices weigh on feedlot margins.

Domestic demand lifts import forecast

U.S. beef imports in April 2019 were up 16% from year-earlier levels at 273 million pounds. Among major suppliers, higher imports were from Mexico, Australia, New Zealand, Uruguay and Nicaragua, while imports from Canada and Brazil were lower. The price for imported beef (90% lean) in the U.S. was also higher year over year in April 2019, suggesting stronger demand for lean meat for processing. The strong import growth in April resulted in the year-to-date total of 1 billion pounds, 6% above the same period last year. The forecast for second-quarter beef imports was revised upward by 25 million pounds to 830 million pounds, raising the 2019 annual import forecast to 3.038 billion pounds. The 2020 import forecast is unchanged from the previous month’s forecast at 2.96 billion pounds.

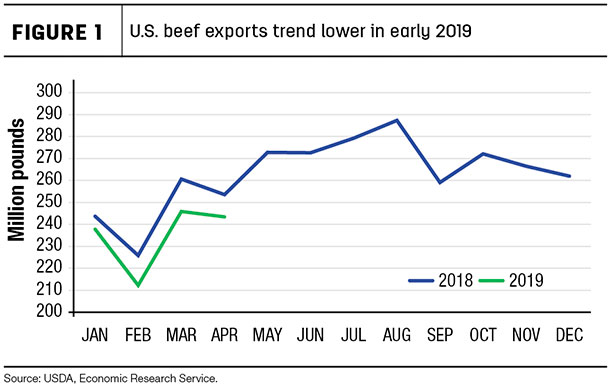

Beef exports continue to lag year-ago levels

U.S. beef exports for the month of April were down 4% from year-earlier levels, which kept year-to-date exports almost 5% below the same period last year (see Figure 1).

There were year-over-year declines in shipments to most of the major destinations, with the exception of South Korea and Taiwan. For the period January through April, most of the declines in U.S. beef exports reflected lower exports to Hong Kong, Canada and Japan. Exports to Hong Kong have continued to decline year over year, with January-to-April shipments 44% lower compared to the same period last year.

Exports to Canada are likely being offset by domestic production; through late April, weekly federally inspected fed beef production in Canada was 12% above 2018. U.S. exports to Japan for January-April were 4% below 2018. The decline likely reflects increased competition with other suppliers such as Australia, Canada and New Zealand, who have been granted tariff concessions under the implementation of the 11-member Pacific trade deal known as the Comprehensive and Progressive Trans-Pacific Partnership. In addition, larger beef production in Australia and Canada has increased their supplies of exportable beef, increasing competition with U.S. product. Nonetheless, through April, the U.S. share of Japan’s imports was 39%, about the same as January-April 2018.

FAS weekly sales reports suggest year-over-year higher export sales in May. However, this is not expected to offset the decline in April. On this basis, the second-quarter 2019 export forecast was revised downward by 10 million pounds to 800 million pounds, for a 2019 annual forecast of 3.161 billion pounds. The 2020 export forecast was left unchanged from the previous month at 3.245 billion pounds.

2019 cattle imports revised upward

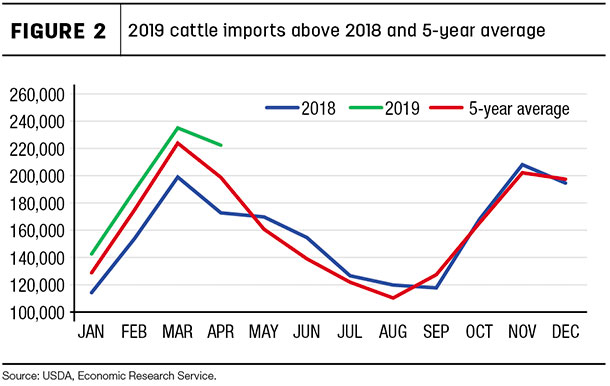

In April 2019, U.S. cattle imports increased by 29% from year-earlier levels to 222,429 head, with gains in imports of feeder cattle contributing two-thirds of the increase. Imports for the period were higher from both Mexico and Canada. Cattle imports for January-April were up 23% from the same period last year to 789,514 head, above the five-year average levels (see Figure 2).

The Mexican cattle herd is in an expanding phase, producing more feeder cattle and thus increasing available shipments to the U.S. Most of these calves will be for backgrounding. Slaughter-ready cattle imports from Canada were more than 32% higher from year-earlier levels in the first four months of 2019.

The cattle import forecast for 2019 was revised upward by 15,000 head from the prior month to 2.045 million head based on higher April imports and strong weekly imports reported by the USDA Agricultural Marketing Service. The import forecast for 2020 was unchanged from the previous month’s forecast of 2.105 million head. ![]()

Analyst Lekhnath Chalise assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.