In this column, Progressive Dairy summarizes issues in the news and attempts to describe how they might affect dairy farmers.

Items in this column are compiled from Progressive Dairy staff news sources. Send news items to Dave Natzke.

2021 WORLD DAIRY EXPO

What happened?

World Dairy Expo (WDE) leaders and local government officials continue to work on plans for both the 2021 event and its longer-term future.

What’s next?

The event is currently scheduled for Sept. 28 – Oct. 2, 2021 in Madison, Wisconsin. The WDE executive committee said a formal decision on the 2021 show would be announced this spring.

Bottom line

Canceled in 2020 due to the COVID-19 pandemic, WDE’s return in 2021 – including its location – likely hinges on evolving local and county restrictions on maximum allowable attendance at indoor and outdoor gatherings and restaurant and hotel capacity limits.

In early March, the WDE executive committee said it was continuing to meet with government officials regarding those restrictions. The committee also said it was considering alternative locations for the event, which has been held in Madison for more than five decades.

The Public Health Office of Madison and Dane County updates pandemic-related requirements monthly. The latest order, in effect through April 7, sets maximum limits of 150 to 350 people for indoor gatherings and a maximum of 500 people for outdoor gatherings. World Dairy Expo historically attracts more than 60,000 people over the five-day event.

After the WDE executive committee announcement, Dane County executive Joe Parisi issued a release saying the county had offered WDE a 10-year contract extension to keep the event at the county’s Alliant Energy Center through 2030. In addition, the 2021 and 2022 shows would be hosted by Dane County at no cost to WDE, reflecting a discount for decreased revenues from the event. News reports estimate that would save WDE about $1.6 million.

The release said current rates of COVID-19 vaccinations and nearly a half million dollars’ worth of upgrades to the Alliant Center’s facility air handling units indicated this fall’s WDE would be able to safely occur. It didn’t, however, specifically address attendance and/or hotel and restaurant capacity limits.

The extension contract needs approval by the WDE board and then must be ratified by the Dane County board of supervisors.

CWT HERD RETIREMENT LAWSUITS

What happened?

The confounding cases of milk supply management in a litigious society are coming to a conclusion.

What’s next?

The claim deadline in a class-action lawsuit involving the National Milk Producers Federation’s (NMPF) Cooperatives Working Together (CWT) “herd retirement” program is April 23. The $220 million settlement in the lawsuit (First Impressions Salon Inc., et al. v. National Milk Producers Federation, et al.), was reached in April 2020. It involved wholesale buyers of dairy products and individual consumers who purchased butter and/or cheese directly from one or more CWT members during the period from Dec. 6, 2008 to July 31, 2013.

Bottom line

This and other lawsuits alleged dairy cooperatives and their producer members conspired to raise milk and dairy product prices by sending dairy cows to slaughter to reduce milk supplies.

The CWT herd retirement program was created by NMPF during a period of growing milk supplies and declining prices, culminating in historically low farmer milk prices in 2009. Under the herd retirement program, CWT announced invitations for dairy producers to submit bids to sell their dairy herds and cease milk production in an attempt to bring milk supply in closer balance with demand. CWT conducted 10 herd retirements between 2003 and 2010.

During CWT creation, NMPF leaders said they believed the program fell under provisions of the Capper-Volstead Act, a 1922 law which provides farmers and agricultural producers certain exemptions from antitrust laws when marketing, pricing and selling their products through cooperative means. NMPF contended CWT’s structure was a federation of co-ops and producers working together to achieve stable milk prices.

CWT’s activities were vetted with the USDA, and no Capper-Volstead concerns were raised at that time. The U.S. Department of Justice also raised no concerns.

However, defendant lawyers allege the herd retirement program was not covered under Capper-Volstead protection because it controlled pre-production milk supply by removing cows from production.

That question has never been resolved. The settlements do not mean that any law was broken or that the defendants did anything wrong, and no court has decided in favor of the plaintiffs or defendants.

NEGATIVE PPDS

What happened?

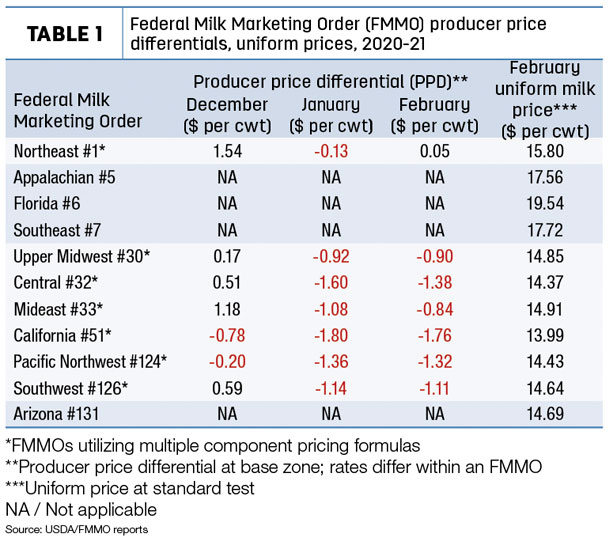

February’s Federal Milk Marketing Order (FMMO) uniform prices and producer price differentials (PPDs) weren’t markedly different from a month earlier (Table 1).

What’s next?

As a predictor of depooling, negative PPDs and the “Class I price mover,” Chicago Mercantile Exchange (CME) futures prices indicate the gap between Class III-Class IV milk prices expands slightly in the second quarter of 2021 but then tightens somewhat into the first quarter of 2022. Based on CME futures prices at the close of trading on March 12, the Class III-Class IV price gap averages $2.28 per hundredweight (cwt) in the first quarter of 2021, expands to $2.66 per cwt in the second quarter, closes to $1.99 per cwt in the third quarter and tightens further to $1.35 per cwt in the fourth quarter of the year.

In comparison, the 2020 Class III-Class IV price gap averaged $4.68 per cwt in 2020, with a low of 40 cents in January to more than $10 in July and November.

Bottom line

February uniform prices at standardized test were down in all FMMOs outside the southeastern U.S., with prices below $15 per cwt in seven FMMOs and dipping below $14 per cwt in the California FMMO. The January-February price declines ranged from 5 to 29 cents per cwt. Uniform prices at standardized test were up 13 to 28 cents per cwt in the Appalachian, Florida and Southeast FMMOs.

February PPDs remained negative in six of seven applicable FMMOs, although not near as dramatic as those seen during most of the second half of 2020. The Northeast FMMO PPD moved into positive territory, albeit just a nickel. PPDs have zone differentials, so they’ll vary slightly within each FMMO. In addition, PPD impacts on individual milk checks are based on individual milk handlers.

February levels of Class III milk utilization and pooling were also mostly steady with recent months, although volumes were down slightly due to fewer days in the month compared to January.

Class III pooling does remain below pre-coronavirus levels. Total Class III milk pooled across all FMMOs in February 2021 was about 1.35 billion pounds, down from 3.76 billion pounds a year earlier. Class III utilization was about 14% in February 2021, well below the 33% pre-COVID-19 average for January-May 2020. Class III utilization averaged about 41% in 2019.