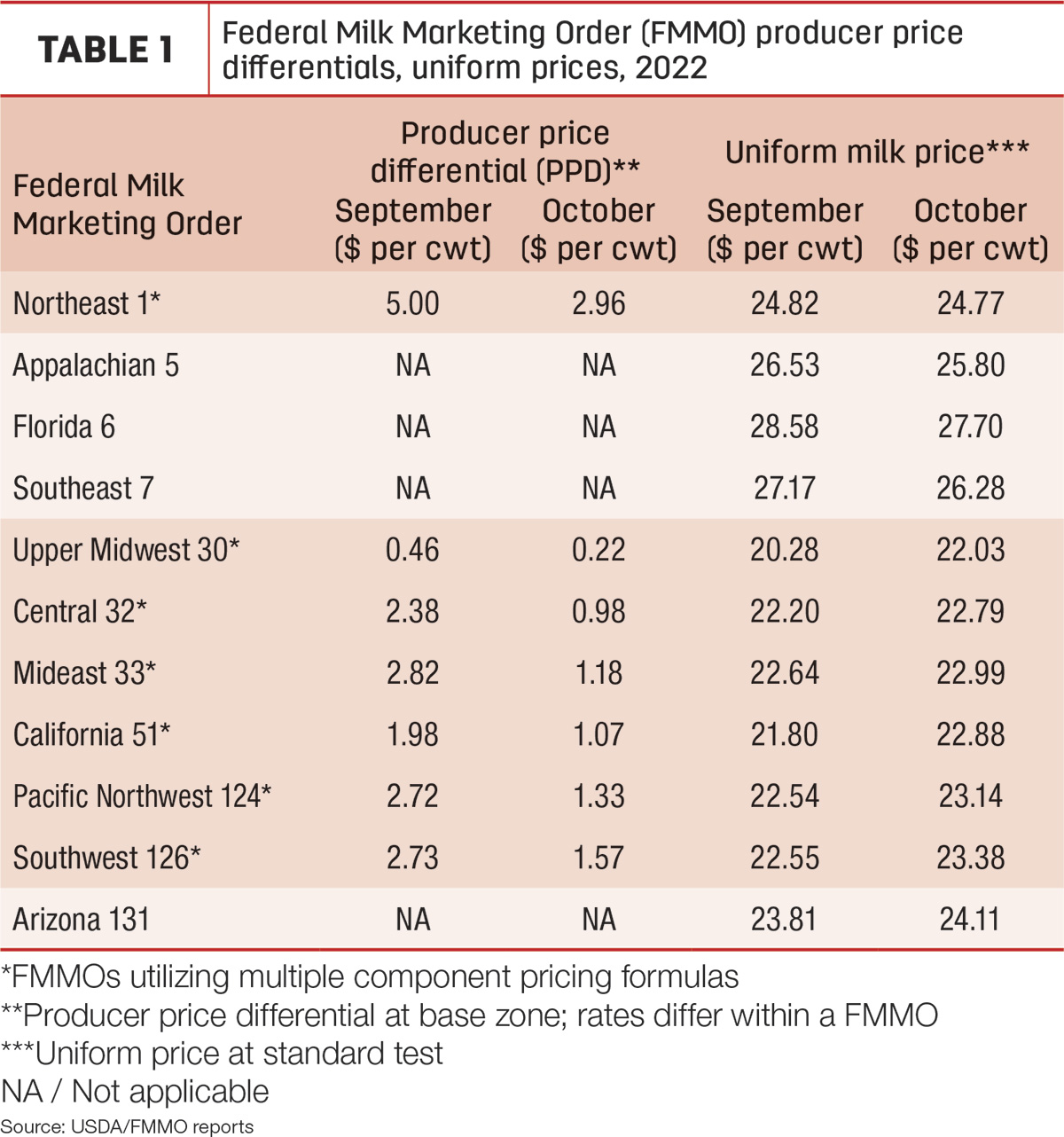

Administrators of the 11 Federal Milk Marketing Orders (FMMOs) reported October 2022 prices and pooling data, Nov. 10-14. Uniform or blend prices were mixed, producer price differentials (PPDs) were positive but lower, the Class I mover formula affected Class I prices and the spread between Class III-IV milk prices continued to impact pooling.

Uniform prices, PPDs

October 2022 uniform milk prices were mixed (Table 1), moving lower in FMMOs with highest Class I utilization higher. Largest declines in October were in Appalachian 5, Florida 6 and Southeast 7 FMMOs; largest increases were in Upper Midwest 30 and 51 California. Even with those changes, however, the highest uniform price for the month was in Florida 6 at $27.70 per hundredweight (cwt), with the low in the Upper Midwest 30 at $22.03 per cwt.

October baseline producer price differentials (PPDs) were again positive but also lower in all applicable FMMOs (Table 1), ranging from a high of $2.96 per cwt in the Northeast 1 to a low of 22 cents in the Upper Midwest 30. PPDs have zone differentials, so actual amounts will vary within each FMMO.

Also, individual milk handlers apply premiums and deductions to milk checks differently. Numerous processors are implementing “market adjustment” deductions on milk checks this fall to cover rising processing, transportation and labor costs.

Class prices for October

FMMO milk class prices were mixed in October:

- Class I base price: $22.71 per cwt, down 91 cents from September and below $23 per cwt for the first time since March

- Class I base with zone differentials: $25.53 per cwt across all FMMOs, ranging from a high of $28.11 per cwt in the Florida 6 to a low of $24.51 per cwt in the Upper Midwest 30

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($7.04 per cwt) and advanced Class IV skim milk pricing factor ($12.67 per cwt) was $5.63 per cwt, the widest since July 2020. Based on Progressive Dairy calculations, the Class I mover calculated under the “higher-of” formula would have resulted in a Class I base price of $24.71 per cwt, $2 more than the actual price determined using the “average-of plus 74 cents” formula. The economic impact on uniform milk prices within individual FMMOs depends on Class I milk utilization in each FMMO.

- Class II milk price: $25.73 per cwt, down 78 cents from September

- Class III milk price: $21.81 per cwt, up $1.99 from September

- Class IV milk price: $24.96 per cwt, up 33 cents from September

- Class III-IV milk price spread: At $3.15 per cwt, it was down from $4.81 in September and the narrowest since June.

In several FMMOs, with the average-of Class I formula, the Class IV price was also above the Class I price, even with zone differentials added.

Component values, tests

Supporting the stronger October Class III and IV milk prices, the value of both butterfat and protein rose from the month before:

- Butterfat value: $3.66 per pound, up 9 cents from September – it’s the ninth straight month the butterfat value topped $3 per pound.

- Protein value: $2.45 per pound, up about 57 cents from September and the highest since July

- Solids: The value of nonfat solids and other solids were fairly steady at $1.40 and 29.5 cents per pound, respectively.

Affecting statistical uniform prices “at test,” average butterfat and protein tests in pooled milk were up slightly from September in FMMOs providing preliminary data.

Impact on pooling

Overall milk pooling on all FMMOs in October was up about 543 million pounds from September at 12.96 billion pounds. The USDA releases October milk production estimates on Nov. 21.

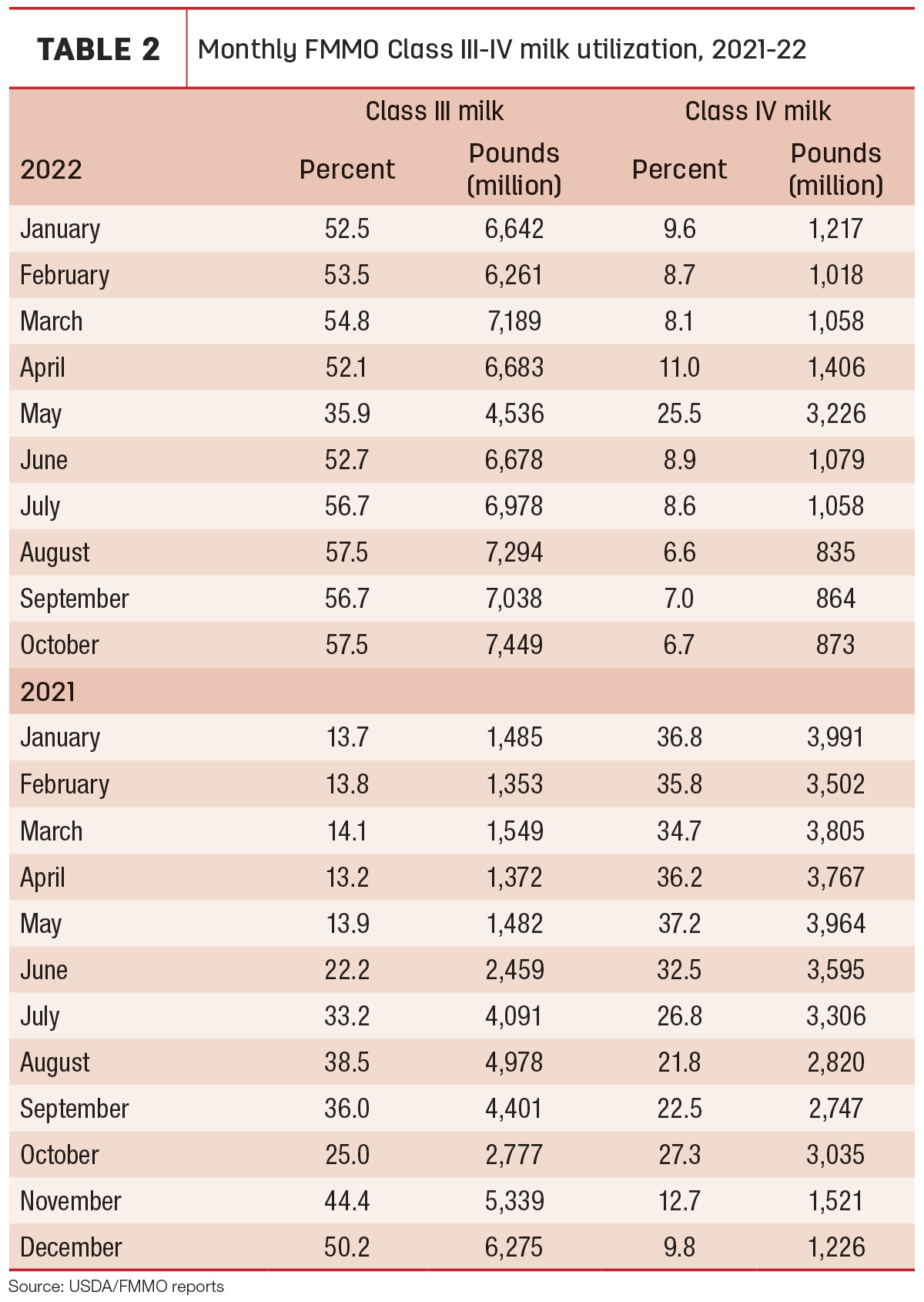

October Class I pooling was up 44 million pounds from September, representing about 26.7% of total milk pooled. Class II pooling was up 13.4 million pounds, representing just under 9% of the total pooled. Class III pooling was up 411 million pounds, representing almost 57.5% of the total pool (Table 2).

At about 873 million pounds in October, Class IV pooling across all FMMOs increased slightly, up about 8 million pounds from September, but still represented under 7% of the total milk pooled (Table 2). It was the eighth month so far in 2022 that Class IV pooling was below 10% of total milk pooled.

Looking ahead

November uniform prices and pooling totals will be announced around Dec. 11-14. The outlook for November prices is again mixed:

- Class I base price: Already announced, it’s $24.09 per cwt, up $1.38 from October and $6.11 higher than November 2021.

- Class I base with zone differentials: $26.91 per cwt across all FMMOs, with a high of $29.49 per cwt in the Florida 6 to a low of $25.89 per cwt in the Upper Midwest 30

- Class I mover formula: The spread in the monthly advanced Class III skim milk pricing factor ($9.17 per cwt) and advanced Class IV skim milk pricing factor ($12.61 per cwt) is $3.44 per cwt, the narrowest since July 2022. Based on Progressive Dairy calculations, the Class I mover calculated under the higher-of formula would have resulted in a Class I base price of $25.04 per cwt, 95 cents more than the actual price determined using the average-of plus 74 cents formula.

- Other class prices: November Class II, III and IV milk prices will be announced on Nov. 30. As of the close of trading on Nov. 11, the Chicago Mercantile Exchange (CME) Class III milk futures price closed at $20.98 per cwt for November, down 83 cents from October; the Class IV milk futures price closed at $23.14 per cwt, down $1.82 from October.

- Class III-IV milk price spread: Based on those futures prices, the November spread in Class III-IV milk prices will tighten another $1, to about $2.16 per cwt. Heading into December and beyond, that spread and depooling incentives will all but disappear.

WASDE outlook

The USDA’s monthly World Ag Supply and Demand Estimates (WASDE) report, released Nov. 9, raised the 2022 U.S. milk production estimate from last month’s forecast but left the 2023 production forecast unchanged. Projected prices for both years were reduced slightly. The USDA forecast lower cow inventories but a rise in output per cow for both years.

Read: USDA raises 2022 milk production forecast, lowers 2022-23 price projections slightly