Just a year ago that same railcar went for $450 or less, but as fracking and crude oil production in North Dakota have ramped up dramatically so has demand for rail transit. By 2017, the U.S. and Canada will be producing 5 million barrels of crude oil per day, and it has to move somehow.

“If you’re in the cattle feeding business and the railcars are tight in North Dakota, I’d imagine basis is going to get very sloppy (in Nebraska) come October,” Basse says.

“Cash delivery in North Dakota is trading close to $2.20 a bushel today,” Basse said. “I’d imagine at harvest, we’ll have more corn under $2. Would you ever have thought?”

Barge freight is also rising sharply, so Midwestern farmers relying on export markets are also at a disadvantage.

“Not only does the transportation issue lower basis in the north,” he said. At Gulf shipping ports, “it raises basis, which reduces our export competitiveness.”

“Being centric to the supply of corn will help the basis of your operation,” Basse said, noting that the feeding industry could shift north, where grain is close. Elsewhere? “It’s a struggle to find a railcar just to get (corn) delivered on a timely basis.”

Three main factors will depress the corn price for the next several years, Basse said: a mature biofuel market, lower demand from the livestock sector and the lowest U.S. export share on record for a non-drought year.

“If the U.S. has normal weather going forward, it will have to buy back that export share through price,” he said.

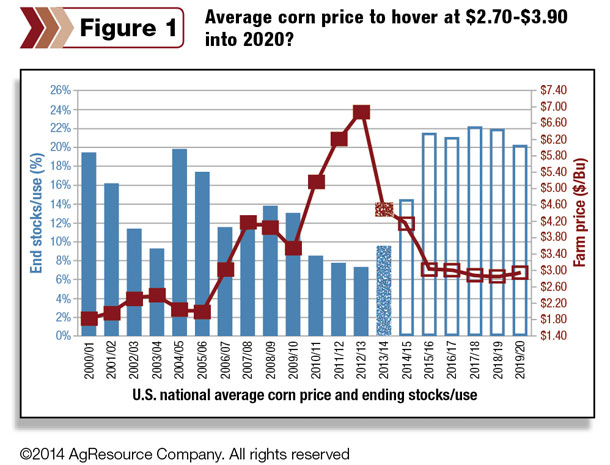

This is the first time in history the world has produced record high corn, wheat and soybeans all in the same year. With a fall corn-crop estimate of 14 billion bushels, Basse said the 2014-15 price will average around $3.60 per bushel, with a long-term average of $2.70 to $3.20 through 2020 – not accounting for basis.

Still, Basse expects it to take five to seven years for profitability to swing toward the cattle feeding sector.

“Cows hold the opportunity,” he said.

U.S. per capita meat consumption is at the lowest point since 1985, but world beef consumption is still rising, and beef production is also stagnant, which will push prices higher.

“You have to manage risk,” Basse said. Last year the average per hundredweight (cwt) price fluctuation in the fed cattle market was $17 cwt, compared to $25.40 already in 2014. Producers should expect $25 to $35 swings going forward.

In the near term, Basse predicts fed cattle will find their peak between $162 to $168 in November or December.

“Last year I talked about cattle trading in the low 150s, and people thought I was crazy,” he said. “I missed it by $10 – the other way. It’s $160. The good times are rolling. Your feed costs are coming down.”

With herd inventories the lowest since 1949, ranchers are still in the driver’s seat.

“Has there ever been a better time to be in the cow-calf business? The market is screaming for feeder calves,” he said.

For more information or event proceedings, visit the Certified Angus Beef website. ![]()

—From Certified Angus Beef news release

PHOTOS

TOP: Dan Basse, president of AgResource Company, speaks at last month’s Feeding Quality Forum.

MIDDLE: The audience at the Feeding Quality Forum listens intently. Photos provided by Certified Angus Beef.