- Lower milk production forecast, stronger cheese demand adds some support to prices

- Rabobank: Rising risks

- CoBank: Dairy outlook better for second half of 2019

Lower milk production forecast, stronger cheese demand adds some support to prices

Citing slowing growth in milk output per cow, the USDA trimmed its 2019 milk production forecast, even though cow numbers are expected to increase. The agency’s monthly World Ag Supply and Demand Estimates (WASDE) report, released April 9, also raised projected cheese prices, providing some support for Class III and the all-milk prices.

The 2019 milk production forecast was reduced about 200 million pounds from last month’s estimate to 219.5 billion pounds. The USDA also raised the final estimate for 2018 production, up 100 million pounds, to 217.6 billion pounds. If realized, 2019 production would be up less than 1 percent from 2018.

The annual product price forecast for cheese was raised from last month based on higher current prices and expected stronger demand. However, projected prices for butter, nonfat dry milk and whey were reduced.

As a result, the USDA projected the 2019 Class III milk price in a range of $15.10 to $15.60 per hundredweight (cwt), for a midpoint of $15.35 per cwt. That compares to $14.61 per cwt in 2018.

The Class IV milk price is projected in a range of $15.75 to $16.35 per cwt, for a midpoint of $16.05 per cwt. That compares to $14.23 per cwt last year.

Finally, the 2019 all-milk price is projected in a range of $17.25 to $17.75 per cwt, for a midpoint of $17.50 per cwt. That would be up $1.32 per cwt from 2018.

Looking at the WASDE report’s beef and feed situation and forecast:

• Beef cattle: The 2019 beef production forecast was reduced on lower carcass weights offsetting increased slaughter. The 2019 cattle price forecast was narrowed in a range of $117 to $122 per cwt, with strongest prices in the first half of the year.

• Corn: This month’s 2018-19 U.S. corn outlook is for lower feed and residual use, reductions in corn used for ethanol and exports, and larger stocks. The projected 2018-19 season-average corn price received by producers was narrowed, with the midpoint unchanged to $3.55 per bushel. That would be up from $3.36 per bushel in 2017-18.

• Soybeans: U.S. soybean supply and use changes for 2018-19 include lower imports, higher seed use and lower ending stocks. The soybean price was forecast in a range of $8.35 to $8.85 per bushel, yielding an average of $8.60 per bushel, below the $9.33 per bushel average in 2017-18. The soybean meal price forecast, in a range of $305 to $325 per ton, yields a midpoint of $315 per ton. That’s down from $345 per ton in 2017-18.

Rabobank: Rising risks

The latest RaboResearch Dairy Quarterly report also sees limited growth in U.S. milk production in 2019. However, when combined with pressures on domestic demand (higher prices, lackluster retails sales in some categories) and geopolitical conditions (trade wars and tariffs), U.S. producers may miss out on the full upside in 2019 global dairy prices.

There are reasons for optimism:

- Combined year-on-year milk supply growth from the “Big 7” exporters – the U.S., the European Union (EU), New Zealand, Australia, Brazil, Argentina and Uruguay – stalled in the first quarter of 2019, and growth may venture into negative territory into the first half of 2019. The outlook for milk supply for the Big 7 will remain tight into 2020.

- China started the new year with strong import activity. Although a near-term slowdown is expected, import growth will accelerate in the second half of 2019.

- In New Zealand, milk flow growth will moderate over the tail end of the season as dry conditions take hold in key regions. While supplementary feed reserves are generally plentiful, some North Island farmers will dry off earlier than usual. In Australia, milk production will continue to fall throughout 2019.

- The EU dairy herd declined by 1.6 percent in 2018. Five of seven of the largest milk-producing countries reported reduced herd sizes, led by the Netherlands, Germany and France.

There are, however, clouds on the horizon.

- Farmgate milk prices aren’t keeping up with input costs.

- Dairy demand outlook uncertainty remains heightened, and global economic growth is expected to weaken across the next 24 months. An environment of weaker economic growth and rising retail prices will limit affordability.

- While milk supply growth in the EU is unlikely until the second half of 2019, some intervention stocks remain, and discounts on skim milk powder will continue. Chaos reigns over the Brexit situation.

- South American milk production is advancing and will likely cause local prices to move lower by the end of 2019’s second quarter. Challenging economic conditions in Brazil and Argentina will limit demand growth.

CoBank: Dairy outlook better for second half of 2019

Stabilizing dairy supplies could lead to improving markets in the second half of 2019, according to the latest quarterly economic outlook from CoBank. Nonetheless, U.S. agriculture will face challenges in 2019 as slowing domestic and global economic growth rates, trade talks continue and weather casts uncertainty in the short- and long-term markets.

Specific to dairy, 2018 U.S. milk production growth was lower than normal, and extreme winter conditions and storms in the Northwest and Upper Midwest have created regional challenges to milk production in the first quarter of 2019. A slower growth rate in U.S. milk production translates into less excess milk being dried into powder, and powder production in the EU is down as well, providing support for global prices.

Higher powder prices and stable butter prices will support Class IV milk prices, and recent gains in cheese prices provide hope for high Class III milk prices.

If tariffs and trade disruptions are resolved and exports improve, there is optimism that the second half of the year could show some improvement. The net result should be prices about $1 to $1.50 per cwt higher in 2019 than they were in 2018.

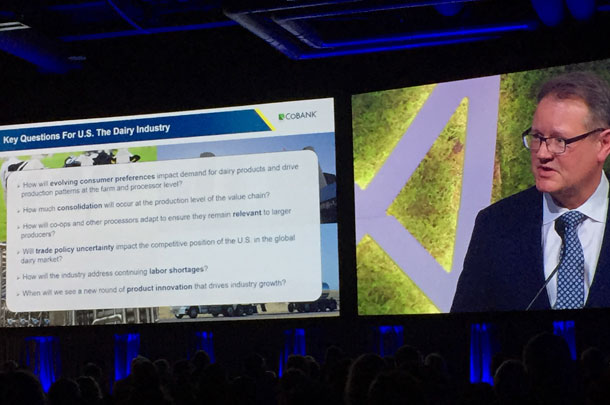

Addressing the 2019 annual meeting of Dairy Farmers of America, March 19, in Kansas City, Missouri, Tom Halverson, president and CEO of CoBank, summarized six key questions CoBank considers when thinking about the long-term economic health of the U.S. dairy industry:

1. How will evolving consumer preferences impact demand for dairy products and drive production patterns at the farm and processor level?

2. How much consolidation will occur at the production levels of the value chain?

3. As farm size increases, how will co-ops and other processors adapt to ensure they remain relevant to their members, their customers and their partners?

4. Will trade policy uncertainty impact the competitive position of the U.S. in the global market?

5. How will the industry address the persistent problems of labor shortage and, if automation is a solution, what impact will that have on farm operations and the economics of dairy farming?

6. When will we see a new round of product innovation that drives future industry growth? ![]()

PHOTO: Tom Halverson, president and CEO of CoBank, addressed the 2019 annual meeting of Dairy Farmers of America, March 19, in Kansas City, Missouri. Photo by Dave Natzke.

-

Dave Natzke

- Editor

- Progressive Dairyman

- Email Dave Natzke