June DMC margin: $9.99 per cwt

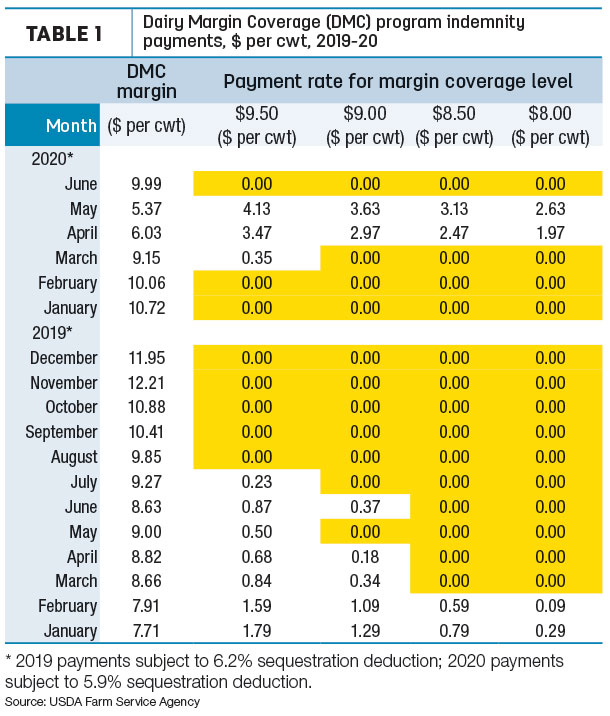

First, the good news. The USDA released its latest Ag Prices report on July 31, including factors used to calculate DMC margins and payments. Based on USDA calculations, the June DMC margin is estimated at $9.99 per hundredweight (cwt), up $4.62 per cwt from May and ending a three-month run on indemnity payments for those insured at the highest eligible level (Table 1).

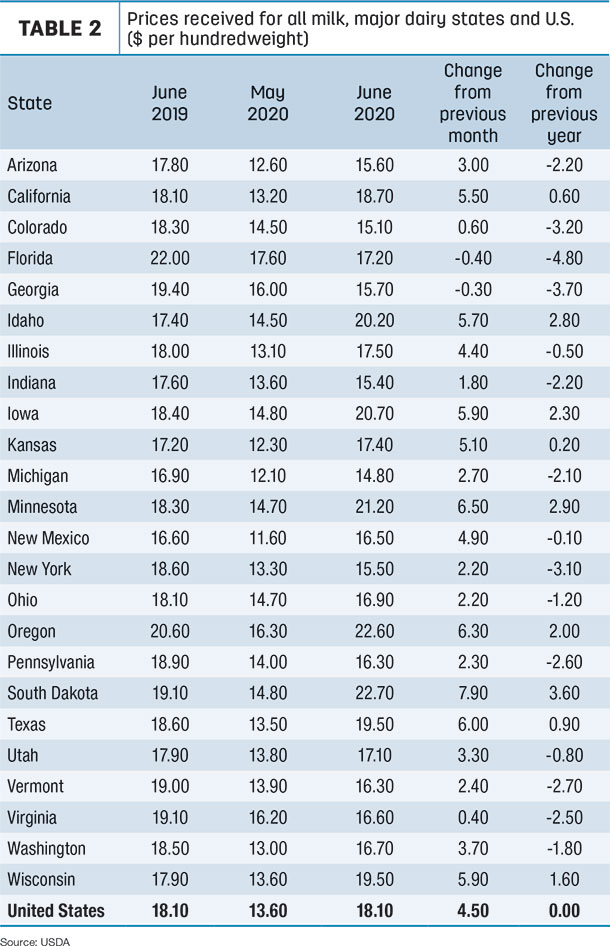

The June 2020 U.S. average milk price increased to $18.10 per cwt, up $4.50 from May’s average of $13.60 per cwt (Table 2).

Compared to a month earlier, milk prices jumped in all major dairy states except Florida and Georgia, states with high Class I (fluid milk) utilization. South Dakota saw the biggest increase, up $7.90 per cwt. Announced average prices were also up $6-$7 in Minnesota, Oregon and Texas, and up $5-$6 in California, Idaho, Iowa, Kansas and Wisconsin.

The unique scenario created a situation where announced all-milk prices in 10 states were higher than those in Florida ($17.20 per cwt), the traditional price leader due to its high Class I utilization.

The highest announced milk prices for June 2020 were in South Dakota and Oregon at $22.70 and $22.60 per cwt, respectively. Lowest announced prices were in Michigan ($14.70 per cwt), with Arizona, Colorado, Georgia, Indiana and New York all under $15.70 per cwt.

While the June 2020 U.S. average price of $18.10 per cwt was equal to the national average in June 2019, there was a wide variation among individual states. Announced prices in Colorado, Florida, Georgia and New York were at least $3 per cwt below year-earlier levels; prices in Idaho, Indiana, Iowa, Minnesota, Oregon and South Dakota were up at least $2 per cwt.

The June all-milk prices announced by the USDA didn’t reflect what most dairy farmers saw in their milk checks. Among the seven FMMOs utilizing multiple component pricing formulas, PPDs ranged between -$3.81 in the Upper Midwest to more than -$8 per cwt in parts of California. That resulted in substantial milk check deductions for some producers. Read: Negative PPD impact will likely vary by order, handler.

Corn, hay prices drop; soybean meal steady

Overall, June feed costs were lower, with declines in U.S. average prices for corn and hay contributing to the cheaper rations. The June 2020 U.S. average corn price was $3.16 per bushel, down 4 cents from the month before. The average price for a blend of premium and all alfalfa hay used in DMC calculation was $190 per ton, down $5 per ton from May and matching a six-month low. Soybean meal averaged $288.66 per ton in June, up 10 cents per ton from May.

That yielded an average DMC total feed cost of $8.11 per cwt of milk sold, down 12 cents from May (Table 3).

Margins headed much higher

DMC margins are forecast substantially higher though the next several months, although conditions can change. Based on milk and feed futures prices at the close of trading on July 31, the DMC Decision Tool estimates margins are likely to rise above $13.30 per cwt in July, top $12.90 per cwt in August and hit $11.40 in September. Thereafter, monthly DMC margins are forecast above the $9.50 threshold through at least March 2021.

While the DMC outlook for margins appears good, it won’t fully reflect what’s happening on the farm. Current forecasts predict negative PPDs could impact uniform milk prices paid through FMMOs into at least September. ![]()

-

Dave Natzke

- Editor

- Progressive Dairy

- Email Dave Natzke