When cattle herds were liquidated two years ago, I doubt many ranchers believed they would go this long without buying replacement heifers or cows.

Ranchers who bought feeders this summer and fall and hoped wheat pastures would keep cattle fed until March 2013 are now bringing feeders back to auctions because of the poor condition of wheat.

Without rain, wheat pastures are much too dry to maintain feeders, let alone adding pounds.

Without rain, wheat pastures are much too dry to maintain feeders, let alone adding pounds.

When and if it turns cold, feeders can easily become sick without stored energy.

Click here or on the image at right to view it at full size in a new window.

It should be expected to have much lighter runs of feeder cattle in 2013. Feeder cattle are being moved into feedlots now.

For the third year in a row cattle numbers remain low. Without breeding heifers and cows, it will be another two-and-a -half years at the very earliest to three-and-a-half to four more years before any increases might take place.

Weather is a large part of why the breeding herd was liquidated, but the prices for heifers and cows for breeding competing against buyers for slaughter are a factor that can’t be denied.

As of Nov. 30, 2012 the cutter cow cutout value was $161.22 per cwt. 90 percent lean beef from cutter cows is over $200 per cwt.

Without pastures, ranchers have very few alternative feed sources unless they buy hay. However, hay is too high priced and too scarce. The logical alternative is to move cows to slaughter and sell unbred heifers to feedlots.

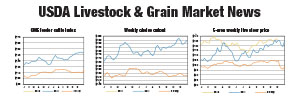

Feeder cattle

I am sure there are many producers selling feeder cattle that will want to differ with what I am about to say, but I am surprised feeder cattle remain as high priced as they are being sold on the futures markets and cash markets.

Feeder cattle are off the historic highs of last May and June when they traded over $160 per cwt, but with corn prices trading well over $7 per bushel and cash wheat prices 50 cents per bushel to $1 per bushel over corn, feeder cattle currently trading at the CME from $145 per cwt to over $150 per cwt are high priced.

Without the Plains and Southwestern pastures, feeder cattle are moving into feedlots. With 80 to 85 percent of live cattle contracted or owned by a packer, demand to fill previously contracted cattle is maintaining current prices for feeders.

If cattle are contracted and a packer expects either the feeders to be in their own private lots or live cattle delivered to fulfill contracts for slaughter, feeder cattle must be purchased.

Without previously contracted cattle, and without the pastures, it is very likely feeder cattle prices will be substantially lower.

With high-priced feeders combined with high-priced feed, along with negative feeding margins, don’t be at all surprised to see feedlots default on contracts to packers when they claim bankruptcy.

Feedlots for 45 weeks in a row have been keeping cattle on feed longer rather than buying replacements. Dressed steer weights are up 20 more pounds than a year ago.

For now, it is probably not as negative as it could be. The current spread between choice and select boxed beef as of Nov. 30 was $20.83 per cwt.

As the year ends and demand for choice beef slows after the holidays, monitoring the spread will be of prime importance. A narrowing spread will be negative.

Rumors have been flying since October that Japan will extend the age of cattle accepted for export from the U.S. up to 30 months.

If and when it takes place, the demand for beef from heavier carcasses should maintain the spread with choice over select.

However, if demand for choice moves too far over select, the lesser-quality product could become burdensome and prices will need to adjust, which easily could drop the choice products.

It should also be considered that Japan will buy beef from U.S. competitors. Brazil and Australia have been selling beef to Japan.

With exchange rates favoring Australia and Brazilian beef over U.S., Japan will likely continue to buy more beef from countries other than the U.S. In 2012 Japan showed the U.S. they would not hesitate to increase purchasing ag products outside of the U.S. when they purchased large quantities of grain from Russia and the Ukraine.

At the same time with tight grain stocks, Russia showed the world to maintain market share, it wouldn’t hesitate to offer and sell grain.

There is no reason to believe Brazil and Australia won’t do the same with beef moved to Japan especially when U.S. beef supplies in 2013 will be extremely low and tight.

What to do?

Currently commodity future prices for live cattle and feeder cattle are bullish with live cattle prices from February 2013 $5 per cwt below February 2014.

Traders want to believe fewer cattle in 2013 will increase prices. Yes, the supply will be down, but will the lack of supply mean higher prices?

U.S. packers are losing nearly $80 per head. Will they be able to maintain plants having losses week after week?

Packers will not continue to post losses in the U.S. if they have positive margins with facilities outside of the U.S. In 2012 one of the largest packers had no qualms buying grain from Brazil to feed hogs and poultry in the southeastern U.S.

If exchange rates favor selling more beef from outside of the U.S., look for packers to close older and smaller facilities needing renovations in favor of newer larger Brazilian plants. Look for small regional packers to close facilities, especially older plants.

Grain pricing for livestock

Producers are buying feed hand to mouth and are possibly being lulled into a false sense of reality with the inversion of grain prices into 2013.

Grain prices from now through the next U.S. harvest are vulnerable to price rallies with even the slightest disturbance in weather.

With major rain events in South America, traders seem more concerned there is too much rain rather than “rain makes grain.” With the extremely tight U.S. feed grain stocks, the world will be watching every drop of rain to the lack of rain throughout 2013.

If feed grain prices remain inverted and trade lower, it will be terrific for livestock producers. But with any adverse weather in 2013, buyers will push prices to the upside. ![]()