A sharp drop in milk prices and marginally higher feed costs in early March gave way for a waning margin. Additionally, lower Class III and Class IV futures prices worsen the margin in upcoming months, despite falling feed costs and a tight milk supply, indicating positive cash flows may be nonexistent. Until prices recover as predicted to be the case in the second half of the year, additional margin coverage would be beneficial.

Here's Progressive Dairy’s look ahead at important dates, reports and advice affecting risk management decisions, as well as other information impacting your milk check in April.

Dairy Margin Coverage (DMC) program

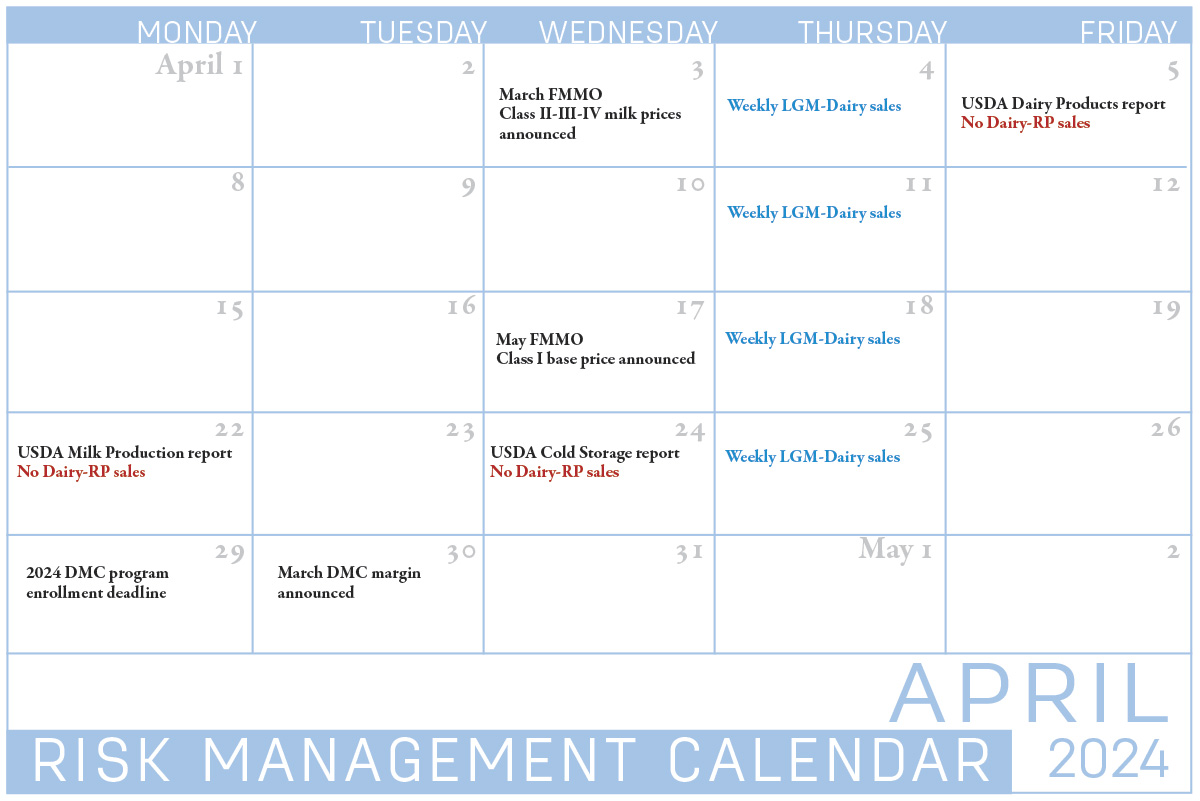

The February 2024 DMC margin and indemnity payments will be announced March 28, with the March 2024 DMC margin calculated April 30.

