Q&A With Texas Land Lender, Jordan Shipley

Q: It takes a lot of physical and mental discipline/preparation to make it all the way to the NFL. How has that self-discipline helped prepare you to work in the land lending business?

A: When it comes to discipline and work ethic, I’ve always been of the opinion that if you want to accomplish what other people can’t, you have to be willing to do what others won’t. I had to work harder than a lot of my peers in the NFL to get there and then to stay there, and the very same process helps me in the land lending business because I’m willing to work extremely hard to get folks every bit of financial help they need to accomplish their business goals.

Q: You host “The Bucks of Tecomate”, which shows how to grow bigger deer via farming food plots, and how to hunt whitetail deer. How has your involvement with the show helped you better understand the farming and agriculture industry? What has been your favorite aspect of working on the show?

A: My experiences with Tecomate have afforded me a priceless education from some of the world’s most knowledgeable experts in recreational land and wildlife management—David Morris and Dr. Gary Schwarz. No one knows more about wildlife management, rec land, and how to utilize farming techniques to create the ultimate environment for wildlife, whether it be for deer, bass, upland birds, or waterfowl, than David and Dr. Schwarz. My favorite parts of hosting “The Bucks of Tecomate” are getting to experience and evaluate different tracts of land and developing lifelong relationships with the landowners we meet.

Q: In the short film by YETI entitled “Coach’s Son” your father stated, “The only person that probably hates losing more than me is Jordan.” Do you feel that your competitive spirit will help you working in ag lending? If so, in what way?

A: Absolutely. I hate to lose. And I have no question that it’s an attribute that will help me in ag lending, and it’s one of the things I love about AgAmerica. If there’s any way for AgAmerica to win on loan terms (and they nearly always can), they will.

A: Absolutely. I hate to lose. And I have no question that it’s an attribute that will help me in ag lending, and it’s one of the things I love about AgAmerica. If there’s any way for AgAmerica to win on loan terms (and they nearly always can), they will.

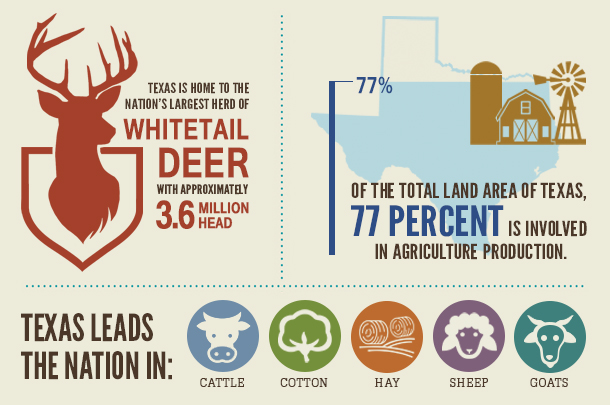

Q: According to Texas ag stats, Texas leads the nation in cattle, cotton, hay, sheep, goats and mohair production. Do you foresee Texas becoming a production leader in any other ag commodities?

A: Texas is a vast state with incredible natural resources, and I wouldn’t be surprised to see The Lone Star State moving up the rankings in many ag commodities, although I think cattle will be king for years to come. The state population is projected to increase dramatically over the next 30 years, and related commodities will likely rise as a result.

Q: How important is rec land investing to the ag industry in Texas? If you were talking to an investor, what would be some key points to bring up to convince him to invest in rec land with financing provided by AgAmerica?

A: Rec land is unbelievably important to the ag industry in Texas. In fact, I’d go so far as to say that in many areas whitetail deer have driven the market for land prices in the last 15 years. There is now more money in Texas in whitetail deer than in cattle, and Texas is the highest-ranking state in the nation in terms of numbers of cattle. Looking at it through that lens, even though unconventional, rec land in Texas may very well be one of the most important overall ag industries in the entire country.

AgAmerica is simply able to do things that no other lending company can do. Obviously, having highly competitive terms is key, but our unparalleled ability to tailor products to our borrowers’ needs truly separates AgAmerica from any other brand in the ag lending world. We can compete on rates and terms, all the while carefully evaluating a borrower’s goals/wants/needs to build a custom package that fits their needs.

At AgAmerica Lending, we’re committed to finding unique solutions for our clients. As the nation’s premier agricultural land and rural infrastructure lenders, we help agribusinesses big and small grow and prosper with our low interest rates, long amortizations, and an outstanding 10-year line of credit.

Find out more about AgAmerica’s custom loan products by contacting us today.