The USDA National Agricultural Statistics Service (NASS) released its semi-annual Cattle report on Jan. 31. The total number of all cattle and calves on Jan. 1, 2023, was estimated at 89.3 million head, about 2.8 million fewer than the previous year. This marks the fourth year of contraction for aggregate beef and dairy cattle inventories, in the ninth year of the current cattle cycle – the cyclical expansion and contraction of the national cattle herd over time. The cycle is influenced by the combined effects of cattle prices and input costs that drive cow-calf producer profitability, the gestation period for cattle, the time needed for raising calves to market weight and climate conditions.

The largest category estimated in the Cattle report is the number of beef cows, which is particularly impacted by those factors affecting the cattle cycle. Over the past few years, cow-calf producers have been faced with drought, leading to less forage and higher feed costs, as well as higher operating expenses, which limits their ability to maintain their herds and decreases their desire to retain heifers as replacements or additions to their herd. As a result, in 2022 producers culled their cows at a higher percentage of the beginning 2022 beef cow inventory than during the last drought-induced cattle cycle in 2004-14.

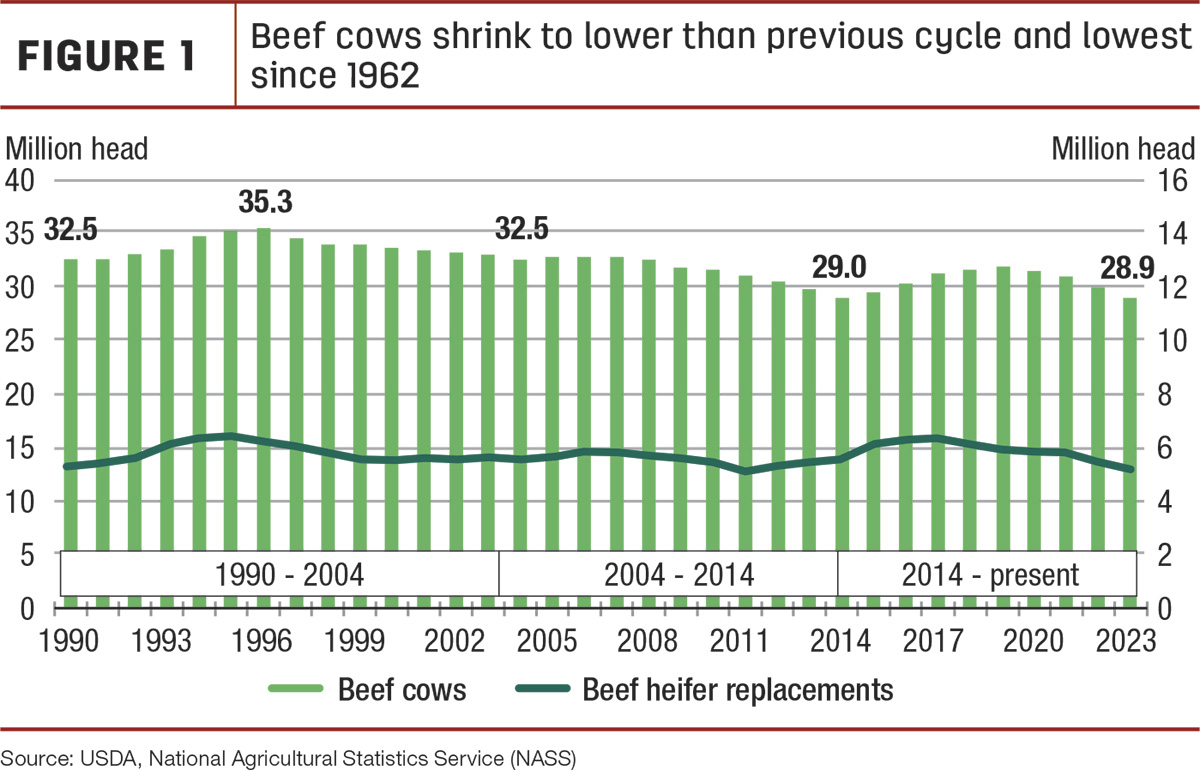

Figure 1 shows that the Jan. 1 estimate of beef cows at 28.9 million head was down 3% from a year ago.

