Total cattle and calf inventories for Jan. 1, 2014, were almost 800,000 head larger than the prior estimate for 2014. Included in the new higher numbers were 42,000 additional beef cows and about 80,000 heifers retained for beef cow replacement.

The 2014 calf crop was also revised upward by 300,000 head. In addition to generally revising Jan. 1, 2014 cattle numbers upward, NASS also reported higher Jan. 1, 2015 inventory numbers for many categories.

The total cattle and calf inventory increased about 1 percent from 2014, with about 2 percent more beef cows and 4 percent more heifers for beef cow replacement. Producers indicated they expect 7 percent more heifers to calve during 2015.

The total cattle and calf inventory increased about 1 percent from 2014, with about 2 percent more beef cows and 4 percent more heifers for beef cow replacement. Producers indicated they expect 7 percent more heifers to calve during 2015.

States with the largest increases in all cattle and calves include Oklahoma and Texas, with a 6 and 7 percent increase, respectively.

Overall, the total cattle and calf inventory is still historically low, but coupled with revisions to 2014, the report shows a faster-than-anticipated herd expansion with more beef cows and a large retention of heifers.

Anecdotal comments have suggested that some cows may have been put on pasture or feed for weight gains prior to slaughter.

This strategy makes sense in light of low-priced corn and the available cornstalk pasture cows can use to good advantage.

These cows have some potential to be sold as either breeding cows, particularly if bred, or as slaughter cattle. The same potential pertains to heifers – they could be added to the cow herd or sold as feeder cattle and placed on feed.

The NASS Cattle report also indicated larger numbers of cattle on small-grains pastures than have been reported in several years.

The estimate of 1.93 million head for Jan. 1, 2015, was just ahead of the 1.92 million head in Jan. 1, 2010. Prior to 2010, the year in which cattle on small-grains pastures exceeded this year’s estimate was 2007.

The estimate of 1.93 million head for Jan. 1, 2015, was just ahead of the 1.92 million head in Jan. 1, 2010. Prior to 2010, the year in which cattle on small-grains pastures exceeded this year’s estimate was 2007.

This level of small-grains pasturing is somewhat surprising because of continuing drought conditions in most of the Southern Plains. Some of these cattle are beginning to come off wheat pasture to be placed in further stocker programs or, more likely, in feedlots.

The number of cattle on feed in U.S. feedlots with a capacity of 1,000-plus head was up 1 percent on Jan. 1, 2015 (Cattle on Feed, Jan. 23, 2015).

Placements in December dropped 8 percent compared with 2013. In addition, marketings of fed cattle in December 2014 were 5 percent lower than in 2013.

Beef production down in December 2014

Livestock Slaughter, released Jan. 22, 2015, reported a 2 percent decrease in beef production in December 2014 over the previous December.

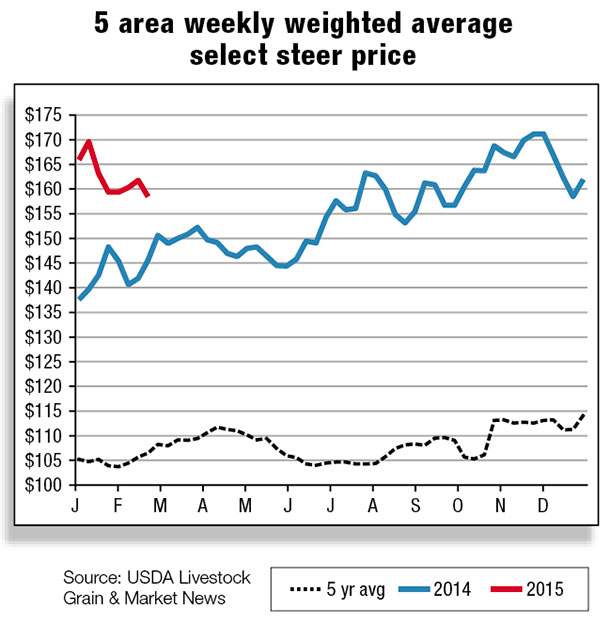

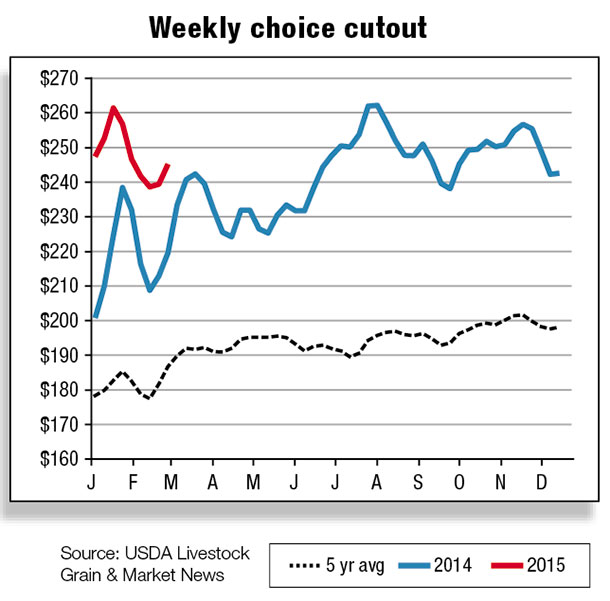

However, cattle slaughter in December 2014 was 5 percent lower than December 2013. December 2014’s all-fresh beef retail value was $6 per pound, up nearly $0.96 from last year. Retail choice beef prices in December 2014 were $6.31 per pound compared with $5.36 in December 2013.

Cattle imports up in 2014

U.S. cattle imports ended 2014 up 16 percent at about 2.36 million head as imports remained strong from both Canada and Mexico. While monthly imports from Mexico were 9.2 percent higher than last December, imports of Canadian cattle were 4.4 percent below a year earlier.

Feeder cattle imports continue to expand from Canada and were primarily responsible for the growth in overall shipments in 2014.

The forecast for U.S. cattle imports in 2015 is expected to decline to 2.3 million head as demand for imported cattle is expected to remain strong through next year due to tight U.S. cattle inventories.

Beef imports rise in 2014

U.S. beef imports were up 31.0 percent in 2014 compared with a year earlier. Imports rose by the greatest volume from Australia (+73.5 percent), New Zealand (+13.5 percent), Canada (+11.9 percent) and Mexico (+23.3 percent).

Demand for imported processing beef expanded rapidly in 2014 due to lower domestic supplies of lean beef. The majority (65.8 percent) of the total increase in beef shipments in 2014 came from Australia. Imports from Australia totaled 1.08 billion pounds in 2014.

Demand for imported processing beef expanded rapidly in 2014 due to lower domestic supplies of lean beef. The majority (65.8 percent) of the total increase in beef shipments in 2014 came from Australia. Imports from Australia totaled 1.08 billion pounds in 2014.

A strong U.S. dollar and relatively cheaper prices of imported products have encouraged imports of beef. U.S. beef imports in 2014 totaled 2.95 billion pounds.

Imports in 2015 are forecast at 2.81 billion pounds. At 2.57 billion pounds, U.S. beef exports ended the year down 0.7 percent from 2013.

Despite a significant increase in U.S. beef prices, export volumes to a number of markets rose. Exports were up to Hong Kong (+16 percent), Mexico (+7.8 percent) and South Korea (+19.2 percent). Japan remains the largest market for U.S. beef, but shipments were down 1.3 percent for the year.

Exports to Canada declined in 2014 (-22.2 percent) as the combination of higher U.S. prices and a weaker Canadian dollar took a toll on Canadian demand for U.S. beef. Exports are forecast to fall in 2015 to 2.450 billion pounds due to lower expected U.S. beef production and a strong dollar. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.

Kenneth Mathews

Market Analyst