The forecast for first-quarter beef production is lowered 25 million pounds, based on USDA Agricultural Marketing Service reports of federally inspected livestock slaughter, showing a slower pace of fed cattle slaughter and lower aggregate carcass weights than expected last month. The outlook for second-quarter beef production partly reflects a temporal shift of fed cattle slaughter out of the first quarter and into the second quarter.

Coupled with a slightly more rapid increase in second-quarter marketings, beef production is raised 40 million pounds from last month’s forecast. Third-quarter beef production projections are raised 150 million pounds on higher fed cattle slaughter. This increase in fed cattle slaughter stems from higher expected marketings that are raised on more anticipated first-quarter placements than last month. In the fourth quarter, production is forecast down 55 million pounds, as fewer fed cattle are expected to be marketed at that time. Lower projected marketings are due to fewer anticipated placements in the second quarter. The outlook for 2023 beef production is raised by 110 million pounds to 26.8 billion pounds.

The latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), showed a March 1 feedlot inventory of 11.64 million head, over 4% below 12.19 million head in the same month last year. Feedlot net placements in February were over 7% lower year over year at 1.67 million head. Although reported placements in February were lower year over year, they were higher than expected. Marketings in February were 1.73 million head, up about 5% year over year. On March 1, the number of cattle on feed over 150 days was up over 2% above year-ago levels.

Tight supplies in Nebraska support fed cattle prices

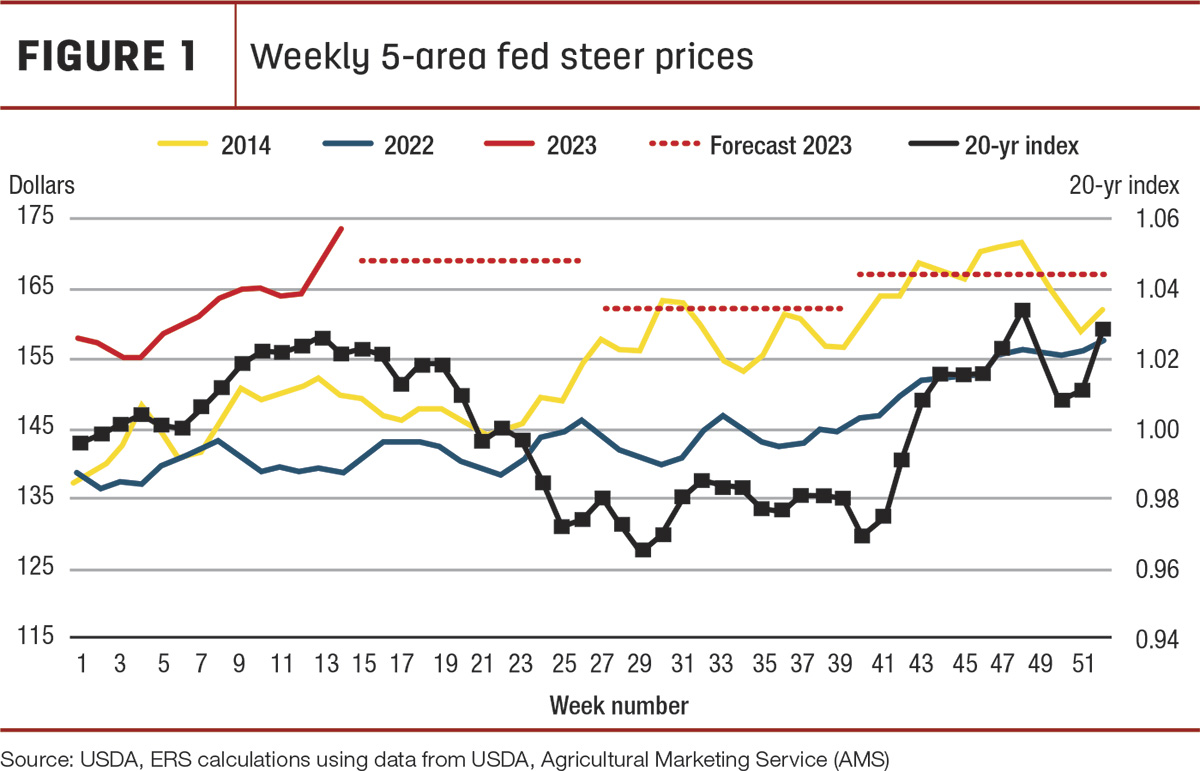

Fed steers in the 5-area marketing region averaged $165.56 per hundredweight (cwt) in March 2023, over $26 above last year. Since the end of March, prices have jumped nearly $10. As shown in Figure 1, reported prices for the week ending April 9 (week 13) set a record at $173.10 per cwt, surpassing the previous high in late November 2014.

