It seems that backgrounders begin acquiring their grass cattle earlier each year and in-turn they are wrapping up their stocker buying earlier too. This year saw an extremely early push for lightweights with many cattle growers taking featherweights (under 450 pounds) through the harsh winter to have a hardened old-crop calf ready to fully utilize cheap gains on early forage. Early April saw the transition of calf offerings go from the last of the old crops to the arrival of fall calves. By the end of the month, fleshy new crops (many of them bawlers) dominated auction receipts and caused stocker buyers to straighten their tally cards and slide them back into their shirt pocket. Sadly, the extreme drought in the Southern Plains has become so severe that spring grazing has not materialized at all. Most winter wheat grazers were pulled-off early and although many fields will not end up producing a crop this year, graze-out was not much of an option as fields quickly matured and turned tough. Farther north and east, moisture was more than adequate and major grazing areas like the Kansas Flint Hills were fully stocked by late April.

Like most beef cattle marketings over the last several months, the spring yearling run came early this year and was mostly complete by the end of April. The lack of May shipments of feeders off graze-out wheat should help explain why we have seen month after month of heavier inventories on-feed than year ago levels. Dry weather in the Southwest and the early marketing of cattle that have quickly increased in value (speculation or “trading”) have kept auction receipts at a decent level, although still much lighter than recent years. However, the tight numbers of available supplies of feeder cattle should limit auction receipts and direct trade volume from now until fall. Despite acres of supply data, many market watchers want to see hardened proof that we are short of cattle before participating in additional driving of the market.

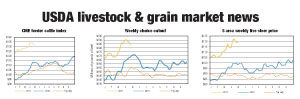

Tight supplies of calves and yearlings have mostly been responsible for their price advance, but demand has mostly been to blame for the finished cattle rally. Year-to-date slaughter through the first quarter was .5 percent larger than last year and 1.7 percent more than the five-year average. Also during that period, U.S. beef exports were 50 percent greater than in 2010 with most of the additional sales going to South Korea. Eventually, the smaller headcounts of mother cows will result in shorter showlists - which could be interesting if demand remains at least constant. However, the sound of $5 gallon fuel tends to spoil appetites for both the family on a budget and the export customer who has to ship products to the other side of the world. ![]()