With increasing U.S. milk production outpacing growth in domestic consumption, the global market will become more important as an outlet for U.S. sales. U.S. dairy marketing leaders outlined efforts to boost U.S. dairy product exports during a press conference at World Dairy Expo, Oct. 4, in Madison, Wisconsin.

Tom Vilsack, president and chief executive officer of the U.S. Dairy Export Council (USDEC), and Tom Gallagher, CEO of Dairy Management Inc. (DMI), pointed to a common theme to build markets whether at home or abroad: consumer trust.

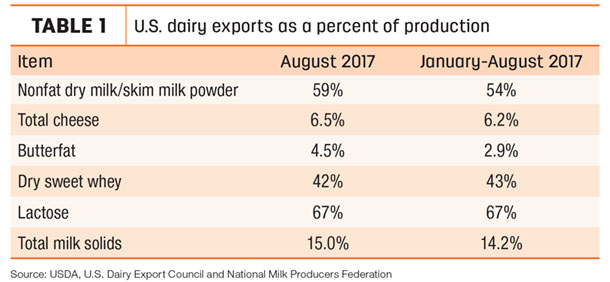

Announced previously, the goal seeks to boost U.S. dairy exports to 20 percent of total milk solids production by 2021. (Read: Vilsack: ‘Next 5 percent’ is Big, Hairy, Audacious Goal) U.S. dairy exports have fluctuated around 15 percent of total production for several years. Thus far in 2017, dairy exports as a percentage of total production have been running about 14.2 percent (Table 1).

“The future of the dairy industry is bright,” Vilsack said. “The reality is, we do an incredible job of milk production, and no matter how well we do on domestic consumption, we’re going to have to have strong exports to stabilize markets.”

Vilsack said current levels of exports add about $1.25 per hundredweight (cwt) to farmer milk prices.

“We can’t stay at 14 to 15 percent. We have to expand exports to 17 percent, 20 percent and beyond,” Vilsack said. “We believe if we can get that 5 percent bump in volume while focusing on value, it will add $2.2 billion of additional sales opportunities. That’s the goal. If we don’t reach that goal, it potentially creates real challenges in terms of stability in the prices our dairy farmers receive.”

Vilsack said USDEC has set specific product volumes and geographic markets to meet the overall goal of increased sales. Additionally, those areas have been analyzed as to whether there are adequate people and resources to reach those geographic goals. The effort also has contracted with citizens already in those markets to create business links and opportunities. USDEC will work with U.S. dairy co-ops and companies to create marketing channels.

Mexico, already the leading export market for U.S. dairy, remains a primary focus to protect and expand current markets. Efforts include high-end restaurants and tourist areas, as well as retailers and grocery stores.

The focus in Canada is to seek greater access to consumers through the North American Free Trade Agreement (NAFTA).

Due to population bases, Southeast Asia and China are specific targets. In Asia, Japan’s shrinking domestic milk production could open trade for the U.S. In Southeast Asia, a younger population is recognizing the importance of dairy to human health. China’s exploding middle-class population is providing opportunity.

The U.S. must regain focus on markets in North Africa where strong population growth is anticipated, Vilsack warned.

Gallagher said the goal to increase exports fits into DMI’s two-fold mission: increase dairy sales and improve trust among consumers.

“Trust is the No. 1 thing on my mind,” Gallagher said. One DMI program launched earlier this year, “Undeniably Dairy,” seeks to build the consumer trust that will be vital for dairy farmers to continue to operate, he said.

“It’s important we also establish trust with consumers around the world,” Vilsack said. “If they trust us, they’ll try our product, and if they try our products, they will love them and continue to buy them.”

To fund the effort, producers’ support of the dairy checkoff will be vital, Vilsack said. USDEC receives checkoff dollars from DMI and state and regional groups.

Gallagher said there were no plans to increase the dairy checkoff. However, USDEC has not raised dues paid by its 120 member organizations for at least a decade, Vilsack said, noting the organization will review its dues structure in 2018.

Resources will come from DMI and state and regional checkoff organizations, adding people to build foreign markets.

Through partnerships already forged by DMI around the world, USDEC is seeking to enhance that level of trust. DMI’s partnerships with Pizza Hut and Kentucky Fried Chicken in Southeast Asia have already increased sales, Gallagher said.

New investment takes risk, and one of USDEC’s roles will be to reduce risks faced by dairy companies seeking to build foreign markets, Vilsack said. “To lower risks, you have to have knowledge, insights, understanding of the market and the opportunities; identify the necessary innovations; and provide that information to the industry and let them make decisions when they are comfortable with the risks. It takes relationships, knowledge, insights and people.”

Vilsack expects a 3- to 5-year effort to reach the goal, although U.S. positions on trade agreements, European Union success on geographical indicators and the strength of the U.S. dollar are variables.

August exports stronger

After a setback in July, U.S. dairy exports improved in August, posting the second-highest volume in the last 10 months. Cheese led the way and butterfat shipments picked up, offsetting a slowdown in sales of nonfat dry milk/skim milk powder (NDM/SMP), whey products and lactose, according to Alan Levitt, USDEC vice president of communications and market analysis.

Suppliers shipped 164,279 tons of milk powder, cheese, butterfat, whey and lactose during the month, up 2 percent from last year. U.S. exports were valued at $469 million, up 17 percent, slightly above the monthly average since last October.

Cheese exports in August were 30,370 tons, exceeding last year’s volume by 35 percent. For the first time, Australia was the No. 2 destination for U.S. cheese, taking 3,900 tons, nearly triple the volume of a year ago.

In the June-August period, U.S. suppliers exported 8,219 tons of butterfat, up 158 percent from last year. Canada has been the major customer, taking 4,187 tons in three months, more than triple year-earlier purchases.

Dairy replacement sales look to build

At 1,459 head, exports of dairy replacement heifers remained softer in August, turning in the second-lowest monthly total of the year. The heifers were valued at $2.66 million.

NAFTA partners Canada and Mexico were again the leading U.S. markets for the month, taking 857 and 469 head, respectively. Qatar imported 132 head.

Year-to-date 2017 U.S. dairy replacement heifer exports stand at 19,380 head, surpassing the total of 12,216 for all of 2016 and 16,171 for all of 2015.

Tony Clayton, Clayton Agri-Marketing Inc., Jefferson City, Missouri, said Qatar and the U.S. recently agreed on health protocols. Qatar is seeking genomic-tested animals, but needs to rapidly build its domestic milk production due to an export embargo by several of its neighbors.

In Mexico, price has become a driving factor, with less emphasis on quality.

Pakistan is also seeking high-genomic cattle, and Nestle is offering a $700-per-head subsidy to import dairy cattle, said Clayton, who was headed to the Middle East and Africa in search of sales for 2018.

At 631, August exports of dairy embryos fell off sharply after setting an eight-month high in July. The embryos were valued at $601,000. China and Japan were leading buyers.

Hay exports rebound

Monthly hay exports rebounded in August. While still below average, sales of alfalfa hay totaled 204,067 metric tons (MT), up 20,000 MT from July. August sales to China, at 93,816 MT, and Saudi Arabia, at 31,900 MT, were each up 9,500 MT from July. Through August, sales of alfalfa hay remain at a record-high pace. Alfalfa hay exports were valued at $60 million for the month.

Japan remained the leading foreign market for other hay in August, at 61,828 MT. At 139,863 MT, total export sales were the highest since March 2017. South Korean buyers purchased their largest volume of other hay for the year, at 54,872 MT in August. Other hay exports were valued at more than $44 million for the month.

With the exception of dehydrated alfalfa meal, export sales of other meal and alfalfa cube products were lower.

U.S. ag trade surplus shrinks

Despite stronger sales of dairy products and hay, the August U.S. ag trade surplus narrowed.

Overall August 2017 U.S. ag exports were valued at $10.2 billion. Monthly U.S. ag imports were valued at $9.9 billion. As a result, August’s U.S. ag trade surplus was $287 million, the smallest since May.

U.S. ag exports for the first 11 months of this fiscal year are at $129.9 billion, $11.3 billion more than the same time in 2016, and more than $20 billion higher than imports. ![]()

PHOTO: U.S. dairy leaders discussed dairy promotion and export issues during a press conference held in conjunction with World Dairy Expo, Oct. 4, in Madison, Wisconsin. Participants included (left to right) Marilyn Hershey, Cochranville, Pennsylvania dairy farmer and vice chair of Dairy Management Inc. (DMI), Tom Vilsack, CEO and president of the U.S. Dairy Export Council, and Tom Gallagher, CEO of DMI. Photo courtesy of DMI.

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke