- 2022 DMC enrollment posts small decline

- ‘Replacement’ economics improves

- January all-milk, mailbox price spread averaged $1

- GDT price index tumbles

- Ag producer sentiment improves but input costs, availability remain top concern

2022 DMC enrollment posts small decline

With the outlook for substantially higher milk prices this year, enrollment in the USDA’s 2022 Dairy Margin Coverage (DMC) program declined slightly – but probably not as much as many anticipated.

The USDA released latest 2022 DMC program enrollment numbers on May 2. As of that date, 17,570 dairy operations (about 71.5% of those with established milk production history) had enrolled in the 2022 DMC program. The 2022 total is down about 1,500 dairy operations from 2021 DMC enrollment.

With smaller producers eligible to boost annual milk production history retroactively to 2021 through 2023 under the Supplemental DMC, total milk production recorded with the USDA’s Farm Service Agency (FSA) for 2022 is just over 205 billion pounds, down 14 billion pounds from 2021.

Of that total, milk production enrolled for 2022 was estimated at 157.2 billion pounds, down about 5.6 billion pounds from 2021 and representing about 76.7% of the established history.

Likely contributing to that decline is the drop in dairy farm numbers; the USDA’s National Ag Statistics Service (NASS) estimated there were 29,858 dairy herds licensed to sell milk in 2021, down from 31,652 in 2020.

Updated 2021 DMC program enrollment numbers (as of May 2) showed 19,072 dairy operations were enrolled last year, about 73.5% of operations with established milk production history. Milk production enrolled for 2021 was estimated at 162.8 billion pounds, about 74.3% of the established history. Producers enrolled in 2021 received a total of $1.19 billion in indemnity payments.

Despite rising feed costs, the online DMC Decision Tool forecasts 2022 monthly DMC margins will average $11.66 per hundredweight (cwt) for January-June 2022 and remain above $10.60 per cwt for the second half of the year, yielding a 2022 average of $11.18 per cwt, well above the $9.50 per cwt maximum Tier I coverage level.

Based on current market conditions, April’s DMC margin, to be announced May 31, is forecast to be the high for the year at $12.50 per cwt. The March 2022 DMC margin was announced at $11.69 per cwt. Read: Milk price rise outpaces feed costs in March DMC margin.

Enrollment for 2022 DMC and Supplemental DMC programs closed on March 25. State-by-state enrollment information is available here.

‘Replacement’ economics improves

Stronger milk prices and tighter supplies of cows and heifers are pressuring U.S. average prices for dairy replacements higher. However, when comparing gross income generated from milk sales, replacements can be purchased with less milk.

U.S. replacement dairy cow prices averaged $1,570 per head in April 2022, up $190 (14%) from January 2022 and $260 (20%) more than April 2021. U.S. average milk prices for the first quarter of 2022 averaged $24.93 per cwt. So it took the sale of 6,297 pounds of milk to generate enough gross income to purchase a replacement animal.

Looking back, U.S. average milk prices averaged $18.69 per cwt in 2021 and $18.24 per cwt in 2020, while replacement cow prices averaged $1,350 and $1,315 per head, respectively. In both those years, it took the sale of about 7,250 pounds of milk to generate the gross income to purchase a replacement cow.

