In January, the USDA reported the U.S. beef cow herd stood at 31.2 million, up 3.5 percent from 2016. While these results were widely reported and published, the purpose of this article is to step back and consider the recent trends in the U.S. beef cow herd.

U.S. beef herd trends

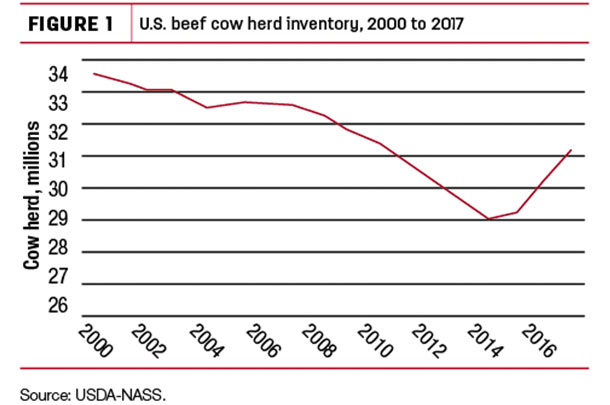

In Figure 1, the size of the U.S. beef cow herd from 2000 to 2017 is shown. Specifically, these data are based on the USDA’s January estimates as this dataset has been continuously reported.

At 31.2 million, 2017 marked the third year of expansion as the herd inventory rebounded from a low of 29.1 million head in 2014.

The 2014 low was part of a significant contraction that occurred from 2008 to 2014. During these six years, the U.S. herd decreased by 3.3 million head. Even with the current expansion, which added roughly 2.1 million head, the U.S. beef cow herd remains below mid-2000 levels.

Even before 2008, the trend for a smaller U.S. beef cow herd has been in motion for decades. In 2000, the U.S. cattle herd stood at 33.6 million (Figure 1) and, going back to the 1980s, the U.S. herd reached a 37-year high of 39.2 million in 1982.

State-level trends

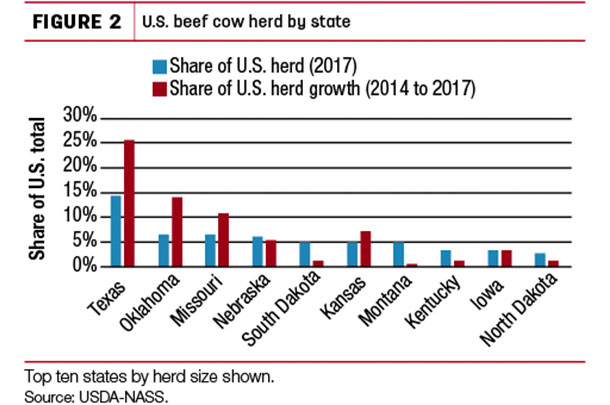

Digging deeper into the data provides insights into state-level trends. In Figure 2, two measures of the beef cow herd are shown for the top 10 beef cow states. In total, these states account for 58 percent of the U.S. herd (2017).

In blue is the share of the total U.S. herd each state accounts for. With nearly 4.5 million head, Texas has the largest beef cow herd. In fact, Texas accounts for 14 percent of the total U.S. beef cow herd and is larger than Oklahoma and Missouri combined (the second- and third- largest beef cow states).

The second data point in Figure 2 is the share of total U.S. herd growth from 2014 to 2017 each state accounted for (shown in orange). As mentioned earlier, the U.S. beef cow herd expanded by more than 2.1 million head during this time.

The 10 states shown in Figure 2 collectively increased their herd by more than 1.5 million, equal to 72 percent of the total U.S. expansion. Given these states account for only 58 percent of the U.S. herd, expansion among these states has been at a rate faster than the rest of the country.

The expansion is especially noteworthy in Texas. Accounting for 14 percent of the beef cows in 2017, Texas represented a much larger share, 26 percent, of the 2014-to-2017 expansion. Oklahoma, Missouri and Kansas also accounted for a large share of the U.S. herd expansion.

More on Texas

While Texas accounted for a large share of the recent expansion, it is important to note Texas also accounted for a large share of the 2008-to-2014 contraction. During this time frame, when the number of U.S. beef cows reduced by 3.3 million head, Texas alone contracted 1.2 million head, equal to 37 percent of the total U.S. reduction. The decline in Texas is partly attributable to the lengthy and persistent drought from 2010 to 2013.

Currently, the U.S. beef cow herd is 96 percent of its size in 2008. Texas, however, is only at 87 percent of 2008 levels. Even though Texas has added more than a half million head of beef cows in recent years (550,000 head), it would take almost another half million to get it back on par with the current, relative U.S. herd size of 96 percent of 2008 levels (an additional 494,000 head in Texas would be needed).

This could affect the cattle industry and markets in coming years, especially if Texas remains relatively drought-free and continues to rebuild the herd.

Wrapping it up

2017 marked the third year of expansion for the U.S. beef cow herd. The recent uptick, however, does not erase or undo the decades-long downward trend in the U.S. beef cow herd.

Texas, which has the largest beef cow herd in the U.S., has been a major player in herd expansion. Independently, Texas accounted for one-fourth of the recent expansion while only accounting for 15 percent of the herd. However, Texas played an even larger role in the earlier herd contraction when the state accounted for 37 percent of the 2008-to-2014 U.S. beef cow decline.

Looking ahead, many will be watching the size of the U.S. beef cow herd in 2018 and beyond. Texas, already a major player, could play a critical role as the state’s current herd size, relative to 2008 levels, suggests more expansion could be possible. ![]()

David Widmar is an agricultural economist specializing in agricultural trends and producer decision-making. He is the co-founder of Agricultural Economic Insights LLC and a researcher in the Center for Commercial Agriculture at Purdue University.

David A. Widmar

- Agricultural Economic Insights

- Email David A. Widmar