The export forecast for 2023 is unchanged from last month at 3.09 billion pounds. If realized, this would represent a year-over-year decrease of about 13%. Production is forecast to decrease about 6%, reducing exportable supplies and bolstering prices; additionally, U.S. beef will face more competition from Oceania in the global market. The forecast is still relatively high, as this would be the third-highest annual export volume behind 2022 and 2021, reflecting sustained strong demand for U.S. beef.

Import data suggests another strong first quarter

Imports are running 3% behind the record pace of first-quarter 2022, according to weekly data published by the USDA, Agricultural Marketing Service in the weekly Imported Meat Passed for Entry report. Year-to-date imports from Canada, Australia and New Zealand are ahead of the same period last year, but not quite enough to offset decreases from Mexico and Brazil. Imports from Mexico account for the largest portion of the year-over-year decrease, down 25% compared to the same period last year. Total imports from Brazil are down 6%; fresh beef imports from Brazil have increased 10% but have been more than offset by a decline of over 50% in processed beef.

Additionally, the U.S. Customs and Border Protection Quota Status Report from Feb. 6 shows the tariff-rate quota for “other” countries (countries without a specific quota or free trade agreement, set at just over 65 million kilograms, or 143 million pounds) is more than 50% filled. The quantity is 7% ahead of the same week last year. The quota fill rates for Australia, New Zealand and Argentina are also ahead of the same period last year.

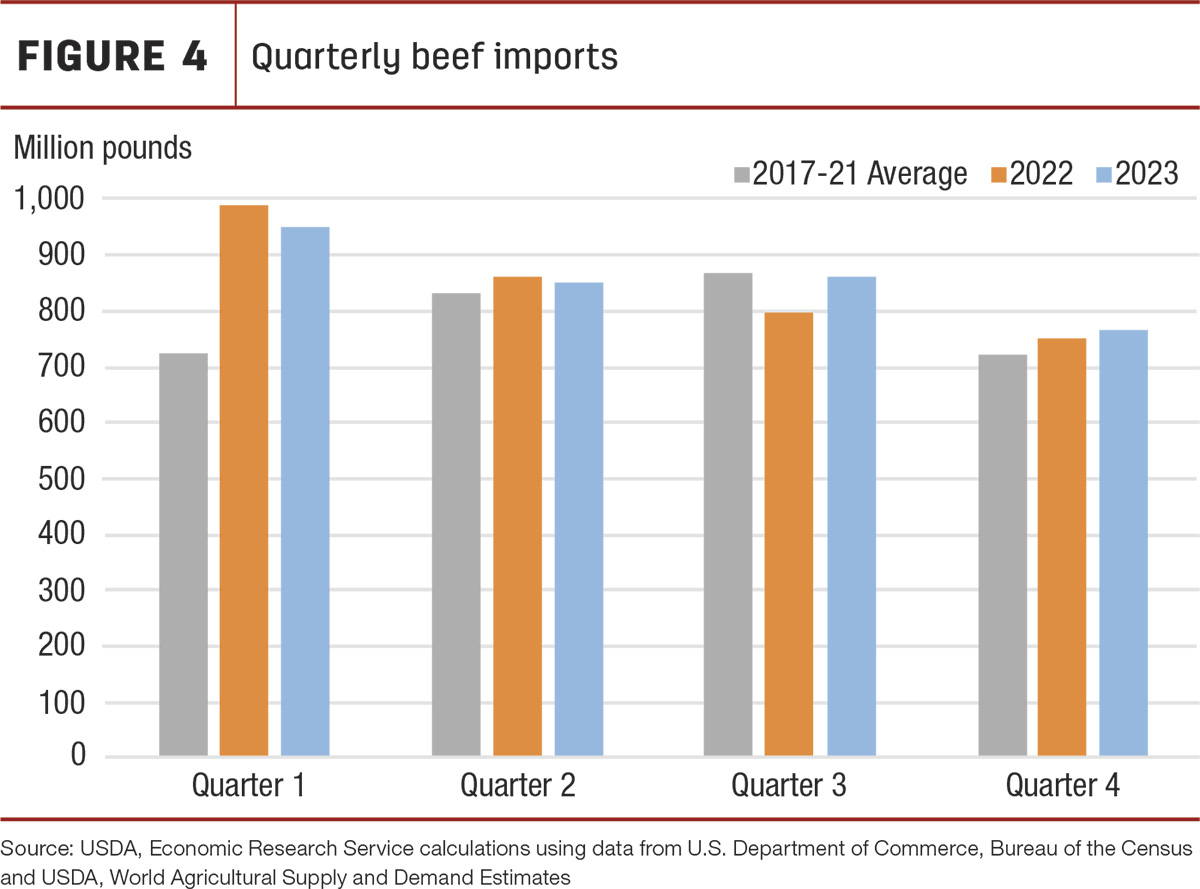

As implied by the relatively strong import data in early 2023, stronger imports are expected in the first quarter with a partial shift from the second half of 2023 to the first quarter and a net increase of 25 million pounds for the year. Specifically, the first-quarter forecast is raised 100 million pounds to 950 million, implying a year-over-year decrease of only about 4%. The second-quarter forecast is unchanged at 850 million. The third quarter is lowered 30 million pounds to 860 million and the fourth quarter is lowered 45 million pounds to 765 million. Therefore, the annual forecast is raised 25 million pounds to 3.425 billion.

