Here’s something we haven’t seen in quite some time: Producer price differentials (PPDs) in all applicable Federal Milk Marketing Orders (FMMOs) were positive in June. Whether it lasts is yet to be determined.

FMMO administrators reported June 2021 uniform milk prices, PPDs and milk pooling data during the week of July 12. For the first time since the COVID-19 pandemic began to impact marketing and prices, there was some semblance of normalcy.

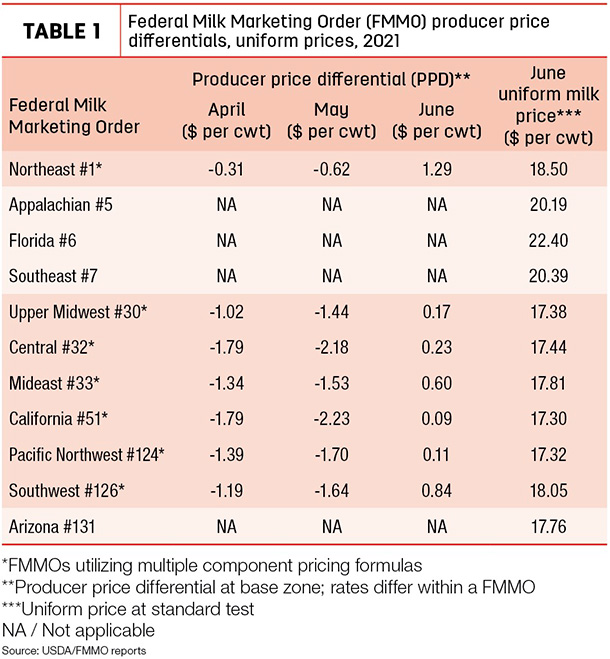

Uniform prices and PPDs

June uniform prices at standardized test hit six-month highs in 10 of 11 FMMOs, improving between 6 cents and $1.14 per hundredweight (cwt). The lone FMMO to post a lower uniform price in June was the Upper Midwest #30, down 14 cents from May at $17.38 per cwt. The high was $22.40 per cwt in Florida #6; lows of under $17.50 per cwt were in four FMMOs (Table 1).

More noteworthy are the PPDs, which have drawn a lot of attention since early 2020. June 2021 marked the first month that baseline PPDs are positive in all applicable FMMOs since January 2020, moving $1.61 to $2.48 higher from May.

It should be noted, however, that PPDs have zone differentials and vary slightly within each FMMO. A few marketing zones in California #51, the Upper Midwest #30 and Central #32 FMMOs will see small negative PPDs on June milk marketings.

Also, whether positive or negative, PPDs’ impacts on producer milk checks are based on individual milk handlers.

Several factors have a role in determining prices, PPDs and milk pooling behavior. The news was mixed.

First, the June Class I base price was $18.29 per cwt, up $1.19 per cwt from May. Not only was it the highest Class I base price since December 2020, but it was also the first time the monthly Class I base price was higher than the Class III milk price over the same period. Adding zone differentials, Class I prices ranged from $20.09 per cwt in the Upper Midwest to $23.69 per cwt in Florida, with minor adjustments within each individual FMMO.

The values of milk protein and butterfat both declined in June, although not at the same rate. At about $2.58 per pound, the value of milk protein in June FMMO milk price calculations fell about 55 cents from May and is the lowest since May 2020. The value of butterfat posted a more modest 2-cent decline to about $1.96 per pound and remains near a 15-month high.

When incorporating those values in milk class price formulas, the June 2021 Class III price was $17.21 per cwt, $3.83 less than a year ago, when USDA food box purchases pushed cheese prices higher. The June 2021 Class IV price was $16.35 per cwt, $3.45 above a year ago and a 17-month high.

The resulting Class III-Class IV price spread fell to 86 cents per cwt in June and the slimmest gap since pre-COVID February 2020.

Some Class III returns to the pool

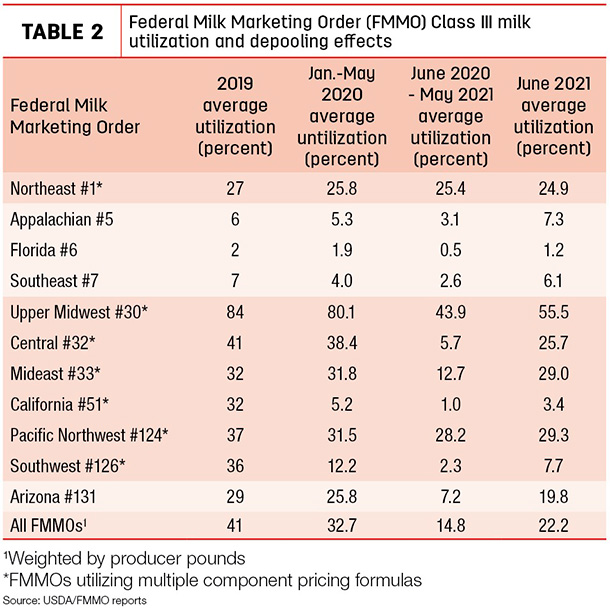

Both the higher Class I base price and the smaller spread between Class III and Class IV milk prices reduced FMMO Class III milk depooling incentives. On both a percentage and volume basis, June 2021 levels of Class III milk utilization and pooling inched toward pre-COVID levels.

On a percentage basis (Table 2), Class III utilization was about 22.2% of all FMMO milk marketings in June 2021, up from 13.9% in May and the 14.8% average during June 2020-May 2021. Class III utilization remained below the 32.7% pre-pandemic utilization rate in January-May 2020 and far below the average of 41% for all of 2019.

On a volume basis, total Class III milk pooled across all FMMOs in June 2021 was about 2.46 billion pounds, up from the 1.54 billion monthly average during June 2020-May 2021, but down from the 4.56-billion-pound average for January-May 2020, prior to milk marketing disruptions caused by COVID-19. By comparison, Class III pooling across all FMMOs averaged 6.6 billion pounds per month during January-August 2019.

Looking ahead

How long June’s “normalcy” lasts is yet to be determined. With the gap between Class III and Class IV milk prices impacting depooling and PPDs, tracking Chicago Mercantile Exchange (CME) Class III and Class IV milk futures prices provides some guidance. As of the close of CME trading on July 13, the July spread sat at about 93 cents. (Actual July Class III and Class IV milk prices will be announced on Aug. 4.)

Beyond that, however, the spread grows to more than $2 per cwt in August through November 2021, resurrecting depooling possibilities. Based on actual and futures milk prices as of July 13, the Class III-Class IV spread will average $2.03 per cwt in 2021, the second largest annual spread since 2016. While subject to changing markets, current futures prices for 2022 suggest a Class III-Class IV price spread falling below 50 cents per cwt.