Citing declining milk cow numbers and slower growth in milk per cow, the USDA’s December World Ag Supply and Demand Estimates (WASDE) report cut milk production forecasts for both 2018 and 2019. However, the outlook for less milk again didn’t translate into improved milk price projections for either year.

USDA’s 2018 milk production estimate now stands at 217.8 billion pounds, down 100 million pounds from last month’s forecast. That would be up just 1.1 percent from 2017’s production total of 215.5 billion pounds.

Due to weaker cheese prices, the USDA reduced 2018 projected average milk prices (midpoint of range) by about 5 cents per hundredweight (cwt) compared to its forecast a month ago, to: Class III – $14.55 per cwt; Class IV – $14.20 per cwt; and all-milk – $16.20 per cwt. That would put the 2018 all-milk price about $1.45 less than last year’s average of $17.65 per cwt and slightly below the 2016 average of $16.30 per cwt.

For 2019, the USDA cut its milk production forecast to 220.6 billion pounds, about 300 million pounds less than November’s forecast. If realized, it would be up about 1.3 percent from the level forecast for 2018.

In its price projections for 2019, the USDA forecast averages will improve from 2018, but not much. Projected prices are (midpoint of range): Class III – $15.05 per cwt; Class IV – $14.80 per cwt; and all-milk – $16.80 per cwt.

November Class III price falls

With weakening cheese prices, the November 2018 federal order Class III milk price fell to $14.44 per cwt, the lowest since July.

November’s Class III price is down $1.09 per cwt from October and $2.44 less than November 2017. The year-to-date Class III price average stands at $14.69 per cwt, down $1.55 from the same period a year earlier.

The November Class IV price is $15.06 per cwt, up a nickel from October and at its highest point since September 2017. The January-November Class IV price average is $14.15 per cwt, down $1.16 from the same period a year earlier.

Drought areas shrink

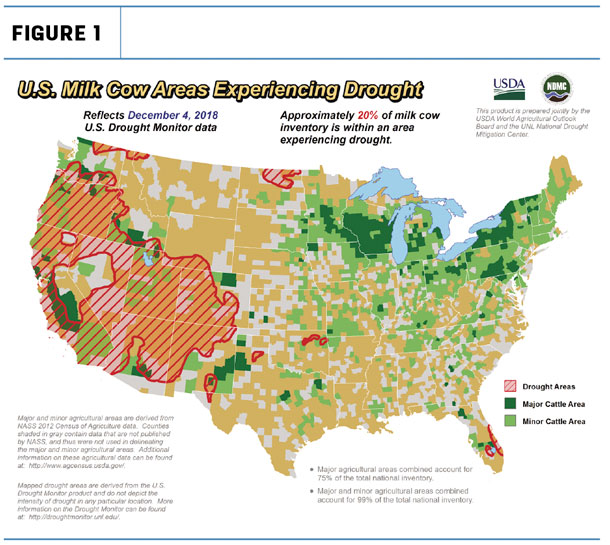

Although the overall U.S. drought picture improved slightly, the estimate of U.S. dairy cows located in drought areas increased, according to the USDA’s World Agricultural Outlook Board. About 20 percent of the nation’s milk cows were located in areas experiencing drought at the start of December (Figure 1), a 7 percent increase compared to a month earlier.

Pockets of drought were reduced in dairy sections of upstate New York and New Mexico, but increased in central California. Dry areas remain most prominent in the Southwest and stretched into Oregon, southern Washington and southern Idaho.

The weekly U.S. Drought Monitor overlays areas experiencing drought with maps of major production areas for hay, alfalfa hay, corn, soybeans and other crops, as well as primary dairy and all cattle areas. The report also showed about 18 percent of major alfalfa hay production areas were in areas experiencing drought, unchanged from a month earlier.

Coming up: The USDA’s November 2018 Milk Production report will be released Dec. 19.

Beef outlook

The USDA WASDE report raised its 2018 beef production forecast, citing a faster pace of steer and heifer slaughter, but offset somewhat by lighter carcass weights. For 2019, the beef production forecast was also lowered on the anticipation of lower carcass weights. The cattle price forecast for 2018 was raised on recent price strength, but the 2019 cattle price forecast was unchanged from the previous month.

Feed outlook

The USDA’s monthly Crop Production report was released simultaneously with the WASDE report, but did not include updates for corn, soybeans or hay.

• Corn: This month’s WASDE report lowered the 2018-19 forecast for U.S. corn used for ethanol, leading to larger ending stocks. The projected 2018-19 season-average corn price received by producers narrowed to a range of $3.25 to $3.95 per bushel, or $3.60 per bushel at the midpoint. That would be up from $3.36 per bushel in 2017-18.

• Soybeans: Supply and use projections for 2018-19 were unchanged from last month. Projected 2018-19 marketing-year average prices paid to growers for soybeans were narrowed, but left unchanged at the midpoint. The soybean price was forecast in a range of $7.85 to $9.35 per bushel, yielding an average of $8.60 per bushel; the soybean meal price forecast, in a range of $290 to $330 per ton, yields a midpoint of $310 per ton. That’s down from $345 per ton in 2017-18.

• Cottonseed: The 2018-19 U.S. cotton production forecast was projected slightly higher than a month ago, mainly due to a larger crop in Texas. The USDA estimated the cottonseed harvest at about 5.858 million tons, about 8 percent less than the 2017 harvest. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke