Before making big end-of-year equipment purchases like a new tractor, hay baler or skid-steer loader, carefully evaluate if these purchases are truly needed and if they will help the operation become more efficient, reduce other operational costs and, most importantly, improve the future success of the operation.

End-of-year purchases of additional replacement females is another common strategy to avoid paying additional taxes, as evidenced by the numerous special replacement female sales held each November and December.

These purchases should also be evaluated. Is the price of replacement females likely to go down in the next several months? If so, it might be better financially to pay some taxes now and purchase the females later at a lower price.

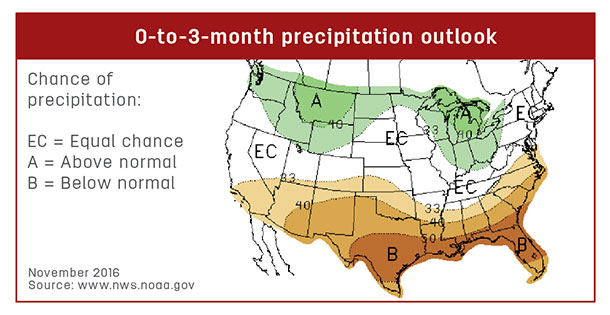

Is the operation currently stocked at capacity or is there room to expand without stressing forage resources? If already stocked at capacity and more females are added, additional feed costs could quickly exceed the money saved in reduced taxes. Also consider the current weather situation and future forecasts.

In addition, calculate how long it will take for a group of females to become profitable based on their purchase price, estimated cull rates, annual cow costs and calf price projections. Although the purchase may reduce taxes in the short term, it many not be wise from a long-term standpoint if the females can’t pay for themselves and become profitable in a reasonable period of time.

This year especially, with the declining market, instead of purchasing replacement females to reduce taxes, it might be wiser to purchase supplies like herbicides, insecticides, animal health products and even fertilizer that will be needed in 2017 or, depending on the product, even 2018.

Regardless of what strategy is chosen, good records are important to make sound decisions. Good financial records don’t have to be complicated. For example, a simple computer spreadsheet set up to record expenses in the same categories as reported on the IRS Schedule F could be used.

An example can be downloaded online (beef.tamu.edu). Click on publications and then look for “Record Keeping Examples” under the business and marketing section. Several commercial software programs are also available to help with record-keeping. ![]()

-

Jason Banta

- Associate Professor and Extension Beef Cattle Specialist

- Texas A&M University

- Email Jason Banta