For additional context, the beef cow herd is also down 37% from its historic peak in 1975 of 45.7 million head and is the smallest inventory since 1962. Further, producers expressed their intentions to retain the fewest heifers since 2011, which was during the last drought-fueled contractionary period of the last cattle cycle. This suggests that producers are not optimistic about growing their herds despite a higher year-over-year outlook for cattle prices in 2023. On the dairy side, milk cow numbers were up 0.3%, while heifers for milk cow replacement were estimated down 2.3%.

The 2022 calf crop estimate was revised down from the last report to 34.5 million head, reflecting a 2% decline year over year. The lower calf crop contributed in part to the relatively low inventory of 13.6 million calves under 500 pounds on Jan. 1, 2023, down 365,600 head from 2022. Steers 500 pounds and over were estimated at 16.1 million head, down 573,100 head from 2022, and other heifers 500 pounds and over were estimated at 9.7 million head, down 322,300 head from 2022. It was further noted in the Cattle report that the number of all cattle on feed was estimated at 14.2 million head, down 537,300 head from last year. As a result, fewer feeder cattle supplies were available on Jan. 1, 2023, 724,000 head lower at 25.3 million head, the fewest to start the year since 2015.

2023 beef production raised on higher cow slaughter

Beef production in 2022 is estimated at 28.3 billion pounds, up over 1% from 2021. Total cattle slaughter was up over 1%, which more than offsets a slight decline in average dressed weights. The increase in slaughter was primarily driven by a higher percentage of cows in the slaughter mix, which most likely pressured average dressed weights downward even as fed cattle experienced optimal feeding conditions last year.

Based on the most recent U.S. Drought Monitor data, the effects of drought on livestock and crop producers continue. However, since peaking in late October 2022 when 76% of the cattle inventory was experiencing drought, conditions have improved. For the week ending Jan. 31, 2023, 55% of the herd was in an area of drought compared to 53% on Feb. 1, 2022. Given existing low hay stocks, the current drought exposure supported continued high beef cow slaughter in early 2023.

The latest NASS Cattle on Feed report showed a Jan. 1 feedlot inventory of 11.682 million head, about 3% below 12.037 million head in the same month last year. Feedlot net placements in December were more than 8% lower year over year at 1.75 million head. Marketings in December were 1.741 million head, down more than 6% year over year. On Jan. 1, the number of cattle on feed over 150 days was up 2% above year-ago levels, likely on the slower reported pace of marketings in December.

