Weaker dairy product prices led to a decline in the October all-milk price. However, with income margins still above trigger levels, there will be no Margin Protection Program for Dairy (MPP-Dairy) indemnity payments for the September-October pay period. Replacement and cull cow prices continued to drop.

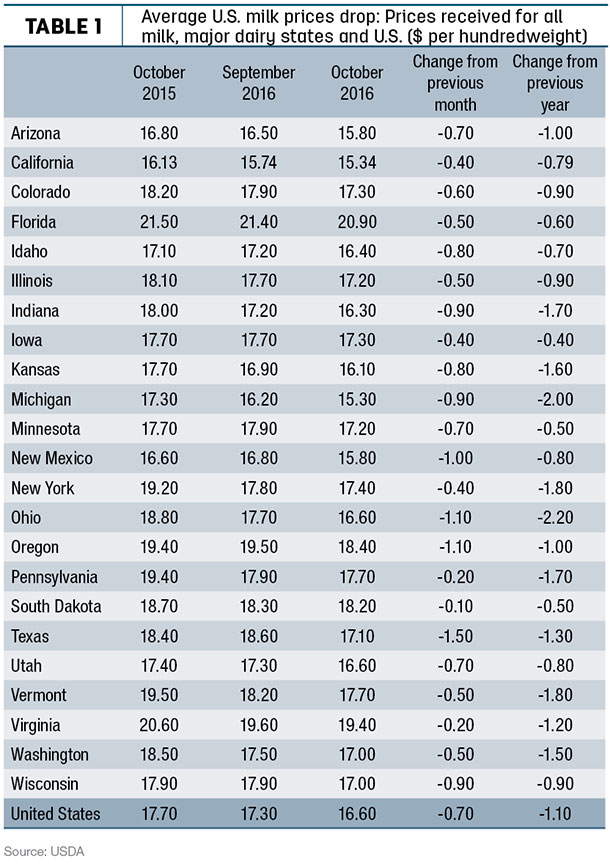

USDA estimated the October 2016 U.S. average all-milk price at $16.60 per hundredweight (cwt), down 70 cents per cwt from September and $1.10 less than October 2015’s average of $17.70 per cwt.

All major dairy states saw price declines in October, with Texas, New Mexico, Oregon and Ohio registering price drops of $1 or more (Table 1) from September. Compared to a year ago, prices were down at least $2 per cwt in Michigan and Ohio.

The October price brings the 2016 U.S. average to $15.85 per cwt, $1.13 (6.7 percent) less than the same period a year ago.

Florida had the highest average price in October at $20.90 per cwt; California had the lowest at $15.34 per cwt.

MPP-Dairy review

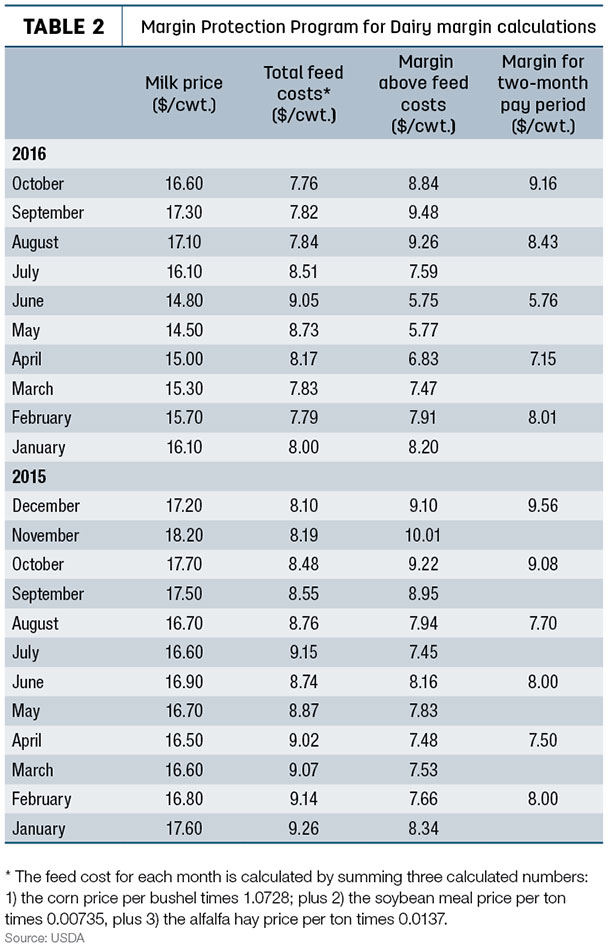

The October U.S. average milk-income-over-feed-cost margin declined somewhat from September, but not enough to provide an MPP-Dairy indemnity payment at any margin coverage level for the September-October pay period.