The recent surge in prices may be attributed to stronger demand in the North, where packing capacity is the greatest, but market-ready supplies may be relatively tighter. Weekly negotiated prices for Nebraska have jumped $11 per cwt since the end of March. Based on price data for the week ending April 9, the total all-grades price for Nebraska steers averaged $175.37 per cwt, $5.42 over the reported prices in Texas.

The difference in prices likely reflects, in part, the relative availability of fed cattle in the South. Nebraska has a relatively smaller supply of market-ready cattle, despite poor winter weather conditions, possibly pushing Nebraska feedlots to keep cattle on feed longer to achieve the desired carcass grades. According to the Midwest Regional Climate Center’s accumulated winter season severity index, many locations in the northern Plains experienced extreme winter weather this year, and this likely decreased feedlot performance, lowering cattle outweights. As a result, packers likely had to increase prices paid for fed cattle in Nebraska relative to Southern markets.

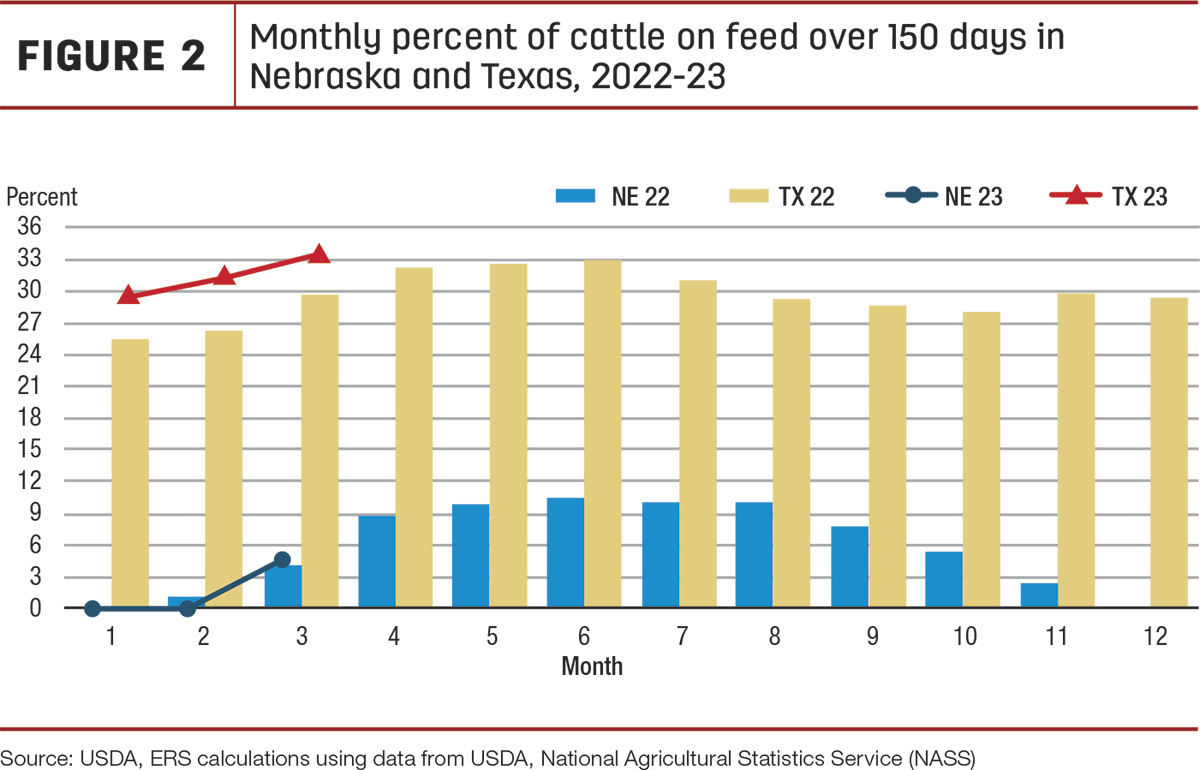

Based on data from the NASS Cattle on Feed report, the overall estimated number of cattle on feed over 150 days is greater than a year ago at the beginning of March, which suggests elevated supplies of cattle would have been available for marketing. However, most of that volume is driven by Texas feedlots, where there are 7% more cattle on feed on March 1 than at the same time last year. Texas has also shown consecutive higher year-over-year supplies over 150 days since April 2022. Figure 2 also shows Nebraska with a year-over-year increase of cattle on feed over 150 days on March 1, which is the first increase year over year since November 2022. Although the length of time cattle spend in feedlots in Nebraska seasonally declines over the winter, the rise to above year-ago levels on March 1 may reflect the need for feedlots to keep cattle on feed to compensate for early poor weather conditions.

