For the final quarter of 2020, beef production was lowered 80 million pounds on fewer-than-expected cattle slaughtered in December. This decline was particularly driven by fewer steers and heifers in the slaughter mix. As a result, 2020 beef production is forecast at 27.2 billion pounds, almost unchanged from 2019 production levels. Based on the USDA National Agricultural Statistics Service (NASS) Livestock Slaughter report for November, data for January through November for 2019 and 2020 showed almost 3% fewer cattle slaughtered. However, carcass weights were up nearly 3%, which almost offset the reduction in cattle slaughter to bring beef production for the year within less than 1% of 2019 levels.

Similarly, the forecast for 2021 beef production was lowered by 70 million pounds from the previous month to 27.2 billion pounds. This adjustment was based in part on fewer fed cattle to be slaughtered in second-quarter 2021 as a result of lower expected placements in fourth-quarter 2020. Further, higher feed costs in 2021 are expected to negatively impact cattle carcass weights. NASS released the semiannual Cattle report on Jan. 29, which provides estimates of heifers held for breeding and an insight into the number of cattle that might be available for placement during 2021.

Fed cattle prices forecast higher on lower production

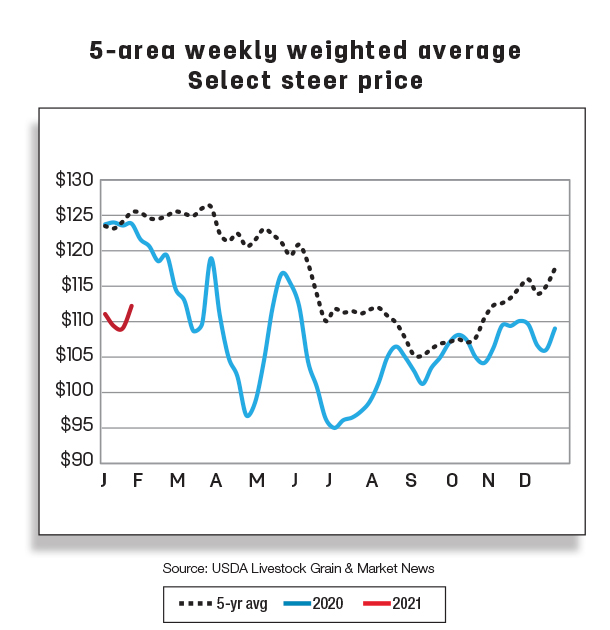

The 2020 annual price for live steers in the 5-area marketing region averaged $108.51 per cwt, down 7% from 2019.

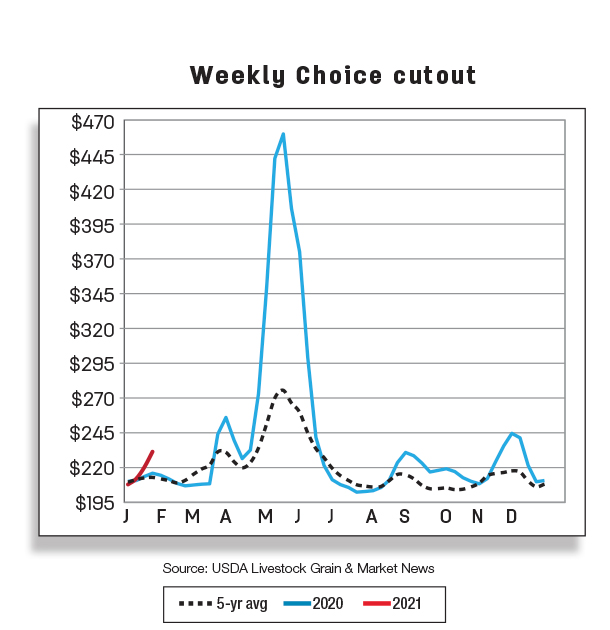

This average largely reflects reduced packer demand because of packing facilities that had to reduce shifts or temporarily close in second-quarter 2020 due to COVID-19 issues. This resulted in an increase in fed cattle supplies that had backed up which, in turn, pressured prices during the third quarter.

Packers were able to work through the backlog of fed cattle supplies, which helped cattle prices recover in the fourth quarter and into the new year. However, prices continue to lag year-over-year levels. Live steer prices in the 5-area marketing region for the first week of January were reported at $111.27 per hundredweight (cwt), more than $13 below last year for the same week and the lowest January starting price since 2011. However, the annual price forecast for 2021 was raised 50 cents to $115.50 per cwt on lower expected production and expected improved packer demand in 2021.

