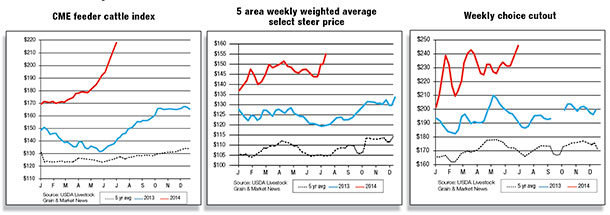

Increased precipitation could also motivate support for prices already at record levels for all weights of feeder cattle and cows.

Despite what appear to be weakening corn prices and still-positive feeding margins, cattle feeders are caught between steady-to-stronger feeder cattle prices already at record levels and fed cattle prices that are moving erratically higher at a slower pace than feeder cattle prices are increasing.

Steer and heifer slaughter is currently below previous expectations for this point in time but could increase into summer as the year-over-year larger numbers of cattle placed on feed during the fourth quarter of 2013 begin to reach market finish.

Based on recent and current feeder cattle and corn prices, and even with the recent jump in fed cattle prices, red ink could reappear for cattle feeders later this summer.

On the other hand, packers appear to be back with positive margins despite stalling cutout values. Average monthly retail choice beef prices for April jumped more than 2.5 percent to a new record from March and were up a whopping 12 percent over the April 2013 average.

The average price for May 2014 was $5.91, up from April’s price – a new record – and 13 percent above the May 2013 average price.

Despite the record price levels, lackluster demand for middle meats is exerting some downward pressure on retail prices and wholesale cutout values.

Click here or on the image above to view it at full size in a new window. (PDF, 15.5KB)

Stronger feeder shipments from Canada spur growth in cattle imports

U.S. cattle imports through April 2014 totaled 846,943 head, 5 percent higher than a year earlier. Imports have grown from Canada (+12 percent) due to rising shipments of feeder cattle.

Strong U.S. prices for cattle due to lower inventories have created incentives for Canadian producers to ship cattle south. U.S. feeder cattle prices accelerated rapidly in the second half of 2013 and continue to grow.

Prices for Canadian feeders grew more slowly during 2013, and a widening price differential between U.S. and Canadian feeders increased demand from U.S. buyers.

Canadian prices have accelerated more rapidly in 2014, closing some of the gap between U.S. and Canadian prices. A weaker Canadian dollar also supports U.S. imports. Over the past 12 months, the Canadian dollar steadily depreciated against the U.S. dollar and has averaged 10 percent lower throughout most of 2014.

Through April, feeder cattle imports were up 33 percent, while imports of slaughter cattle – accounting for more than half of all imports – were down 3 percent from last year. Cattle imports from Mexico have fallen 2 percent this year despite prices well above previous years.

Lower Mexican cattle inventories limited imports in 2013 and continue to constrain imports this year. Due to the growth in imports from Canada, the forecast for U.S. cattle imports was raised to 2.05 million head in 2014 and 2.1 million head in 2015.

While demand for imported cattle is expected to remain strong throughout the forecast period, growth will be limited due to reduced cattle supplies.

Beef imports surge from Australia

U.S. beef imports through April 2014 were up 6 percent from a year earlier as lower U.S. beef production has increased demand for imported beef.

Imports accelerated from Australia (+26 percent) and Canada (+11 percent), more than offsetting lower shipments from New Zealand (-5 percent), Uruguay (-24 percent) and Brazil (-25 percent).

Beef imports typically peak in the second quarter of the year to fulfill increased demand for processing-grade beef during the summer. Imports were especially strong in April, reaching the highest monthly total since July 2007.

Imports from Australia exceeded 96 million pounds, the highest monthly total from Australia in five years. Australian beef production has risen 11 percent this year through April as continuing drought has caused record-high cattle slaughter.

Total Australian exports through April have risen 19 percent as a result of higher production. U.S. beef imports from Canada have also jumped this year as higher U.S. beef prices and a lower exchange rate have increased returns for Canadian suppliers.

The forecast for U.S. beef imports in 2014 was raised to 2.446 billion pounds, almost 9 percent above 2013. Demand for imported beef has risen as weekly U.S. federally inspected cow and bull beef production through the end of May is nearly 11 percent lower than a year earlier.

Imports in 2015 are forecast at 2.445 billion pounds, nearly unchanged from 2014. U.S. beef production is not expected to increase next year, as herd rebuilding will take several years. Although import demand will remain strong as a result, the U.S. is likely to face increasing competition from Asia for global beef supplies.

U.S. beef exports strong through April

U.S. beef exports were up 7 percent year-over-year through April, led by higher shipments to Japan, Mexico and Hong Kong. Japanese demand for U.S. beef has risen considerably over the past year since beef imports from U.S. cattle 30 months old or less were allowed in February 2013.

Total Japanese beef imports through April are roughly equivalent to year-earlier levels, but the U.S. market share has increased while imports from Australia and Mexico have declined.

U.S. beef exports to Mexico have also increased steadily since last summer despite rising prices for U.S. beef. Beef production fell last year in Mexico after severe drought led to a reduction in cattle inventories. Total U.S. exports are forecast to fall 3 percent in 2014 to 2.508 billion pounds.

Despite higher year-over-year exports during the first four months of the year, lower U.S. beef production and higher prices are expected to curb export demand in the latter half of the year.

This trend is likely to extend into 2015, when exports are forecast to decline 3 percent year-over-year to 2.425 billion pounds. ![]()

Kenneth Mathews

USDA – Economic Research Service