Despite an increase in expected fed cattle marketings in 2023 from last month, supplies will remain tighter than last year. Based on recent price data, the forecast for steers in the 5-area marketing region is raised $6 in the second quarter and $3 in the third and fourth quarters. The annual fed steer price is raised about $2.50 for a projection of $164.50 per cwt in 2023, which is 14% above last year.

In March, the weighted-average price for feeder steers 750-800 pounds at the Oklahoma City National Stockyards was recorded at $187.63 per cwt, over $34 above March 2022. The feeder steer price reported on April 10 reached $194.85 per cwt, almost $37 above the same week last year. Based on recent price data, the second-quarter forecast is raised by $6 to $199 per cwt for an annual feeder steer price of $205 per cwt, a 23% increase from last year.

Export forecast raised on trade data

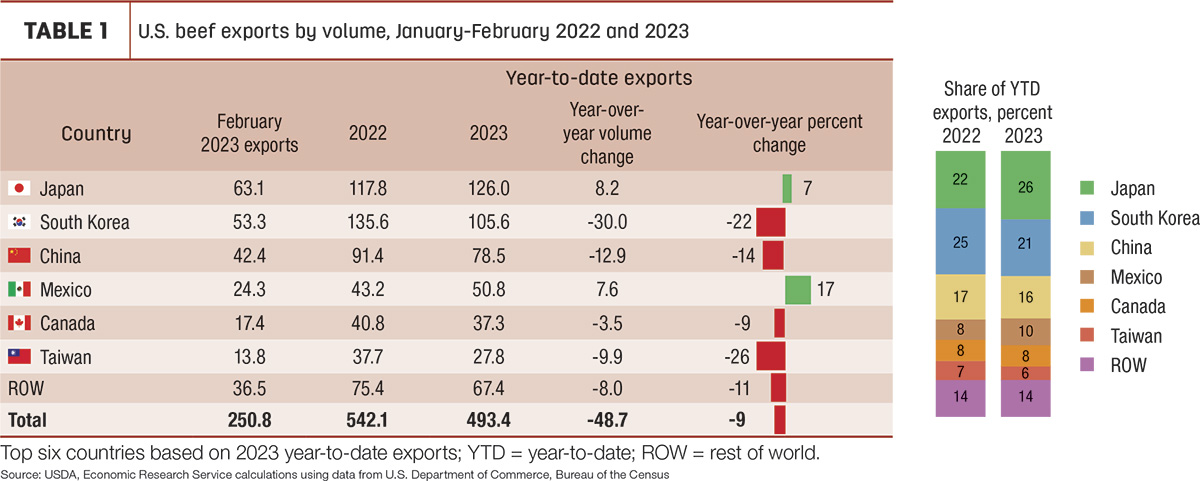

February exports were higher month over month at 251 million pounds (Table 1). After a weaker month in January, exports moved counter-seasonally higher in February, falling just short of the previous year but 5% above the five-year average. The biggest driver behind the month-to-month climb was exports to China. However, the year-to-date exports to China remain 14% below last year. So far in 2023, the U.S. is the sixth-largest supplier of beef to China, with about 5% market share. According to data from the Trade Data Monitor, the unit value of U.S. exports to China is the highest among suppliers to the country, followed by Australia, which sends a similar mix of boneless versus bone-in and fresh versus frozen products to China. China will continue to be a very important market for U.S. beef exports throughout the year. However, U.S. beef could face more competition for market share as beef production in Oceania increases and U.S. beef supplies tighten.

