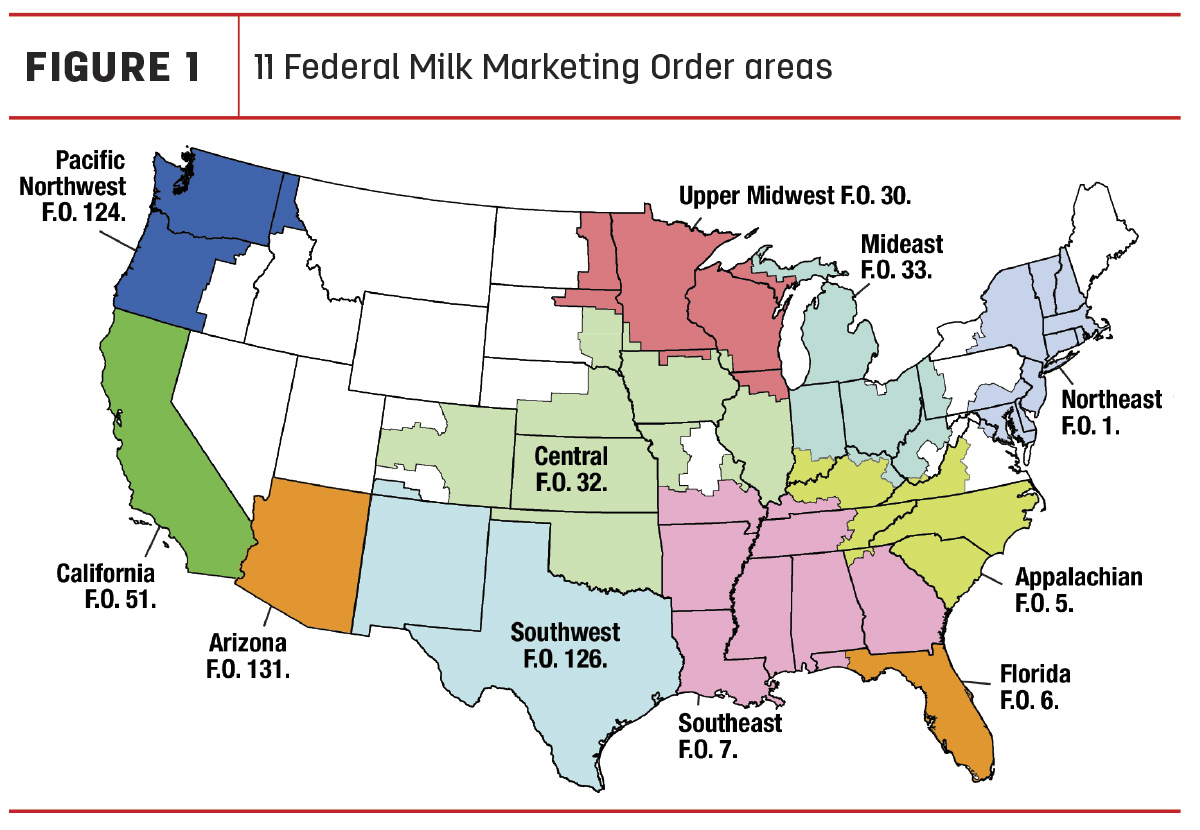

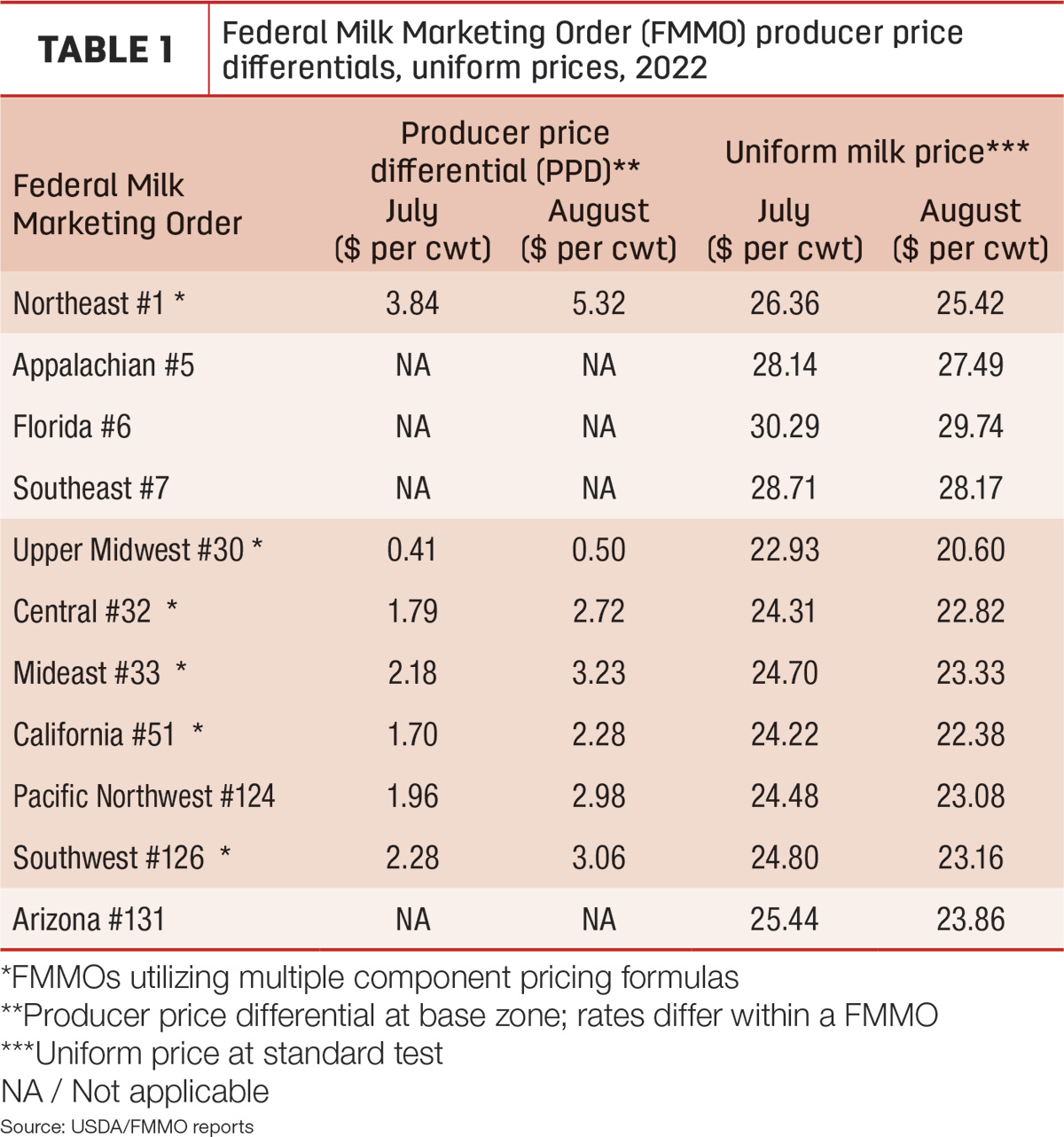

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported August 2022 uniform milk prices, producer price differentials (PPDs) and milk pooling data, Sept. 11-14. In a repeat from last month, uniform or blend prices moved lower, while the wide spread between Class III-IV milk prices continued to affect pooling.

Uniform prices, PPDs

After setting record highs in most FMMOs in June, August 2022 uniform milk prices followed the downward trend started in July (Table 1). Largest declines were again in FMMOs utilizing multiple component pricing, where a lower value for protein pressured Class III milk prices lower.

Seven FMMOs saw uniform prices decline more than $1 per hundredweight (cwt) from the month before, led by Class III milk-heavy Upper Midwest 30 and California 51.

August baseline PPDs were higher in applicable FMMOs (Table 1). The August PPD was up $1.48 in the Northeast FMMO 1, hitting $5.32 per cwt, but up just 9 cents in the Upper Midwest 30 at 50 cents. PPDs have zone differentials, so actual amounts will vary. Also, individual milk handlers apply PPDs and other deductions to milk checks differently.

Class prices for August

Three of four FMMO milk class prices were lower in August, and the Class I milk price was affected by the formula change made in 2019:

- Class I base price: $25.13 per cwt, down 74 cents from July

- Class I base with zone differentials: $27.95 per cwt across all FMMOs, ranging from a high of $30.53 per cwt in the Florida FMMO 6 to a low of $26.93 per cwt in the Upper Midwest FMMO 30

- Class I mover formula: The Class I mover “average-of plus 74 cents” formula reduced Class I prices paid to producers compared to the previous “higher-of” formula. Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $26.17 per cwt, $1.04 more than the actual price determined using the average-of plus 74 cents formula.

- Class II milk price: $26.91 per cwt, up 25 cents from July

- Class III milk price: $20.10 per cwt, down $2.42

- Class IV milk price: $24.81 per cwt, down 98 cents

- Class III-IV milk price spread: At $4.71 per cwt, it was the widest since November 2020, when the Class III milk price was supported by pandemic food box cheese purchases – a wide spread creates incentives for the higher-priced milk class to be depooled.

Component values, tests

Affecting Class III-IV milk prices, the value of butterfat rose in August, but the value of protein declined:

- Butterfat value: $3.40 per pound, up 4 cents from July – it’s the seventh straight month the butterfat value topped $3 per pound.

- Protein value: $2.14 per pound, down about 77 cents from July – the value of protein is now down nearly $1.73 per pound since May and the lowest since May 2020.

- Solids: The value of nonfat solids fell about 13 cents to $1.49 per pound. The value of other solids decreased about 4.5 cents to 31.5 cents per pound.

Affecting statistical uniform prices at test, average butterfat and protein tests in pooled milk were up slightly from July in most FMMOs providing preliminary data. An exception was in the Northeast FMMO 1.

Impact on pooling

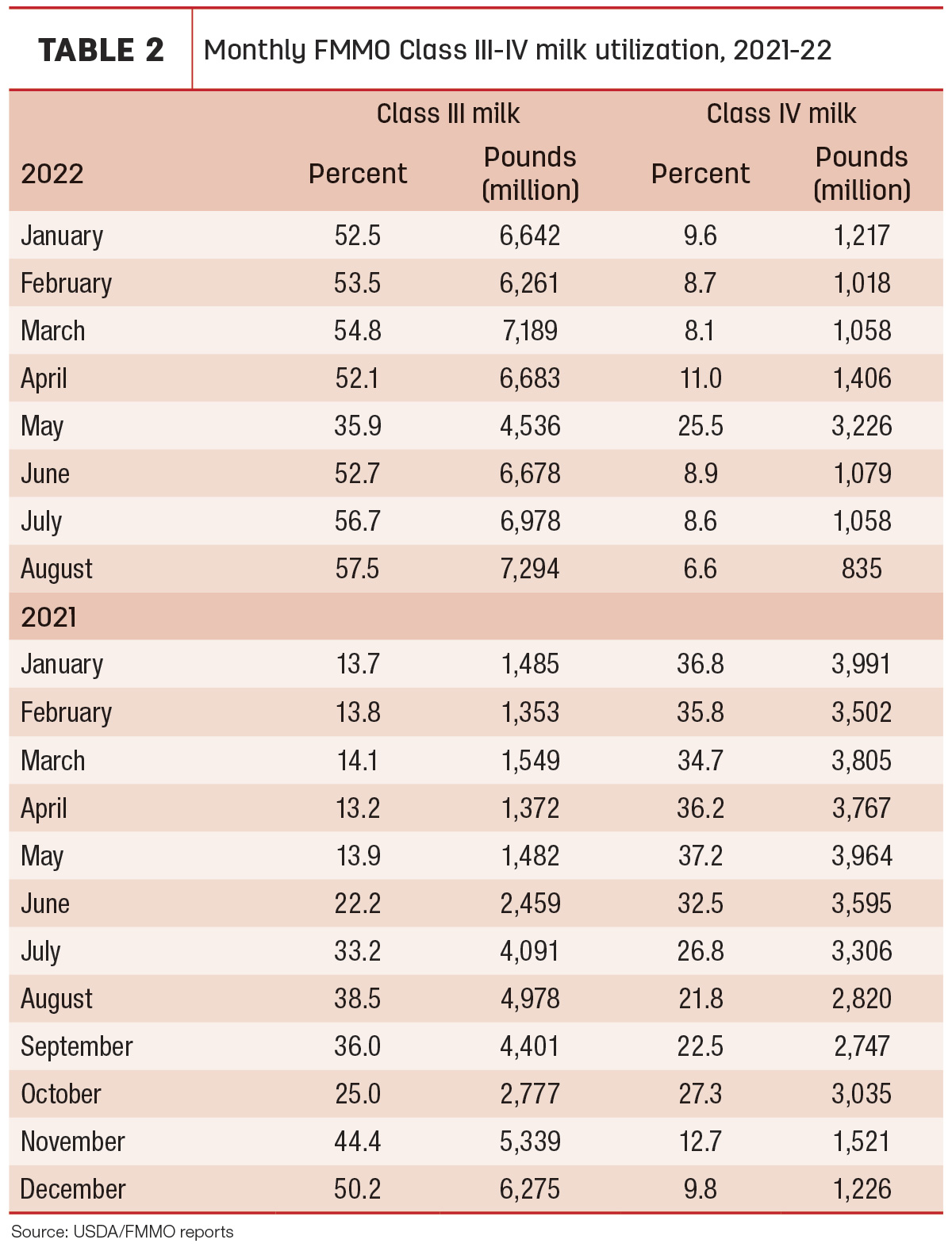

Overall milk pooling on FMMOs in August was up about 388 million pounds from July at 12.7 billion pounds. The USDA releases August milk production estimates on Sept. 19.

Class I pooling was up 319 million pounds, likely due to school openings, and Class III pooling was up 315 million pounds. However, the larger August Class III-IV price spread kept more Class IV milk out of the pool, down 224 million pounds from July (Table 2).

- At about 835 million pounds in August, Class IV pooling across all FMMOs represented just 6.6% of the total milk pooled, the smallest volume and percentage since at least 2017, well before California joined the FMMO system. It was the sixth month so far in 2022 that Class IV pooling was below 10% of total milk pooled.

- In contrast, at 7.3 billion pounds in August, Class III pooling represented about 57.7% of total milk pooled, the highest percentage of the year and the highest percentage since at least 2017, the earliest year USDA records are available. On a volume basis, August Class III pooling was the highest since June 2019, the first year California joined the FMMO system.

Looking ahead

September uniform prices and pooling totals will be announced around Oct. 11-14. The outlook for September prices is trending lower:

- Class I base price: Already announced, it’s $23.62 per cwt, down $1.51 from August and a six-month low.

- Class I base with zone differentials: $26.44 per cwt across all FMMOs, ranging from a high of $29.02 per cwt in the Florida FMMO 6 to a low of $25.42 per cwt in the Upper Midwest FMMO 30

- Class I mover formula: Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $25.31 per cwt, $1.69 more than the actual price determined using the average-of plus 74 cents formula. The economic impact on uniform milk prices within individual FMMOs depends on Class I milk utilization in each FMMO.

- Other class prices: September Class II, III and IV milk prices will be announced on Oct. 5. Chicago Mercantile Exchange (CME) futures prices have been gyrating. As of the close of trading on Sept. 14, the CME Class III milk futures price closed at $19.91 per cwt for September, down 19 cents from August; the Class IV milk futures price closed at $24.76 per cwt, down 5 cents from August.

- Class III-IV milk price spread: Based on those futures prices, the September spread in Class III-IV milk prices will climb to $4.85 per cwt, further incentivizing Class IV depooling. The spread in fourth-quarter Class III-IV milk futures prices closes somewhat after that to $3.14 in October, $2.44 in November and $1.78 in December 2021.

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report, released Sept. 12, revised 2022-23 U.S. milk production estimates lower from last month, yielding slightly higher milk price projections.

Affecting production and milk marketings, estimated milk cow numbers were reduced, with slower growth in 2022 expected to carry into 2023. Output per cow was forecast to increase at a slightly more rapid pace in 2022, but the forecast for 2023 was unchanged.

Read: USDA cuts 2022-23 milk production forecasts, with slight improvement in price outlooks.