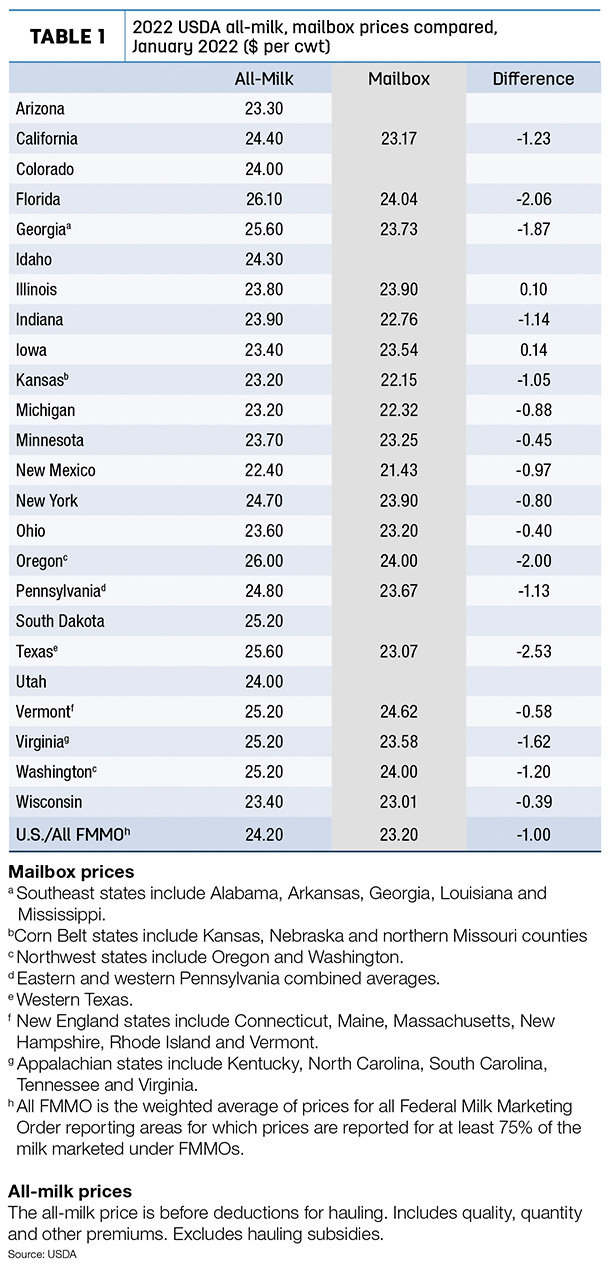

January all-milk, mailbox price spread averaged $1

January 2022 “mailbox” prices averaged about $1 per cwt less than announced average “all-milk” prices for the same period, based on a preliminary look at two USDA milk price announcements.

- During January, U.S. all-milk prices averaged $24.20 per cwt, up $2.40 from December 2021 and $6.70 more than January 2021.

- The January 2022 mailbox prices for selected Federal Milk Marketing Orders (FMMOs) averaged $23.20 per cwt, up $2.33 from December 2021 and $7.08 more than January 2021.

Reported monthly by the USDA NASS, the all-milk price is the estimated gross milk price received by dairy producers for all grades and qualities of milk sold to first buyers, before marketing costs and other deductions. The price includes quality, quantity and other premiums, but hauling subsidies are excluded.

Mailbox prices are reported monthly by the USDA’s Agricultural Marketing Service (AMS) but generally lag all-milk price announcements by a month or more. The mailbox price is the estimated net price received by producers for milk, including all payments received for milk sold and deducting costs associated with marketing.

There’s a disclaimer of sorts: Comparing the all-milk price and mailbox price isn’t exactly apples to apples.

The price announcements also reflect similar – but not exactly the same – geographic areas. The NASS reports monthly average all-milk prices for the 24 major dairy states. The mailbox prices reported by the USDA’s AMS cover selected FMMO marketing areas.

In Table 1 below, Progressive Dairy attempts to align the state-level all-milk prices and the FMMO marketing area prices as closely as possible. January’s spread between individual states or regions varied widely. Producers in two states, Iowa and Illinois, saw January 2022 mailbox prices surpass the announced all-milk prices.

For additional background information, read: All-milk, mailbox price spread shrunk a little in 2021.

GDT price index tumbles

The latest Global Dairy Trade (GDT) auction saw the overall index decline 8.5%, with prices down across all product categories. By product, prices were:

- Skim milk powder was down 6.5% to $4,130 per metric ton (MT, or about 2,205 pounds).

- Whole milk powder was down 6.5% to $3,916 per MT.

- Butter was down 12.5% to $5,807 per MT.

- Cheddar cheese was down 8.6% to $5,652 per MT.

- Anhydrous milkfat was down 12.1% to $6,008 per MT.

The GDT platform offers dairy products from six global companies: Fonterra (New Zealand), Dairy America (U.S.), Amul (India), Arla (Denmark), Arla Foods Ingredients (Denmark) and Polish Dairy (Poland). The next GDT auction is May 17.

Ag producer sentiment improves but input costs, availability remain top concern

The financial outlooks of U.S. agricultural producers improved in April, as measured in the monthly Purdue University/CME Group Ag Economy Barometer survey.

The brighter outlooks were supported by higher commodity prices, especially for corn and soybeans, according to James Mintert, the barometer’s principal investigator and director of Purdue University’s Center for Commercial Agriculture. Despite this month’s improvement in sentiment, the index was still lower than a year earlier, indicating producers remain troubled regarding the uncertainty surrounding input prices and availability.

The Ag Economy Barometer provides a monthly snapshot of farmer sentiment regarding the state of the agricultural economy. The survey collects responses from 400 producers whose annual market value of production is equal to or exceeds $500,000. Minimum targets by enterprise are as follows: 53% corn/soybeans, 14% wheat, 3% cotton, 19% beef cattle, 5% dairy and 6% hogs. Latest survey results, released May 3, reflect ag producer outlooks as of April 18-22.

Producers continue to say that their top concern for their farming operation is higher input costs. This month, 60% of survey respondents said they expect input prices to rise by 30% over the next 12 months. Beyond higher costs, availability of herbicides, fertilizer, insecticides and machinery parts continues to be a concern. More than 10% of crop producers said they received notice an input supplier would not be able to deliver one or more crop inputs they had already purchased for use in 2022.

Despite the improved financial performance outlook, investment plans remained at an all-time low. Although less pessimistic than in March, producers cited supply chain problems and high costs as factors in slowing both machinery purchases and implementing new construction plans in the upcoming year.

A breakdown on the Purdue/CME Group Ag Economy Barometer April results can be viewed here. Find the audio podcast discussion for insight on this month’s sentiment here.