Fewer than 80,000 head of feeder cattle were price protected in the year before the 2020 overhaul of the Livestock Risk Protection (LRP) program. This year, on an annualized basis, approximately 4.5 million head of feeder cattle LRP will be purchased. Some things have changed with LRP, and those changes are working for the cattle owner like never before. Also, there is more reason than ever for producers to be managing the market price risk on cattle. No other generation has seen wars halfway across the world impact feeder cattle prices so quickly, but this is the world we live in today. Practically speaking, LRP is helping people sleep at night. Those that use it are protected against the downside associated with increasingly volatile markets, while still getting to participate in the upside.

So what actually is LRP? Let’s define it:

- LRP is an insurance product that protects against a decline in the market price of owned cattle.

- Expressed as a price per hundredweight (cwt), cattle owners select the price per cwt they desire, and that becomes a price floor, while not constraining higher prices if they occur.

- It is published and backed by the USDA, but it reaches the cattle owner through private insurance agencies.

- Premiums are subsidized, which means they offer a price advantage relative to what can be purchased elsewhere.

- Settlement of LRP is not tied to the cash sale of specific cattle.

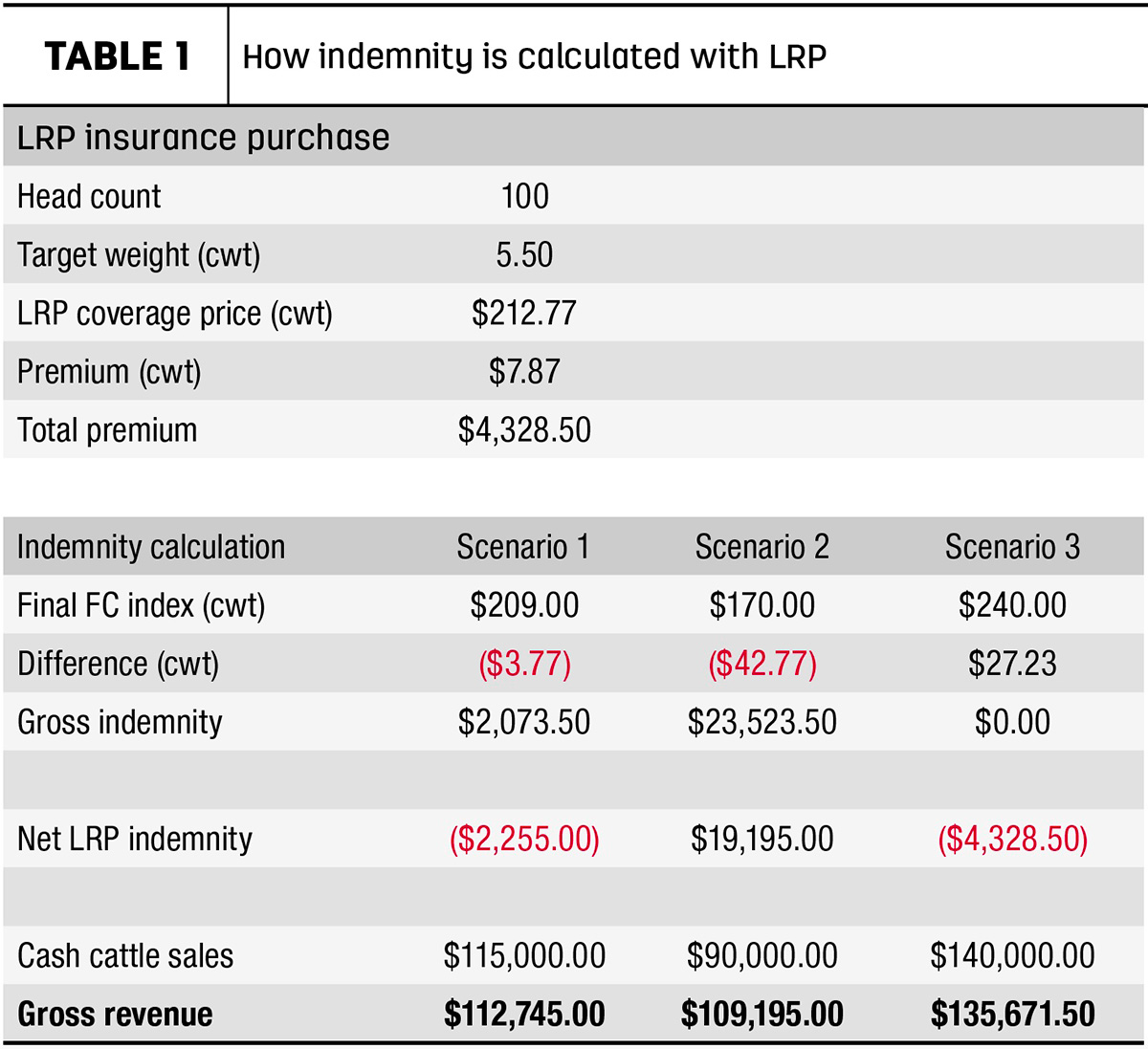

The goal with LRP is not to pick the top, it’s to pick a worst-case scenario. It’s worth saying that another way: Cattle owners are not trying to guess the market with this tool. They are establishing a price floor for their cattle. This can be accomplished because feeder cattle LRP settles back to the Chicago Mercantile Exchange (CME) feeder cattle index, not a cash sale or physical cattle receipt. The index is a cash average that is calculated daily and represents a national feeder cattle price. It is helpful to illustrate how an LRP price floor functions and settles through an example. Table 1 shows how the indemnity (what is owed to the cattle owner from the insurance owned) is calculated with LRP. This example highlights three scenarios: settlement close to the LRP floor, settlement severely below the LRP floor and what happens when the market is above the LRP floor at settlement.

The bulk of the example in Table 1 walks through LRP settlement on those calves – they still need to be cash sold. The “cash cattle sales” line, above gross revenue, calls out the cash sale of the cattle, and they can be sold in any way a cattle owner would normally market them. Hopefully this drives home a couple points. First, LRP does not settle to the cash price an owner receives for selling cattle. Second, if the market goes up, so does the gross revenue on cattle that are price protected with LRP. Most cattle owners mentally evaluate LRP as a minor cost compared to the value it preserves, even when it results in no positive net indemnity (the third scenario).

