The outlook for dairy prices will be somewhat brighter moving into the middle of 2019, with a much more bullish forecast possible if the U.S. and China can reach a trade agreement, according to Dan Basse, economist and president of AgResource Company.

Basse presented his overview of agricultural economic conditions during a Professional Dairy Producers of Wisconsin (PDPW) webinar, Nov. 21.

Struggling dairy farmers continue to liquidate herds, Basse noted. With dairy cull cow slaughter at the highest rate in years, he forecast U.S. cow numbers to fall to about 9.3 million head in late spring or early summer of next year. He said the Milwaukee Stockyards reported too many cattle coming to market in the week prior to Thanksgiving.

While increasing milk production per cow is offsetting declining cow numbers, Basse expects a further reduction in cow numbers into winter should reduce milk receipts beginning in December.

“There’s still more liquidation to work through, but this is part of the process to getting the market to turn around,” he said.

Other factors providing a brighter dairy outlook include declining milk powder stocks and increased demand from China.

Global milk powder prices have been the drag on milk prices, but that trend may be ready to turn, Basse said. Milk powder stocks in the European Union (EU), the U.S. and Oceania are coming down for the first time since 2013, a positive sign for the dairy market. He forecasts milk powder markets could gain 15 to 20 percent in 2019.

One cloud in that outlook: While drought in the EU has hurt feed supplies and led to higher feed prices that are negatively impacting milk production there, milk production in New Zealand is up substantially and will continue into the first quarter of 2019.

U.S. exports of powder are promising even with rising New Zealand milk production, however. Basse said he believes the USDA outlook for China’s milk production is too optimistic, with economics and environmental issues likely to drive production lower. That, in turn, drives up demand for milk powder, making it critical the U.S. get a trade agreement with China by the middle of next year.

The dampening impact of tariffs on dairy exports during July-September has lowered U.S. milk prices by about 50 to 75 cents per cwt, he said.

Basse said he is more bullish on butter and cheese in 2019, with milk prices showing improvement beyond February 2019. Based on current conditions, he forecasts a Class III milk price of $17 per hundredweight (cwt) by August and September, perhaps reaching $18 per cwt by the fourth quarter.

“If we get a U.S.-China trade deal, it could be a really big deal,” Basse said.

Threats to an improving dairy and agricultural outlook include Congress voting down the U.S.-Mexico-Canada trade agreement (USMCA) and uncertainty over world political issues, which could substantially ramp up volatility in agricultural markets.

Cropp-Stephenson outlook

Two University of Wisconsin – Madison dairy economists were less optimistic in their monthly podcast. Mark Stephenson, director of dairy policy analysis, and Bob Cropp, dairy economics professor emeritus, reviewed recent USDA reports and the impact on dairy markets.

Cropp called the Milk Production report somewhat bearish, even though U.S. cow numbers were down and milk production was up just 0.8 percent. (Read: October milk production: Cow numbers continue to drop.)

The Cold Storage report (see more below) indicated slight growth in cheese stocks, with American cheese stocks about 10 percent higher than a year earlier and butter stocks up about 6 percent over the same period. Dairy product prices weakened with the news, and Cropp called current cheese prices “terrible, [having] gone down more than I would have anticipated based on the fundamentals.”

Cropp and Stephenson cited global factors for weaker prices, including continued softening of Global Dairy Trade prices and strong New Zealand milk production. Softer cheese sales and the impact of retaliatory tariffs on U.S. cheese and dry whey exports were also having a negative impact.

As a result, milk prices could end the year on a downward slide and continue weak into the first quarter of 2019.

The November Class III price could be as low as $14.60 per cwt, with the current December Class III futures prices of $14.30 per cwt, Cropp said. “If that holds, we’ll have a 2018 Class III average of about $14.60 per cwt, the lowest average in the last four years.” He doesn’t foresee Class III prices hitting $16 per cwt until the second half of the year, which will pressure more farmers to exit the business.

“We seem to be range-bound,” Stephenson said. “One month it’s up a little, the next month it‘s down. There’s no piece of news that gives us any comfort to make a big statement about where prices are going.

“I think we both agree 2019 will look a lot like 2017,” Stephenson said. “It’s a market that’s range-bound in prices, has a little more than product wants to see and unfriendly trade practices.”

Dairy-RP activity nears 4.5 billion pounds of milk

The Thanksgiving holiday and the release of two USDA dairy reports limited activity in the Dairy Revenue Protection (Dairy-RP) program for the week of Nov. 19-23. Nonetheless, dairy producers have now covered revenue on about 4.5 billion pounds of 2019 milk production, according to a weekly update from the USDA’s Risk Management Agency (RMA).

