As a result, fewer cows are likely to be slaughtered until fall. Improved pasture conditions will also provide a longer grazing season, allowing feeder cattle to gain weight prior to placement in feedlots.

The longer pasture time will leave fewer cattle for placement in feedlots until the fall end of the grazing season. Despite issues with planting, recent precipitation will likely have a positive effect on corn and soybean yields, which could keep feed prices low through the latter part of 2015 and most of 2016.

Recent storms and flooding have impacted both Texas and Oklahoma. The ground in many regions is reported to be completely saturated, with lakes and reservoirs having reached their capacities.

The weekly summary of the National Agricultural Statistics Service’s State Crop Progress and Condition report for May 25-31 reported that Texas received upward of 10 inches of rain and Oklahoma chalked up the wettest May since 1921.

The June 2, 2015, U.S. Drought Monitor showed drought intensity in Texas and Oklahoma reduced to D0 (“Abnormally Dry”) compared with earlier weeks showing the same regions with D3 (“Extreme Drought” levels) (droughtmonitor.unl.edu).

As a result of the recent storms, the Southern Plains pasture conditions are improving and plantings have been interrupted or delayed, while hay that has been cut but not yet baled is likely to be of poor quality. California and parts of the West remain in one of their worst droughts.

Reduced slaughter exacerbated by cow and heifer retention

Cattle producers are culling fewer cows due to the improved pasture prospects for this spring and the early part of the summer. This likely means fewer cows will be going to slaughter until the fall culling season.

The paucity of cows for slaughter this spring, summer and early fall will likely have implications for supplies of processing beef and ground beef production through summer 2015.

First-half 2015 cow slaughter could be down 6 percent over first-half 2014, following a steeper 13 percent decline for 2014 over 2013. Reduced cow slaughter will likely support demand for imported processing beef.

Heifers will also be more likely to be retained for breeding due to improvements in pasture conditions, which will leave feeder cattle in even shorter supply for placement on feed later.

Another consequence of the improved pasture situation is that feeder cattle will likely not come off pasture until late summer/early fall, many of them likely not until November, when forage supplies diminish.

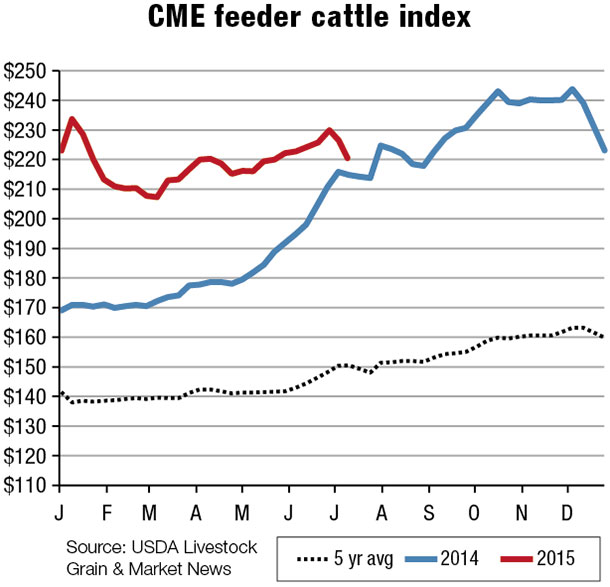

This could reduce supplies of feeder cattle for placement on feed from now until fall, which could provide some support for feeder cattle prices.

The April 2015 placements of cattle on feed in 1,000-head-plus feedlots was lower than many industry analysts expected. Instead of sending cattle to feedlots, many producers are letting their animals graze on pasture longer.

Placements of cattle weighing 800-plus pounds totaled 640,000 head, continuing as the largest net placement category. Cattle feeders may find limited supplies of feeder cattle for placement in feedlots until grass cattle are sold off pastures in late summer/early fall.

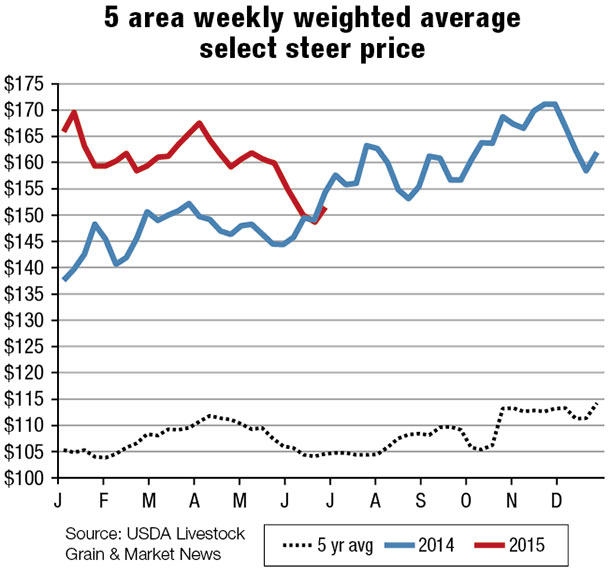

Marketings of fed cattle from 1,000-head-plus feedlots during April 2015, down 8 percent from April 2014, were the lowest April marketings since the series began in 1996.

With feeder cattle prices at relatively high levels, reflecting the relative scarcity of placement-weight feeder cattle, cattle feeders continue to experience negative margins as they find themselves sandwiched between high feeder cattle prices and fed cattle prices that have declined sharply.

Wholesale prices moderate

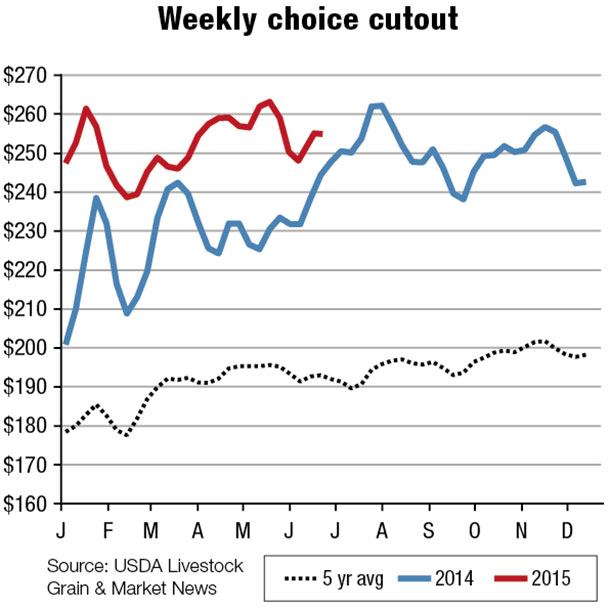

Historically small cattle inventory numbers continue to support high beef prices in 2015, but at least in the short term, increasing import volumes of processing beef and heavy carcass weights have moderated wholesale boxed-beef prices.

After topping $260 per hundredweight in May, the weekly choice cutout value has declined and is now trading around $250 per hundredweight (as of the week ending June 5).

The current declining price trend could motivate cattle feeders to return to their behavior of withholding cattle from the market as they continue feeding cattle to heavier weights “until prices move higher” – a strategy that has sometimes worked in the past.

Fed cattle live and dressed weights remain significantly heavier than in the previous year, due in part to improvements in forage and pasture conditions, timely rains across Texas and Oklahoma, and the extra time on feed due to reduced steer and heifer slaughter this year. Incentives exist for cattle feeders to hold out for higher prices by continuing to feed cattle to heavy weights.

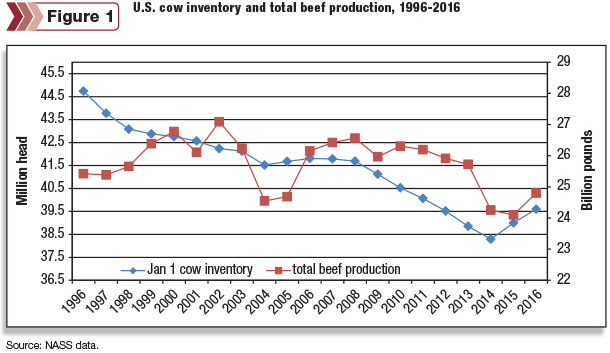

One uncertainty is the extent to which feeding cattle to heavier weights will offset the decrease in slaughter numbers in 2015 and the ultimate effect this will have on total commercial beef production; reduced slaughter led the USDA to revise 2015 commercial beef production to 24 billion pounds.

In 2016, U.S. beef production is expected to increase moderately due to cattle inventory numbers that began increasing in 2015 and the effects of heavier average carcass weights.

However, it is important to note that while seasonal increases in cattle slaughter and beef supplies may result in downward pressure on wholesale prices, this is not necessarily the case for seasonal patterns in retail prices. While retail prices tend to decline seasonally into summer, they often do so at a much slower rate than wholesale prices.

The USDA-ERS reported April retail beef prices at an all-time record of $6.40 per pound. The USDA anticipates retail beef prices will remain relatively high through 2015 and 2016 as it will take time for cattle inventories and beef production to grow enough to cause noticeable declines in retail prices. At the same time, retail pork and poultry prices are expected to remain competitive.

Global demand for U.S. beef remains sluggish

The combination of high U.S. beef prices, tight domestic availability and a relatively strong U.S. dollar (although it has eased in recent weeks) continue to constrain U.S. beef export growth. April exports of U.S. beef were 199.6 million pounds, down 3.6 percent from last year.

However, the April trade data did show some signs of improved demand for U.S. beef in international markets such as Japan, South Korea and Taiwan.

The data also showed increased beef shipments to smaller global markets (volume-wise) such as the Netherlands, Philippines, Dominican Republic and Italy.

Shipments to other top trading partners such as Mexico, Canada and Hong Kong experienced declines relative to the previous year.

With less beef available for export this year due to constrained domestic availability, annual beef exports for 2015 are projected to decline to 2.46 billion pounds, down approximately 4 percent from 2014 exports. Total exports of U.S. beef are expected to rise slightly in 2016 to 2.51 billion pounds.

Beef imports bolstered by brisk Australian liquidation

Imports of beef into the U.S. are expected to remain strong much of 2015. The flow of beef from major suppliers remained brisk through the first four months of 2015.

Persistent drought in major production regions in Australia and the wide price spread between Australian and U.S. 90 percent lean beef have led to consistently high monthly shipments of processing beef into the U.S. January-through-April imports from Australia have totaled 412.3 million pounds.

Beef imports from Canada, Mexico and Brazil were also reported higher year-over-year. Imports of beef into the U.S. for 2015 are expected to reach 3.3 billion pounds.

For 2016, the USDA is forecasting annual beef imports at 2.92 billion pounds, down 11.9 percent relative to 2015 as U.S. domestic beef supply increases and supplies of Australian beef tighten. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.