Based on the most recent U.S. Drought Monitor data, drought conditions have improved compared to a year ago. For the week ending Feb. 28, 2023, 48% of the herd was in an area of drought compared to 62% on March 1, 2022. Despite moderating drought conditions, low hay stocks are likely contributing to stronger-than-expected beef cow slaughter. At the same time, during the week ending Feb. 11, 2023, weekly federally inspected dairy cow slaughter surpassed beef cow slaughter for the first time since the week ending April 3, 2021.

Earlier winter weather conditions continue to play a role in lighter fed cattle carcass weights this year. For the week ending Feb. 18, steer and heifer carcass weights were lower by 15 and 21 pounds, respectively, from the same period last year. Further, cow and bull carcass weights are down 10 and 30 pounds, respectively. The anticipated share of cows in the slaughter mix is raised in 2023, which will contribute to lighter expected average carcass weights. The results have lowered the outlook for cattle weights the rest of teh year.

The latest Cattle on Feed report, published by the USDA National Agricultural Statistics Service (NASS), showed a Feb. 1 feedlot inventory of 11.704 million head, about 4% below 12.209 million head in the same month last year. Feedlot net placements in January were almost 4% lower year over year at 1.869 million head. Marketings in January were 1.847 million head, up more than 4% year over year. On Feb. 1, the number of cattle on feed over 150 days was up 2% above year-ago levels.

The forecast for first-quarter beef production was raised 15 million pounds, based on a faster expected pace of cow slaughter in the latter part of the quarter that will more than offset less bull slaughter and lower aggregate carcass weights. In the second quarter, an increase in cow slaughter more than offsets a lower outlook for weights. As a result, production is raised 40 million pounds from last month’s forecast.

Third-quarter beef projection is raised 115 million pounds on higher fed cattle and cow slaughter numbers that more than offset lower expected carcass weights. The increase in fed cattle slaughter stems from higher expected marketings that were raised on higher forecast first-quarter placements. Despite reported lower year-over-year placements in January, they were higher than expected.

In the fourth quarter, production is forecast marginally down as lower weights more than offset a slight increase in cow slaughter. Thus, for the year, an increase in cow slaughter and an increase in fed cattle marketings in the third quarter more than offset the decrease in anticipated weights, raising the outlook for 2023 beef production by 165 million pounds to 26.7 billion pounds.

Fed cattle prices raised on firm demand

In February, the weighted average price for feeder steers, 750-800 pounds at the Oklahoma City National Stockyards, was recorded at $184.42 per hundredweight (cwt), about $27 above February 2022. The feeder steer price reported on March 6 reached $188.76 per cwt, almost $40 above the same week last year. As noted, there is an expectation of higher placements in the first quarter. The outlook for feeder calf prices is improved given existing tight supplies of cattle, a projection for lower market-year average corn prices and higher expected fed cattle prices, as well as recent price data. These factors support raising the forecast for the first two quarters by $1 each for an annual 2023 feeder steer price of $204 per cwt, surpassing the previous record set in 2014.

Fed steers in the 5-area marketing region averaged $160.89 per cwt in February 2023, almost $20 above last year. After January’s strong pace of fed cattle slaughter relative to a year ago, the pace in February declined compared to last year. Carcass weights lower than a year ago have further decreased expected production in February. This has likely helped support the sharp rise in composite boxed beef values, which are at historic levels for this time of year. Reported prices for the week ending March 5 averaged $165.02 per cwt, up over $24 from the same week last year. Based on recent price data, tightening supplies of cattle and lower forecast carcass weights for the entire year, fed steer prices are raised across the quarters for an annual projection of $162 per cwt in 2023.

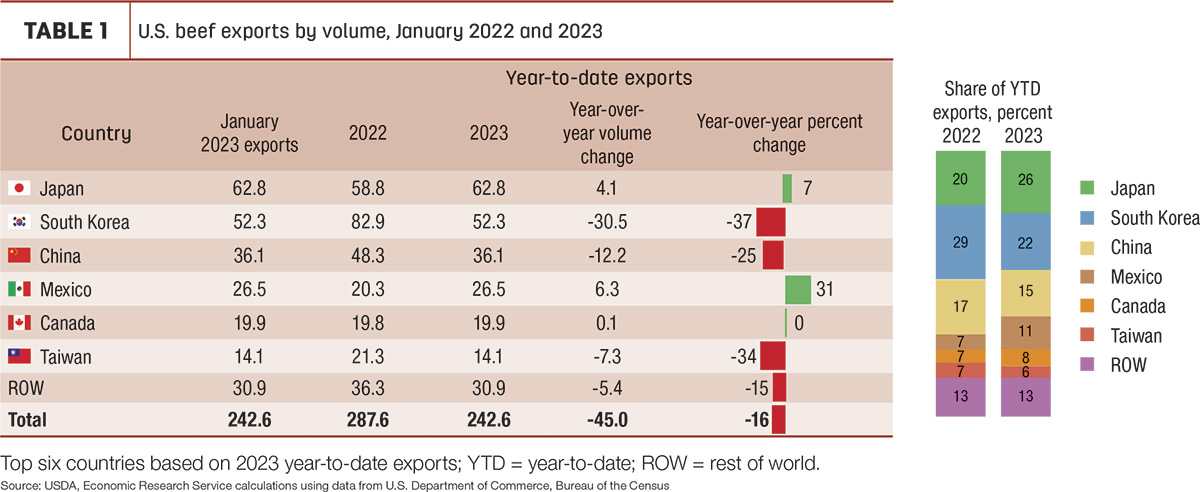

Monthly beef exports continuing to slow since October

Monthly exports in January were 243 million pounds, a year-over-year decrease of 16% and 4% below the five-year average (Table 1).

The largest year-over-year decrease was in exports to South Korea, down nearly 37%. Exports to China were also down over 25% and exports to Taiwan were down 34%. Monthly exports to Japan and Mexico were higher year over year, up 7% and 31%, respectively. Exports have decreased month-over-month and year-over-year since October.

U.S. beef exports have been facing economic headwinds for months and are expected to continue to face challenges throughout 2023. The nominal broad U.S. dollar index for January was about 4% higher year over year, indicating a stronger U.S. dollar. Additionally, U.S. imports will likely face more competition from countries in Oceania as beef production there increases. The export forecast for 2023 is unchanged from last month at 3.09 billion pounds, a 13% decrease year over year.

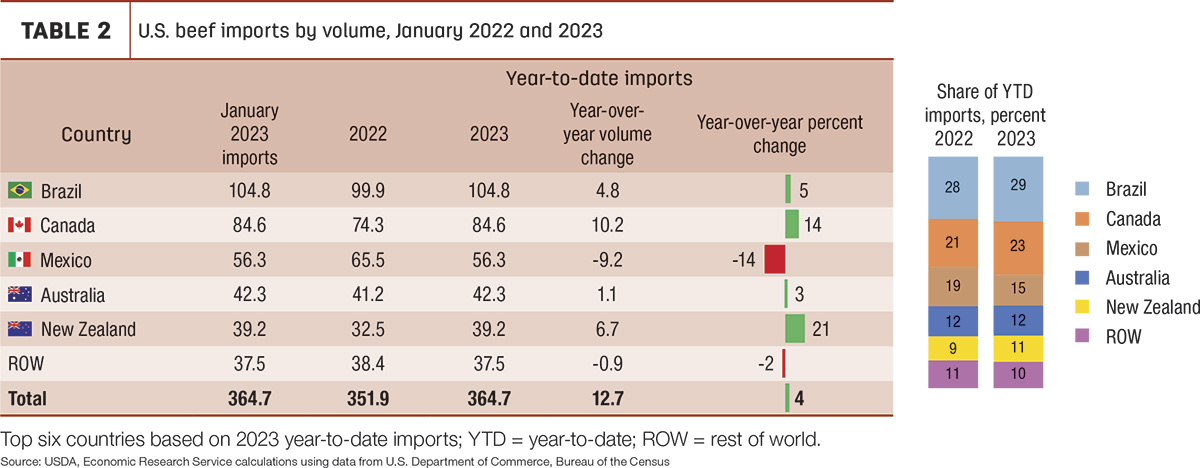

Another record January for beef imports

January beef imports were a record for the month at 365 million pounds, up 4% from last year and the third-largest monthly import level overall (Table 2).

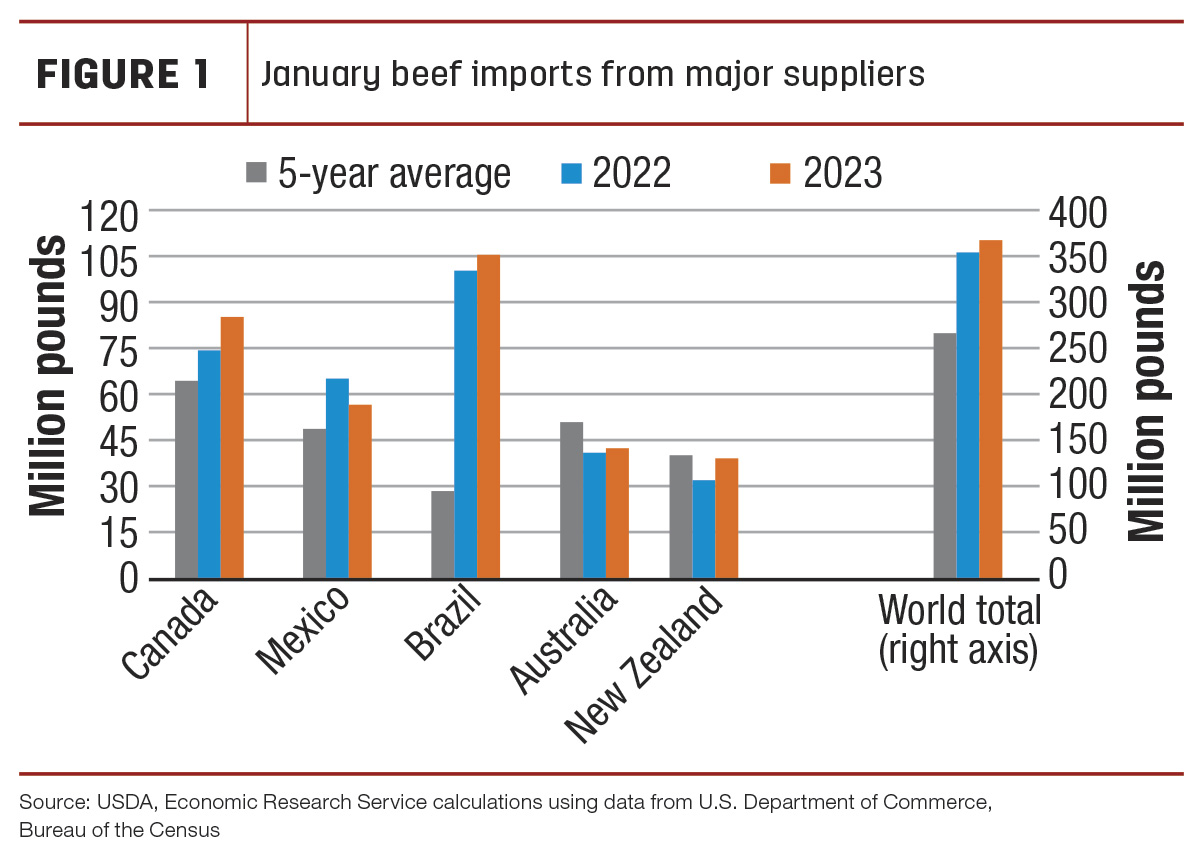

Compared to the five-year average, January imports were up 38%. Figure 1 shows how January 2023 imports from major suppliers compare to the previous year and the five-year average.

The only major supplier providing lower year-over-year imports was Mexico; however, it was still the second-highest import level for the month of January. Imports from Canada in January were also the second-highest for the month.

January imports from Brazil were an overall record from the country at nearly 105 million pounds, 5% higher than the previous year. Beef imports from Brazil fall under the tariff-rate quota for countries without a specific quota or free-trade agreement. This quota is set at just over 65 million kilograms, or 143 million pounds; once filled, imports face a larger out-of-quota tariff. Last year, imports from Brazil spiked in the first few months until the quota was filled and then tapered off throughout the rest of the year. A similar pattern could occur this year. The U.S. Customs and Border Protection Quota Status Report from March 6 shows the tariff-rate quota for “other” countries is already more than 70% filled, about 8% behind the same period last year. The annual aggregate import forecast is unchanged from last month at 3.425 billion.