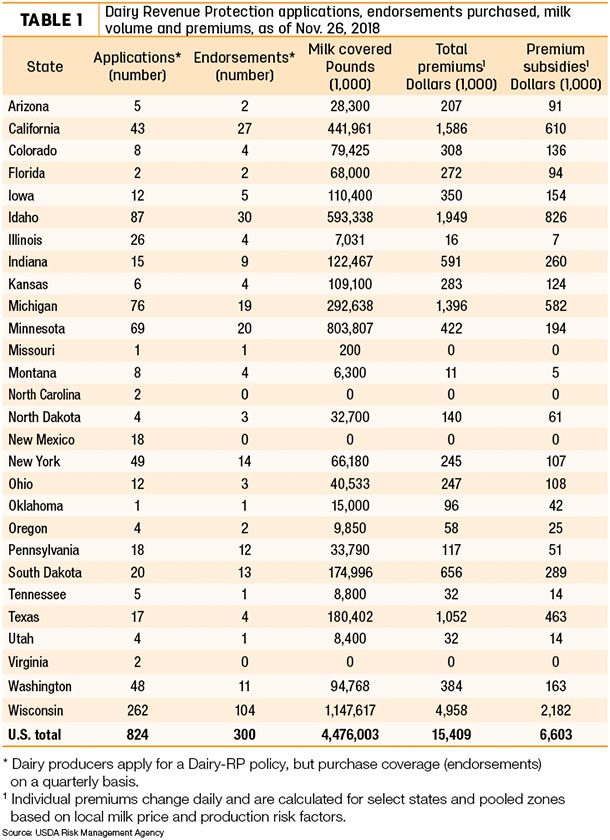

Based on information as of Nov. 26, 824 dairy producers had filed applications in 28 states (Table 1). A reminder: Dairy producers apply for a Dairy-RP policy, but purchase coverage, called “endorsements,” on a quarterly basis.

Of the applications, 300 quarterly endorsements had been purchased, covering 4.48 billion pounds of milk. Total premium costs on purchased endorsements were about $15.4 million, with USDA RMA subsidies covering about $6.6 million of that.

Dairy-RP policies are not available for sale on days following USDA dairy reports with a potential impact on markets. The agency released its monthly Milk Production report on Nov. 19, followed by the Cold Storage report on Nov. 21. In addition, the Chicago Mercantile Exchange was closed Nov. 22-23 for the Thanksgiving holiday.

Class I base price ends year weaker

The December 2018 Federal Milk Marketing Order (FMMO) Class I base price is $15.05 per cwt, down 47 cents from November, $1.83 less than December 2017 and the lowest average for the month since 2009.

As a result, the 2018 Class I base average is just $14.84 per cwt, about $1.61 less than 2017 and just 4 cents more than the 2016 average.

Some good news in cold storage inventories

There was some good news in the USDA’s latest Cold Storage estimates: Dairy product inventories were somewhat lower than the month before, or at least didn’t increase dramatically.

As of Oct. 31, U.S. butter stocks were estimated at 230.7 million pounds, down 19 percent from Sept. 30, 2018, but up 6 percent from Oct. 31, 2017.

Total natural cheese stocks were estimated at 1.37 billion pounds, unchanged from Sept. 30, 2018, but up 8 percent from a year earlier. American cheese stocks, at 813.8 million pounds, were up 1 percent from September and up 10 percent from a year earlier. Swiss and “other” cheese stocks were down from the previous month, but up from a year earlier.

Dairy margins started November weaker

Dairy margins weakened further through the first half of November as lower milk prices more than offset a slight decline in projected feed costs, according to Commodity & Ingredient Hedging LLC. Nearby dairy margins in both the fourth quarter of 2018 and first quarter of 2019 are now negative, with deferred margins in the second and third quarters of 2019 only slightly positive and above average from a historical perspective.

Milk prices continue to suffer from increased production and insufficient demand. USDA reported October milk production up 0.8 percent from last year, despite increased cow slaughter.

USDA’s November World Ag Supply and Demand Estimates provided shocking revisions to the world balance sheet. U.S. corn production declined 152 million bushels from October due to a reduced yield forecast, with ending stocks down 77 million bushels from last month. World ending stocks increased, however, with China’s corn production raised by 266 million tons. While the changes are not expected to factor into world trade, the tone of the report was decidedly bearish for the corn market. ![]()

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke