A look back at past price relationships during May sheds some light on the gross margin of running stockers. This spring the gross margin and feed costs have again changed, suggesting implications for several different prices.

In May a stocker can be purchased in South Dakota and turned out on grass or fed to gain 200 pounds over a 4.5-month period. The sale value would be as a feeder-weight sold in September or the September feeder cattle future price observed in May plus the basis for South Dakota. This May to September scenario is one of several followed to assess risk and rewards in the cattle complex.

The gross margin is calculated as the expected feeder price times 7.5 minus the spot stocker price times 5.5 with the basis assumed known with perfect foresight. The gross margin was only $135 per head as recently as 2009 and in 2013 was an unprecedented $292 per head. In 2014 the September feeder futures contract price averaged $183 during April while the stocker price averaged $226. Assuming basis equals the five-year average for September of $5 implies a gross margin for 2014 of $163 per head after rounding.

What explains the size of the gross margin? Historically, the gross margin and an equivalent feed cost were very closely related; feed costs explained over 90% of the variability in the margin. A ration of 13.5 bushels of corn and a ton of hay (as-fed) would be adequate to have the stocker gain 1.5 pounds per day for 135 days (4.5 months). The cost of corn and hay can be found by using the NASS price during May for those commodities.

From 1995 to 2012 there was a positive net margin after the implied feed cost in each year except 2003. The average net margin was $20 per head. Until a year ago, I thought I had found a rare, stable relationship among agricultural markets. In May of 2013 the price of corn was $6.87 per bushel and the price of hay was $241 per ton.

That gave a feed cost of $334 per head, above the gross margin in 2013. In April of 2014, corn was $4.14 per bushel and hay was $127 per ton. That gave a feed cost of $183 per head, again running well above the gross margin. While the levels have moved together, the positive net margin has not returned.

The gross margin would also be the expected revenue from running stockers on grass. However, in recent years the midpoint of the spring grazing quotes for yearlings in South Dakota has been $17-$18 per head per month (from USDA’s Agricultural Marketing Service), suggesting a very low feed outlay compared to other feed and relatively high net returns. In 2014, the midpoint was $25.50 per head per month, reducing such returns to the lowest level since 2006 and coming in at less than a fourth of the net returns available a year earlier.

There seem to be several aspects at work affecting the net margin. First, South Dakota calves may have had a higher value in other places during the past two years. If other locations have cheaper feed, then the relationship is reflecting high demand for stockers. Second, the quoted price of hay may not reflect the price or cost of the hay quality needed for growing a stocker.

Alternatively, the quoted price may not reflect the transaction costs of hay. Third, the pasture quotes may not be reflecting the cost to run stockers or yearlings. The quotes may not reflect the cost of grazing provisions or transaction costs for stockers. I have heard variations of all three reasons during the past few years, and none preclude the rare, stable relationship from returning in the future.

The Markets

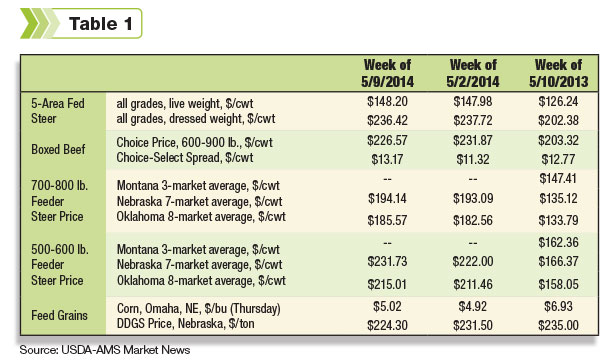

Fed steer prices were higher this week, but remain well above last year's level. Boxed beef prices were lower for the week. Despite slightly higher corn prices, feeder cattle traded higher in Nebraska and Oklahoma across weight classes. Hay stocks in the May Crop Production report were higher from North Dakota to Kansas and over to Missouri. Higher stocks in cow-calf states are a necessary condition for expansion. ![]()

—Matthew Diersen is an economics professor at South Dakota State University. This originally appeared in the "In the Cattle Markets" newsletter.