Despite a loss of 5% to 6% in slaughter capacity for fed cattle since mid-August, beef packers are processing federally inspected cattle at or above 2018 levels. Further, from early September through mid-October, weekly beef cow slaughter increased more than 10% above year-earlier levels. Higher beef cow slaughter was particularly evident in the southeast U.S., in part reflecting drought conditions that appeared during this time.

The forecast for 2020 beef production was revised lower by 120 million pounds from the previous month to 27.6 billion pounds based on a slower-than-expected recovery in carcass weights and slightly fewer expected marketings of fed cattle in early 2020. The ERS webpage Livestock & Meat Domestic data has a table titled “Feeder Cattle Supplies Outside Feedlots.” The table estimates that on Oct. 1 the number of cattle available to place into feedlots was 30.4 million head, about 1.1% larger than this time last year.

However, the availability of winter wheat pasture is expected to result in a slower pace of placements in the fourth quarter. Lower placements in late 2019 will likely result in fewer cattle marketings during the first half of 2020.

Cattle prices continue upward seasonal trend

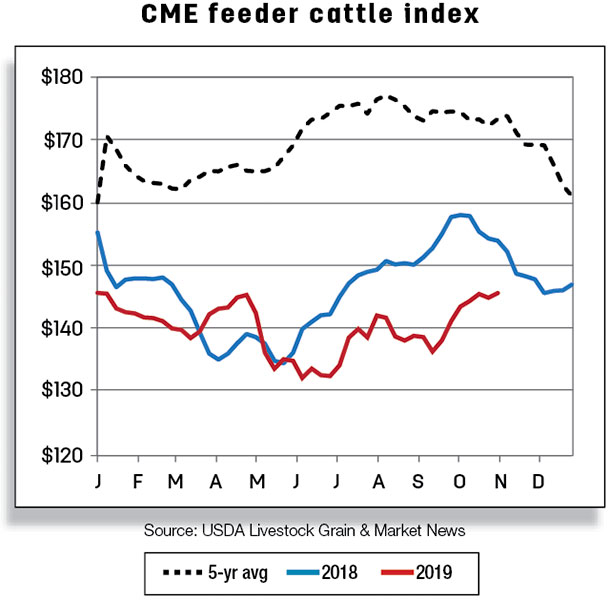

On Nov. 4 at the Oklahoma City National stockyards, sales of feeder steers weighing 750 to 800 pounds were reported at $148.04 per cwt, a recovery of more than $13 from the recent low of $134.80 per hundredweight (cwt) the week of Sept. 9. Based on recent price data, the fourth-quarter 2019 feeder steer price was raised by $3 to $144 per cwt. The first-quarter price forecast for 2020 was raised by $2 to $138 per cwt. The annual price forecast for feeder steers is raised by $1 to $142 per cwt.