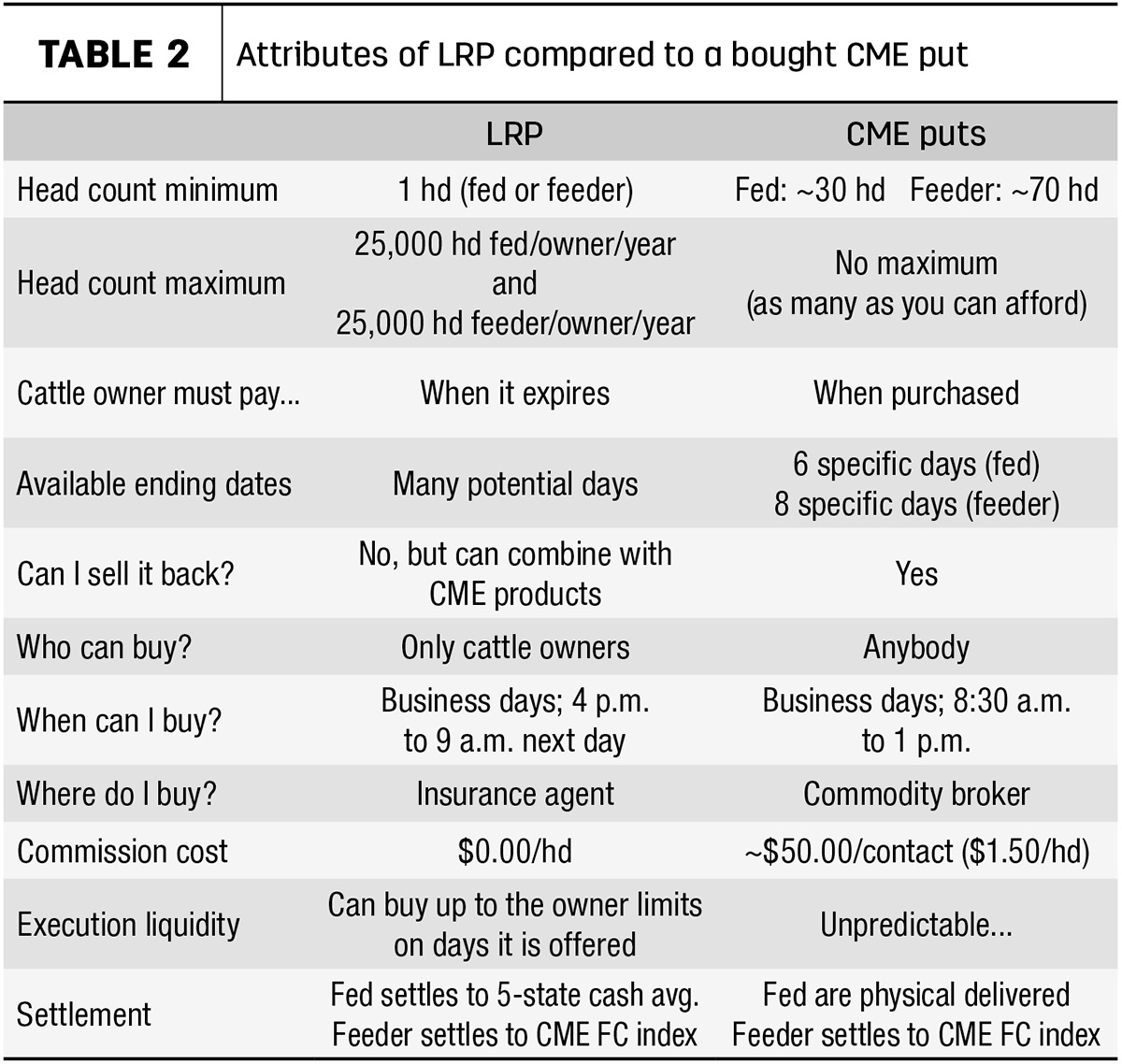

Table 2 shows the attributes of LRP and compares those to a bought CME put.

There are pitfalls and opportunities when it comes to the finer mechanics of LRP, especially with the nuance of timing. This is where understanding cattle risk management and cattle futures markets is advantageous. That advantage is realized in identifying the value of LRP subsidies and how daily LRP offers compare to similar price protection in the CME products. Many people ask about LRP’s increased subsidy percentages. This gets at the right idea with the wrong question. The subsidies did increase, but learning to use LRP starts with understanding how it is valued, relative to alternatives. It is like a grocery store that puts an item on sale for “80% off” but hikes up the before-sale price by 140%. The percentage of the sale, or subsidy, is arbitrary because the before-sale price is inflated. What matters is what the same item costs at the next store down the road. In this case, the store to comparison shop is the CME and the item is a bought put. Since the 2020 changes, the average feeder cattle LRP subsidy is about $16 per head. This means that LRP floors cost about $16 per head less than the CME equivalent. You can see from Table 2 that price is only one of several benefits that bring some critical advantages for the cattle owner.

There is great pressure on the cattle industry today. Cattle owners need to know where help can be found and how to consider the opportunities afforded by that help. Livestock Risk Protection can be a helpful tool amidst volatile circumstances. This LRP knowledge arms cattle owners with valuable information for using price risk management tools to navigate volatility.