USDA’s Farm Service Agency (FSA) calculated an October margin of $8.84 per hundredweight (cwt), down about 64 cents from September (Table 2). Combined with September’s calculations, the two-month pay period national margin averaged $9.16 per cwt, the largest margin of the year and well above the highest insurable margin of $8 per cwt.

The lower October milk price ($16.60 per cwt) contributed to the shrinking margin. On the cost side of the equation, a small increase in the national average corn price ($3.29 per bushel) was offset by lower prices for alfalfa hay ($135 per ton) and soybean meal ($323.27 per ton). Total national feed cost under the MPP-Dairy formula averaged about $7.56 per cwt.

A reminder: The deadline to select an MPP-Dairy coverage option for the 2017 program is Dec. 16 at FSA offices.

One other note of interest, USDA’s latest “Farm Sector Income Forecast” estimates the federal government will realize a net positive of $11.3 million from MPP-Dairy in 2016, after all dairy producer fees and premiums are collected and indemnity payments are issued.

Replacement cow prices weaken; cull cow prices at 5-year low

With slumping milk prices, average U.S. dairy herd replacement cow prices trended lower for a fifth consecutive quarter.

Preliminary October 2016 U.S. quarterly replacement dairy cow prices averaged $1,690 per head, $40 less than July 2016 and $290 per head less than October a year ago. National average replacement cow prices had peaked at $2,120 per head in October 2014.

October 2016 average prices ranged from highs of $1,900 per head in Colorado and $1,850 in Oregon to lows of $1,500 in Ohio and $1,530 in New York (Table 3).

Meanwhile, estimated U.S. October 2016 cull cow prices (beef and dairy combined) averaged just $65.40 per cwt, the lowest monthly average in 5 years. Through the first 10 months of 2016, cull cow prices averaged $77.57 per cwt, nearly $32 per cwt less then the same period a year earlier.

Year-end prices look better

A rebound in cheese, whey and butter prices in November should support better prices heading into the end of the year. Compared to October, the federal milk marketing order minimum November Class II milk price was up 51 cents per cwt; the Class III price was up $1.94 per cwt; and the Class IV price was up 10 cents per cwt. The November Class I base price was down $1.82 per cwt from October, but increased more than $2 per cwt for December.

The trends are similar in California. The November Class 4a price is up 58 cents per cwt from October, with the Class 4b price up $3.02. November Class 1 prices were down $1.64 from October, but then jumped more than $3 per cwt for December.

Dairy margins improved over the last two weeks of November, according to the latest CIH Margin Watch report from Commodity & Ingredient Hedging LLC. Higher milk prices combined with steady feed costs during the period.

Margins through the third quarter of 2017 were at or above the 80th percentile of the past 10 years, offering dairies opportunities to secure forward coverage.

Milk prices were supported by both domestic and international factors. Recent milk production data from Oceania and Europe reflect growing year-over-year declines in milk output, according to CIH.

USDA’s latest Cold Storage report reflected a large month-over-month decline in butter stocks, with cheese stocks also showing a seasonal decline during October. Even so, butter and cheese stocks remain above year-ago levels.

Global Dairy Trade index up again

The Global Dairy Trade (GDT) price index rose 3.5 percent during the latest auction, held Dec. 6.

Compared to the previous auction, prices were higher for nearly all products listed. Butter milk powder, down 2.6 percent to $2,408 per metric ton (MT), was the only decliner.

Prices for other products included: anhydrous milk fat (+2.9 percent to $5,500 per MT); butter (+1.7 percent to $4,262 per MT); cheddar cheese (+2.2 percent, to $3,752 per MT); lactose (+10.6 percent to $873 per MT); rennet casein (+2.3 percent to $6,201 per MT); skim milk powder (+1.4 percent to $2,570 per MT) and whole milk powder (+4.9 percent to $3,593 per MT).

The next GDT auction is Dec. 20. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke