Producers interested in winter grazing, especially in eastern Texas, are likely to be carefully monitoring conditions as the drought may impact their plantings of winter wheat. (U.S. winter wheat plantings can be found in upcoming USDA Crop Progress reports.)

Backgrounding programs in Oklahoma and much of Texas are reportedly experiencing favorable pasture conditions, and it is likely that cattle are being held back to take advantage of the grazing opportunities.

The USDA’s Cattle on Feed report, released Aug. 21, 2015, reported U.S. cattle on feed in 1,000-plus feedlots totaled 10 million head, up 3 percent compared with August 2014. July 2015 placements were 1 percent lower than in 2014 – the lowest for July since the series began in 1996.

The 800-plus-pound category for cattle placed on feed continues to be high, roughly 19 percent above July 2014. These cattle will likely come off feed in the near future, potentially resulting in an upswing in marketings in early 2016.

A reason for the higher Cattle on Feed numbers could be that producers chose to keep cattle on feed for increased periods. Feed costs are relatively low, and the recently widening spread between choice and select boxed beef values may be providing incentives for feeding cattle to choice grades.

July 2015 marketings totaled 1.73 million head, 3 percent lower than 2014 – like placements, marketings are also the lowest for July since 1996.

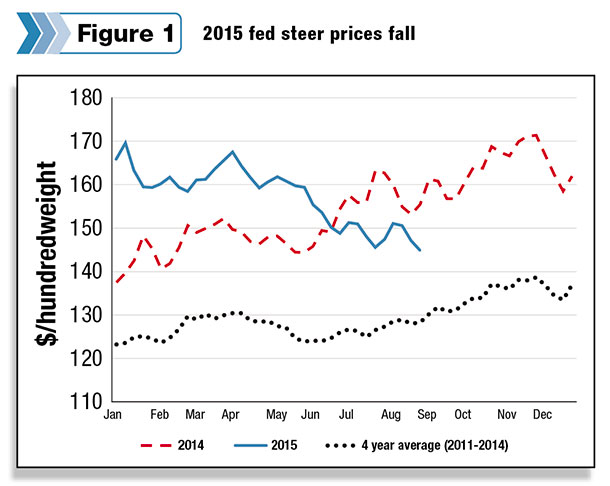

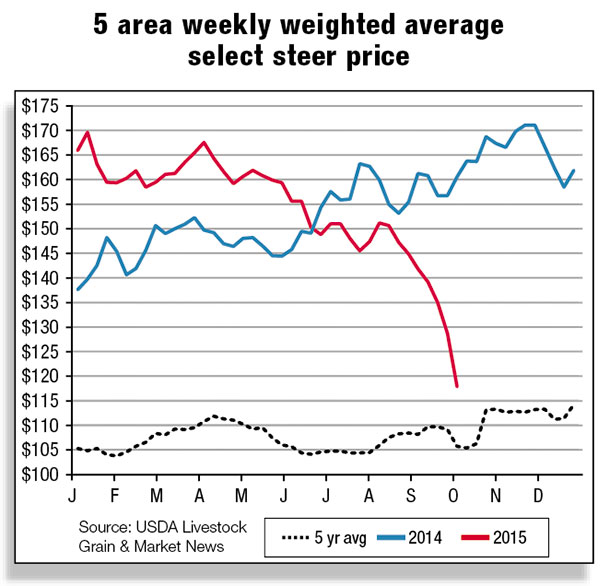

Third-quarter fed cattle marketings in 1,000-plus feedlots are likely to be low, as preliminary data indicates third-quarter slaughter could be below a year earlier. Fed steer prices (five-area, direct, total all grades) have fallen; nevertheless, they are above the four-year average.

The first- and second-quarter fed steer prices of 2015 hit record highs. However, July and August of 2015 showed a decline in fed cattle prices compared with 2014 prices.

Packer margins were relatively weak during the summer months, and packers may have slowed the pace of slaughter to improve their margins. To the extent there is consumer resistance to the recent record-high beef prices (see Meat Price Spreads for monthly retail values), packer moves to support their margins could put downward pressure on cattle prices.

The USDA reduced forecasts of fed cattle prices; third-quarter prices are $144 to $147 per hundredweight (cwt), down roughly $10 compared with this time last year.

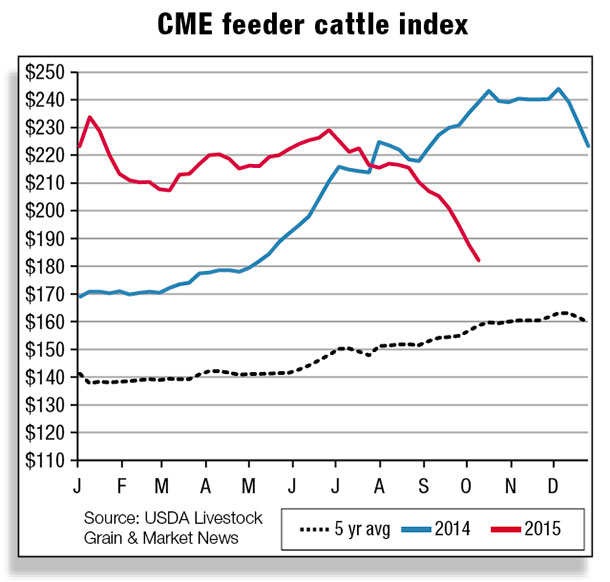

Oklahoma National Stockyards feeder cattle prices (KO LS 750 report) for the week ending Aug. 31, 2015, reported medium No. 1 feeder steers weighing 750 to 800 pounds are ranging around $206 to $213 per cwt – down approximately $10 compared with this time last year. Like the fed cattle market, feeders are also experiencing a downward trend in the third quarter; however, the fourth quarter may see a seasonal upswing in prices.

Lower cow and heifer slaughter implies herd expansion

Commercial heifer and beef cow slaughter continues to track well below year-prior levels, primarily driven by cattle producers’ strong incentive to hold back beef cows and heifers in an effort to expand domestic cow inventory levels.

Through the week ending Aug. 29, federally inspected weekly heifer slaughter is about 14 percent below year-prior levels, while cow slaughter is approximately 18 percent lower than last year. Solid year-over-year reductions in cow and heifer slaughter suggests that expansion efforts are well underway.

This being the case, heifers will likely continue to represent an even smaller percentage of total steer and heifer slaughter, and low cow slaughter will remain the norm through the end of the year.

In the short term, expansion of the breeding herd should continue to limit the growth in beef production through the remainder of 2015. The USDA’s current forecast for 2015 beef production is 23.5 billion pounds, down about 3 percent relative to a year earlier.

Beef packers’ margins improve on falling live cattle prices

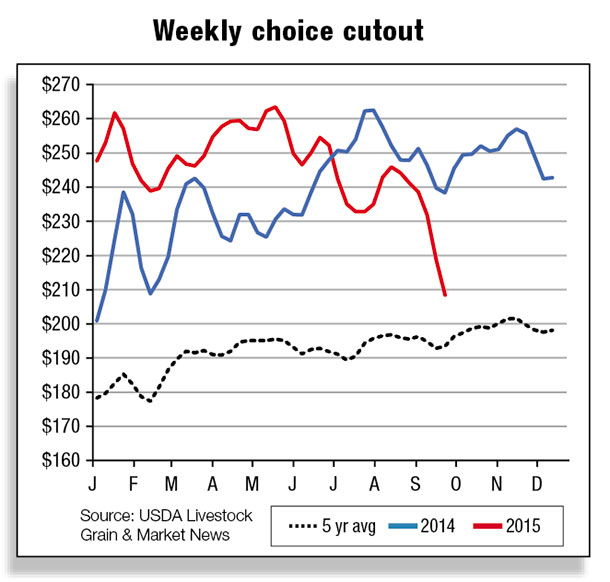

Beef processing margins are in positive territory after significant losses during most of the summer. Beef packers’ ability to maintain profitable margins while operating below full capacity is not the result of a surge in domestic beef demand; more likely, it is due to the combination of declining live cattle prices and steep reductions in animals being processed on a weekly basis, which has underpinned wholesale beef prices.

