As of May 8, 2014, the U.S. Drought Monitor still showed “moderate” to “exceptional” drought in an area that is home to roughly 37 percent of the domestic beef cow inventory: most of California, the southwestern U.S. and the Central and Southern Plains.

While the winter wheat crop in the Southern Plains continues to deteriorate, corn planting appears to be moving ahead at full speed.

As of May 11, 2014, 59 percent of the U.S. corn crop had been planted – somewhat lagging the norm, but ahead of last year – on an anticipated 91.7 million acres.

Projected prices received by farmers for marketing-year 2013-2014 were recently projected at $4.50 to $4.80 per bushel compared with the 2012-2013 marketing-year average of $6.89.

Fewer cows are going to slaughter in 2014. However, cow slaughter has continued at a pace inconsistent with herd expansion and reflects continuing drought conditions and the escalating price of hay.

Cumulative weekly federally inspected cow slaughter thus far in 2014 is about 9 percent lower than for the same period in 2013 but is occurring at a higher level than was anticipated before 2014 began.

Heifer demand increasing

Recently, heifer prices have shown relatively more strength than steer prices, likely due to competing demand from buyers for feedlot placements versus buyers for cow-herd building and to heifers’ potential for either placement in feedlots or retention for breeding stock.

As anticipated retention of heifers for breeding stock increases, fewer heifers will be available for placement in feedlots, which, in addition to exerting upward pressure on prices, will lead to reduced cattle slaughter and reduced beef production later in 2014 and beyond.

Signs of heifer retention have begun to appear. For example, USDA National Agricultural Statistics Service (NASS) Cattle on Feed report showed a 6 percent drop in heifers and heifer calves on feed on April 1 compared with last year at this time, while steers and steer calves were up 2 percent.

Supplies of feeder cattle outside feedlots declined just over 5 percent, year-over-year, on April 1. While the April 1 estimate is often a seasonal low for the year, the April 1, 2014, estimate is the lowest since 1996.

Consistent with the significant decline in feeder cattle supplies, steers and heifers on feed in 1,000-plus-head feedlots were down, but only slightly less than 1 percent.

The 1 percent decrease consisted of 7.07 million steers and steer calves (up 2 percent from 2013) and 3.71 million heifer and heifer calves (down 6 percent from 2013). In addition, feeder cattle prices remain strong at near-record levels.

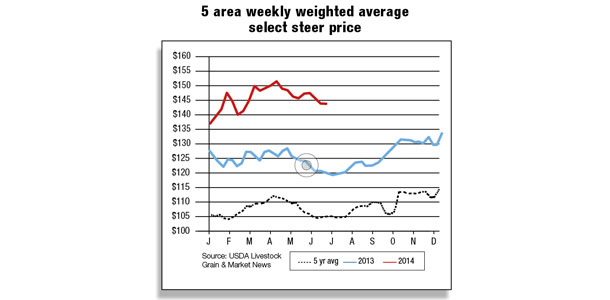

However, the recent weakness in fed cattle prices will likely exert some downward pressure on feeder cattle prices.

In addition, estimated total federally inspected cattle slaughter has declined, down 6 percent so far this year compared with 2013. NASS Livestock Slaughter reported commercial slaughter of 2.45 million head in March, a decline of 5 percent from the same period last year.

For the remainder of 2014, the steer portion of total cattle slaughter is expected to be a larger percentage of the total cattle slaughter mix as fewer heifers are placed on feed and as fewer cows are sold for slaughter.

With more steers and fewer heifers and cows in the slaughter mix, dressed weights for all cattle could average higher for the foreseeable future. Already, the average dressed weight for all cattle was up slightly from last year’s weights for the same period.

Veal calves have also been heavier this year than last, averaging 277 pounds live weight (NASS), up 25 pounds from last year, likely due to their recent significantly higher value as meat animals.

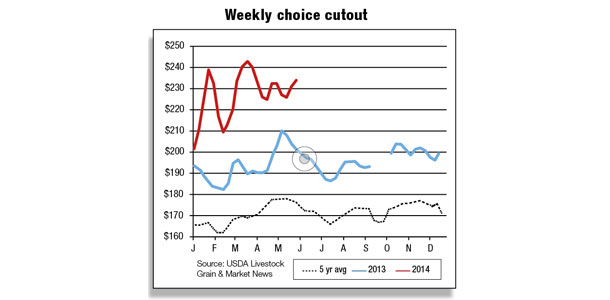

Wholesale cutout values in April 2014 appear to have moderated somewhat from their March peak. Retail choice beef reached a record of $5.72 per pound in March 2014.

The demand for middle meats at present appears to be lagging the demand for lesser cuts and ground products. The extent to which retailers will feature the higher-priced cuts to meet the season’s grilling demand, which is almost upon us, remains to be seen.

Feeder cattle imports improve from Canada

U.S. cattle imports totaled 599,392 head during the first quarter of 2014, up 2 percent from a year earlier. Imports rose from Canada (+9 percent) but fell from Mexico (-6 percent).

While shipments of Canadian slaughter cattle fell 3 percent year-over-year, shipments of feeder cattle were stronger. Feeder cattle imports during the first quarter of 2014 increased 26 percent as high U.S. prices and a favorable exchange rate increased incentives for Canadian sellers.

Demand for imported cattle is robust, with the U.S. cattle herd at its lowest point since 1951.

Despite attractive U.S. prices, imports of Mexican cattle through March 2014 were 17,233 lower than last year. Mexican inventories have yet to recover from heavy herd liquidation over the past few years due to severe drought.

Although shipments from Mexico typically reach a seasonal peak during the spring months, AMS weekly imports through May 3, 2014, totaled 375,920 head, 7 percent lower than 2013 and more than 40 percent lower than 2012.

The forecast for U.S. cattle imports in 2014 is unchanged at 1.97 million head. Cattle imports in 2015 are forecast at 2 million head, an annual increase of 2 percent.

Although strong demand for cattle is expected to continue, low inventories across North America are expected to limit stronger growth in imports.

Beef imports and exports higher in March

U.S. beef imports accelerated in March, increasing 13 percent from the previous March. In the first quarter of 2014, imports totaled 596 million pounds, 1 percent higher than the first quarter of 2013.

Shipments have risen by the greatest volume from Canada (+12 percent) and Australia (+9 percent). The Canadian dollar averaged about 10 percent lower during the first three months of the year, making Canadian beef comparatively less expensive for U.S. buyers.

The Australian dollar has also depreciated considerably against the U.S. dollar during the past year.

Australian shipments to the U.S. have risen this year, although Australian beef production is expected to fall in 2014 due to lower cattle supplies after drought caused record-high cattle slaughter in 2013.

The forecast for U.S. beef imports in 2014 is 2.396 billion pounds, an increase of 6 percent from 2013.

Demand for imported beef is expected to strengthen as U.S. beef production is forecast to decline more than 4 percent this year.

Weekly cow slaughter through April 26 is down over 10 percent and will remain well below 2013 for the remainder of the year, increasing demand for imported processing beef. U.S. beef imports in 2015 are forecast at 2.445 billion pounds, 2 percent higher than 2014.

Demand for imported beef will remain strong next year as U.S. beef production is expected lower.

U.S. beef exports during the first quarter of 2014 totaled 583 million pounds, an increase of 5 percent from 2013. Exports increased by the greatest volume to Mexico, Hong Kong and Japan (Table 1).

Although Japan’s total imports of beef through March are consistent with year-earlier levels, imports of U.S. beef continue to displace Australian product despite higher prices this year for U.S. beef. High prices and a weaker Canadian dollar have taken their toll on U.S. exports to Canada.

Exports during the first quarter of 2014 were 30 percent lower than a year earlier.

The forecast for total U.S. beef exports in 2014 is 2.508 billion pounds, a decline of 3 percent from 2013. Demand in top markets for U.S. beef is expected to remain strong, although lower production is expected to limit growth in trade through 2015.

The forecast for exports in 2015 is 2.425 billion pounds, a decline of 3 percent from 2014. ![]()

Economist Ken Mathews is with the USDA.