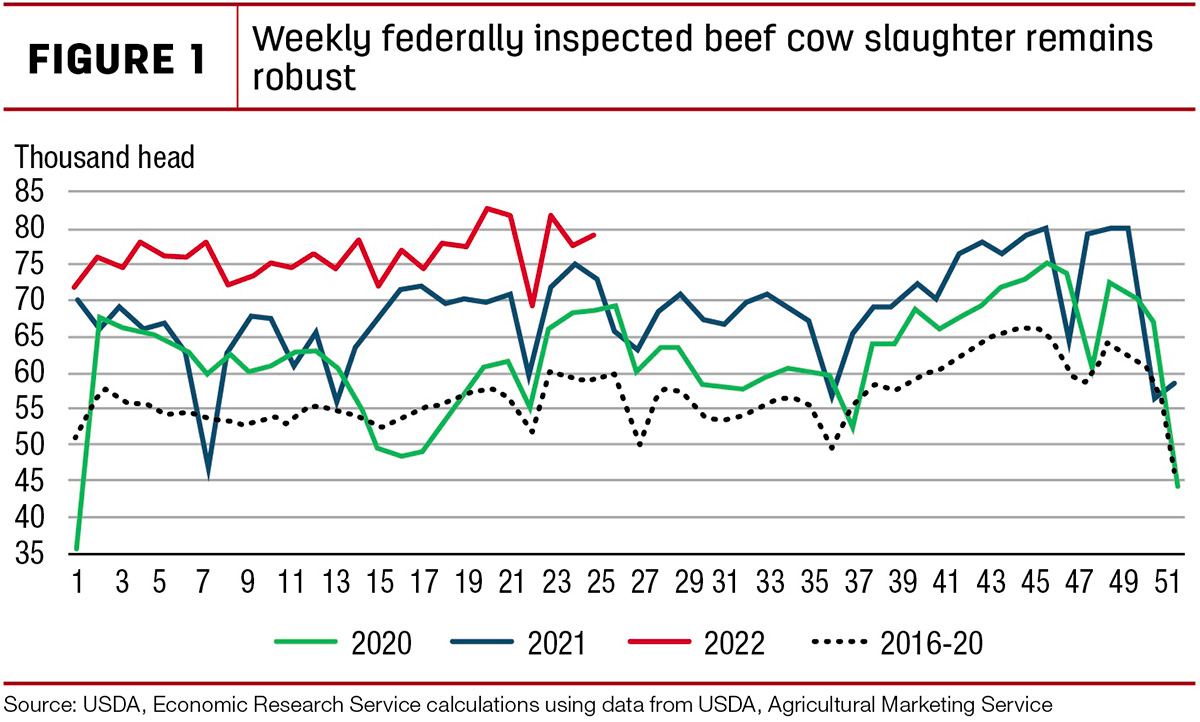

At the close of the year’s second quarter, beef cattle producers continue to cull a large portion of their breeding herds, as shown in Figure 1 of weekly volumes of federally inspected beef cow slaughter for the previous three years.

