We are all consumers so higher costs against a constant or dropping disposable income, if employed, are a concern.

To the corn producer, cow/calf producer, rancher or feedyard, higher prices do not always equate to more income, if their costs are rising as well.

The consumer wants to go to the grocery store or restaurant and get a choice piece of steak at an affordable price. But what takes place before that piece of meat hits the barbecue?

All sectors of the economy have a common condition to survive in the business world: identifying and managing risk.

The agri-business sector of the U.S. economy is expected to feed the world, but the world is not willing to make it a cost-plus opportunity.

This leaves agriculture to fend for itself to manage risk. Risk management is identification, assessment and prioritization of risks.

Over the past 37 years of helping ranchers and feedyards manage risk through use of futures, options and forward contracts, I have identified three risks to focus on: profitability, price risk and basis risk.

Let’s step back and find out why these should be considered risk. If I were to ask you what the most important outcome you would like to see from feeding cattle, what would you say?

The unified response is “Make money!” Then the primary focus on risk management should be on your balance sheet. The three risks identified above affect the equity portion of your balance sheet.

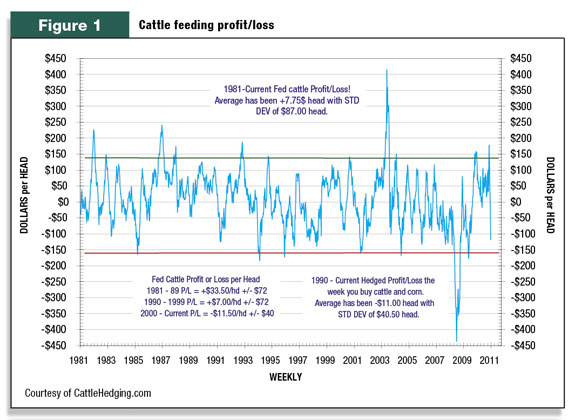

Profitability focuses on feeding margins and flows to equity through retained earnings. Look at the cattle feeding P/L graph.

You will notice the huge price swings in buying a 750-pound feeder steer, buying corn to protect cost-of-gains and selling that animal 140 to 160 days out.

The swings range typically between $150- per-head profits to $150-per-head losses. Within the graph you will note the shifts in feeding margins from the decades of the ’80s, ’90s to the 21st century.

The need for risk management has become more significant over time. After the Canadian BSE outbreak in May 2003, the U.S. border was closed and U.S. fed cattle supplies were very tight, taking prices and profits to unheard-of levels.

While the cattle feeding industry was living off such growth in equity, the recession into the first quarter of 2009 took that equity back from those without risk management.

So one of the focuses for risk management is identifying an acceptable rate of return without riding the +/-$150 swings in retained earnings.

Consistently locking in $5-per- head to $35-per-head profit will return 6 to 40 percent return on equity (ROE), respectively, using a $200-per-head equity base.

When pondering these returns, you must consider your vantage point. If you own the feedyard, do ROE estimates include mark-up on feed and yardage?

Hedging in a breakeven or $5-per- head profit may have great returns for the feedyard owner, while his customers may require $25 per head or more to continue feeding cattle.

Price risk looks at both the asset and liability side of the balance sheet, netting in equity. If the trend of your assets (such as cattle for ranchers and feedyard or corn for farmers) is up, then you have a positive flow to the equity portion of your balance sheet.

In turn, if the trend in those assets is down, then you will experience an erosion of equity. The costs for replacement feeder cattle, corn and distillers, as well as energy costs, are vital to the liability costs flowing to the equity portion of the balance sheet.

This may require locking in losses in bear markets to protect from bigger equity loss or planning ahead with long hedge alternatives to protect from rising input costs.

Basis risk or opportunity is the relationship or spread between the local cash price of your cattle and your hedge or futures price.

Basis risk or opportunity can make the difference between a profitable hedge and a losing hedge. There are two perspectives to trading basis.

1. The basis condition is the current relationship between current cash price and nearby or deferred live cattle futures.

There are two conditions to look for: “strong” and “weak.” Strong basis conditions are when the current cash is at a premium to live cattle futures and a weak basis condition occurs when the cash is at a discount to futures price.

2. Basis trend identifies the direction or where the basis is shifting. Is the trend “strengthening” or “weakening?”

The value of such information can identify the rate at which you market cattle, as well as identifying your hedge alternative (using futures or options).

The discipline required to be successful in a risk management program is defining a hedge policy. The individual’s or corporate risk tolerance is weighed against the assessment and prioritization of acceptable profitability (ROE), price risk and basis risk.

This moves on to defining what percent to be hedged, buying unhedgeable inventory (capacity utilization), as well as who will execute these disciplines.

I will conclude with one critical ingredient when defining a hedge policy. Make sure the operating line of credit with your bank has separated out or allowed adequate funds to completely utilize your risk management plan.

Your borrowing base requires a hedge program, but many feedyards were running to their operating line of credit max by April of this year when soaring feeder and corn costs were battling against the dollars required to maintain their short hedges.

A quick rule of thumb to use with the banker for allocation of margin money would be $200 per head. This may seem like a lot, but $200 per head is what was required for many at the peak in April of this year. ![]()

PHOTOS

TOP: Risk management requires you to see when trends are rising in the marketplace for assets. Higher auction prices for calves and seedstock can solidify your equity and manage risk. Photo by Julie Brown.

BOTTOM: For the feedyard owner, profitability focuses on feeding margins and buying corn to protect cost of gains. Photo by Paul Marchant.

Larry Hicks

Commercial

Hedge Broker

Cattlehedging.com

larry@cattlehedging.com