Based on the latest USDA National Agricultural Statistics Service (NASS) federally inspected Livestock Slaughter report, the inferred (federally inspected production/federally inspected head slaughtered) carcass weight for September is 827.1 pounds, while the USDA Agricultural Marketing Service (AMS) weekly actual and estimated federally inspected Livestock Slaughter reports showed that the inferred weight for October was 831.8 pounds, about 4.7 pounds heavier month-over-month.

There were more fed cattle in the slaughter mix, which pushed up expected carcass weights in the fourth quarter. The pace of cow slaughter is greater year-over-year, despite one less slaughter day in October 2021 than a year ago.

The forecast for 2021 beef production was raised slightly on heavier anticipated carcass weights and expected pace of fed cattle slaughter that more than offset a decline in expected cow slaughter in the fourth quarter. As a result, the month’s forecast for 2021 beef production at the time of this writing is 27.885 billion pounds, up 53 million pounds from the previous month. The forecast for 2022 beef production was revised up slightly by 5 million pounds from the previous month to 27 billion pounds, with a temporal shift in expected fed cattle marketings from first-half 2022 to the second half of the year as improvement in winter pastures is expected to shift cattle placements from late 2021 to first-half 2022.

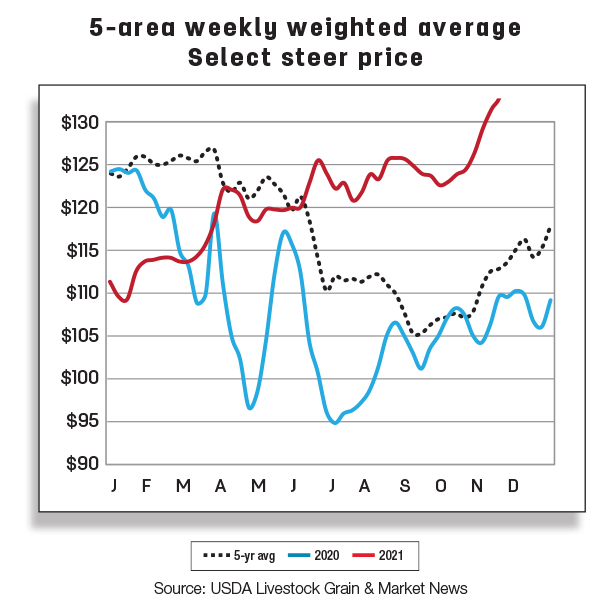

Fed and feeder steer price improvements

In October 2021, the average price for all grades of live steers sold in the 5-area marketing region was reported at $124.33 per hundredweight (cwt), up 16.6%, or $17.68, from October 2020. The fed steer price for the week ending Nov. 7 was $129.23 per cwt, while for the week ending Oct. 24 it was $124.39 per cwt, a $4.84 increase in two weeks. The fourth-quarter forecast for fed steer was raised $1 to $128 per cwt on current price strength. The 2022 annual forecast for fed steers was raised $1.25 to $130 per cwt from the previous month on expected continued strength in packer demand.

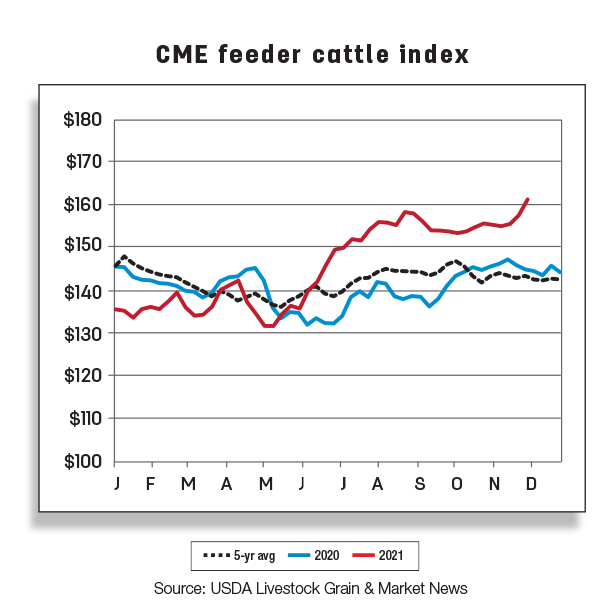

Feeder steers weighing 750 to 800 pounds sold in the Oklahoma City National Stockyards had an average price of $153.52 per cwt for October, up about $16 per cwt from a year earlier. Feeder prices averaged $159.71 per cwt for Nov. 8, more than $21 above the price recorded the same week a year ago. The fourth-quarter forecast was raised by $3 to $154 per cwt relative to the previous month on current price strength and improved prospects of winter pasturing of stocker cattle, which will likely increase competition for feeders. The 2021 price was revised up from a month earlier to $145.55 per cwt. The 2022 price is unchanged from the previous month at $155.50.

Imports stronger than expected

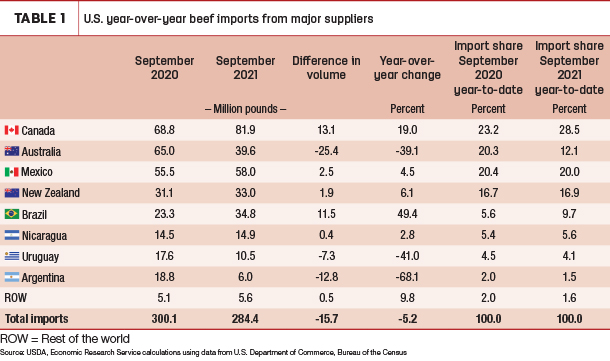

September beef imports totaled 284 million pounds, down 5% from last year but up 16% compared to the five-year average for the month. The year-over-year decrease was driven mainly by imports from Australia, down about 25 million pounds from 2020, or 39%. Imports from Uruguay and Argentina also decreased year-over-year, by 7 million and 13 million pounds, respectively.