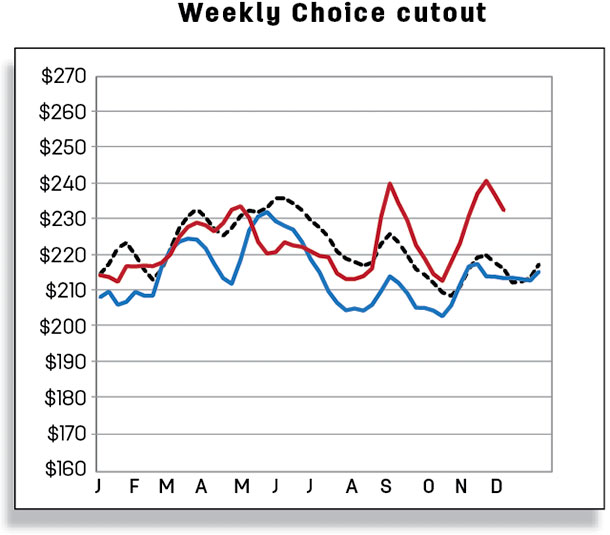

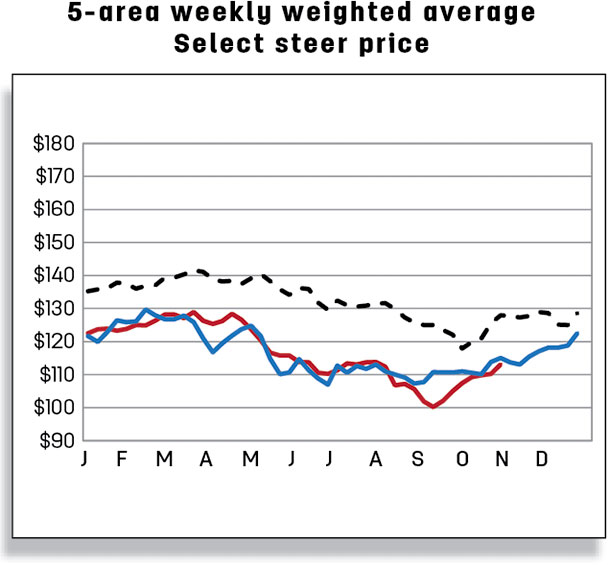

The market price for fed steers continues to make up ground since the low of $100.07 per cwt was reached the week ending Sept. 15. Since then, the price for fed steers in the 5-area marketing region has increased more than 13% to $113.03 per cwt in the week ending Nov. 3. As the Choice-Select price spread stays abnormally high, packers appear to be paying higher prices to bid cattle out of the feedlots as the spread is likely incentivizing feedlots to keep cattle on feed longer. Packers’ willingness to pay higher prices is likely supported by the strong boxed-beef market going into the holiday season. The price forecast for fourth-quarter 2019 was raised by $2 to $112 per cwt. The 2020 annual price forecast for fed steers was unchanged at $116 per cwt.

Beef exports down on lower exports to Japan, Mexico and Hong Kong

U.S. beef exports in September were 253 million pounds, down 3% from a year ago. Most of the decline in U.S. beef exports came from three major beef destinations: Japan (-11 million pounds), Hong Kong (-6 million pounds) and Mexico (-6 million pounds). Other reductions in U.S. beef exports to Canada (-1.5 million pounds) and Chile (-0.9 million pounds) also contributed toward the change in the total exports in September.

Several factors, including increased demand for animal proteins in Asia, changes in trading patterns and tighter supplies in Australia, positioned the U.S. to expand its shipments of beef to a number of Asian countries during September. Compared to 2018, beef exports in September increased to South Korea (+5.7 million pounds), Indonesia (+3.5 million pounds), China (+2.2 million pounds), Philippines (+2 million pounds), Taiwan (+1.3 million pounds) and Vietnam (+1 million pounds).

Several factors, including increased demand for animal proteins in Asia, changes in trading patterns and tighter supplies in Australia, positioned the U.S. to expand its shipments of beef to a number of Asian countries during September. Compared to 2018, beef exports in September increased to South Korea (+5.7 million pounds), Indonesia (+3.5 million pounds), China (+2.2 million pounds), Philippines (+2 million pounds), Taiwan (+1.3 million pounds) and Vietnam (+1 million pounds).

Third-quarter beef exports totaled 788 million pounds. The fourth-quarter beef export forecast remains unchanged at 830 million pounds.

Beef imports fell slightly in September

U.S. beef imports in September were down less than 1% from a year earlier to 238 million pounds. The decline was driven by reductions in beef imports from Australia, Canada, New Zealand, Uruguay and Nicaragua totaling 10.5 million pounds. In contrast, beef imports from both Mexico and Brazil were up 14% and 15%, respectively, year over year. September imports from Mexico totaled 47 million pounds, an increase of almost 6 million pounds from a year earlier. Imports from Brazil were over 16 million pounds of beef to the U.S., which was its second-largest shipment over the last year. Beef imports totaled 771 million pounds in the third quarter. The fourth-quarter forecast for beef imports remains unchanged at 675 million pounds. ![]()

Analyst Christopher Davis assisted with this report.

Russell Knight is a market analyst with the USDA – ERS. Email Russell Knight.