Figure 4 shows how the quarterly import forecasts compare to 2022 and the five-year average. First quarter is expected to again be the highest quarter.

The second half of 2023 is expected to be stronger than 2022, as cow slaughter is forecast to decrease substantially in late 2023, increasing the need for imported lean trim.

Recap of 2022 beef imports

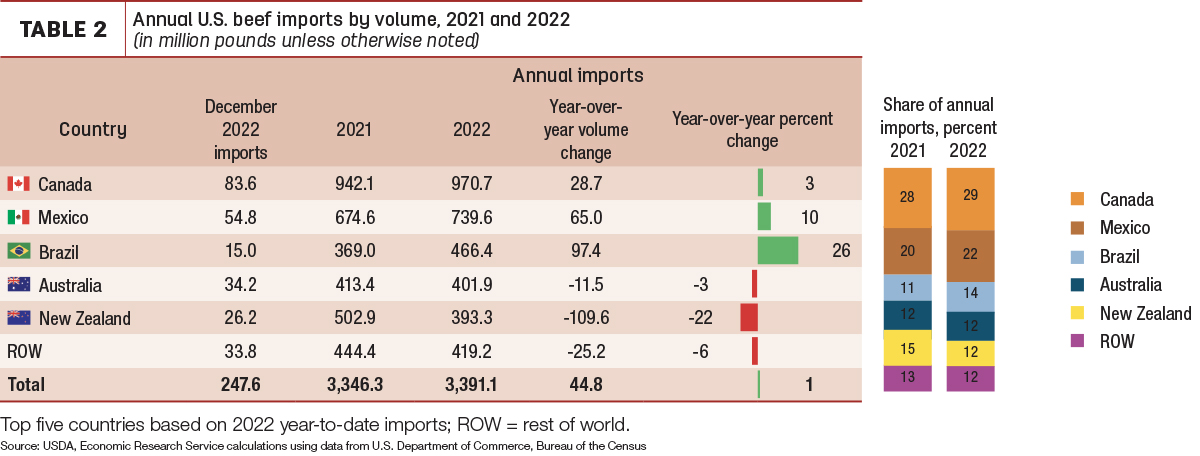

December imports came in at 248 million pounds, 9% lower year over year, but 9% higher than the five-year average (Table 2). Imports from Brazil were significantly lower than the previous December when a temporary ban by China on Brazilian beef caused a surplus of exportable supplies and helped boost shipments to the U.S. Imports of fresh beef from Brazil in late 2022 faced a higher out-of-quota tariff after the quota was filled in April. Imports from Canada in December increased 30% year over year, only partly offsetting the decrease from Brazil.

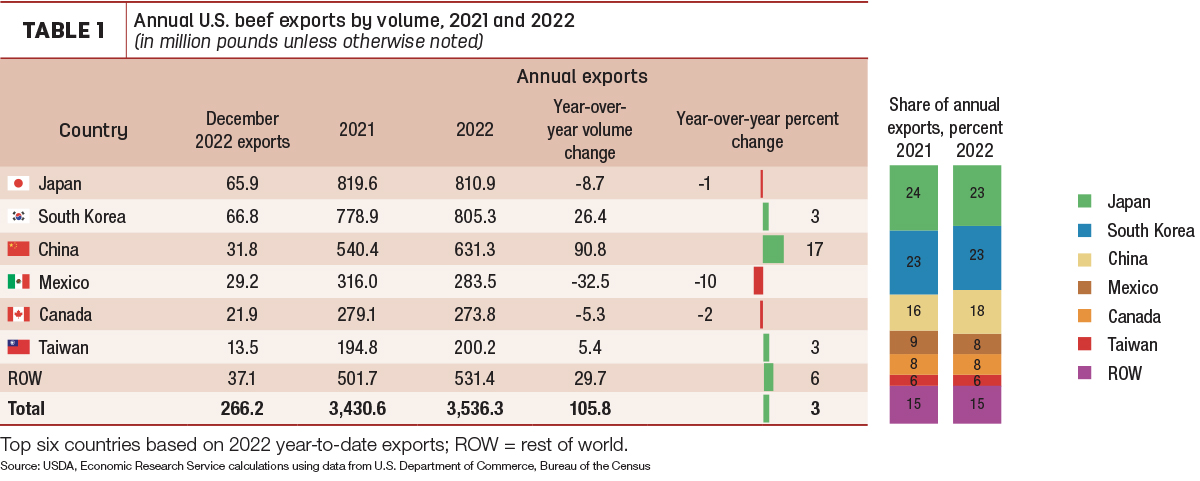

Fourth-quarter imports were 750 million pounds, making the annual total 3.391 billion pounds. This was a year-over-year increase of just over 1%. Imports from Brazil constituted the largest increase. Its share of imports increased to 14%, making it the third-largest supplier of imports to the U.S. A majority of this increase was from fresh beef rather than processed or heat-treated beef; the USDA Food Safety and Inspection Service lifted a ban on fresh beef from Brazil in 2020, and imports have grown significantly since then. Canada and Mexico remained the top suppliers of beef to the U.S. in 2022, increasing year over year at 3% and 10%, respectively.

Imports from New Zealand showed the largest decline from the previous year, down 22%, while imports from Australia were down 3%. According to data from the Trade Data Monitor, total exports from both Australia and New Zealand were lower year over year by 4% and 5%, respectively. The increase in fresh beef from Brazil offset a large portion of the decline in imports from Oceania.