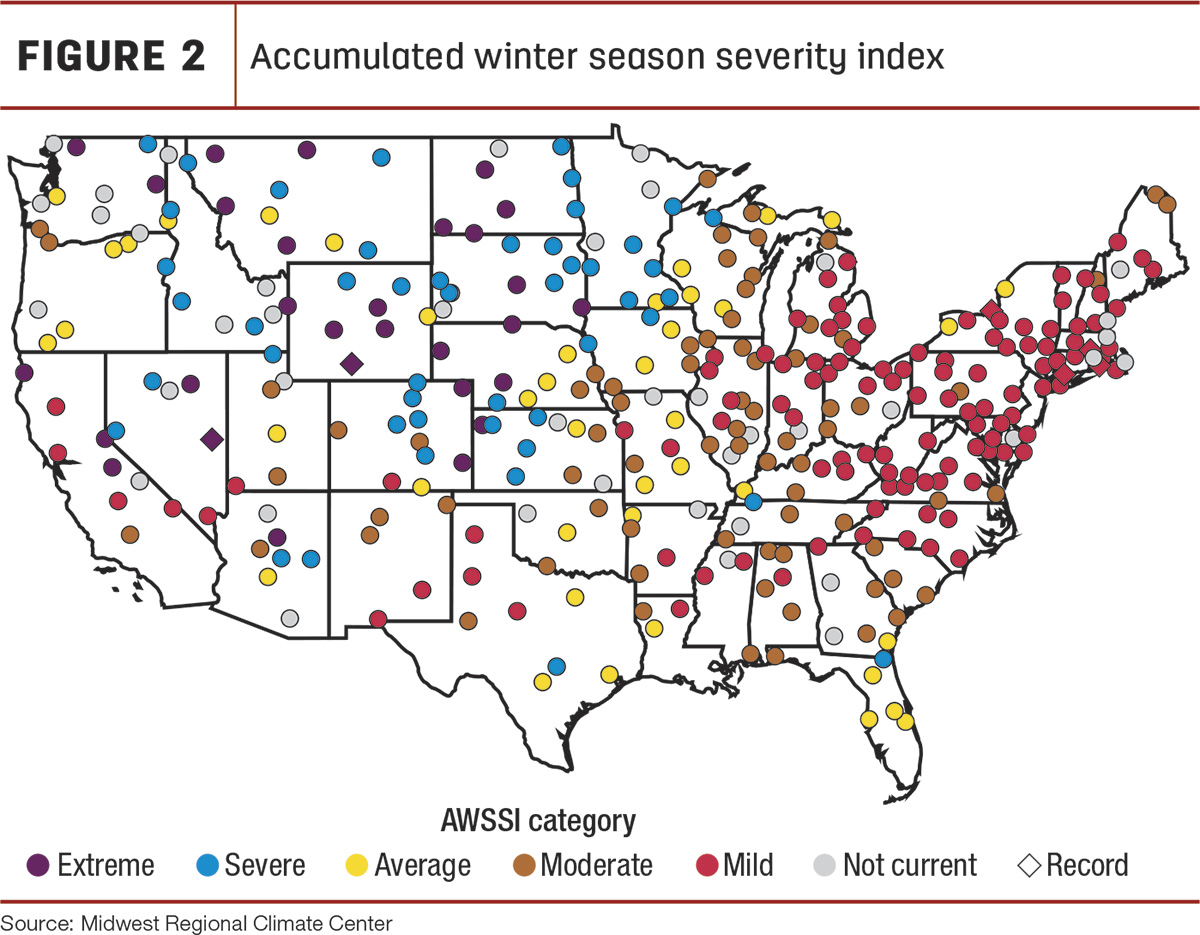

As noted, the share of cows in the slaughter mix is anticipated to be greater in the first half of 2023 than anticipated last month. Although more cows in the slaughter mix will likely keep pressure on average carcass weights, severe winter weather conditions have also played a factor in lighter dressed weights early in the year. Based on data from the Midwest Regional Climate Center, the Accumulated Winter Season Severity Index (AWSSI) shows extreme winter at 29 locations with numerous others listed as severe in the central and northern Plains and the West (Figure 2).

Each location has its own index value, and the locations that are designated severe and extreme represent the 80th and 99th percentiles, respectively, of past winters. In the first three weeks of 2023, severe weather lowered steer and heifer dressed weights by an average 9 and 18 pounds, respectively, below the same period last year. Further, cow and bull dressed weights are down 9 and 29 pounds, respectively.

Based on the January Cattle on Feed data, greater-than-expected market-ready supplies of fed cattle on Jan. 1 increased the anticipated pace of marketings in first-quarter 2023. However, smaller-than-expected placements in December lowered the outlook for marketings in the second quarter. Further, a faster pace of cow slaughter is anticipated in the first half. As a result, in first-quarter 2023, total cattle slaughter was raised but was partially offset by lower expected weights, leaving production up 140 million pounds from last month.

In the second quarter, a reduction in expected marketings is forecast to more than offset an increase in cow slaughter. In addition, the outlook for lower weights was carried over into the second quarter, further reducing production from last month by 90 million pounds. As a result, an increased cow slaughter in first-half 2023 more than offset the net decrease in expected marketings and lighter anticipated weights, which raises the outlook for 2023 beef production by 50 million pounds to 26.5 billion pounds.

Fed cattle prices raised on lighter weights

In January, prices for feeder steers 750-800 pounds at the Oklahoma City National Stockyards recorded a weighted average of $178.38 per hundredweight (cwt), about $20 above January 2022. The feeder steer prices reported on Feb. 6 jumped about $14 week over week to $187.31 per cwt, almost $27 above the same week last year. As indicated by the Cattle report, supplies of cattle available for placement in early 2023 remain tight. These factors support leaving the forecasts for 2023 feeder steer prices unchanged at $203 per cwt.

Fed steers in the 5-area marketing region averaged $156.30 per cwt in January 2023, about $19 above last year. Fed cattle prices have continued steady into the new year, with reported prices for the week ending Feb. 5 at $158.17 per cwt. Based on recent price data and the premium to cash for the February contract, as well as on lower forecast dressed weights for the first half of the year, fed steer prices are raised in the first two quarters to $158 and $159 per cwt for an annual projection of $159 per cwt in 2023.

Export volume and value were record high in 2022

Monthly exports in December were 266 million pounds, a year-over-year decrease of 17%, falling just below the five-year average for the first time in the year. The largest year-over-year decrease was in exports to China, down over 36%, followed by exports to Canada and Taiwan, down 30% and 28%, respectively. Monthly exports to South Korea were strong, increasing 20% year over year and setting a record for the month. December topped off the fourth-quarter total at 844 million pounds, the second-highest total for the fourth quarter, just over 1% below 2021. Quarterly exports to South Korea set a record for the quarter as well, almost 11% higher year over year.

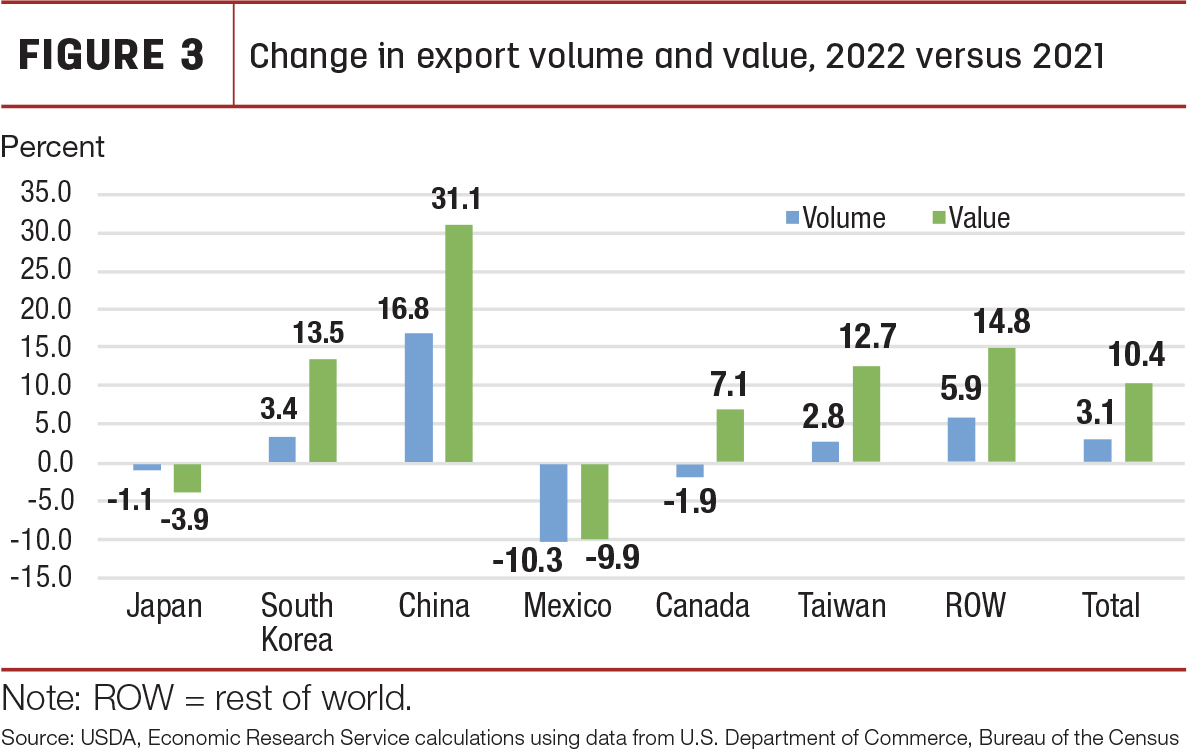

Annual beef exports in 2022 reached a record at 3.536 billion pounds, a year-over-year increase of 3%. The annual value of exports also set a record at nearly $11 billion, an increase of more than 10% over the previous year. Figure 3 shows the year-over-year changes in export volumes and values to the top markets. Higher beef prices bolstered export values.

Exports to China increased nearly 17%, while the value of those exports increased over 31%. The largest decrease was in exports to Mexico, continuing a four-year trend. Exports to Japan were also lower year over year, but as shown in Table 1, the country maintained its position as the top market for U.S. beef in 2022, followed closely by South Korea. China, the third-largest market, was the only top market with a significant increase in its share of U.S. exports over 2021.