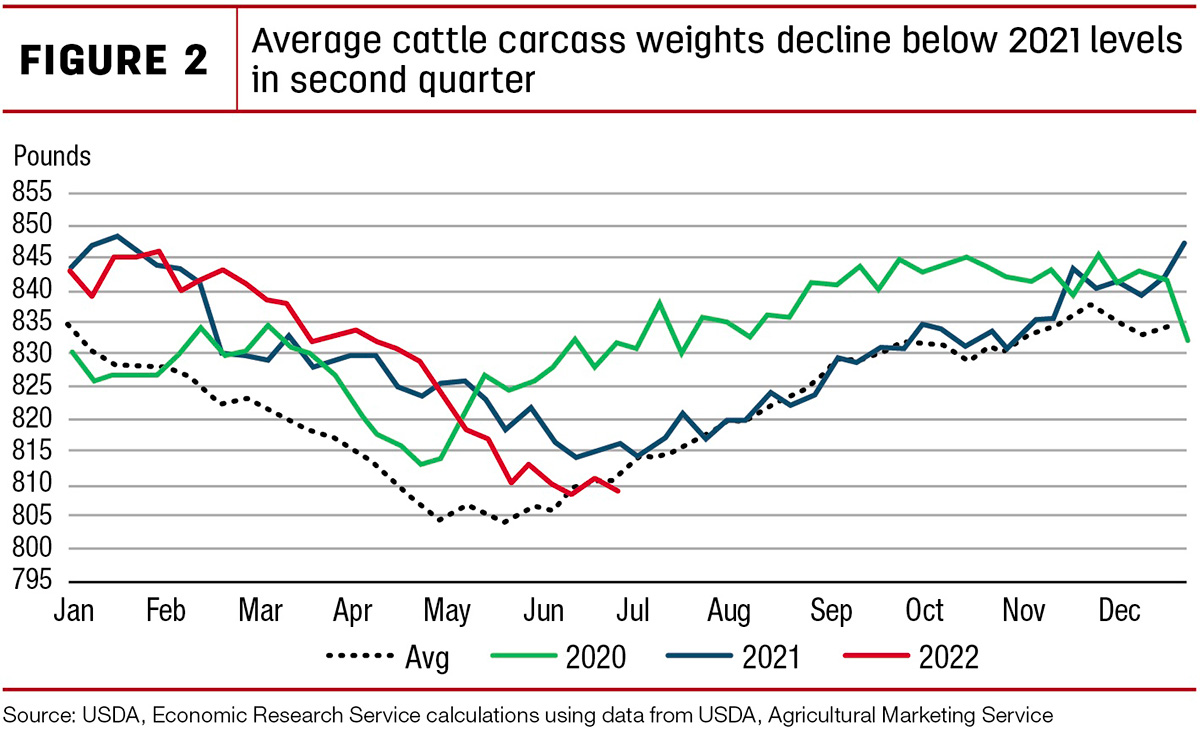

When a higher number of cows are introduced into the slaughter mix, average carcass weights tend to decline, as cows weigh less than steers and heifers. Further, when fed cattle are marketed for slaughter in a timely manner, steer and heifer carcass weights tend to follow seasonal trends. With an increase in year-over-year cow slaughter and a faster pace of federally inspected fed cattle slaughter, average carcass weights have dropped at a steeper-than-normal pace to levels below last year in the second quarter of 2022 (see Figure 2).

Based on production data for April and May, the USDA Agricultural Marketing Service (AMS) actual weekly slaughter numbers, and weights through June 25 and estimated slaughter over the last days of the month, second-quarter 2022 production is unchanged from the previous month.

Despite the overall improved pace of fed cattle slaughter in the second quarter over the prior year, the pace is slower than expected in the previous forecast. As a result, anticipated fed cattle slaughter in third-quarter 2022 was lowered while cow slaughter was raised. Based on recent carcass weight data and a change in the projected slaughter mix, expected weights for the third quarter of 2022 were reduced. Overall, third-quarter production is projected 35 million pounds lower than the previous forecast.

In the latest Cattle on Feed report, the USDA National Agricultural Statistics Service (NASS) reported a June 1 feedlot inventory of 11.846 million head, a series record for the month and about 1% higher than June 2021. Feedlot net placements in May were down almost 3% year-over-year at 1.793 million head. Marketings in May were 1.914 million head, up over 2% year-over-year with one more weekday in the month. NASS will release the Cattle report on July 22, providing an opportunity to calculate the percent of cattle outside feedlots on July 1 and a glimpse into possible feedlot placements in second-half 2022.

Net placements in May were higher than expected, and as a result anticipated second-quarter 2022 net placements were raised. Along with a slower expected pace of steer and heifer slaughter in the third quarter, this is expected to lead to higher marketings in fourth-quarter 2022. Further, in the fourth quarter, anticipated cow slaughter was reduced as cows were pulled forward into the second and third quarters. Anticipated average carcass weights were also reduced. The increase in fed cattle slaughter in the fourth quarter more than offsets lower expected cow slaughter and lighter expected carcass weights, increasing projected production by 50 million pounds.

Projected commercial beef production in 2022 is up 15 million pounds to 27.9 billion pounds, nearly equal to last year. Beef production in 2023 is adjusted downward slightly as anticipated lower carcass weights were carried into the first quarter for an overall decline of 10 million pounds to 25.9 billion pounds.

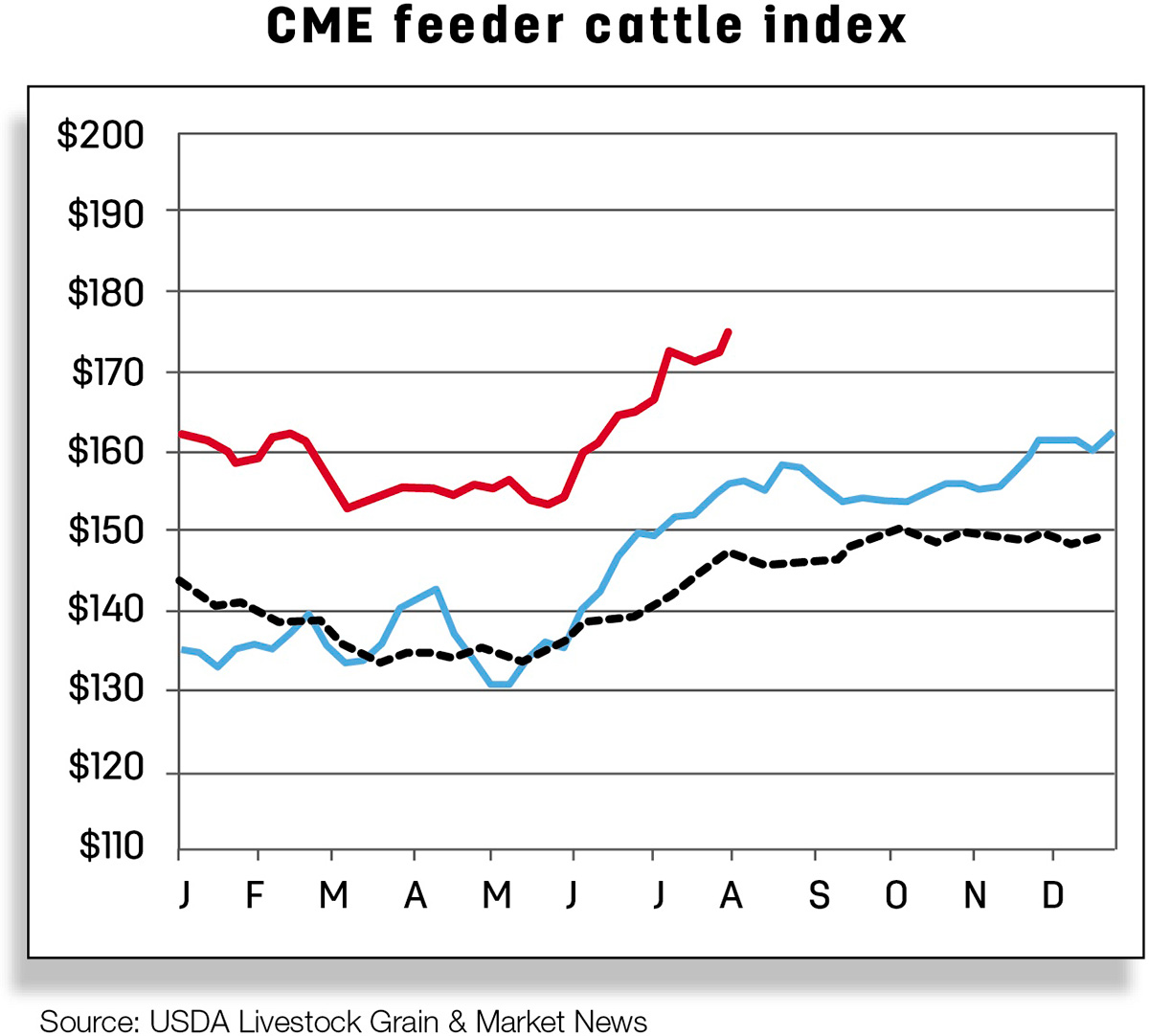

Support for cattle prices

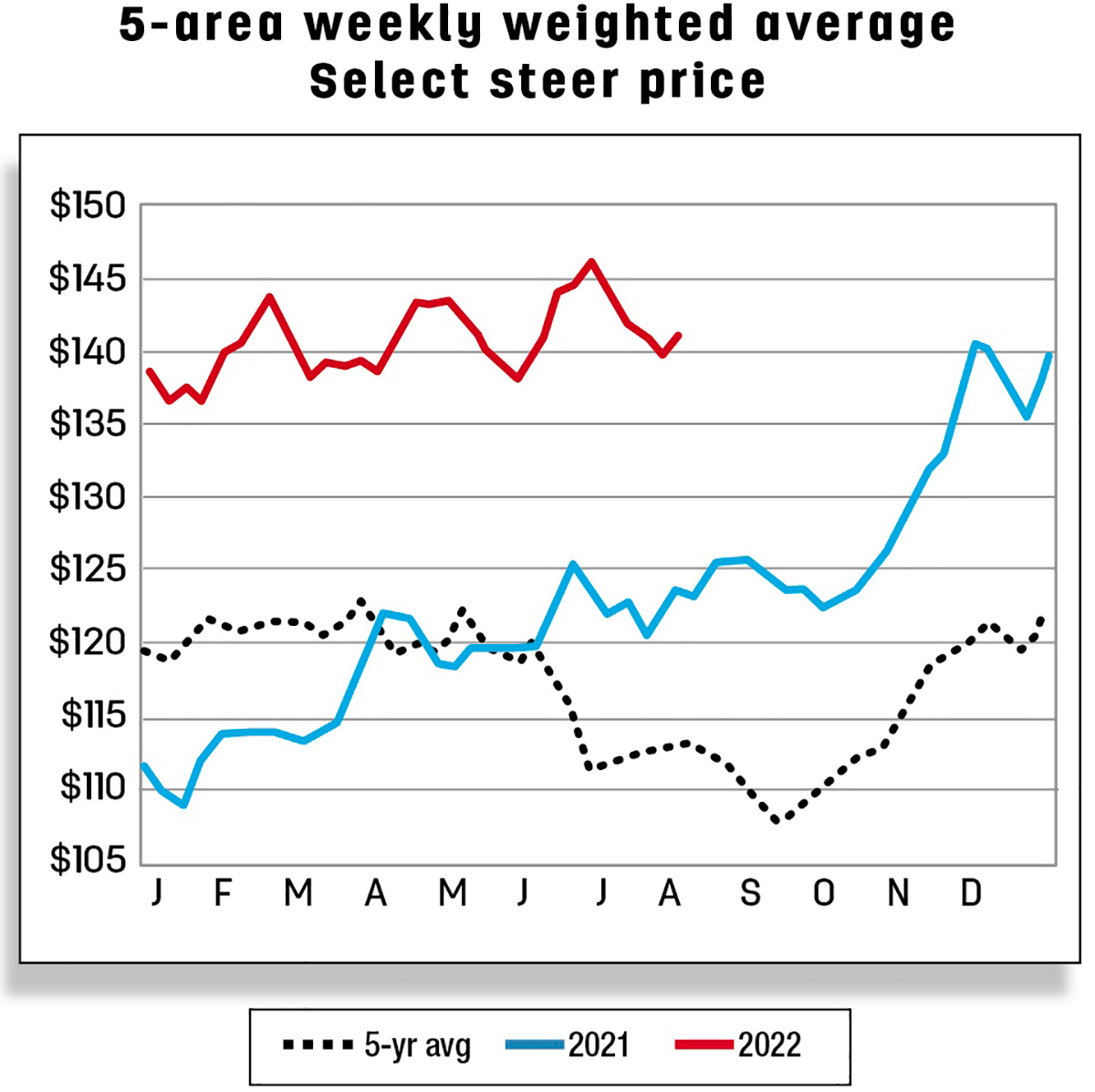

Further, on July 11, the price for feeder steers 750 to 800 pounds at the Oklahoma City National Stockyards was reported at $166.82 per cwt. Based on stronger-than-expected placements in May 2022 and current price data, the second-half 2022 price forecasts are raised for an annual forecast of $163.30 per cwt. Feeder steer price forecasts in 2023 are raised $1 to $199 per cwt. Weekly fed steer prices reached a new high this year, moving counter-seasonally at $146.16 per cwt during the week ending July 3. The fed steer price for the 5-area marketing region for the week ending July 10 was $144.35 per cwt, more than $22 above a year ago. A generally faster pace of slaughter from packers than last year, lighter weights and strong boxed beef prices are providing support to fed cattle prices. Based on current price data, the third-quarter 2022 fed steer price is projected higher at $139 per cwt, for a new annual price of $141.30 per cwt. The 2023 fed steer price is unchanged from the previous month at $153 per cwt.

2022 and 2023 forecasts raised on record May exports

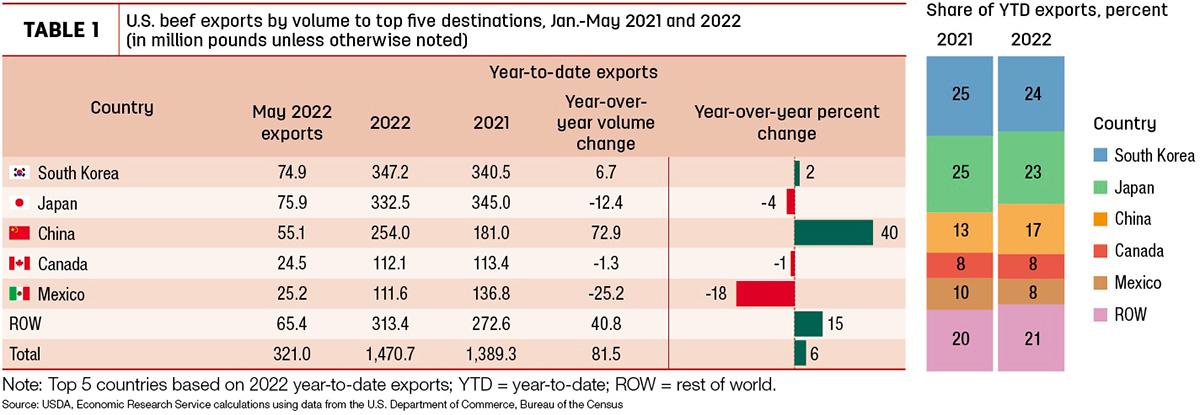

Beef exports in May reached a new record for the month at 321 million pounds, the second-largest monthly export overall behind August 2021 (Table 1). Exports to China were over 55 million pounds, the second-largest shipment on record to that country. Exports to South Korea were the fourth largest on record at nearly 75 million pounds.

Cumulative exports to all destinations from January through May this year were 6% above last year. The largest increase was to China, where the share of exports has increased 4% over last year. Increases to other countries not in the top five have also contributed to the strength in exports. Year-to-date exports to Taiwan were up 25 million pounds, over 35% above a year ago. The next five largest year-to-date increases were to Indonesia, Netherlands, Colombia, Dominican Republic and the Philippines, a cumulative year-over-year increase of over 27 million pounds.