At $8.48 per hundredweight (cwt), the January DMC margin triggered Tier 1 indemnity payments of $1.02 per cwt for producers that elected for the $9.50 per cwt coverage level, 52 cents for $9 coverage and 2 cents for $8.50 coverage. (Read: January DMC margin is $8.48 per cwt)

January prices reflected the continuing trend from 2023. As of March 4, DMC indemnity payments distributed through the USDA’s Farm Service Agency (FSA) for milk marketing for 2023 (January-December) reached about $1.29 billion. All DMC indemnity payments are subject to a 5.7% sequestration deduction.

Based on the latest enrollment data as of March 4, a total of 17,118 dairy operations were enrolled in the 2023 DMC program, representing just over three-quarters of all operations with established production history. Producers have until April 29 to extend coverage for 2024, retroactive to Jan. 1. (Read: 2024 DMC program enrollment to begin Feb. 28)

As of March 21, February 2024 margin forecasts at $9.41, which would trigger Tier 1 indemnity payments for producers enrolled at the $9.50 coverage level. Current projections do indicate improved margins for the remainder of the year, although markets can change.

Dairy Revenue Protection (Dairy-RP)

Producers managing risk through Dairy-RP are eligible to cover revenue quarterly. In April, Dairy-RP coverage is available for the third quarter of 2024 (July through September) through the third quarter of 2025.

The market changes daily and Dairy-RP endorsements must be purchased between the Chicago Mercantile Exchange (CME) market closing and the next CME opening. Dairy-RP is also not available on days when applicable futures contracts move limit-up or limit-down, or on days when CME trading is closed due to holidays (see Calendar).

Also, Dairy-RP coverage cannot be purchased on days when major USDA dairy reports that could impact markets are released. This includes Milk Production, Cold Storage and Dairy Product reports.

This optional risk management program has emerged as a proven effective tool in its first five years of existence (2019 to 2023). In that time, dairy producers covered nearly 300 billion pounds of milk – roughly 27% of the U.S. milk supply.

Alex Gambonini of HighGround Dairy states that since 2019, Dairy-RP enabled producers to safeguard against downside price risk with limited opportunity losses.

“The significant indemnity payments during poor-performing periods of the market outweighed the frequency of losses, resulting in an average net gain of 23 cents per hundredweight over the last five years,” she says.

In February, the Federal Crop Insurance Corporation board of directors met to vote on a proposal for subsidy rates that vary with endorsement length, a proposal that was developed in response to the argument that higher premium rates for Dairy-RP are more than what most dairy producers can afford for a risk management program. Following the meeting, the board gave notice of intent to disapprove of the modification.

Livestock Gross Margin for Dairy (LGM-Dairy)

LGM-Dairy is another subsidized margin insurance program administered by the USDA’s Risk Management Agency (RMA).

LGM-Dairy provides protection when feed costs rise or milk prices drop, and can be tailored to any size farm. This program uses futures prices for corn, soybean meal and milk to determine the expected gross margin and the actual gross margin. LGM-Dairy is similar to buying both a call option to limit higher feed costs and a put option to set a floor on milk prices.

Coverage can be purchased on expected milk marketings over a rolling 11-month insurance period. For example, the coverage period available during the final week of March includes months of May through March 2025.

Sales periods for the LGM-Dairy program are open on a weekly basis. Unlike Dairy-RP, LGM-Dairy is available even if a sales period falls on the day of a USDA report. Premium payments are due at the end of the insurance period.

Production and price outlooks

- The Federal Milk Marketing Order (FMMO) advanced Class I base prices for April inches to $19.18 per cwt, up 33 cents from April 2023. It’s the first year-over-year increase since January 2022-23. (Read: Economic Update: April 2024 Class I base price inches higher)

- February 2024 U.S. milk production jumped more than 2.2% compared to the same month last year, but that doesn’t account for the extra day in this February. (Read: Leap day factors into milk production jump)

- Low cow inventories and lower expected output per cow brought the milk production forecast for 2024 down in March. At the same time, strong demand and price strength raised cheese and butter prices. (Read: USDA milk production lower due to lower cow inventories)

Check the Progressive Dairy website for updates affecting milk prices as they become available.