Last year’s drought that ravaged pasture conditions across the U.S. Southern Plains created widespread hardships for backgrounders and feedlot managers alike.

If that was not bad enough, this year’s version of the drought that spanned the heart of the Corn Belt in the Midwest has led to the largest yield loss since 1988, with the damage still being tallied.

What once appeared to be a very promising season following ideal spring weather conditions and early planting has now turned into a complete disaster, with a busy autumn likely for insurance adjusters.

The significant loss to this year’s corn crop has dramatically changed the profitability outlook for cattlemen who will have to deal with soaring feed bills for the foreseeable future.

This is probably not lost on feedlots that are currently “open” to the market on feed without pre-existing coverage in place from earlier in the year.

Corn has risen about 60 percent from as recently as June when the market was trading around $5 per bushel to near $8 at present.

Meanwhile, fat cattle prices, while also slightly higher from earlier in the summer, have not gained nearly as much as corn, which has negatively impacted margins for nearby marketing periods against the October and December live cattle futures contracts at the CME Group.

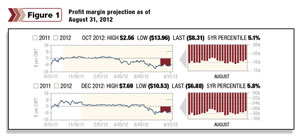

The figures (Figure 1 and Figure 2) reflect the open market margin for these two periods, which project significant losses for cattle feeders through the end of this year.

The figures (Figure 1 and Figure 2) reflect the open market margin for these two periods, which project significant losses for cattle feeders through the end of this year.

While the figures are no doubt discouraging with profit margins projected in the bottom fifth percentile of the past five years, it is interesting  to note that margins in more deferred marketing periods do not project nearly as bad.

to note that margins in more deferred marketing periods do not project nearly as bad.

This is because feeder cattle prices have lost significant value along with the sharp rise in corn earlier this summer.

For cattle feeders that have yet to purchase feeder cattle for this fall, finishing margins in the late winter to early spring look much more promising.

The charts below reflect the open market margin for the marketing periods against the February and April Live Cattle contracts at the CME Group:

What these charts suggest is that it may currently be quite profitable for a cattle feedlot to place a margin hedge around these forward marketing periods to help secure projected profitability.

Sometimes referred to as a cattle “crush,” this means simultaneously buying corn and feeder cattle futures and selling live cattle futures to lock in the price relationships among the three components of the forward profit margin.

The model used to generate these charts does make some assumptions on a cattle feedlot’s fixed expenses as well as basis values to translate CME Group futures prices in Chicago to local values in the cash market, and it is true that these values and costs change over time.

Generally speaking, however, the variance of these factors is far less than that of the futures prices that derive their value from the cash market where the actual purchases and sales will be made.

Because there is a high correlation between the cash prices and the futures prices of these commodities, a cattle feedlot can have a reasonable degree of confidence that a forward contracting strategy to protect these unrealized profit margins will be successful in helping to secure a favorable return on cattle to be finished over the winter.

As an alternative to “locking in” the forward profit margin by contracting with futures, a feedlot might opt to simply protect the current level of forward profit margins by contracting with options.

This would allow for the opportunity of an improved margin should the cattle finishing landscape become more favorable over the intermediate to longer term.

A feedlot may be concerned, for instance, that locking in corn prices now for the winter may open up a significant opportunity cost should the market begin moving lower.

Similarly, there might also be concern that forward contracting fat cattle prices for spring delivery might not be optimal right now should beef production decline due to a shrinking cattle herd and cause prices to rise over the winter.

Either one or both of these developments could potentially improve the profit margin from what is currently being projected.

As an alternative to protecting margins using exchange-traded futures or options, a feedlot could also potentially forward contract in their local cash market, assuming that is available.

Feed could be purchased on a cash forward contract from the elevator or feedmill – and cattle could be sold to the packer as well under a forward agreement.

Here too, basis and other fixed costs would still potentially be a variable although the main component of the profit margin’s risk would be locked in.

Options could even be used in conjunction with physical contracting in the cash market to provide the feedlot with greater flexibility around the forward profit margin.

Regardless of how it is accomplished, it is important to understand that there are alternatives to simply taking what the market gives you on a spot basis from one period to the next.

It is often the case that the best profit margin opportunities will occur well ahead of the actual marketing period where physical purchases and sales will be made in the local cash market.

By following a margin approach, a cattle feedlot can identify forward opportunities that are historically attractive from a profitability standpoint and then evaluate all of the alternatives available to secure or protect that profitability over time.

Just because the market projects a profit margin opportunity in a deferred period does not mean that opportunity will always exist. The markets are dynamic by nature and conditions can change rapidly over time as new developments occur.

That certainly has been the case this year with regard to the corn market and the projected cost of feed.

Fortunately, given the cost of purchasing feeder cattle right now and the projected value of live cattle against either the February or April Live Cattle futures contract, this feed cost works out for a finisher. Only time will tell whether or not this relationship will last. ![]()