The answers point to an evolution beyond the line between choice and select, which has been blurred by feeding to heavier weights. Premium choice and prime premiums are exerting more influence on today’s cattle markets, observers say.

“In today’s differentiated market, producers who are only paying attention to the choice-select spread are missing some of the more significant signals,” says Mark McCully, vice president of production for the Certified Angus Beef (CAB) brand.

Licensed packers pay $50 million in annual grid premiums for cattle that qualify for that brand. And there are other branded programs that pay for quality.

Ted Schroeder, director of the Center for Risk Management Education and Research in agricultural economics at Kansas State University, agrees there’s more to the quality beef market than the choice-select spread.

“Low choice is not as valued as high choice,” he says, “but there’s still some distinction between choice and select in eating quality. Most private label brands have quality grade requirements that do not distinguish between choice and upper choice, and those will continue to be premium priced products.”

McCully says buyers of boxed beef have learned that what’s left on the market after branded programs like CAB take most of the upper choice is “a bit of a leftover.”

Data from the USDA and the 2011 National Beef Quality Audit indicate branded beef programs reduce that upper two-thirds of choice (modest or higher marbling) from 36 percent to just 11 percent after sorting for brands. What remains in the choice box is 89 percent small marbling – and quality is further reduced after branded programs rail off the low choice that is at least small 50 marbling.

Brands that do not require premium choice will, by default, source primarily low choice beef.

Consumer demand for beef from branded programs has grown in the last 10 years, Schroeder says. Responding to market signals for branded choice has resulted in less select product over that time span. The shift in the supply ratio might suggest a narrower choice-select spread.

“There is a lot less select product out there today than choice, or even upper two-thirds choice and prime on a percentage basis,” McCully says. “Typically when our supply of choice increases, the choice-select spread has decreased, but that really hasn’t happened. It has been relatively constant over the last few years, averaging around $7 per hundred.”

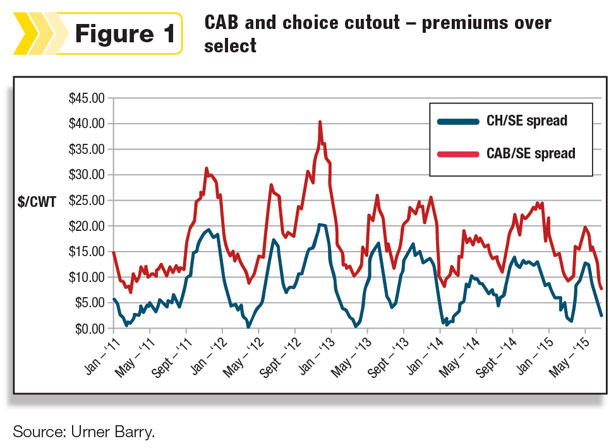

In the first six months of 2015, the spread widened by $.41 per cwt, with an average choice cutout $24.06 per cwt higher than a year ago, according to USDA figures. But other spreads may be more telling: The CAB-select spread is often twice as wide as the choice-select quote (see Figure 1).

“CAB demand and volume have continued to increase,” Schroeder says. “Branded programs will continue to expand as we see strength in consumer demand for high-quality beef.”

The trend of more branded programs and greater choice supply is counterintuitive to premiums, unless there’s a shift in demand. Research says that is exactly what has happened.

“As we continue to put out a better product, we shouldn’t expect premiums to retrace,” McCully says. “Rather, meeting the expectations of our brand, and as we differentiate our beef from other protein options out there, the value increases.”

That reality of growth and demand for branded beef programs has bolstered the choice-select spread and added more value to high-quality beef, Schroeder says.

“If we did not have these private label programs with so much prominence and apparently growing in importance, the choice-select spread would be narrower,” he says. To the extent that any brand adds value to choice beef; it widens the spread, “but the relative supply of choice and select beef will continue to be an important driver.”

Higher costs come with higher expectations. With record-high prices for all beef, differentiating quality becomes more important. Consumers need more confidence and have turned to branded programs to provide some of that assurance.

“The industry as a whole benefits when consumers have more desirable eating experiences with beef because it increases overall beef demand,” Schroeder says. “CAB picked upper two-thirds choice instead of all choice, because all choice did not have sufficiently predictable eating quality.

“Now, with most of upper two-thirds choice going to these branded programs, I think the incentives are pretty clear,” he says. “My best recommendation to producers is, strive for high quality.”

Once retail beef prices rise, they are slow to subside. Consumers have made the shift to paying and expecting more, says McCully. That says demand for high-quality beef will remain strong, and that’s a key point as producers begin to rebuild their herds.

“With an eye on the long-term trends, the decisions we make today in breeding and genetics will impact supplies within a couple of years and build from there,” he says. “Now is the time to better position your herd and your operation for the future.” ![]()

—From Certified Angus Beef news release