Ranchers are often asked multiple economic questions when meeting with their bankers. These may include: Are you making more money on raised or purchased cattle? Are you better off selling your calves at weaning, as stockers or carrying them through the feedlot? Is it more profitable to retain heifers or purchase cows when replenishing the herd? These questions are most effectively answered by using an accounting method called enterprise tracking.

Enterprise tracking simply groups similar crop and cattle transactions together to determine which entities are the most profitable and which ones need improvement. Enterprise accounting is available in QuickBooks through the class tracking feature. QuickBooks classes allow users to tie different enterprises to multiple income and expense transactions. If ranchers create meaningful classes and consistently assign them to QuickBooks checks, bills, invoices, deposits, etc., throughout the production cycle, they can eventually run a profit and loss by class report to determine which livestock entity made the most money.

A real-world example

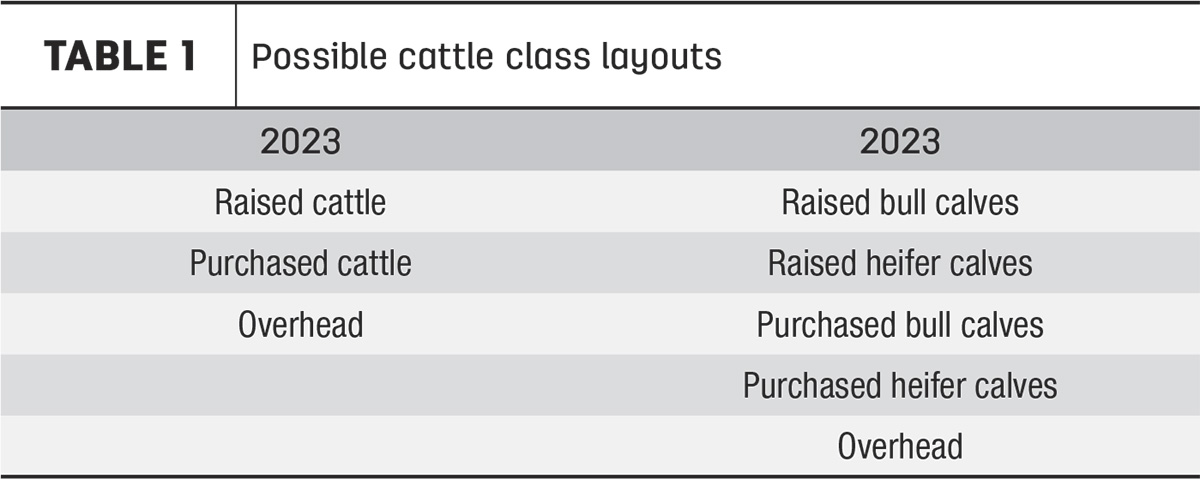

Let’s say a rancher sells all his calves between 700 and 800 pounds, but some are raised and some are purchased. He wants to know which group is more profitable. Creating different cattle classes and tying them to income and expense transactions should find the answer to this question. Two possible class layouts can be found in Table 1.

When creating classes, accountants typically recommend using the year the cattle are born or purchased as a parent/primary class and the livestock groups as subclasses. Since cattle are often obtained in one year and sold in another, this approach allows the same groups to be evaluated from start to finish regardless of the calendar year. Once all livestock are sold, a rancher can inactivate those classes and create new groups for the next production period (in this example, 2024). Another recommendation is to add an overhead, or support class to track expenses that cannot be easily tied to a particular profit class (example: Labor, Repairs, Fuel).

At the end of the year, transactions within the overhead class can be assigned to profit classes through journal entries if desired. Finally, it is important to note that more classes mean additional work, so the second example that has five subclasses will likely require extra bookkeeping time compared to the first example with just three.

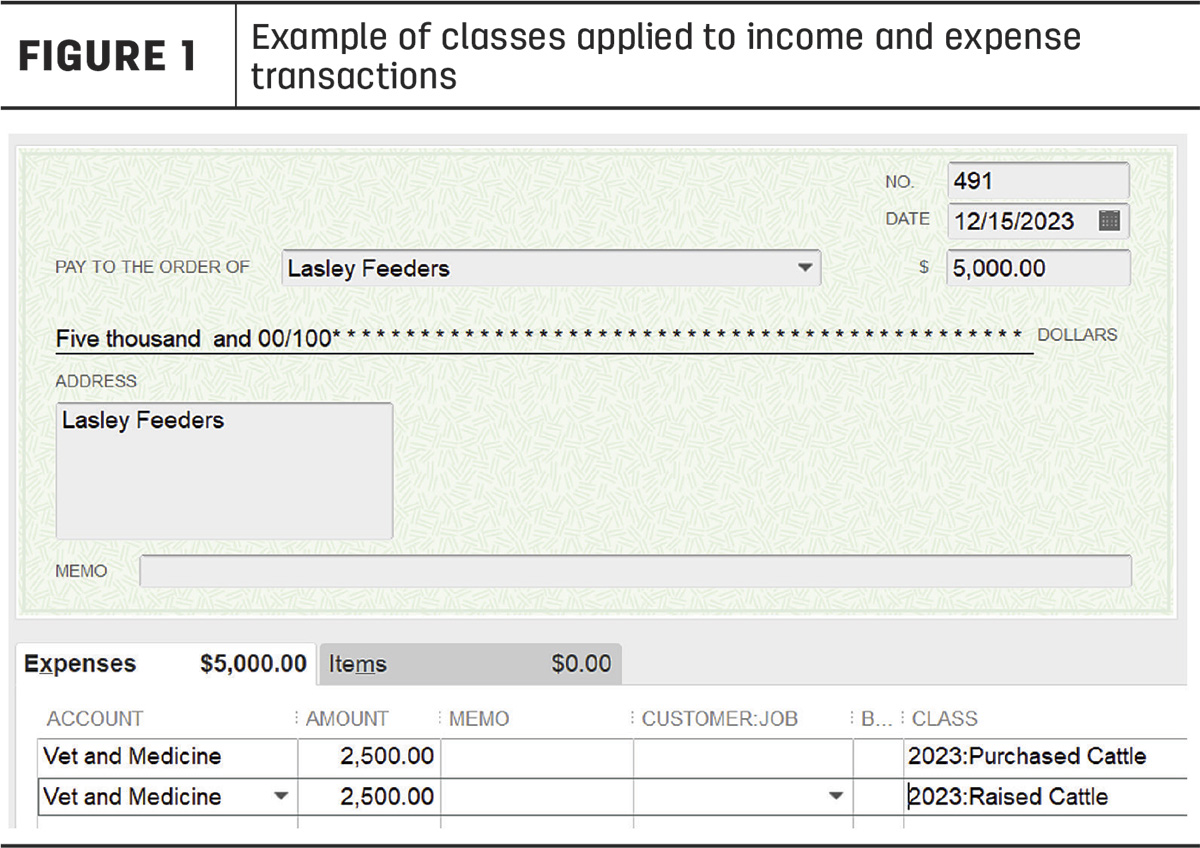

Once classes are created, the rancher then conducts business as usual, with the added step of tying income and expense transactions to various classes. Let’s look at a check example (Figure 1).

In Figure 1, the operator wrote one check for $5,000 for vet and medicine and assigned $2,500 to the purchased cattle class and $2,500 to the raised cattle class. If the operator continues to consistently assign classes to income and expense transactions, at the end of the production cycle, a profit and loss report by class can be run to evaluate each enterprise.