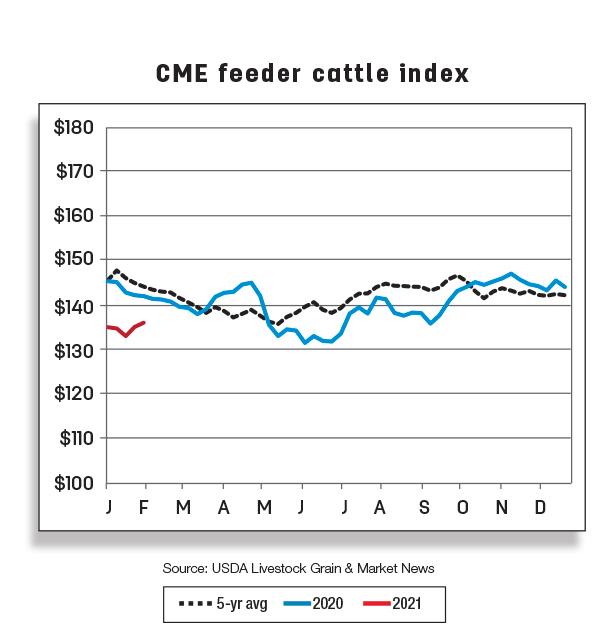

Feeder cattle prices fared slightly better in 2020 when compared to 2019. In 2020, the average price was down almost 5% from 2019 at $135.45 per cwt for feeder steers weighing 750 to 800 pounds that were sold in the Oklahoma City National Stockyards. Prices in the first two weeks of January 2021 averaged $134.81 per cwt, about 7% below the monthly average for January 2020. To the extent prices at the beginning of 2021 were higher than expected, the first-quarter 2021 forecast was raised $1 to $134 per cwt. However, higher expected feed costs lowered expectations for prices the rest of the year and, as a result, the annual price forecast for feeder steers was lowered $1 to $137 per cwt.

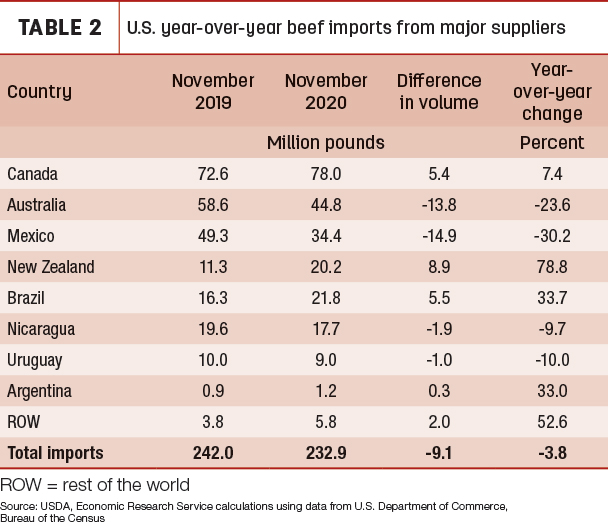

November imports drop, ending five months of consecutive year-over-year increases

Beef imports in November totaled 233 million pounds, down 4% (9 million pounds) from a year ago. U.S. beef imports have been declining continuously since reaching their peak in July as stocks continue to build despite slowdown in beef imports. Shipments from major suppliers such as Mexico and Australia were among the largest declines in beef shipped to the U.S. Lower imports from Australia reflect a smaller herd there. Smaller volumes were also imported from Nicaragua and Uruguay in November relative to a year ago.

In contrast, there were year-over-year increases in shipments from a few major beef suppliers. The greatest increase in imported beef came from New Zealand. The U.S. also imported sizable volumes of beef year-over-year from Brazil, which had not surpassed 22 million pounds since November 2008. Imports from Canada, the top beef supplier of U.S. beef, were up 7% above last year. The November increases from a few major suppliers were not enough to offset the substantial reduction in beef shipments from Australia and Mexico.

The forecast for the fourth-quarter beef imports was lowered 35 million pounds to 725 million pounds from the previous month. Changes in U.S. beef imports were adjusted based on November import data and the USDA Agricultural Marketing Service December WIMPE data. The 2020 annual forecast for beef imports totals 3.375 billion pounds. The forecast for first-quarter 2021 was lowered by 20 million pounds to 780 million pounds on weaker expected demand for lean trimmings used in producing ground beef.

Beef exports remain robust in November as sales to China continue trending upward

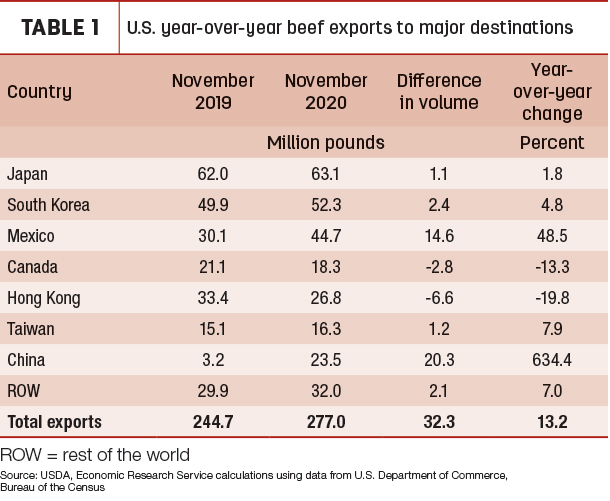

November beef exports were up 13% or 32 million pounds year-over-year, totaling 277 million pounds. The last time U.S. beef exports equaled or exceeded that total was in August 2018. The November increase was mostly driven by a global economy recovering at a moderate pace.

While exports to the top two destinations, Japan and South Korea, increased by 1% and 5% year-over-year, respectively, their volumes accounted for 42% of November’s total exports (see Table 1). Mexico, the third-largest destination, purchased more beef in November than it had since December 2013.

However, the largest year-over-year increase in volume of beef was in exports to China, where the U.S. exported record-breaking amounts of beef from July to November as the country continued to expand its demand for animal proteins.

Beef shipments to Canada and Hong Kong, two of the top seven U.S. beef destinations, were down in November year-over-year. The greatest reduction in exports was to Hong Kong, down 20% or 7 million pounds from a year earlier. U.S. beef exports to Canada were also lower than volumes recorded last November.

The fourth-quarter forecast for beef exports was raised by 30 million pounds from the previous month to 800 million pounds on October and November export data and USDA Foreign Agricultural Service (FAS) Export Sales report data for December. The annual forecast for 2020 totals 2.935 billion pounds. This demand strength was carried over into first-quarter 2021, and the forecast was revised up 10 million pounds to 725 million pounds.

How expensive is U.S. beef in China relative to other competing suppliers?

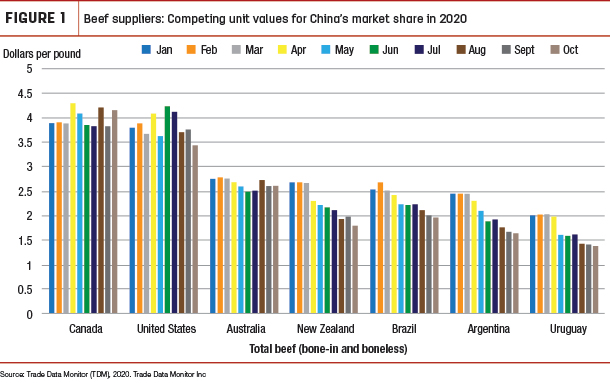

Despite record-breaking volumes of U.S. beef shipped to China from July to November 2020, the U.S. has supplied less than 1% of China’s total beef imports. Beef-exporting competitors of the U.S. – Brazil, Argentina, Australia, Nicaragua, Uruguay and New Zealand – account for the vast majority (94%) of China’s beef imports. In part, this may be because the U.S. value per pound of total (bone-in and boneless) beef shipped to China is higher than that of most of its competitors in the China beef market (see Figure 1).

As illustrated in Table 2, Canada and the U.S. have the highest value per pound of beef imported by China relative to other beef suppliers.

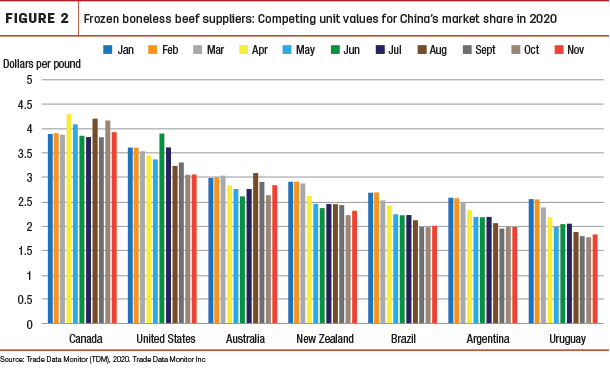

A higher U.S. beef price reflects a better-quality, grain-fed fresh/chilled product, which is different from what China typically imports from other countries. In order to make a more accurate comparison of beef imported by China and evaluate the competitiveness of U.S. beef to other suppliers, the unit values of China’s frozen boneless beef imports are presented in Figure 2.

From January through November, the U.S. unit value per pound of beef averaged $3.23. Canada’s unit value for beef imported by China exceeded that of the U.S. at $4.01 per pound, while among U.S. competitors Argentina, Uruguay, Brazil, New Zealand and Australia, unit values ranged from $1.90 to $2.79. China’s demand for animal proteins will continue to grow as its economy and population expand.

Despite a higher unit price of U.S. beef and certain trade barriers, China’s commitment to purchase an additional $200 billion of American-made products over 2020 and 2021 under the Phase 1 trade deal could lead to continued growth of U.S. beef exports.

Analyst Christopher Davis assisted with this report.