The other major import suppliers showed year-over-year increases. Imports from Canada and Brazil stayed well above last year, accounting for the largest increases in year-to-date import shares; September imports from Canada were up 13 million pounds, or 19%, while Brazil was up nearly 12 million pounds, or 49%, compared to last year. Mexico, New Zealand and Nicaragua also showed modest year-over-year increases as well.

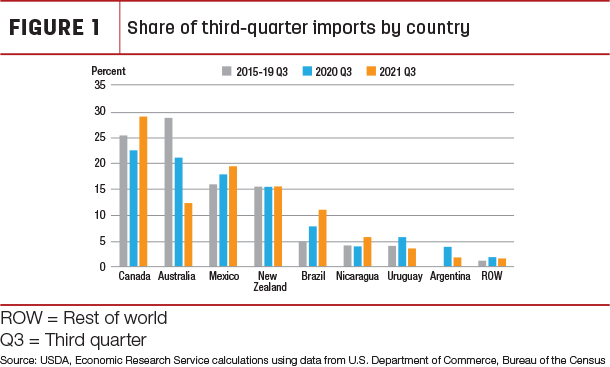

Third-quarter 2021 beef imports totaled 923 million pounds, down about 10% from last year’s record for the third quarter but, compared to the five-year average, third-quarter imports were up 11%. This was the third-largest volume imported for the quarter and eighth-largest volume overall. An accompanying figure shows the share of imports for the third quarter by country.

Australia had the greatest change in import shares for the quarter this year, declining to 12% compared to 21% in 2020. The country has had limited exportable supplies all year as it continues rebuilding its herd.

Canada, Mexico and Brazil showed notable year-over-year increases in import shares for the third quarter. These three countries were also markedly higher than their five-year-average share, contributing to this year’s increase in third-quarter imports exceeding the average.

The fourth-quarter beef import forecast was raised 50 million pounds to 775 million, reflecting recent trade data and strong domestic beef demand. As a result, total imports for 2021 were increased to 3.26 billion pounds. Based on continued demand and greater exportable supplies from Oceania next year, imports for 2022 were also raised to 3.24 billion pounds, maintaining a slight decline year-over-year.

Sales in China continue strong

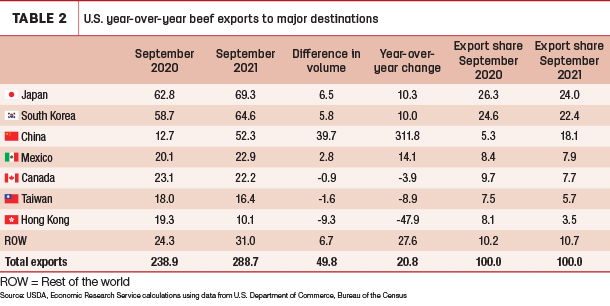

September beef exports totaled 289 million pounds, up 20.9% (or 49.9 million pounds) from a year earlier. This rise in part reflects large shipments of beef to China, which accounted for the largest year-over-year increase in beef exports for September in both volume (39.7 million pounds) and percentage change (313%). The volume of beef sold to China during every month of 2021 has been a record for that destination. For the month of September only, the U.S. exported the largest volume of beef to Japan since 2018. Beef shipments to South Korea, the U.S.’s second-largest destination, exceeded last year beef export volume by 10%, or 5.8 million pounds. Beef exports to Mexico in September were 14.1% higher than a year ago.

In contrast, there were three major destinations in September to which the U.S. exported less beef than a year ago. Beef exports to Hong Kong were down 47.9%, or 9.3 million pounds, from a year earlier. The U.S. also exported less beef to Taiwan and Canada. But while there were some reductions in September’s beef exports, they were not sufficient to offset the increase in U.S. beef exported to China, Japan, South Korea and Mexico.

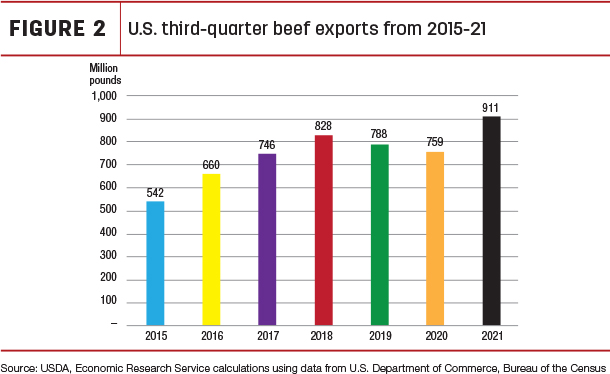

In third-quarter 2021, the U.S. set a record for the largest volume of beef exported in a single quarter – 911 million pounds, smashing the record set in second-quarter 2021 by 38 million pounds.

After exceeding the 2021 second-quarter volume, beef exports in the 2021 third quarter were 10%, or 83 million pounds, larger than the volume recorded in the 2018 third-quarter record. An accompanying figure is a chart displaying third-quarter beef exports from 2015-21. This robust beef export pace in the third quarter was partly due to strong shipments to China.

The fourth-quarter forecast for 2021 beef exports was raised by 50 million pounds from the previous month to 875 million on strong demand in Asian markets. The annual forecast for 2021 beef exports was raised by 41 million pounds to 3.455 billion pounds. The forecast for 2022 was unchanged from the previous month at 3.27 billion pounds.