As shown in Table 1, only year-to-date exports to Japan and Mexico increased year over year among the top markets. Exports to South Korea for the first two months of the year are down 22%, but this is compared with a record spike in exports to South Korea in January 2022. Compared to the five-year average, exports are only down 4%. In total, exports through February are down about 9% from last year but still 1% over the five-year average.

Based on data for the first two months of this year showing slightly stronger-than-anticipated exports, the forecast for first-quarter 2023 is raised 5 million pounds to 765 million and the forecasts for second, third, and fourth quarters are raised 10 million, 20 million, and 10 million pounds, respectively, for an increase of 45 million pounds for the year. The annual forecast is 3.13 billion pounds, which, if realized, would be a year-over-year decrease of about 11%.

Early import data lift 2023 outlook

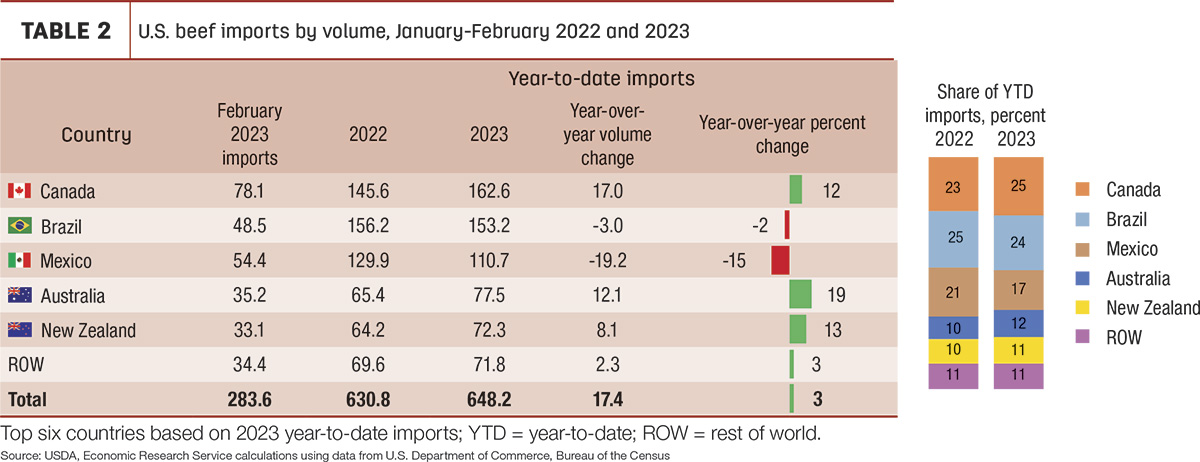

Monthly beef imports were a record for the month of February at 284 million pounds, almost 2% higher year over year (Table 2). The largest increases in shipments came from Australia, Canada and Uruguay, which more than offset decreases in imports from Mexico, Brazil and Nicaragua. February imports from Uruguay were more than double compared to a year ago. Year-to-date imports from Canada, Australia and New Zealand have increased significantly. Conversely, imports from Mexico are down nearly 15% year over year.

Imports from Brazil through February are only about 2% lower year over year. As of April 3, the tariff-rate quota (TRQ) for other countries (which includes Brazil) is 85.5% full; the quantity imported under the TRQ so far is about 15% behind the same period last year. The spike in imports from Brazil in the first quarter of 2022 was partially influenced by a temporary ban on Brazilian beef exports to China after the report of an atypical case of bovine spongiform encephalopathy (BSE). As China is the largest destination for beef from Brazil, some of Brazil’s beef was redirected to other markets, including the U.S. While a similar atypical case of BSE was detected and reported in March of this year, the voluntary beef export ban from Brazil to China was lifted only a month later. The ban was likely not sustained long enough to significantly redirect Brazil’s exports to the U.S. as occurred during the previous ban.

The import forecast for 2023 is raised 75 million pounds based on stronger-than-expected import data in the first two months. The first quarter estimate is raised 25 million pounds to 975 million and the forecasts for the second and third quarters are raised 20 million and 30 million pounds, respectively. The forecast for the year is 3.5 billion pounds, a year-over-year increase of about 3%.