Last year, a Rabobank AgriFinance white paper entitled “Ground Beef Nation” (GBN) questioned the industry’s priorities now that Americans consume 11 billion hamburgers each year. It called for greater efficiency and retooling to fit a changed market for one-third to half of young cattle, and warned business as usual could lead to weakened market share for beef over time.

Everybody began to discuss the implications as the choice beef cutout quote touched $2.50 per pound. They had seen the rise of giant burgers 10 years ago in step with low-carb dieting. They saw another move forward when ground beef was the go-to promotion in the 2008-09 recession and last year as many steaks were priced two or three times higher than the grinds.

Could cattle ranchers, feeders and packers have it wrong? Will a slice of the market ignore quality again, and if that turn is coming, how should seedstock producers reorient genetic selection?

The Angus Foundation set out to learn more, commissioning its own white paper. The 35-year-old nonprofit arm of the American Angus Association funds education, youth and research for the breed and broader beef community.

“Whether we’re talking about ground beef or high-end cuts, it’s important to know their relative values and the market signals that originate with consumer demand for each,” says the foundation’s president, Milford Jenkins. “That helps guide the breeding plans of registered and commercial Angus breeders toward more profit.”

The resulting paper, “Changes in the Ground Beef Market and What it Means for Cattle Producers,” was authored by Nevil Speer while a professor at Western Kentucky University; Tom Brink, the founder and president of Top Dollar Angus; and Mark McCully, vice president of production for the Certified Angus Beef brand. The full paper is available at the Angus Foundation website and the Certified Angus Beef website.

“Ground beef is an awfully important part of the brand’s business, but it still doesn’t carry the value of the middle meats and most whole-muscle cuts,” says McCully. “Most cattlemen don't realize how incredibly complex the entire ground beef market is – from varying lean points, to different raw material options, to premium opportunities.”

Speer summarized the reasons for the current white paper, highlights of which were presented at the Cattle Industry Convention in San Antonio, Texas, last month.

“We wanted to explore and outline some of the important dynamics around the ground beef category,” Speer says, noting the paper looks at “the economics and efficiencies associated with meeting the growing demand for ground beef within the current structure.”

People may think hamburger is hamburger, he says, “but the ground beef market is complex, representing a wide array of ingredients from a variety of sources coming together to make different types of products.”

That’s not a sign of inefficiency – just the opposite, Speer notes.

“The decision as to how to most appropriately combine materials for ground beef is based on a least-cost approach, given the market for various cuts at any given time,” he says. “That decision is complex and dynamic,” but working well today.

Despite rapid growth, ground beef does not overshadow sales of steaks and roasts, still driven by a combination of quality and price. While ground beef makes up 63 percent of foodservice volume, it’s just 37 percent of value; at retail those numbers are 49 percent and 39 percent, respectively.

Even with ground beef at $4, the average for all beef was at $6 per pound, offering little incentive to forego the greater figure for the lesser, Brink says.

What if forces outside of the market set up production of steers and heifers solely for grinding as GBN suggests?

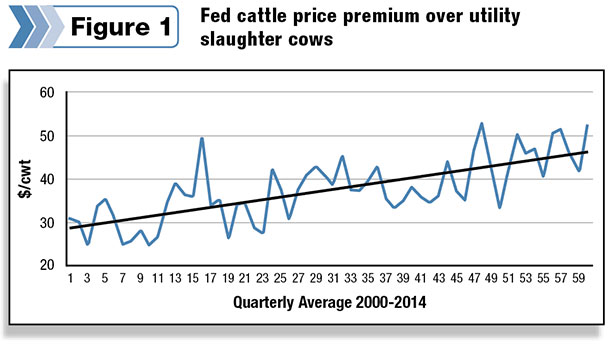

“It would reduce industry revenues, elevate production costs and unnecessarily raise consumer beef prices,” Brink says, citing price relationships. “Fed cattle have been trading at a growing price premium versus cows over the past 15 years [see Figure 1].”

The paper concludes there is no empirical evidence to support producing cattle specifically for the ground beef market.

“The trend toward a larger and more precise focus on marbling and quality grade has served cattlemen well,” McCully says. “We are producing a higher quality product in the end and driving consumer demand.” ![]()

Steve Suther is the director of industry information for Certified Angus Beef LLC.

—From Angus Foundation news release