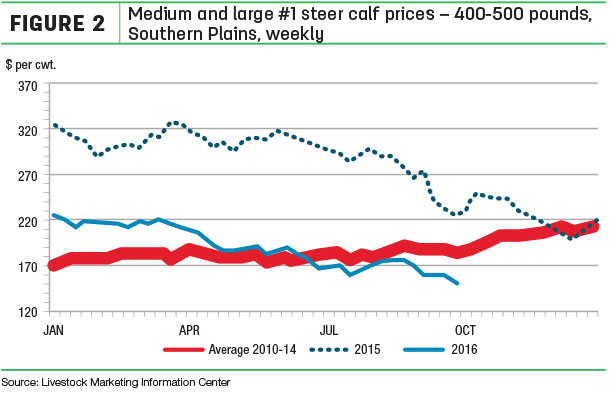

In the first half of 2015, we saw record prices nearly across the board, driven primarily by extremely tight cattle numbers. Prices remained at those high levels through much of the first half of 2015, but began their fall in early July and hit a low in mid-December. Markets stayed relatively steady through the first few months of 2016 before beginning a slow and steady downward trend through summer and into fall.

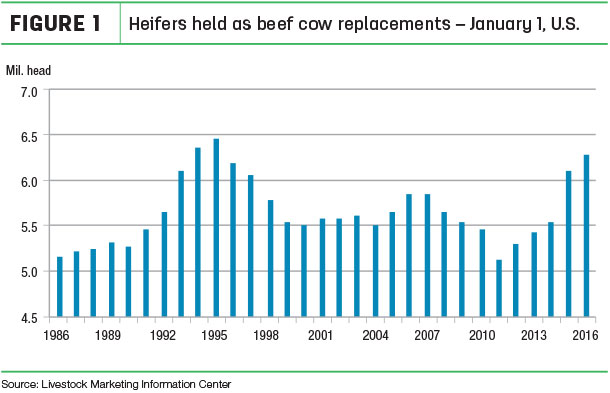

There are several factors that are currently driving the markets. First and foremost is the herd expansion. In the USDA’s January Cattle Inventory report, beef replacements were up 3.3 percent year-over-year and were at the highest level in 20 years. The rapid expansion was much stronger than most industry analysts were expecting, and was the primary driver behind the sharp price drop we experienced last fall.

Indications are that the beef herd expansion has slowed over the course of this past summer. Heifer slaughter numbers have picked up since early July and are now trending above year-ago levels, a sign that fewer heifers are being kept on-farm as replacements. The expansion slowdown should help to provide some support to the markets going forward.

Another factor that is influencing the cattle markets is trade. Several other major cattle-producing countries are seeing downturns in their cattle inventories, which is driving markets higher in countries such as Australia. Higher international prices have helped to make U.S. beef more competitive globally, especially compared to recent years. The most recent estimate has U.S. beef exports over the last month averaging 29 percent higher than a year ago. This improvement in beef exports, while not the major market driver, has at least helped to slow the downward price trend in the cattle market.

Another bright spot for cattle producers is the expected record corn harvest this fall. The latest USDA projections are calling for a U.S. corn yield of 174.4 bushels per acre, which would mark a new record. When we combine the record corn yield with the second highest harvested acreage on record, U.S. corn production could top the 15 billion bushel mark for the first time in history. Demand will likely not be able to keep pace with the record corn production, which means cattle feeders will likely have a supply of cheap corn for the next year.

While there are a few bright spots for the beef industry in the form of lower feed prices and improving exports, the sheer number of cattle hitting the market this fall will likely continue to put downward pressure on the markets. We now have five consecutive years of increased heifer retention under our belts, with the last two years being particularly strong. Many of those heifers put calves on the ground this spring that will be included in the fall run.

When combined with the slowdown in expansion that is putting more heifers on the market, we will likely see more calves hitting the market this fall than we have seen in several years. This in turn will give an additional boost to feedlot placement numbers through the fall, providing additional downward pressure to the markets. On the bright side, there tends to be a seasonal price bump in the winter months after the markets settle from the fall cattle run. If it materializes, the seasonal price bump could provide a marketing opportunity to producers who decide to hold on to their calves a bit longer. ![]()

-

Brian Williams

- Assistant Extension Professor

- Mississippi State University

- Email Brian Williams