Feed costs are higher, and labor costs will be trending higher. The good news is interest rates are still low. The biggest positive factor is that milk prices have been moving higher. As risk management tools to protect those prices, Dairy Revenue Protection (Dairy-RP) and Livestock Gross Margin for Dairy (LGM-Dairy) programs and Chicago Mercantile Exchange (CME) options all have some things in common. If you put positions in place and prices go higher, you get the higher milk prices. If prices go lower, these tools create a price or revenue floor. The protection creates a win-win scenario.

I made these comments a few months back – and they are still relevant. What does your floor look like? The barn floor? The creaky floor in the haymow? The old feed room floor that now has cracks and grass growing in it?

No, I mean your financial floor. Dairy-RP, LGM-Dairy and the USDA’s Dairy Margin Coverage (DMC) program are strong government-backed forms of financial floor prices, providing minimum or guaranteed revenue for your dairy operation. Each has its own unique traits. Using these tools in combination can help design a mosaic floor to protect your dairy business.

Build the floor, then cheer for higher prices

How should dairy producers design this floor? If you haven’t already, most should look at DMC coverage when the enrollment period opens later this fall. Tier I coverage provides relatively inexpensive protection on up to 5 million pounds of milk and will work if milk prices move lower and feed prices move higher.

Remember you can still use Dairy-RP and LGM-Dairy at the same time you have coverage under DMC. Dairy-RP and LGM-Dairy coverages are available through a licensed and trained crop insurance agent. Both programs offer subsidized premiums to help construct your floor.

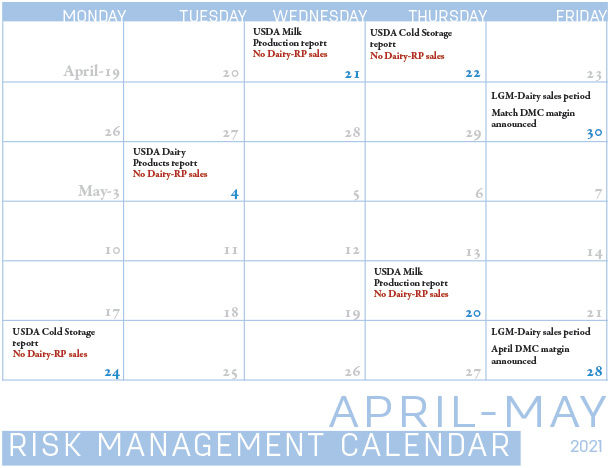

Dairy-RP is available every day except holidays and USDA report days that could impact markets (see Calendar). Dairy-RP is also not available on days when applicable CME futures contracts move limit-up or limit-down. Dairy-RP coverage is generally available for milk produced four or five quarters out into the future. Dairy-RP coverage is currently available for Class III and Class IV milk in the third and fourth quarters of 2021 and the first three quarters of 2022, and for Class III components for the last two quarters of 2021 and the first two quarters of 2022.

The next scheduled sales period for LGM-Dairy is April 30. Coverage is available for up to 10 months, so you will be able to buy coverage for June 2021-March 2022. You need to select coverage in two-month increments to get a USDA premium subsidy. LGM-Dairy covers milk prices (from falling) and also includes coverage for feed prices rising. LGM-Dairy is not only a milk price put option, but a call option on the price of corn and soybean meal.

Click here or on the calendar above to view it at full size in a new window.

When is a good time to build the floor? When using Dairy-RP, LGM-Dairy or CME options, of course, it is on a high day. You will know when you were supposed to do it after the fact.

Given that no one can predict the future, systematically put on price coverage. Do it when prices are trending higher or lower. The preference is to build the floor when prices are above your breakeven. However, you do not always have that opportunity. By being aware of your financial situation, you can protect your milk prices to survive to see better times.

You do not have to cover 100% of your milk with Dairy-RP or LGM-Dairy. Keep it flexible. If prices go higher, you could do a forward contract or buy additional Dairy-RP or LGM-Dairy coverage.

Risk management snapshot

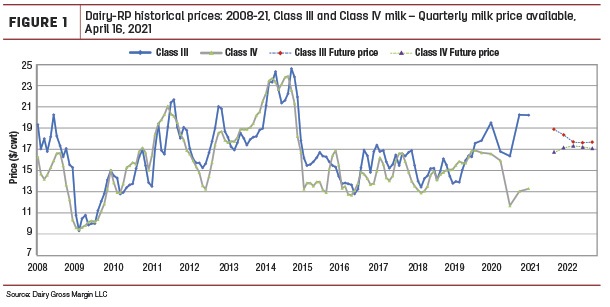

Figure 1 below shows the long-term Dairy-RP settlement prices. The red (Class III) and purple (Class IV) lines on the far right show what price coverages were available through Dairy-RP on April 16. The biggest takeaway from the chart is that Class III prices were near the highs compared to the last five years.

Table 1 shows how prices compare to historical data over the last five years and 10 years as of April 16. In many quarters, current price protection available for both Class III and Class IV milk is the highest in the last five years.

Updated historical charts and graphs can be found here. Detailed Dairy-RP quotes for your farm can be found here.