The volatility in both milk and grain futures has no doubt been unsettling for many dairy producers worrying about their profitability this year following what has been a very challenging time in the industry the past two years.

Fortunately, the recent movement in prices represents an excellent opportunity to take advantage of forward profit margins that have improved significantly as a result of both lower feed costs as well as higher values for milk. Looking at the

Figure 1 of nearby profit margins for first quarter 2010, you can see that current profits of around $0.43 per hundredweight are implied for milk to be marketed through March. While this is only modestly above a projected breakeven level, what you should also notice about the graph is that as recently as early January, a $1 per hundredweight. loss was implied for this particular marketing period. This means that the profit margin has improved by almost $1.50 in less than two weeks.

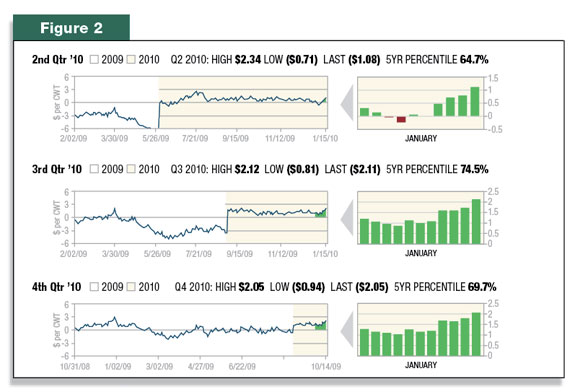

Projecting out further in 2010, you can see that the profit margin progressively improves going into the second half of the year. Similar to the nearby period, these forward profit margins have likewise experienced significant gains recently as a result of the changing price dynamics between milk and feed futures. Projected margins of about $1 per hundredweight. are currently being implied for Q2 2010, while margins for both Q3 and Q4 are forecast at around $2 per hundredweight. These also rest at relatively high historical percentiles of 70 percent or more over the past five years, meaning that they have only been stronger than this around 30 percent of the time in that period.

See Figure 2 . While it is certainly welcome news that the profit margin outlook is improving for the industry this year, it is important to keep in mind that these forward profit margins are merely projections based upon current futures prices, not actual profitability that you may or may not realize once we get to these future time periods. Because futures prices are only assumptions of what forward values will be based upon information available to the marketplace today, these assumptions and thus the futures prices themselves can change over time. The main point is that they represent a consensus of value based upon widespread participation in the marketplace, and these values can be secured by trading the contracts either outright or through the cash market.

Before discussing further about securing a margin through forward contracting or the futures market, let’s take a look at some of the recent dynamics that caused such a fortunate swing in these projected profit margins. First, the USDA’s January crop report was a watershed event for the grain markets – sharply correcting the price strength in both corn and soybean meal. The report contained updated estimates for the size of both the corn and soybean crops recently harvested, as well as demand forecasts for each that were construed as very bearish by market analysts. Despite the late harvest and weather complications this season, the USDA raised both harvested area and yield on the corn crop, which increased production 230 million bushels from the last forecast when the trade was anticipating a 100- million-bushel reduction. Soybean harvested area was reduced, although the yield was raised, which also increased production. In addition, the USDA noted a higher production estimate for Brazil as South American weather remains very favorable for soybean crop development. While demand was raised for both crops, ending stocks still increased for corn, while dropping only slightly for soybeans. Since the report was released, corn futures have dropped about 50 cents per bushel while soybean meal has lost around $25 per ton since the beginning of the year.

Meanwhile, the milk market also contributed to the more favorable margins we have seen since the beginning of the year. Milk futures declined sharply from mid-December into early January, which was tied in part to USDA Cold Storage data indicating a year-over-year increase in cheese production and stocks during November, despite the fact that the milking herd is actually lower following a series of CWT retirement programs last year. The increased efficiency of the milking herd appears to have offset much of the drop in the actual size of the herd itself in regards to both milk production and cheese stocks. Since then, however, milk futures prices have recovered, with an 18-cent gain in butter prices during the second week of January largely responsible for the sharp advance off of the lows in early 2010. December milk production was down 0.9 percent from last year at 15.76 billion pounds, marking the sixth straight month of production declines as optimism increases that this trend may help support prices – particularly if demand improves with a pickup in the U.S. and world economies this year.

Just as margins can improve with changing futures prices, it is also important to remember they can deteriorate quickly as well. Because of this, it is important to be proactive in protecting potential profits when the opportunity occurs. Just because the market is projecting a profitable situation in a forward time period, there is no guarantee that you will earn a profit on your milk when that period rolls around. If you simply buy feed inputs when you need them and sell milk on the spot market, it is merely a matter of luck whether or not you end up with a profit for your efforts. In order to actually capture those potential forward profits you may need to contract feedstuffs and milk ahead of the delivery period…when the opportunity presents itself.

This brings us to the discussion of contracting in order to lock in a favorable profit margin for your dairy. How do you go about capturing these more profitable margins? There are various contracting choices available to dairymen both in the physical cash market as well as through exchange-traded derivatives using futures and options. Some strategies will simply “lock-in” the margin. Here, all that will change are some variable costs that have a smaller impact on profitability relative to feed expenses. As an example, if feed costs are firmly established in the cash market and milk sales are secured with the processor (the basis will remain a variable until we receive our mailbox price), then a margin has effectively been locked-in. This may be acceptable if the margin is at a very profitable level.

As an alternative to locking in the margin through cash contracts in the physical market, futures contracts could be used where Class III milk is sold while simultaneously both corn and soybean meal futures are purchased – representing your corn silage, haylage and other protein equivalents. Here, you have also secured a margin, although there is a risk of basis variation where the cash price received for your milk from the processor may deviate from CME futures while similarly, there may be some variation between the movement of corn and soybean meal futures relative to your feed ingredient prices in the local cash market.

What if margins are merely breakeven, or even negative? Other strategies offer more flexible price features where a “minimum” margin can be protected while allowing the opportunity for that profit margin to improve over time through a combination of lower feed costs, and/or higher milk prices. Here, option contracts on futures can be utilized to “unlock” the fixed price features of long or short futures positions. Similarly, option contracts can also be employed to create this flexibility around fixed-price commitments in the physical market where cash contracts have been used.

Given the recent drop in feed prices reflected in the sharp selloff of corn and soybean meal futures, it would appear attractive to secure some future needs through contracting, but what about the milk price? If you are making a price commitment to only one side of your profit margin equation, you potentially expose yourself to greater risk than if you simply did nothing at all. Consider what would happen if you booked physical feed without contracting the milk price, and then both milk and feed prices declined further. Not only would you have the opportunity cost of failing to lock in a higher milk price when you booked your feed, you would also be stuck with a commitment to higher feed costs relative to what now exists in the open market. The opposite can occur as well. What if you were to sell milk futures on production yet to be marketed, but remained open on your feed needs? Now consider what would happen if both milk and feed prices increased. You would be forced to assume higher costs for your feed while already being committed to a lower milk sales price than what now exists in the open market.

As a margin manager, it is important to manage both revenue and expenses together as a single unit of risk. In order to do this, you first need to identify what your forward profit margin looks like. Once you have a representative model of forward profitability, it is important to put it into context so it can be measured objectively. How historically strong or weak is this profit margin? Does the margin tend to strengthen or weaken during certain periods? What is driving the margin? How does this affect what contracting choices you may want to consider around all the variables of your profit margin? Taking a margin management approach is a superior risk management plan to protect profitability as a dairy producer. While this concept may be new to many, the principles behind it remain simple. The market provides us with the tools to identify and protect profitability as far as 15 months ahead of delivering the milk. PD

-

Chip Whalen

- Email Chip Whalen