Based on the most recent U.S. Drought Monitor data, the impact of drought continues to be a theme into the new year even as rains bring relief to beef cattle producers in parts of the West. However, pasture and forage availability in the central and southern Plains likely remain tight as drought continues there. The impact can be seen in the hay stocks estimate released in the USDA National Agricultural Statistics Service (NASS) report. Hay stocks on Dec. 1, 2022, were 72 million tons, 9% below a year ago and the lowest for this period since 1954. This likely supports higher-than-expected cow slaughter in December, suggesting producers are still hampered by limited forage and higher associated costs. For the week ending Jan. 10, the U.S. Drought Monitor reported that over 69% of the U.S. is experiencing some level of drought, about 4% less than a year ago. According to the USDA World Agricultural Outlook Board, approximately 58% of the U.S. cattle herd is located in drought-stricken areas. This is an increase of 8 percentage points from a year ago.

Clarification concerning the drought impact over last year will be revealed when NASS releases the semiannual Cattle report on Jan. 31. This report will provide estimates of cows and heifers available for breeding and an insight into the number of cattle that producers may be planning to place during 2023.

The latest NASS Cattle on Feed report showed a Dec. 1 feedlot inventory of 11.673 million head, about 3% below 11.985 million head in the same month last year. Feedlot net placements in November were down 2% year over year at 1.868 million head, higher than industry analysts’ expectations. Marketings in November were 1.891 million head, up more than 1% year over year. On Dec. 1, the number of cattle on feed over 150 days dipped 5% below year-ago levels, the lowest since 2018 for the month. Tighter market-ready supplies from a year ago in Iowa, Kansas and Nebraska more than offset larger volumes of cattle on feed over 150 days in Texas.

Based on actual and estimated data for December, the pace of fed and nonfed cattle slaughter according to the number of weekdays in the month was down about 5% and 1%, respectively, from last year. However, the share of cows in the slaughter mix was up more than 2 percentage points, likely pushing down average carcass weights. Winter weather conditions likely played a factor in fewer fed cattle slaughtered at lighter weights in the last two weeks of the month.

From last month’s forecast, fourth-quarter 2022 production is lowered 115 million pounds based on December weekly slaughter reports and daily estimates. Lower reported steer and heifer and bull slaughter, as well as lower carcass weight data, more than offset higher cow slaughter. Total 2022 beef production is projected at 28.3 billion pounds, an increase of about 1% from 2021.

As suggested by the December Cattle on Feed report data, tighter market-ready supplies of fed cattle are expected to slow down anticipated marketings in first-quarter 2023. However, larger-than-expected placements in November raised the outlook for marketings in the second and third quarters. The anticipated cow slaughter outlook for 2023 was raised on early January slaughter data and persistent poor forage conditions. Lighter carcass weights in fourth-quarter 2022 are carried over into early 2023. As a result, the increase in expected marketings and cow slaughter in 2023 more than offset lighter anticipated weights, raising the outlook for 2023 beef production by 170 million pounds to 26.4 billion pounds.

Cattle prices raised on tightening supplies

In December, prices for feeder steers 750-800 pounds at the Oklahoma City National Stockyards recorded a weighted average of $179.88 per hundredweight (cwt), which was $14 above December 2021. This raised the quarterly average to $177.06 per cwt and the average annual price for 2022 to $165.94 per cwt, up $19, or 13%, from last year.

The first feeder steer prices of 2023 were reported on Jan. 9 and 16 at $178.19 and $180.93 per cwt, almost $22 and $19 above the same weeks last year. Based on higher-than-expected November feedlot placements rising and tighter anticipated supplies of cattle available for placement in early 2023, the forecasts for feeder steer prices in the first two quarters of 2023 are raised to $182 and $192, an increase of $5 and $2, respectively. This raises the 2023 annual feeder steer price forecast to $203 per cwt, a year-over-year increase of 22%.

Prices for fed steers in December averaged $156.53 per cwt, more than $17 above December 2021, which raised the fourth-quarter average price to $152.99 per cwt. Fed cattle prices have continued steady into the new year. As reported for the weeks ending Jan. 8 and 15, the negotiated prices for fed steers in the 5-area marketing region were $157.74 and $156.78 per cwt, respectively. Based on tighter supplies and expected strength in boxed-beef prices during the year, fed steer prices are raised in each of the quarters for an annual projection of $158.50 per cwt in 2023.

Export values through November exceed record 2021 full-year value

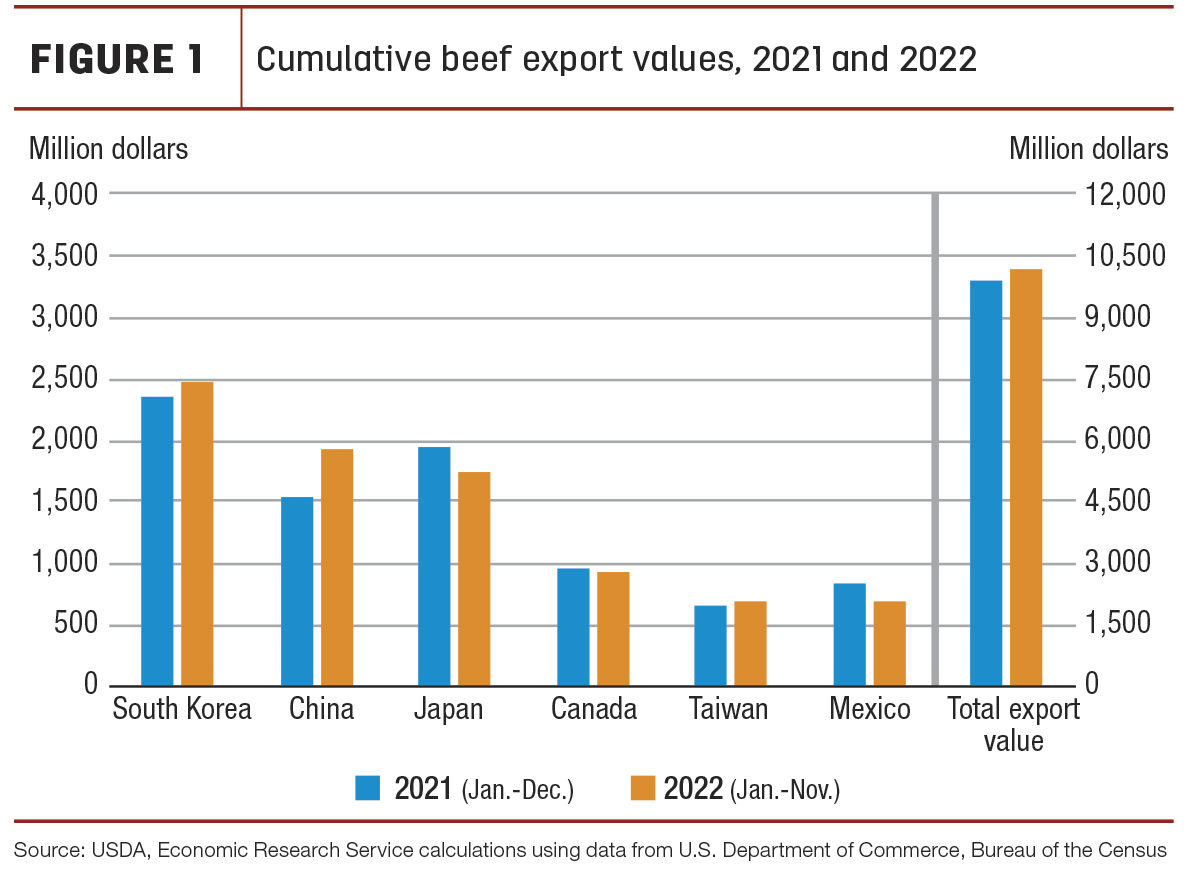

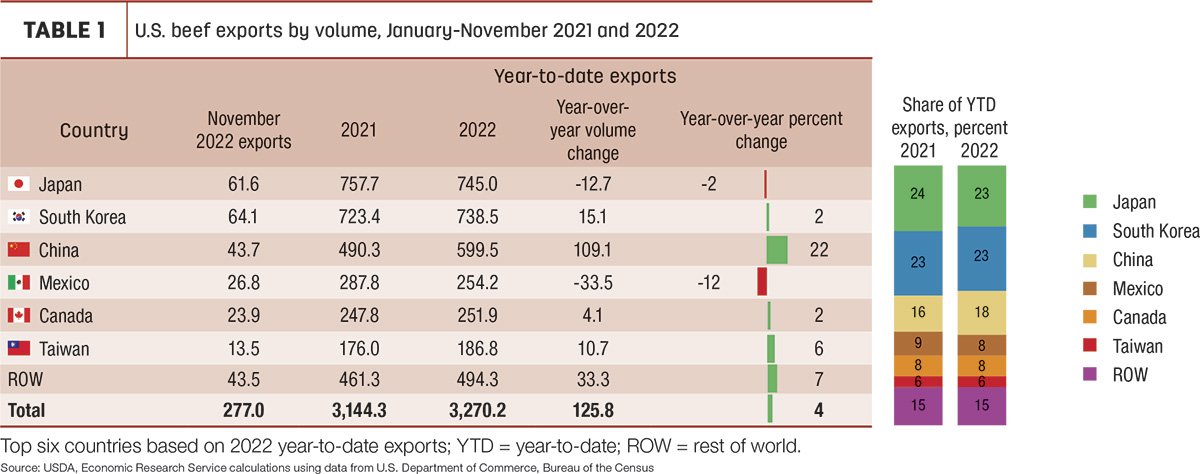

Exports in November totaled 277 million pounds, 6% below November 2021 but 3% higher than the five-year average. The value of exports in November fell by over 100 million dollars from 2021, but the year-to-date value of exports increased 13% year over year. The total value of beef exports through November topped 10 billion dollars, already surpassing the full-year value from 2021, the previous annual record. As shown in Figure 1, export values through November have topped the annual values in 2021 in several key markets, including South Korea, China and Taiwan.

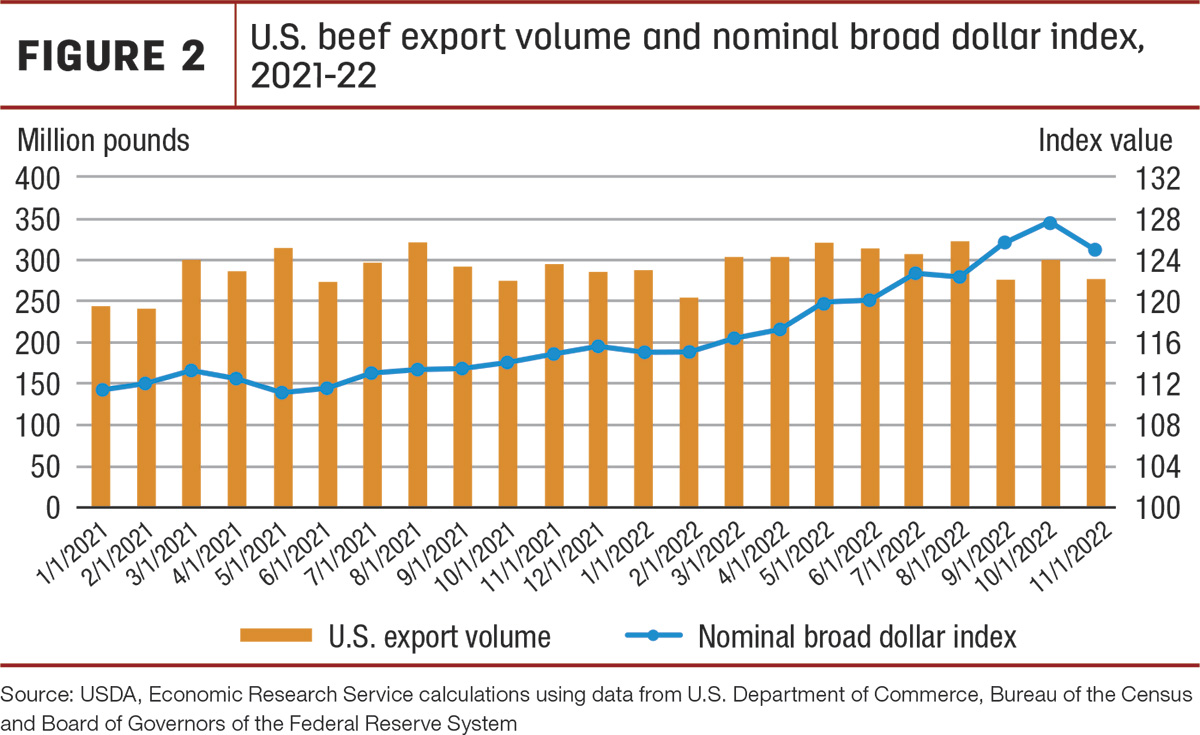

Despite higher prices that have been bolstered by a strengthening U.S. dollar, global demand for U.S. beef has remained strong. The nominal broad dollar index, calculated by the Federal Reserve as an indicator of the exchange rates of the U.S. dollar against selected foreign currencies, has increased substantially since January 2021. Figure 2 shows how exports remained strong through August even as the index rose 6% from the start of 2022.

Limited available supplies from other major beef suppliers such as Australia and New Zealand have supported the strong exports by the U.S. The index fell again in December, but limited beef supplies next year from lower production will continue to support the price of U.S. beef, making it less competitive on the global market, especially as Australia recovers from the supply chain issues causing fewer exports from that country this year.

Cumulative exports through November are shown in Table 1. Exports continue to outpace last year due to strength in the first eight months. However, cumulative exports for September through November are 1% below last year.

Based on recent trade data, the beef export estimate for fourth-quarter 2022 is lowered 20 million pounds to 850 million, 6 million pounds below fourth-quarter 2021. The estimate for annual exports in 2022 is 3.542 billion pounds. The 2023 annual forecast is unchanged at 3.09 billion pounds.

Stronger imports from South America expected to front-load 2023

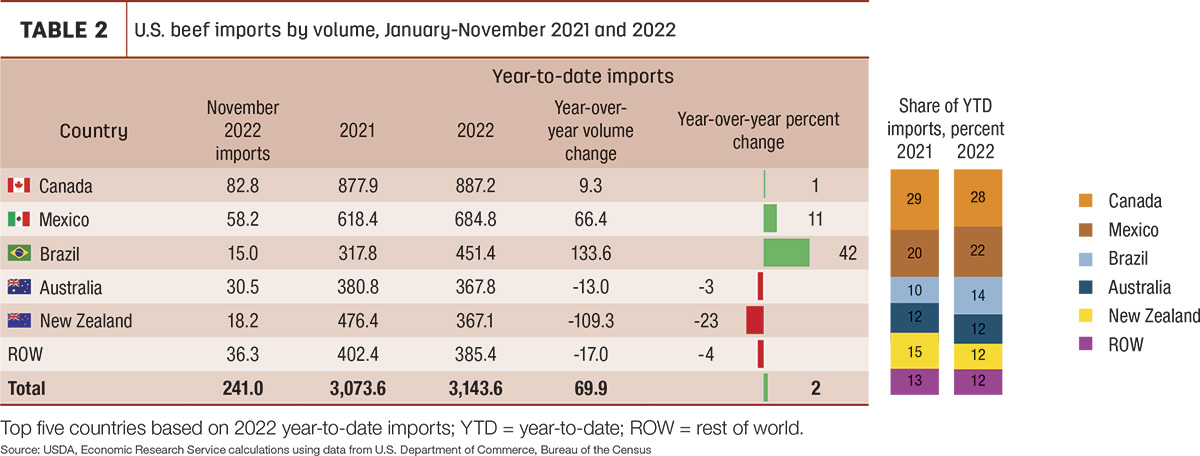

Beef imports in November were 241 million pounds, a year-over-year decrease of about 19% (Table 2).

Imports from nearly all major suppliers were lower year over year in November except for imports from Canada, which were 3% higher. The largest decline in shipments was from Brazil, down 63%; however, year-to-date imports from Brazil continue to outpace last year, up 42%. Year-to-date imports from Australia and New Zealand combined are down 14% from 2021.

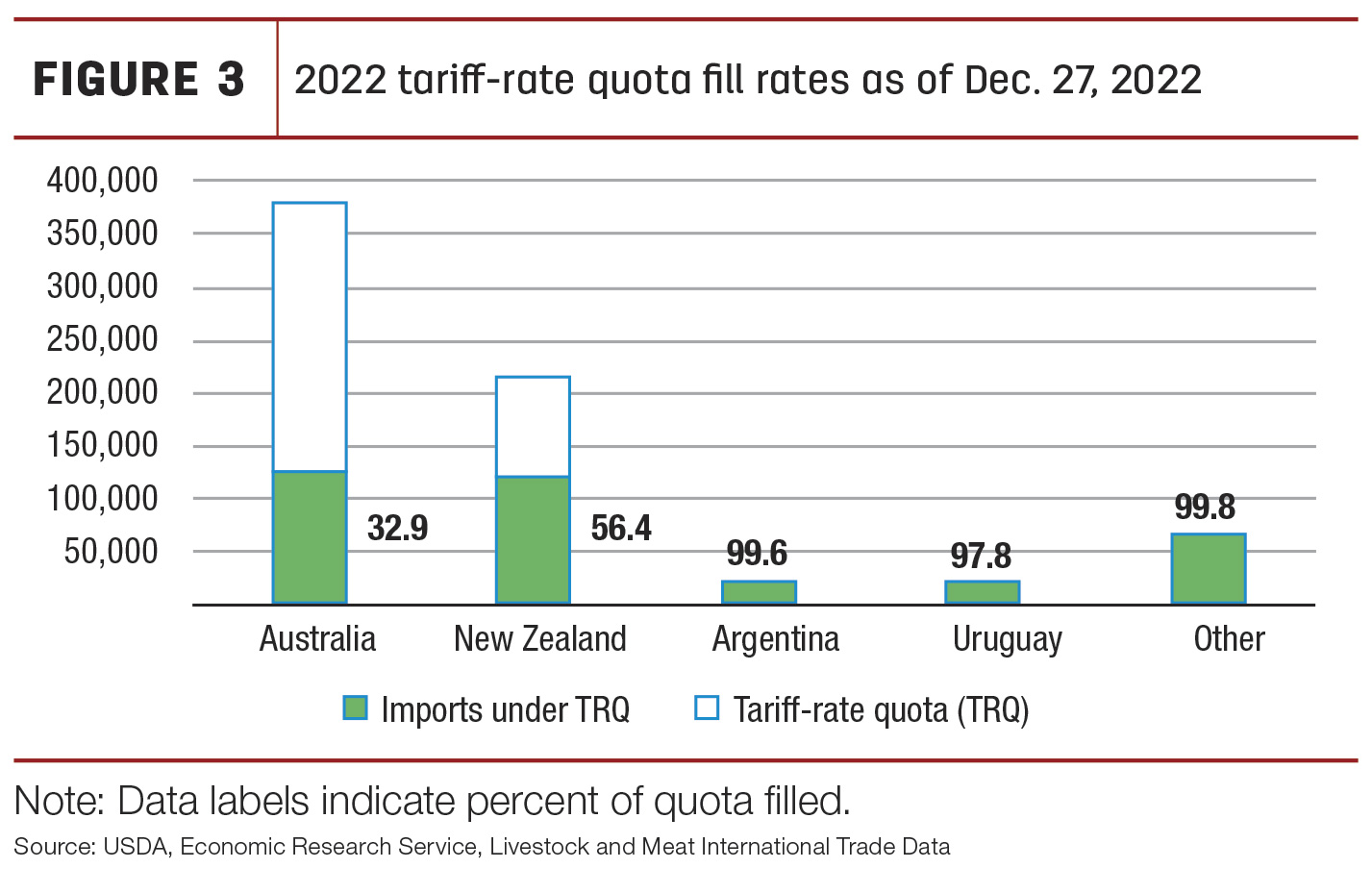

Figure 3 shows the fill rates from the tariff-rate quotas (TRQ) in 2022. Once a quota is filled, imports entering under that quota are subject to a higher tariff.

Imports from countries that do not have a specific quota or free trade

agreement are counted under the “other” quota. A majority of the product

that filled the other TRQ by April of 2022 was from Brazil. The 2022

TRQs ended on Dec. 31 and were reset on Jan. 1. Thus, the countries with

a full quota in 2022 can once again send beef to the U.S. under the

lower in-quota tariff. As of Jan. 6, the other quota for 2023 was

already almost 34% full according to the U.S. Customs and Border

Protection quota status report. This is likely due to beef from Brazil,

which sent nearly 100 million pounds in January 2022. While some of the

spike in early 2022 was caused by China’s temporary ban on Brazilian

beef, it appears that importers are again taking early advantage of the

reset quota this year.

Imports from countries that do not have a specific quota or free trade

agreement are counted under the “other” quota. A majority of the product

that filled the other TRQ by April of 2022 was from Brazil. The 2022

TRQs ended on Dec. 31 and were reset on Jan. 1. Thus, the countries with

a full quota in 2022 can once again send beef to the U.S. under the

lower in-quota tariff. As of Jan. 6, the other quota for 2023 was

already almost 34% full according to the U.S. Customs and Border

Protection quota status report. This is likely due to beef from Brazil,

which sent nearly 100 million pounds in January 2022. While some of the

spike in early 2022 was caused by China’s temporary ban on Brazilian

beef, it appears that importers are again taking early advantage of the

reset quota this year.

Due to this faster expected pace of imports in the first quarter, there was a temporal shift of imports from each of the later quarters of 2023, plus an additional 50 million pounds added, to raise the first-quarter forecast to 850 million pounds. Accordingly, the second-quarter forecast is decreased to 850 million, the third quarter to 890 million and the fourth quarter to 810 million. This still leaves the second half of the year above 2022 by 11%, when production is expected to decline year over year at an increasing rate. The 2023 annual forecast is raised by a total of 50 million pounds to 3.4 billion, reflecting increased imports from South America and Oceania. Expectations for imports in 2023 are unchanged at 3.376 billion pounds.