However, if beef packers’ selective reductions in kills are creating a backlog of fed cattle supplies, when these animals are marketed (presumably in the fourth quarter of 2015), further downward price risk could occur in the live cattle markets. Nonetheless, it appears that packers have more leverage as the spread between fed cattle prices and wholesale beef prices continues to widen.

Beef demand is expected to show the normal seasonal break from current levels heading into the fourth quarter as the focus shifts from grilling items to traditional holiday items such as turkeys and hams, easing wholesale beef prices.

The price of 50 percent lean beef trimmings has plummeted despite lower overall cattle slaughter levels. The average weekly price for 50 percent lean beef trimmings for the week ending Sept. 11 was quoted around $60 per cwt, down about $93 per cwt relative to the same week last year.

This decline is not totally unexpected since cattle are record large, and they are carrying more fat as a result of extended time on pasture and in feedlots.

Ninety-percent lean processing beef prices have also eased in recent weeks (below $280 per cwt), although the magnitude of declines are less than those in the 50 percent lean beef markets.

The price of lean processing meat (90CL) is not likely to collapse thanks to the overall small number of cows being slaughtered and the very strong demand for lean processing meat, which continues to support higher imports.

U.S. beef exports struggle, strong demand for lean processing beef supports higher imports

The impact of appreciation of the U.S. dollar on beef trade is twofold. In regard to exports, the relative strength of the dollar against the currencies of major trade partners has been a drag on beef shipments this year. On the flip side, the strengthening dollar has been an influence on the surge in beef imports. The strong dollar relative to other currencies has made the U.S. an attractive market.

Furthermore, the limited availability of lean beef for processing due to low cow slaughter levels and lower overall beef production will continue to support U.S. beef imports.

In July, the U.S. exported nearly 200 million pounds of beef. Much of the reduction in total beef exports in 2015 can be attributed to overall lackluster demand for high-priced U.S. beef – which, on top of a strengthening dollar, makes U.S. beef even more expensive to foreign buyers.

Consequently a number of key markets, including Canada and Mexico, have imported less U.S. beef than the previous year through most of 2015. In addition to the price effects on exports to Asian markets, another possible impediment to export growth in the months ahead is the potential for a slowdown in Asian economies, driven by mounting economic pressures in China.

China has a ban on U.S. beef products, but other Asian nations such as Japan, Vietnam, Taiwan, Hong Kong and South Korea are destinations for U.S. beef. Additionally, in Australia, higher slaughter and beef production and record export growth this year have been unfavorable for U.S. beef exports. Given the current dynamics surrounding these exports, it is expected that they will continue to struggle through the remainder of 2015.

USDA has revised third- and fourth-quarter beef export forecasts lower, bringing the annual total to 2.3 billion pounds. Regarding next year, exports should begin to recover modestly but will likely remain below 2014 levels.

Strong demand for lean processing beef amid low cow slaughter continues to support robust beef imports. In July, the U.S. imported around 288 million pounds of beef. The majority has been lean processing beef from Australia and New Zealand, for which both countries are now near their respective tariff rate quota limits.

Imports from both Australia and New Zealand are expected to slow down in the fourth quarter as cattle slaughter rates begin to ease and traders manage exports in order to limit exposure to the above-quota duties. It is possible that some volumes of lean beef imports will be placed in bonded storage to avoid incurring additional costs.

It is very likely any processed beef placed in bonded storage during late 2015 will be released in early 2016. Fresh/chilled beef imports from Mexico remain robust as July imports were reported close to 39 million pounds, 31 percent above 2014.

Although the U.S. does not import fresh chilled or frozen beef cuts from Brazil, thermally processed beef imports from Brazil continue well above the previous year. Total annual beef imports for 2015 are projected to reach 3.4 billion pounds, while imports in 2016 are forecast to reach a little more than 3 billion pounds. ![]()

Kenneth Mathews is coordinating analyst for the USDA Economic Research Service. Analyst Mildred M. Haley assisted with this report.