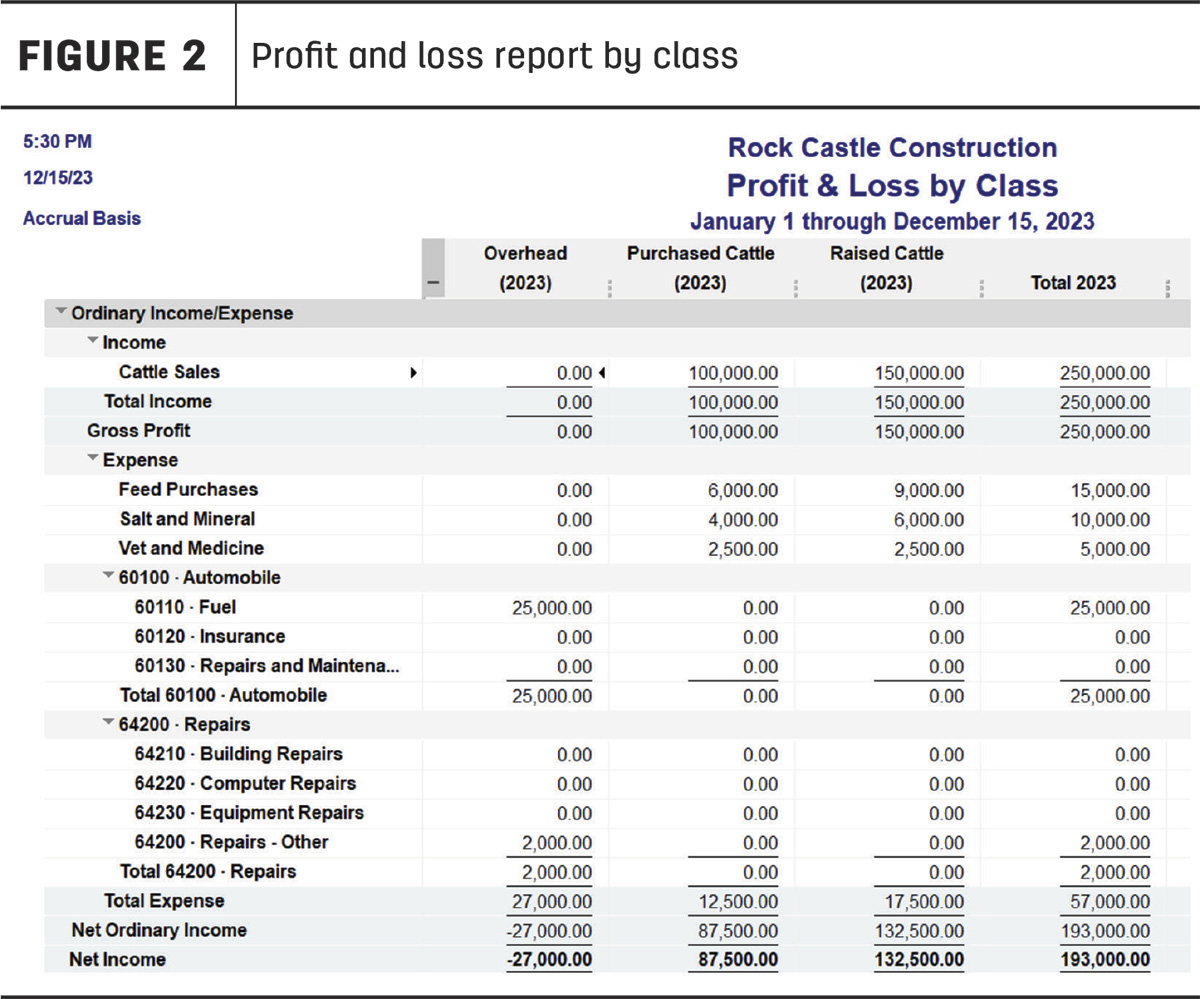

In Figure 2, raised cattle appear more profitable than purchased cattle in 2023.

A rancher may also choose to allocate the overhead class expenses to

the two profit classes (raised and purchased cattle) through a general

journal entry. Deciding what amount goes to each class can be tricky,

but many bookkeepers do it based on percent of the total head in each

group or percent revenue generated.

A rancher may also choose to allocate the overhead class expenses to

the two profit classes (raised and purchased cattle) through a general

journal entry. Deciding what amount goes to each class can be tricky,

but many bookkeepers do it based on percent of the total head in each

group or percent revenue generated.

Setting up QuickBooks class tracking

Now that the concepts of using QuickBooks classes for enterprise accounting have been explained, ranchers should become familiar with the steps involved in creating them. Class tracking is available on all versions of QuickBooks Desktop, but only accessible with the QuickBooks Online Plus and Online Advanced subscriptions. Ironically, this useful feature is disabled by default, so operators will need to enable it before classes are created. After the class tracking feature is turned on and classes are created, ranchers can begin using them to track transactions.

Enabling the class feature

QuickBooks Desktop

- Choose Edit: Preferences from the top of the main menu screen

- In the Preferences window, select Accounting on the left side menu

- Choose Company Preferences

- Check the Use class tracking box

- Click OK to close the window

QuickBooks Online

- From the top gear icon, choose Your Company: Account and settings

- Select Advanced on the left side menu

- Scroll to Categories

- Click on the pencil icon and turn on class tracking

- Click Save and then Done to close the window

Creating new classes

QuickBooks Desktop

- Choose Lists: Class List from the top of the main menu screen

- In the Class Window, click the Class button at the bottom of the screen

- Select New and fill in the relevant information, then click Next to create another class

- Once all classes are entered, select OK

QuickBooks Online

- Choose Lists: All lists from the top gear icon

- Select Classes from the lists menu

- In the class window, choose New

- Fill in the relevant information until all classes are created, then click Save

Hopefully, this article provides cattle operators with useful information on the benefits of utilizing QuickBooks class tracking for enterprise accounting. Although it might seem like a tedious process, consistently tying classes to income and expense transactions provides many long-term benefits. Ranchers get a meaningful view of the economic impact of various enterprises and can more easily track how their money is spent. These benefits ultimately lead to better management decisions and a happier banker.