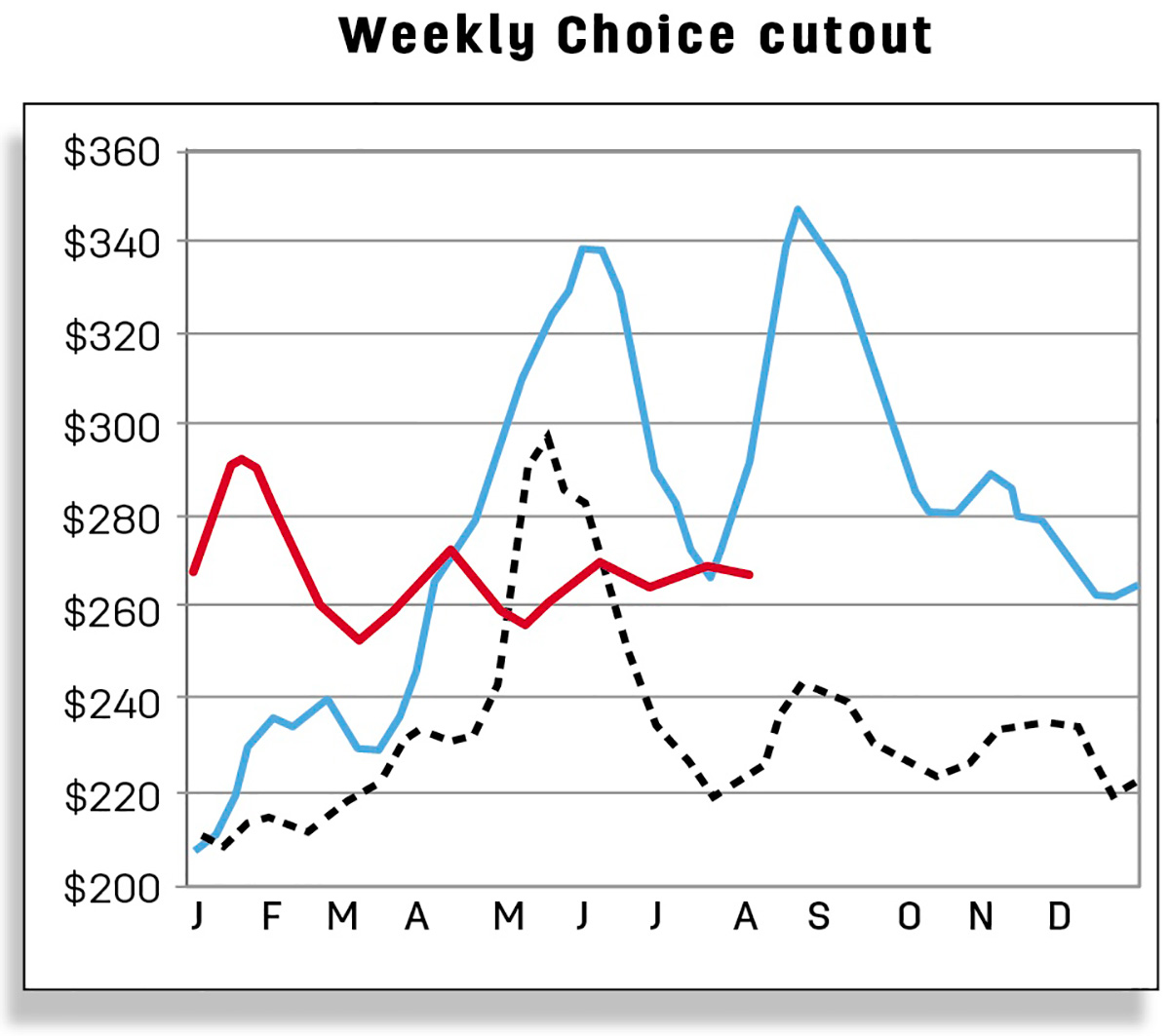

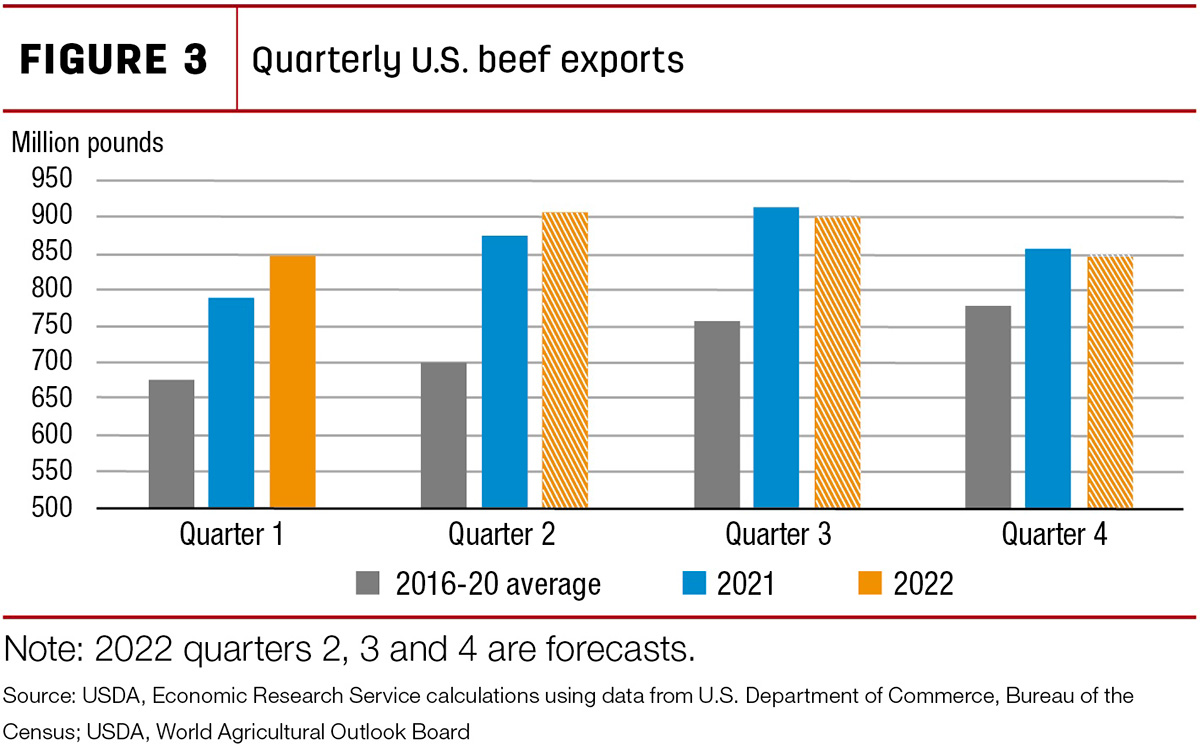

Based on continued strong demand in Asia along with other smaller markets, the export forecasts for the second, third and fourth quarters of 2022 are increased 25 million pounds each to 905 million, 900 million and 845 million pounds, respectively. However, as shown in Figure 3 second-half 2022 is still expected to show a year-over-year decline of just over 1%.

Despite strong exports in the first half of the year, U.S. beef exports may continue to face obstacles over the remainder of the year, including supply chain issues and a strong U.S. dollar, making U.S. beef exports more expensive. The annual export forecast is increased 75 million pounds to 3.496 billion, a year-over-year increase of 2%.

Based on continued demand for U.S. beef, the export forecast for first-quarter 2023 is increased 20 million pounds to 680 million, and the second-quarter forecast is increased 10 million pounds to 750 million. The forecast for the second half of 2023 is raised an additional 10 million pounds, raising the annual forecast 40 million pounds to 2.98 billion.

Beef import forecasts unchanged from previous month

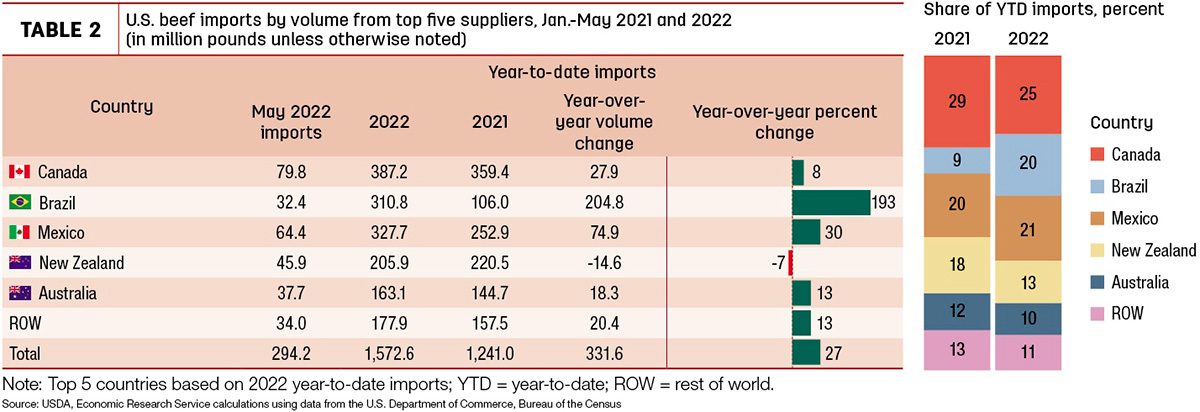

Beef imports in May were 294 million pounds, a year-over-year increase of about 9% (Table 2).

Monthly imports from Brazil were up about 36%, and imports from Mexico were up over 15%. Imports from Australia were up 33% from last year. However, May imports from Canada and New Zealand were down year-over-year.

Year-to-date total imports have increased nearly 27%. Among the top five suppliers, the only decrease has been from New Zealand, down 7% from last year. The largest increase has been from Brazil, which has sent 311 million pounds so far this year, an increase of nearly 200%. Imports from Brazil in May were 32 million pounds, 33% lower than in April. The quota under which the U.S. imports fresh beef from Brazil was filled in April. Therefore, for the remainder of the year, Brazil will be subject to a 26.4% tariff on the value of these imports. Monthly imports from Brazil have decreased month-over-month since March after the higher tariff was triggered at the beginning of April.

The second-quarter import forecast remains unchanged from the previous month at 890 million pounds. The forecasts for the remainder of this year also remain unchanged, for an annual forecast of 3.515 billion pounds. The 2023 annual forecast is unchanged from the previous month at 3.2 billion pounds, a year-over-year decrease

of 9%.